Amidst increasingly stark warnings of economic chaos if the current standoff over the US federal debt ceiling is not resolved, EPFR-tracked US Bond Funds pulled in another $8.1 billion going into the final week of May as they recorded their 21st consecutive inflow.

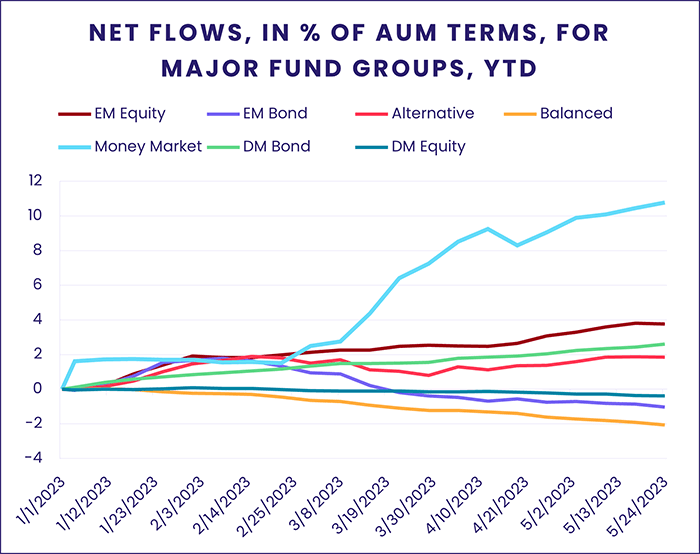

While flows to US Bond Funds proved resilient, other fund groups felt the chill as the uncertainty about US finances weighed on investor sentiment and their appetite for risk. Both Emerging Markets Bond and Equity Funds posted outflows, with redemptions from the latter hitting their highest level since early February, and High Yield Bond, Bank Loan, Alternative and Frontier Markets Funds also saw money flow out.

Getting closer to cash remained a popular option. US Money Market Funds absorbed another $31 billion and Japan Money Market Funds recorded their biggest inflow since 4Q20 while Gold Funds took in fresh money for the 12th straight week and Silver Funds for the sixth time in the past nine weeks.

Overall, the week ending May 24 saw EPFR-tracked Bond Funds post a collective inflow of $9.4 billion while $132 million flowed out of Alternative Funds, $2.7 billion out of Balanced Funds and $3.9 billion out of Equity Funds.

At the single country and asset class fund level, flows into Italy Bond and Brazil Equity Funds hit 29-week highs, Spain Bond Funds recorded their biggest weekly inflow since 3Q16 and India Equity Funds took in fresh money for the 19th week running. Bank Loan Funds racked up their 18th consecutive outflow, Mortgage-Backed Bond Funds experienced net redemptions for the fifth time year-to-date and Inflation Protected Bond Funds added to their record-setting outflow streak.

Emerging markets equity funds

EPFR-tracked Emerging Markets Equity Funds recorded their fifth outflow in the 21 weeks year-to-date during the latest reporting period as questions about the strength of China’s economic rebound – and the willingness of China’s government to boost it – sapped investor appetite. Of the four major regional groups, only Latin America Equity Funds recorded an inflow while redemptions from the diversified Global Emerging Markets (GEM) Equity Funds hit a 10-week high.

The week ending May 24 also saw funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates post their first collective outflow since mid-November of last year.

China Equity Funds narrowly extended their current inflow streak, their longest in over six months, but took in less money than India Equity Funds. Domestic demand in China has been slow to recover, crimping the ability of domestic firms to boost profits and prompting foreign observers to trim earlier full-year GDP forecasts. GEM, Pacific Regional, BRIC, Global, Global ex-US and Asia ex-Japan Regional Equity Funds all cut their allocations to China in April while five of the six increased their exposure to India.

Collective flows to Latin America Equity Funds climbed to a 12-week high as commitments to Peru and Brazil Equity Funds hit 20 and 29-week highs, respectively. In the case of Brazil, better inflation numbers have raised hopes of a cut in the central bank’s benchmark interest rate which currently stands at 13.75%. Mexico Equity Funds, meanwhile, posted their biggest outflow since late 3Q22 during a week when leftist President Andres Manuel Lopez Obrador ordered the temporary seizure of privately held rail lines.

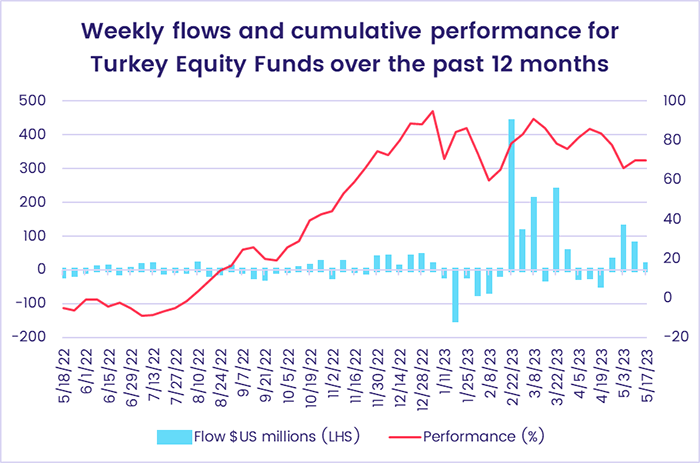

The fortunes of another president opposed to many orthodox economic policies, Turkey’s Recep Tayyip Erdogan, continue to occupy the minds of investors studying the EMEA universe. Erdogan is currently expected to win a run-off election in the coming week. Despite the inflation unleashed by Erdogan’s current policies, Turkey Equity Funds recorded their fifth consecutive inflow.

Developed markets equity funds

Fears of a turbulent summer, as higher interest rates, political and geopolitical tensions, drought, stresses in the US banking system and over-reliance on a few stocks squeeze economic growth and investor confidence, chased more money out of EPFR-tracked Developed Markets Equity Funds during the third week of May. Of the major groups, only Australia and Global Equity Funds recorded inflows. US, Japan, Europe, Canada and Pacific Regional Equity Funds posted outflows ranging from $5 million to $1.8 billion.

The redemptions from Japan Equity Funds were the biggest in 11 weeks and came as the country’s benchmark Nikkei-225 index was testing three-decade highs. While foreign-domiciled funds pulled in over $1 billion, domestically based Japan Equity Funds saw over $2.4 billion redeemed, suggesting local selling into foreign buying.

Europe Equity Funds extended their current outflow streak to 11 weeks and over $17 billion. During the latest week, none of the major groups by capitalization and style recorded an inflow, with Large Cap Blend Funds experiencing the heaviest redemptions in cash terms and Mid Cap Growth Funds in % of AUM terms.

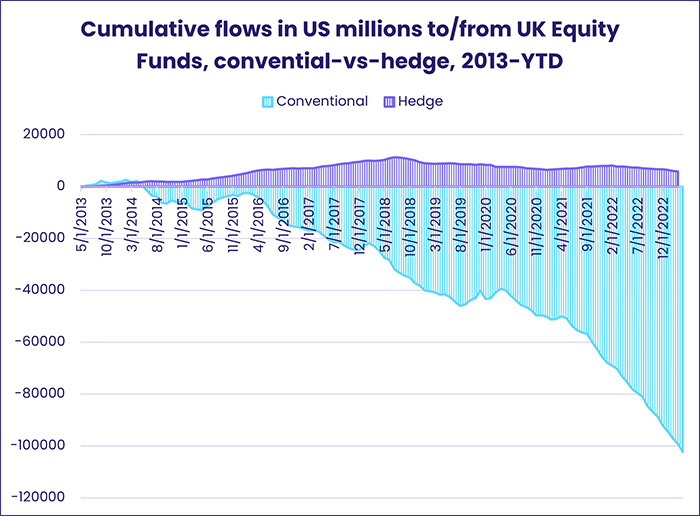

At the country level, investors pulled over $150 million from France, Germany and UK Equity Funds. With more interest rate hikes expected from the European Central Bank and the Bank of England, Germany’s economy has slipped into recession and the jury remains out on the UK’s prospects. While conventional UK Equity Funds have experienced relentless redemptions since mid-2016, flows to UK Hedge Funds over the past decade are still in positive territory.

US Equity Funds chalked up their sixth straight outflow and ninth in the past 10 weeks as flows into US Equity ETFs – which hit a six-week high – were offset by redemptions from actively managed funds. American corporations continue to pour money into buying back their own stock. According to Liquidity Analyst Winston Chua, “since the current earnings season began in mid-April the daily average for buybacks is five announcements with a combined value of $8.2 billion.”

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, posted their third inflow in the past four weeks.

Global sector, industry and precious metals funds

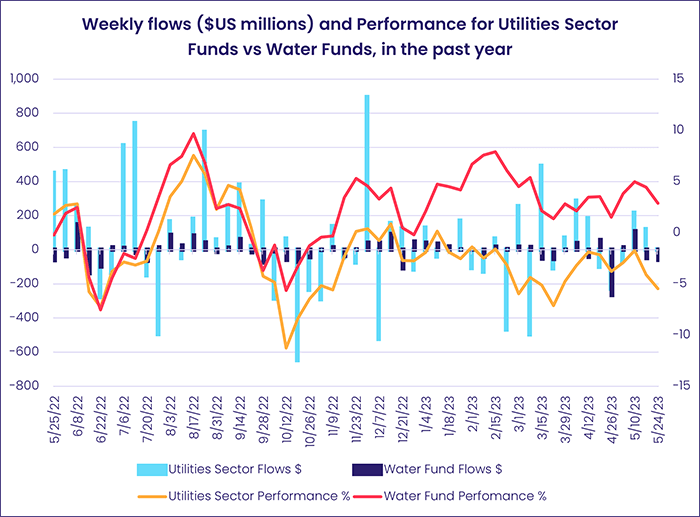

When it came to sector exposure, investors remained largely on the defensive going into the final week of May. Among the five groups recording inflows were Telecoms, Utilities and Consumer Goods Sector Funds, while Industrials, Commodities and Energy Sector Funds recorded outflows ranging from $299 million to $671 million.

The week saw Financials Sector Funds’ three-week outflows streak come to an end. China Financials Sector Funds were the main driver, recording their largest inflow since late 3Q22, while US Financials Sector Funds suffered their fourth straight outflow. Regional Bank Funds also snapped a three-week streak as they posted their largest outflow in seven weeks.

Persistent drought in Europe, southern Africa, parts of Asia and the central US have not provided Water Funds with a tailwind recently. During the latest week, while Utilities Sector Funds overall recorded a modest inflow, the sub-group posted its second straight outflow.

Technology Sector Funds recorded their sixth straight inflow. Behind the headline number was the $250 million committed to US funds and around $150 million that found its way into a mix of funds dedicated to Asian markets: Hong Kong (SAR), China, Korea, Japan and Taiwan (POC). While flows into Robotics & AI Funds climbed to a six-week high and Anime, Comic & Gaming Funds brought in nearly all that was lost in last week’s outflow, Semiconductor Funds suffered their heaviest outflow since early April.

Real Estate Sector Funds extended their current run of outflows to four weeks and $1.76 billion as a major subgroup, REIT Funds, experienced their heaviest redemption in nearly three months.

Bond and other fixed income funds

Going into the final week of May investors continued to cut their exposure to riskier asset classes. But they continued to ignore the threat that the latest standoff over the US debt ceiling will end in some form of a technical default by the country with the world’s largest national debt in cash terms.

The week ending May 24 saw US Bond Funds absorb over $8 billion while High Yield Bond Funds posted their third straight outflow and 11th in the past 15 weeks, Bank Loan Funds extended their current redemption streak to 18 weeks and Emerging Markets Bond Funds chalked up their 13th outflow since the second week of February.

Inflation continues to ebb in many corners of the world, albeit not as fast as policymakers would like, and investors pulled money out of Inflation Protected Bond Funds for the 39th week running. Of the $138 billion that flowed into this group between May 2020 and March 2022, $50 billion has been redeemed since 2Q22.

US Sovereign, Corporate and Mixed Bond Funds all recorded solid collective inflows during the latest week, with Intermediate Term Mixed and Long Term Sovereign Funds the groups to make the biggest contribution to the headline number. Municipal Bond Funds, meanwhile, chalked up their 11th outflow in the past 14 weeks.

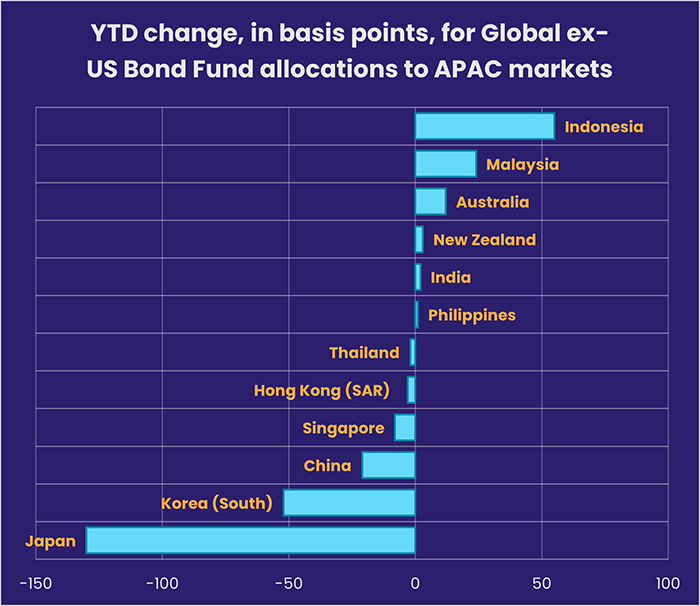

A fund group with minimal exposure to the US, Global ex-US Bond Funds, posted their 11th straight inflow during the latest week. Japan has been the market concerning managers of this group, with the average allocation cut by 135 basis points so far this year as markets tested the ability of Japan’s central bank to maintain its ultra-accommodative policies when most of its peers are aggressively tightening their policies.

China Bond Funds were not among the Emerging Markets Country Fund groups attracting fresh money in late May, and over $190 million flowed out of Thailand Bond Funds as investors wait to see what kind of government emerges after last week’s general election. Funds dedicated to the other market to hold an election recently, Turkey, posted their second biggest outflow since the beginning of last year.

Investors steered fresh money into Europe Bond Funds for 10th week running. Funds with corporate mandates took in more money than funds dedicated to sovereign debt for the first time since mid-April. At the country level, Spain Bond Funds posted their biggest weekly inflow in over six years and Italy Bond Funds since 3Q22.

Did you find this useful? Get our EPFR Insights delivered to your inbox.