The first week of October saw US lawmakers sparring over the country’s debt ceiling, authorities in China scrambling to limit the wider damage property giant Evergrande’s debt crisis may cause, and central bankers from Canada to Poland wrestling with the tradeoff between economic growth and rising prices.

Faced with this unappealing cocktail, investors’ risk appetite slipped several notches during the first week of October. High Yield Bond Funds posted their first outflow since the second week of July, Emerging Markets Bond Funds experienced net redemptions for the third straight week and over $1.2 billion flowed out of Alternative Funds while Inflation Protected Bond Funds absorbed over $1 billion for the third time in the past four weeks.

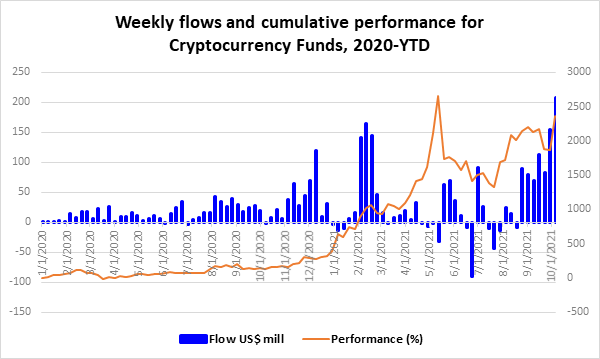

Appetite for exposure to socially responsible (SRI) or environmental, social and governance (ESG) themes remains strong. SRI/ESG Equity Funds extended an inflow streak stretching back to mid-3Q20 and year-to-date flows into SRI/ESG Bond Funds climbed past the $79 billion mark. Dedicated Cryptocurrency Funds also remained popular, with flows the highest in over four years, during a week when US officials said they have no plans to ban digital currencies.

Did you find this useful? Get our EPFR Insights delivered to your inbox.