Actions spoke louder – to equity investors – than words coming into February, with the fact that the latest interest rate hike by the US Federal Reserve was only 25 basis points, boosting flows to US Equity Funds and other groups despite the accompanying verbal warning that the battle against inflation is “not fully done.”

EPFR-tracked Equity Funds posted a collective inflow of $16 billion for the week ending Feb. 1, with nearly $7 billion of that total arriving during the final day of the reporting period when the Fed’s latest policy decision was announced. Over half of the headline number for all Equity Funds on the first day of February flowed into US Equity Funds, which recorded their biggest daily inflow since the fourth week of December.

Although the Fed’s latest hike was the smallest since the beginning of the current tightening cycle in March of last year, it added to the pressure on rate setters at other central banks. Japan Bond Funds saw money flow out for the sixth week running, with the latest redemptions hitting an 18-week high, as the Bank of Japan spent significant sums to defend its policy ceiling for 10-year Japanese government bond yields.

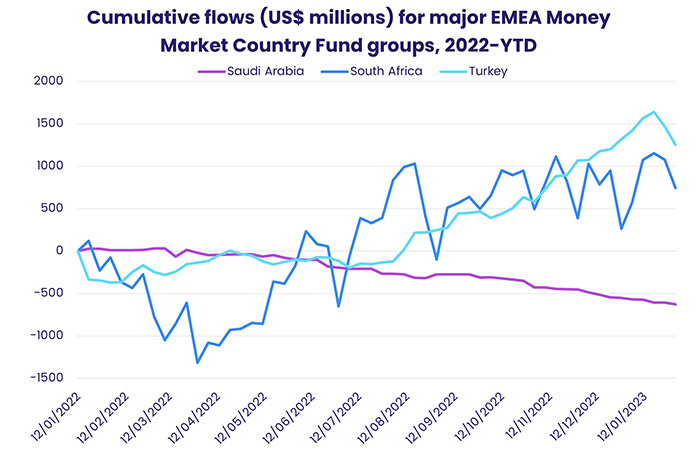

With cash accounts paying more as interest rates rise, US Money Market Funds extended their longest inflow streak since 3Q21. The latest data from EPFR’s iMoneyNet division show seven-day yields on both government and prime US Money Market Funds are now running at over 3.7%. Among the major emerging markets liquidity fund groups, Turkey MM Funds posted their biggest outflow since the first week of last year and over $300 million flowed out of South Africa MM Funds.

At the single country and asset class fund levels, flows into Cryptocurrency Funds climbed to a six-month high, Gold Funds recorded their biggest outflow since late October and redemptions from Inflation Protected Bond Funds hit a 14-week high. Austria, Switzerland and Belgium Equity Funds posted their largest outflows since 3Q22, 4Q21 and 4Q19, respectively, while France Equity Funds chalked up their second biggest inflow since 1Q20.

Emerging Markets Equity Funds

The week ending Feb. 1 was another good one for EPFR-tracked Emerging Markets Equity Funds, which extended their current inflow streak to seven weeks and $33 billion as flows into retail share classes hit a level last seen in late 1Q21. China’s reopening story, the US Federal Reserve’s second straight downshift in the pace of interest rate hikes and optimism about the outlook for Europe all contributed to the latest inflows.

Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds continue to absorb the bulk of the fresh money committed to this asset class. But flows into Latin America Equity Funds climbed to a 10-week high, BRIC (Brazil, Russia, India and China) Equity Funds posted their biggest inflow in over 13 months as they extended their longest inflow streak since 2Q18 and Emerging Markets Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates took in over $1.3 billion.

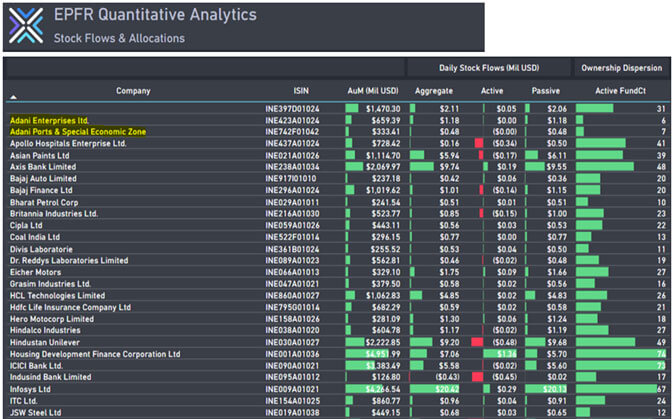

Interest in direct exposure to China remains high, with the latest flows into China Equity Funds exceeding $3 billion for the second time in the past three weeks. Funds dedicated to another regional heavyweight, India, also took in fresh money as they extended their longest inflow streak since 2Q17. The latest flows to India Equity Funds were, however, only a 10th of the previous week’s total as allegations about Indian conglomerate Adani’s financial practices rattled domestic markets. EPFR’s latest stock-level flow data shows that interest in Adani has dropped to minimal levels.

Latin America Equity Funds benefited from the optimism about Chinese growth and demand for raw materials as the year progresses. Brazil Equity Funds snapped a five-week run of outflows, Mexico Equity Funds racked up their seventh straight inflow and 11th in the past 12 weeks, flows into Chile Equity Funds climbed to a 21-week high and Argentina Equity Funds recorded their biggest inflow since mid-1Q21.

Interest in exposure to the EMEA universe remains at a low ebb, with Egypt’s precarious financial situation adding to a lengthy list of investor concerns. These range from Russia’s ongoing assault of Ukraine to the impact of drought in Africa. During the latest week EMEA Equity Funds experienced their heaviest redemptions since mid-3Q22.

Developed Markets Equity Funds

For the second week running, flows into US, Global and Europe Equity Funds more than offset redemptions from Japan, Canada, Pacific Regional and Australia Equity Funds recorded, allowing EPFR-tracked Developed Markets Equity Funds overall to post their third inflow of 2023.

In contrast to the previous week, US Equity Funds were the biggest money magnets among the major groups while Europe Equity Funds extended their current inflow streak – the longest in over a year – by the skin of their teeth. Redemptions from groups dedicated to Germany, Belgium, Spain and two of the major markets outside the European Union, Switzerland and the UK, whittled down the headline number ahead of policy meetings by the Bank of England and the European Central Bank.

The latest sector allocations data shows that coming into 2023, managers of UK Equity Funds had significantly more exposure to financial, consumer staples and energy stocks than their Europe ex-UK Regional Fund counterparts. But their allocation to the technology sector was less than a third of the average for the regional group.

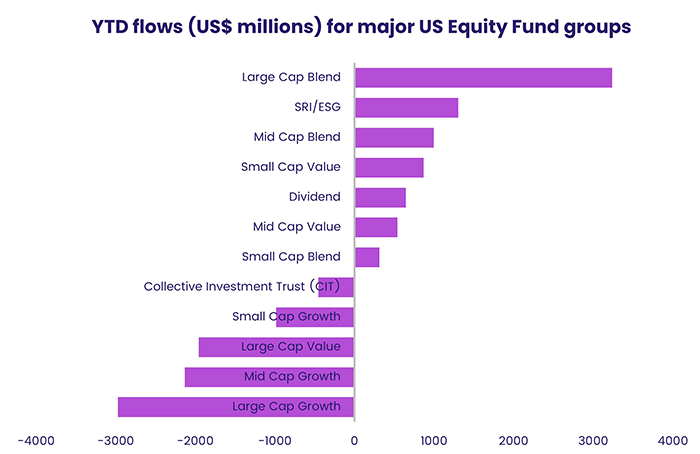

Flows to US Equity Funds included the biggest retail inflow since the final week of 2021, a rebound in flows to US Dividend Equity Funds and a fifth inflow in the past six weeks for US Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. Large Cap Mixed and Value Funds recorded the biggest inflows among the style and capitalization groups while Mid Cap Growth Funds posted the biggest outflow.

Investors pulled another $450 million from Japan Equity Funds as headline inflation in the world’s third-largest economy touched a four-decade high. That, and some eye-catching wage increases, are fueling fears that the Bank of Japan will be forced into a disorderly retreat from its ultra-accommodative monetary policies.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, recorded their fifth straight inflow. Funds with fully global mandates pulled in over $7 for every $1 absorbed by their ex-US counterparts.

Global Sector, Industry and Precious Metals Funds

The week ending Feb. 1 was marked by a slew of earnings reports, the first US rate hike of 2023 and millions of Chinese workers heading home to celebrate the Lunar New Year. Against this backdrop, six of the 11 major EPFR-tracked Sector Fund groups posted inflows while five recorded outflows, as did both Silver and Gold Funds.

While precious metal funds failed to shine, Financial Sector Funds posted their biggest inflow in over three months. Funds dedicated to the US accounted for $730 million of the overall headline number as the Fed’s latest 0.25% rate hike provided more room for net interest margins to grow. Of the top 10 funds ranked by inflows for the week, three were bank-related, three securities-focused and all but one were ETFs.

Higher interest rates are generally not positive for sectors, such as technology, with capital-intensive development costs for new – and hence unproven – goods and services. US Technology Sector Funds posted their 10th consecutive outflow and Taiwan (POC) Technology Sector Funds posted their heaviest outflow since the first week of 2022.

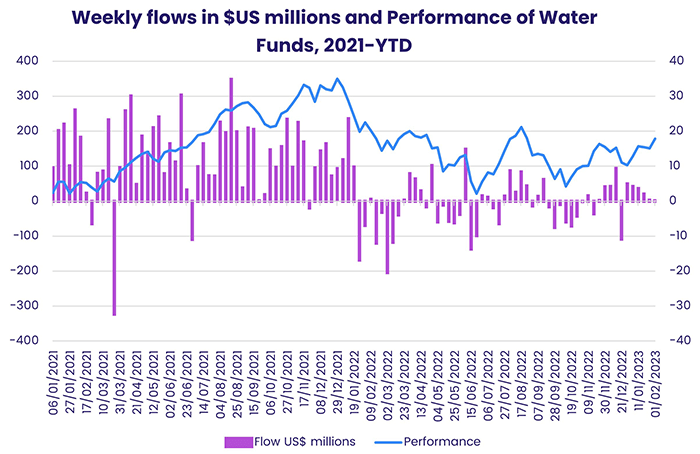

Utilities Sector Funds also posted outflows, snapping a three-week inflow streak along the way. But Water Funds posted their sixth straight inflow as the growing mismatches between supply and demand in many corners of the world attract fresh interest from private investors.

Elsewhere, Commodities Sector Funds posted their second straight inflow, Infrastructure Sector Funds took in fresh money for the second time in the past three weeks and Industrial Sector Funds snapped a two-week outflow streak as defense-related funds dominated the top of the weekly fund-level flow rankings.

Bond and other Fixed Income Funds

Flows to EPFR-tracked Bond Funds slowed during the final week of January as policymakers at the US Federal Reserve, European Central Bank and Bank of England resumed their battles against inflation. But investors got enough of what they were looking for – evidence inflation is moderating in Europe and a slower pace of US rate hikes – to remain cautiously optimistic.

US, Europe, Emerging Markets and Global Bond Funds all recorded inflows going into February. In the case of Emerging Markets and Global Bond Funds, both extended their longest inflow streaks since 3Q21 while Europe Bond Funds posted their 13th inflow in the past 15 weeks.

At the asset class level, investors pulled another $1.5 billion out of Inflation Protected Bond Funds, High Yield and Mortgage Backed Bond Funds chalked up their third inflow in the past three weeks and Bank Loan Bond Funds experienced net redemptions for the 32nd time in the past 34 weeks.

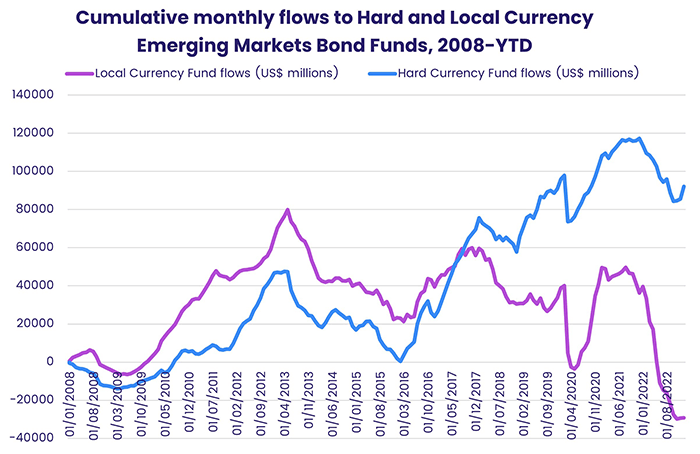

Emerging Markets Hard Currency Bond Funds attracted nearly $1 billion as EM Bond Funds overall posted their fourth straight inflow. Frontier Markets Bond Funds posted consecutive weekly inflows for the first time since mid-3Q22 while, at the country level, Korea Bond Funds posted their 11th straight inflow and redemptions from Brazil Bond Funds hit their highest weekly total since 3Q20.

Among US Bond Fund groups, Municipal Bond Funds saw their longest inflow streak since early 1Q22 come to an end and Long Term Treasury Funds posted their biggest outflow since the first week of 2022. Retail flows to all US Bond Funds were positive for the second time year-to-date.

Global Bond Funds posted their biggest retail inflow in over 16 months. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates chalked up their 13th inflow in the past 14 weeks.

Europe Sovereign Bond Funds attracted more money than their corporate counterparts for only the third time since the beginning of November.

Flows for the two major multi-asset groups, Balanced and Total Return Bond Funds, continued their recent divergence. Total Return Funds posted inflows for the fourth week running, with the latest inflow the biggest since 2Q21, while Balanced Funds posted their third straight outflow.

Did you find this useful? Get our EPFR Insights delivered to your inbox.