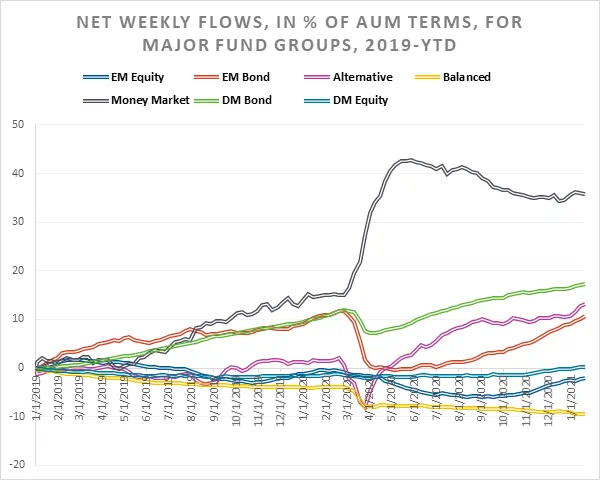

Three weeks into the New Year, general optimism about the global economy continues to clash with specific worries about the capacity of the Covid-19 virus to mutate, the outlook for tourism and travel, the economic costs of the second round lockdowns – especially in Europe – and inflation. The week ending January 20 saw EPFR-tracked Global and Global Emerging Markets (GEM) Equity Funds pull in a combined $17 billion, taking their year-to-date total past the $44 billion mark, while Inflation Protected Bond Funds absorbed fresh money for the 34th time in the past 37 weeks and flows into Bank Loan Funds hit their highest level since 2Q17.

The swearing in of Joseph Biden as the 46th President of the United States added to the tailwinds behind the global reflation and green investment stories. Biden’s promise of another $1.9 trillion stimulus package heavily weighted towards climate change and clean energy goals is positive for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. It is also being translated, to the benefit of Emerging Markets Equity and Bond Funds, into a weaker dollar and increased US demand for emerging markets exports.

Did you find this useful? Get our EPFR Insights delivered to your inbox.