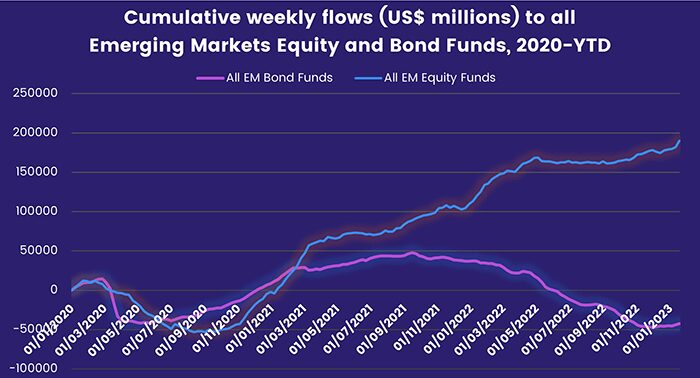

Flows into EPFR-tracked Emerging Markets Equity Funds during the third week of January climbed to their highest level since mid-1Q21 as investors positioned themselves for China’s much anticipated economic rebound and, the anti-inflation rhetoric of the Federal Reserve and European Central Bank (ECB) notwithstanding, an early end to the current interest rate cycles in the US and Europe. Investors also steered $2.5 billion – a 101-week high – into Emerging Markets Bond Funds.

The week ending Jan. 18 also saw US Bond Funds post retail inflows for the first time in over a year, Europe Equity Funds snap their record-setting outflow streak, investors flee Turkey Equity Funds and flows into Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates hit a 25-week high.

Overall, investors steered a net $7 billion into EPFR-tracked Equity Funds, with Dividend Equity Funds recording their 22nd inflow in the past 26 weeks, and parked $11.8 billion in Bond Funds. They also committed $1.5 billion to Alternative Funds, ended Balanced Funds’ short-lived inflow streak and pulled over $16 billion out of Money Market Funds.

At the single country and asset class fund levels, Bank Loan Funds recorded their first inflow since early November, Inflation Protected Bonds racked up their 22nd consecutive outflow and redemptions from Silver Funds climbed to an 18-week high. Netherlands Bond Funds posted their biggest outflow in over seven months, another $252 million flowed out of Brazil Equity Funds and commitments to Israel Equity Funds hit a level last seen in mid-1Q21.

Emerging Markets Equity Funds

Fears that the massive movement of people for the Lunar New Year holiday will serve as a ‘super spreader’ event for Covid in the world’s second-largest economy, investors opted in mid-January to look past that risk and position themselves for accelerating Chinese growth in the second half of this year. With flows into China Equity Funds hitting a 51-week high and the diversified Global Emerging Markets (GEM) Equity Funds posting their biggest inflow since the second week of 2021, EPFR-tracked Emerging Markets Equity Funds took in over $10 billion during the week ending Jan. 18.

It was a record-setting week for EM Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. China SRI/ESG Equity Funds accounted for over half of the headline number for all funds.

Investor interest in Emerging Asian markets was not to confined to China. With India expected to growth over 6% this year while taking the mantle of the world’s most populous nation from China, India Equity Funds have absorbed fresh money for eight weeks running with the latest inflow the biggest in nearly four months. Vietnam Equity Funds also enjoyed another week of above average flows that contributed to the longest inflow streak Frontier Markets Equity Funds have enjoyed since 3Q14.

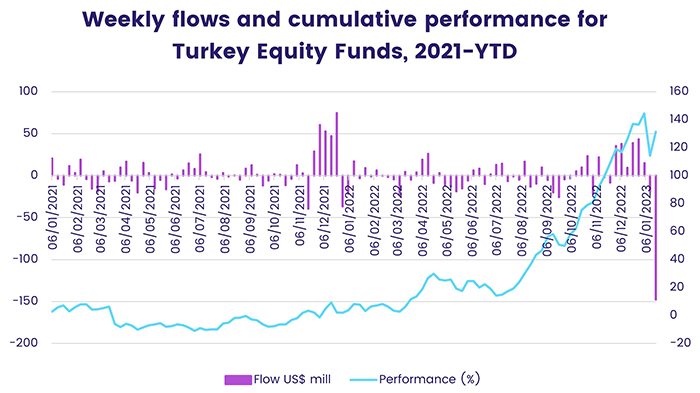

At the other end of the scale, Turkey Equity Funds posted their biggest outflow since mid-2Q13 as investors booked gains from last year’s dramatic rally and looked ahead to the general election expected during the second quarter. If incumbent President Recep Tayyip Erdogan wins another term, the unorthodox, statist policymaking widely blamed for an inflation rate still running north of 60% is likely to continue.

Once again, flows for all Latin America Equity Funds were dragged down by the heavy redemptions experienced by Brazil Equity Funds. Investors are still trying to gauge how new President Luiz Lula da Silva will govern the region’s largest country and finance his agenda. But Argentina Equity Funds did record their biggest inflow in over 22 months as hopes for Chinese growth – and demand for agricultural exports – in 2H23 continue to grow.

Developed Markets Equity Funds

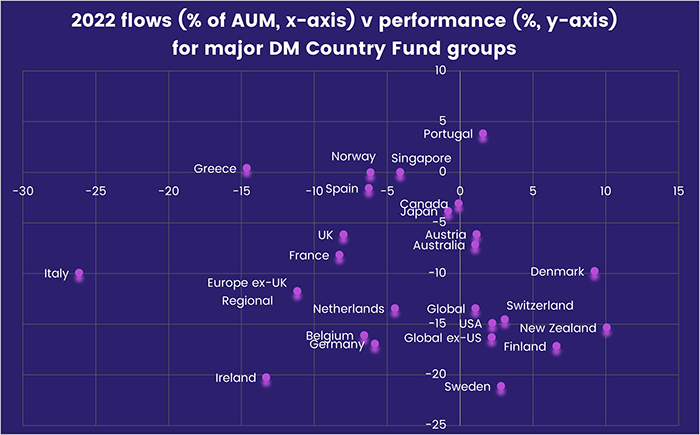

The snapping of Europe Equity Funds’ longest run of redemptions on record during the third week of January was not enough to stop all EPFR-tracked Developed Markets Equity Funds from recording their sixth outflow in the past nine weeks. Concerns that US monetary policy in 2022 has taken the world’s biggest economy to the brink of recession saw US Equity Funds experience net redemptions for the third week running, offsetting positive flows for Global, Europe, Australia and Japan Equity Funds.

Flows into Europe ex-UK Regional and Germany Equity Funds were the biggest contributors to the first inflow for Europe Equity Funds since early February of 2022. A warmer winter that has blunted the impact of Russia’s energy squeeze, improving sentiment in Germany and moderating inflation have prompted investors to reassess the outlook for the continent in 2023. With investors in a less defensive frame of mind, all five of the fund groups dedicated to the so-called Frugal Five markets – Sweden, Austria, Denmark, Finland and the Netherlands – posted outflows for the second week running. Last year all but Netherlands Equity Funds recorded an inflow.

On the other side of the Atlantic, with both consumer and manufacturing data softening and layoffs mounting, investors fear that US Federal Reserve policymakers have already overshot the ideal ‘pivot point’ for interest rates. US Equity ETFs posted outflows for the third straight week – their longest such run since late 2Q20 – with Large-Cap Funds experiencing the heaviest redemptions. Foreign-domiciled US Equity Funds posted their first outflow since the second week of December.

Both of the major Asia Pacific Country Fund groups attracted fresh money. Australia Equity Funds enjoyed another week of above average flows as investors penciled in stronger Chinese demand for Australian commodity exports. Japan Equity Funds recorded a minimal net inflow of $32 million during a week when the country’s central bank wrong-footed markets by sticking with the key planks of its ultra-accommodative monetary policy.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, recorded their third straight inflow. Japan-domiciled funds posted inflows for the 12th week in a row and 36th time in the past 38 weeks while Europe-domiciled Global Equity Funds have taken in fresh money 11 of the past 12 weeks. Funds with fully global mandates again attracted more than twice the amount committed to Global ex-US Equity Funds.

Global Sector, Industry and Precious Metals Funds

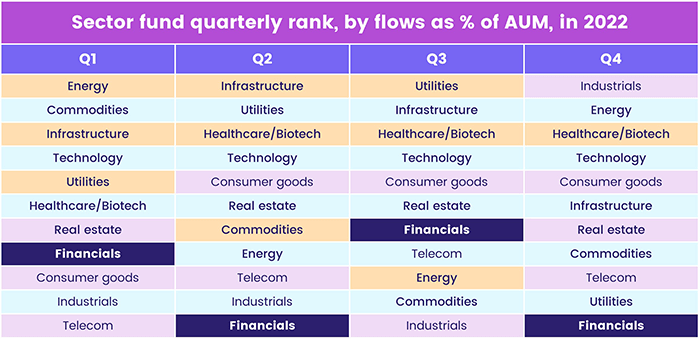

The number of EPFR-tracked Sector Fund groups posting an inflow climbed again in mid-January, with investors steering fresh money into seven of the 11 major groups. Those inflows ranged from $13 million for Utilities Sector Funds to $242 million for Real Estate Sector Funds. Financials Sector Funds topped the list of funds that posted outflows.

With the first batch of 4Q22 earnings reports from major banks studded with frequent references to the negative impacts of inflation, slowing economic growth and eroding purchasing power, Financials Sector Funds snapped a two-week, $560 million inflow streak with US-dedicated funds accounting for 70% of the headline number and China Financial Sector Funds accounting for most of the remaining 30%. Some investors showed an appetite for diversified exposure, with Global Financial Sector Funds enjoying a 31-week high inflow of $87 million.

Financial Sector Funds came into 2023 having ended two of the four quarters in 2022 at the bottom of the flow rankings in relative terms.

A mild winter has sapped investor appetite for Energy Sector Funds, which carried an eight-week redemption streak into mid-January. But the anticipated reopening of China may be changing that calculation. Underpinned by $147 million flowing into US-dedicated Energy Sector Funds – their first inflow in three weeks – the overall group recorded their first inflow since mid-November.

Elsewhere, flows into Real Estate Sector Funds climbed to a 17-week high on the back of Switzerland and Japan-dedicated funds absorbing $160 million each during the latest week. Investors committed $91 million, a 28-week high, to China Real Estate Sector Funds.

With major US tech companies still culling their workforces, the latest outflow streak for Technology Sector Funds hit eight weeks and $3.2 billion. That is their longest run of redemptions since another eight-week run that started mid-December 2018. The two funds recording the biggest outflows for the week have semiconductor mandates.

Bond and other Fixed Income Funds

Three weeks ago, EPFR-tracked Bond Funds closed the books on a year when investors redeemed a record $478 billion. Since then, they have absorbed over $35 billion as investors continue to bet that falling inflation and weak economic growth will cool the appetite of central bankers for further interest rate hikes.

The latest reporting period, which ended on Jan. 18, saw a net $14.3 billion flow in. That number included the biggest flows into Global and Emerging Bond Funds since 1Q21, the nearly $4 billion committed to Europe Bond Funds and the first retail inflows for US Bond Funds since the final week of 2021.

At the asset class level, Inflation Protected Bonds extended their longest outflow streak since a 38-week run ended in 4Q13, High Yield Bond Funds took in over $2 billion for the second week running, Mortgage Backed Bond Funds posted consecutive weekly inflows for the first time since mid-August and Bank Loan Funds chalked up only their fifth inflow since the beginning of last May.

Going into the Bank of Japan’s first policy meeting of 2023, Japan Bond Funds posted a fourth consecutive inflow for the first time in over six months. The BOJ did not, as expected, signal any further retreat for its current policies. That includes defending the cap on 10-year government bonds, something that may require it to step up its purchases as markets test the current line.

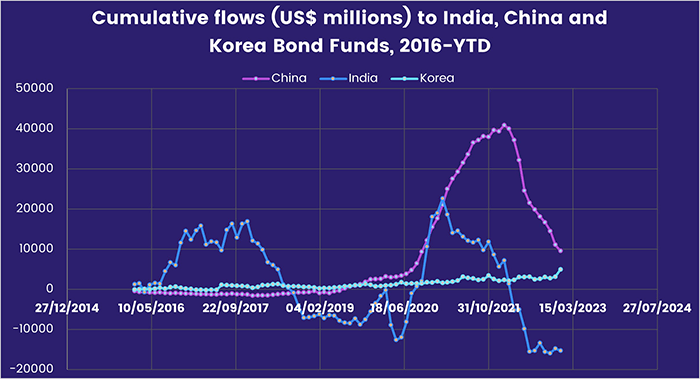

Emerging Markets Bond Funds pulled in over $2 billion as Hard Currency EM Funds posted their eighth inflow in the past 10 weeks and their biggest since 1Q21. At the country level, investors focused on Asia continued to shift their affections from China to Korea with funds dedicated to the former posting their 34th outflow since mid-1Q22 and Korea Bond Funds chalking up their ninth consecutive inflow.

Flows to US Bond Funds were less concentrated in mid-January, with money finding its way to groups of all durations and net flows to all US Sovereign and Corporate Bond Funds in the same ballpark. Short Term Mixed Bond Funds were the least popular group.

Europe Bond Funds posted their biggest inflow since the second week of 3Q21 despite Eurozone inflation running at 9.2% in December and the European Central Bank’s intent to start running down its balance sheet later this quarter.

Did you find this useful? Get our EPFR Insights delivered to your inbox.