Although fears of a Russian strike at the Ukraine border briefly roiled global markets during the fourth week of January, mutual fund investors continued to focus on the degree and timing of tighter US monetary policy. Ahead of the US Federal Reserve’s first meeting of 2022, EPFR-tracked Bond Funds posted their biggest weekly outflow in over 10 months and extended their longest redemption streak since the pandemic-driven sell-off in late 1Q20.

The combination of taper and geopolitical concerns did give Gold Funds a shot in the arm. Flows to this group surged to levels last seen in mid-3Q20. But investors were reluctant to bail out of US Equity Funds in general and US Technology Sector Funds in particular, despite the Fed’s confirmation that it expects to start hiking interest rates at its March meeting.

Funds with socially responsible (SRI) and environmental, social and governance (ESG) mandates again showed their ability to swim against the tide, with SRI/ESG Bond Funds recording a collective inflow of $1.42 billion while $11.5 billion flowed out of all non-SRI/ESG Bond Funds. SRI/ESG Equity Funds, meanwhile, posted their 87th consecutive inflow. During that run they have pulled in over $420 billion.

Other ports in the current storms include funds dedicated to the big Asian markets – with China focused funds to the fore – and Bank Loan Funds. The latter, used to play rising short-term interest rates, have now taken in fresh money for eight straight weeks and 54 of the past 56.

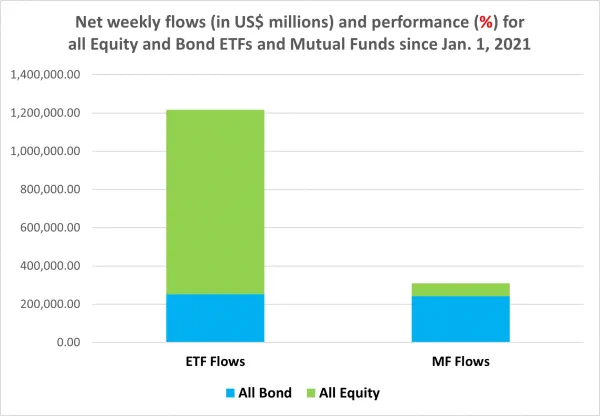

Exchange Traded Funds (ETFs) continue to pull in significantly larger sums than their actively managed counterparts. Year-to-date through Jan. 26, Bond Funds have surrendered $5 for every $1 committed to Bond ETFs. In 2021 they took in twice as much money as their ETF counterparts. For Equity ETFs, the flow ratio is even more in their favor than the 14:1 margin seen last year.

At the asset class and single country fund levels, investors pulled over $4 billion from High Yield Bond Funds, outflows from Municipal Bond Funds climbed to a 94-week high and Mortgage-Backed Bond Funds extended their longest outflow streak since an 11-week run ended in 1Q17. Redemptions from Norway, Belgium and Spain Bond Funds hit 52, 61 and 75-week highs, respectively, while France Equity Funds posted consecutive weekly inflows for the first time since 3Q20.

Did you find this useful? Get our EPFR Insights delivered to your inbox.