A year ago, the prospect of central bank action to curb inflation and rising Covid-19 caseloads helped to chase over $40 billion out of EPFR-tracked Equity Funds. It was the same story during the week ending December 21, as surging Covid cases in China and fears that the monetary tightening cycles on both sides of the Atlantic have further to run prompted investors to pull nearly $42 billion out of those Equity Funds.

“Although there were some technical factors affecting US Equity Fund flows during the latest reporting period – funds going ex-dividend, a ‘triple witching’ of expiring options and futures contracts – those don’t invalidate the overall trend,” noted EPFR Research Director Cameron Brandt. “Alternative, Balanced, Bond and Money Market Funds also experienced significant redemptions as investors grapple with a highly uncertain outlook for the first half of next year.”

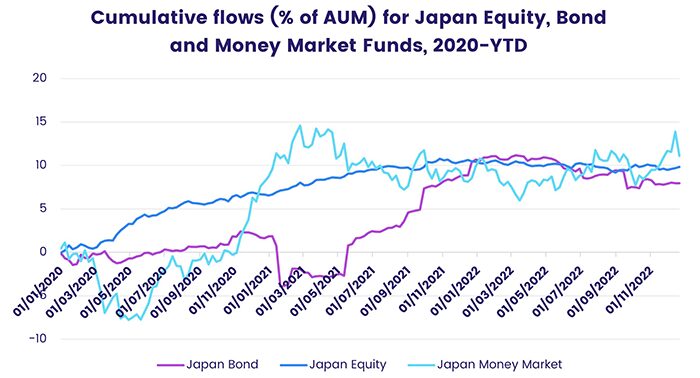

Adding to that uncertainty was the Bank of Japan’s decision to lift its cap on 10-year government bonds from 0.25% to 0.5%, a move seen by many as the first step towards tightening the most accommodative monetary program among the world’s major economies. Flows into Japan Equity Funds climbed to an eight-week high while Japan Money Market Funds posted their biggest outflow since early 4Q21.

The broad pullback swept up Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which posted their first outflow since late October and only their 12th since the beginning of 2019.

Overall, investors removed a net $41.8 billion from all EPFR-tracked Equity Funds during the third week of December. Money Market Funds surrendered $59.5 billion – their biggest collective outflow since mid-February – while Bond Funds saw $10 billion flow out and Balanced Funds $3.3 billion. Redemptions from Alternative Funds climbed to a 12-week high of $4.5 billion as Derivatives Funds recorded their biggest outflow in over 30 months.

Emerging Markets Equity Funds

Having started December with two consecutive outflows, normal service for EPFR-tracked Emerging Markets Equity Funds resumed during the third week of the month as strong flows into China Equity Funds lifted the headline number for Asia ex-Japan and all EM Equity Funds into positive territory. EMEA and the diversified Global Emerging Markets (GEM) Equity Funds also recorded modest inflows.

The latest flows into China Equity Funds lifted the year-to-date total over the $67 billion mark versus $88.3 billion for all EM groups. Although the strong retail support China Equity Funds enjoyed in 2020 and 2021 has evaporated, China’s benchmark equities index is down 22% so far this year and Covid-19 cases have surged as containment measures have been relaxed, this group looks certain to set a new full-year inflow record as investors position themselves for a post-Covid rebound in the world’s second largest economy.

Funds dedicated to India and Vietnam also continue to enjoy strong flows. Vietnam is benefiting from the perception that it will be a major beneficiary when supply chains currently anchored in China are relocated for political and cost reasons. India Equity Funds are also on track for a new yearly inflow record. They have taken in fresh money eight of the past nine weeks as investors seek exposure to an economy expected to grow 6.9% during the current fiscal year and a stock market up some 18% since it bottomed out in mid-June.

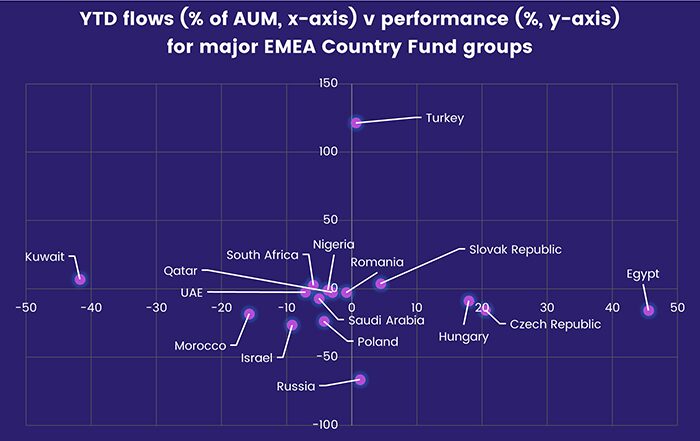

Investors are also scrambling to increase their exposure to the best performing EMEA market, with Turkey Equity Funds posting their biggest inflow in exactly a year as they extended their longest inflow streak since 4Q21. But funds dedicated to the Slovak Republic, the only other group to record positive flows and performance, posted their biggest outflow since early May.

Latin America Equity Funds recorded their fourth consecutive outflow even though Mexico and Brazil Equity Funds both posted modest inflows. In the case of Brazil Equity Funds, domestically domiciled funds recorded their second straight inflow while funds domiciled overseas experienced net redemptions for the fourth week running.

Developed Markets Equity Funds

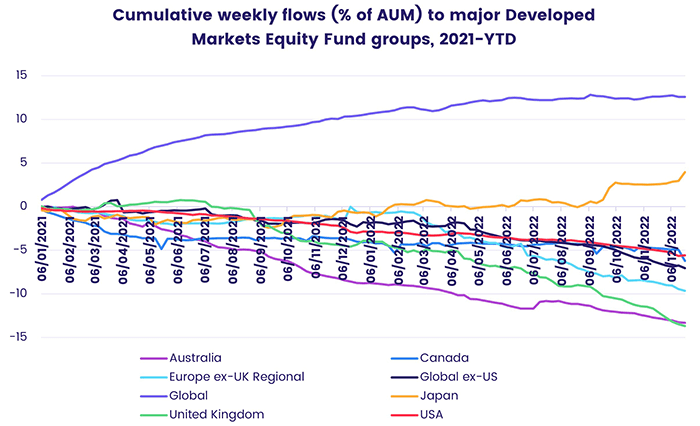

EPFR-tracked Developed Markets Equity Funds struggled to attract fresh money going into the final 10 days of 2022 as fears that monetary tightening, the ongoing war in Ukraine and rising Covid caseloads are increasing the odds of a global recession weighed on investor sentiment. US, Canada and Global Equity Funds were all hit with above average redemptions while Europe Equity Funds racked up their 45th consecutive outflow.

In the case of Canada Equity Funds, the latest outflow was the biggest since EPFR started tracking them in 1Q04. The redemptions were broadly based, with 27 funds seeing over $10 million flow out during the week.

Funds going ex-dividend and the expiring of futures and options contracts had a bearing on flows to US Equity Funds, which recorded their biggest outflow in exactly a year. The group also recorded its first retail inflow since mid-August and biggest since early July. But funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their sixth outflow in the past nine weeks. In 2021, US SRI/ESG Equity Funds posted inflows every week of the year.

While US Equity Funds were enjoying a rare week of retail inflows, Global ex-US Equity Funds were posting their 34th retail outflow in the past 36 weeks and their biggest since late April.

Investors pulled another $2.6 billion out of Europe Equity Funds as that fund group’s current outflow streak hit 45 weeks and $120 billion. Already muted hopes for the region’s growth prospects took another hit at the beginning of the reporting period when the European Central Bank hiked interest rates by another 50 basis points and announced that it will start running down its balance sheet next March. At the country level Austria, UK and Greece Equity Funds posted outflows for the 14th, 26th and 36th straight week, respectively.

Japan’s central bank also rattled markets by lifting its de facto cap on the Japanese 10-year government bond from 0.25% to 0.5%, a move seen by some investors as the start of the BOJ’s retreat from quantitative easing. But Japan Equity Funds took in fresh money for the third straight week, their longest run of inflows since the second quarter.

Global Sector, Industry and Precious Metals Funds

With 2022 winding down and two more interest rate hikes on the books in the US and Eurozone, flows for EPFR-tracked Sector Funds remained subdued during the third week of December with seven of the 11 major groups posting an outflow. Healthcare/Biotech Sector Funds recorded the biggest inflow — $298 million – while Financial Sector Funds experienced the heaviest redemptions.

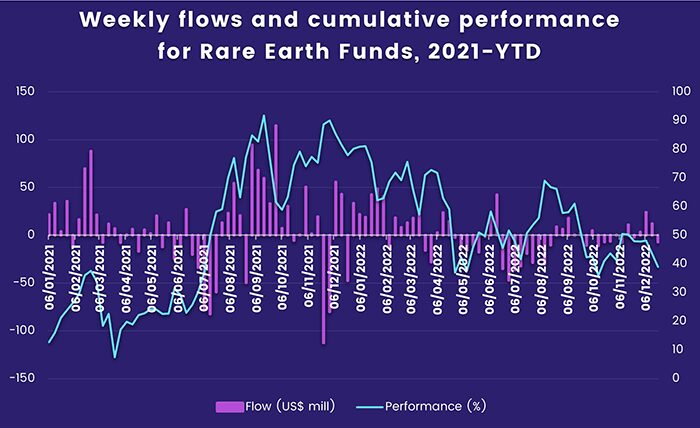

With expectations for global growth during the first half of next year dimming, Industrials, Energy and Commodities Sector Funds all posted outflows. For the latter, it was the fifth outflow in the past seven weeks. Caught up in the downdraft were dedicated Rare Earth Funds, which invest in materials that are critical to many high-end electronic, clean energy and medical products. The biggest producer of rare earths is China.

Also posting outflows were Infrastructure Sector Funds, which posted a third consecutive outflow for the first time since 4Q20. The group, which carried a 19-week inflow streak into the third quarter, has seen investor appetite ebb as rising inflation and interest rates lift construction costs while crimping corporate and government capital budgets.

Technology Sector Funds extended their longest outflow streak since the second quarter. But dedicated China Technology Sector Funds extended an inflow streak stretching back to early August.

Year-to-date Energy and Commodities Sector Funds have delivered the best collective performance, Telecom and Technology Sector Funds the worst.

Bond and other Fixed Income Funds

The turn for worse that flows to EPFR-tracked Bond Funds took towards the end of the previous week put the group on track to record its biggest outflow in two months during the third week of December. With both the US Federal Reserve and European Central Bank dashing hopes of an early pivot from tightening to easing, Emerging Markets Bond Funds saw their short-lived inflow streak come to an end while redemptions from US Bond Funds hit a level last seen in late 1Q20.

At the asset class level, outflows were the norm. Convertible, Bank Loan and Municipal Bond Funds all posted their biggest weekly outflow since late September, Total Return and Inflation Protected Bond Funds extended redemption streaks that started in mid-August and over $5 billion flowed out of High Yield Bond Funds.

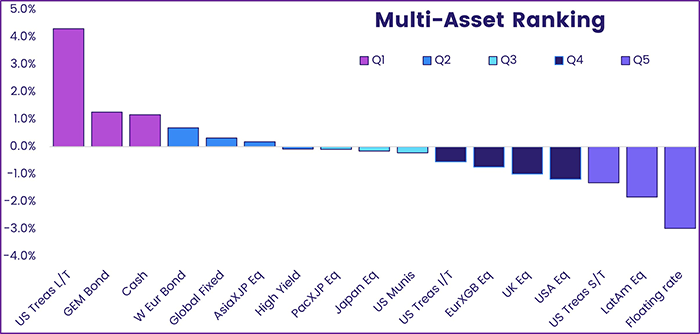

US long-term Treasuries remain atop EPFR’s weekly multi asset rankings, which are based on analysis of funds that invest in more than one asset class. But intermediate and short-term Treasuries, which also feature in the top three coming into the fourth quarter, have tumbled down the rankings while diversified emerging markets debt has climbed from the bottom to the top quintile over the past 12 weeks.

Hard Currency Emerging Markets Bond Funds drove the latest outflow from all EM Bond Funds during a week when their local currency counterparts recorded their biggest inflow since late January. At the country level, China Bond Funds racked up their 44th outflow in the past 45 weeks despite optimism that Chinese policymakers, having turned the screws on heavily indebted issuers from the key property sector, are now intent on bailing out the survivors. At the other end of the flow scale, Korea Bond Funds recorded their biggest inflow since early 3Q17.

The ECB’s latest rate hike did not stop Europe Bond Funds from posting their fifth straight inflow as both of the major regional groups absorbed over $500 million and flows into Switzerland Equity Funds hit a 20-week high, offsetting the biggest weekly outflow from Germany Bond Funds since mid-4Q19.

Among the major US Bond Fund groups, outflows from US High Yield, Long Term Sovereign and Short Term Corporate Bond Funds hit 15, 49 and 144-week highs, respectively. Year-to-date, the best performing US Bond Fund has returned 6.7% while the worst performer is down over 11%.

Did you find this useful? Get our EPFR Insights delivered to your inbox.