What narrative to back? The developed markets reflation story? An increasingly green future? A fairytale financial universe populated by cryptocurrencies and meme stocks? A gothic novel featuring higher taxes, inflation and state intervention?

The search for direction during the first week of June saw investors commit over $5 billion to the two major EPFR-tracked multi asset fund groups, increase their exposure to Europe’s gathering rebound, add to their inflation hedges and extend lengthy inflow streaks for a number of fund groups with socially responsible (SRI) or environmental, social and governance (ESG) mandates.

US Equity Funds, however, saw their record-setting run of inflows come to an end as the focus shifted from America’s strong growth to May’s headline inflation number – it came in at 5%, the highest since 2008 – and the higher taxes that currently seem inevitable. Municipal Bond Funds saw flows hit a 17-week high as they recorded their 22nd inflow year-to-date, TIPS Bond Funds racked up their 36th consecutive inflow and US Bank Loan Funds absorbed fresh money for the 23rd straight week.

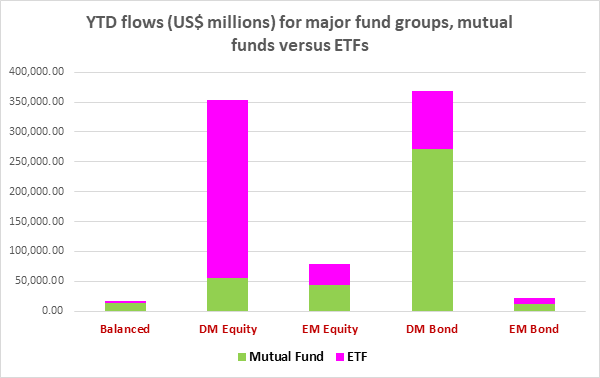

Overall, EPFR-tracked Bond Funds recorded a collective inflow of $12.4 billion during the week ending June 9. Equity Funds took in a net $1.5 billion, a number that would have negative but for flows into SRI/ESG Funds, with Dividend Equity Funds posting their 13th inflow in the past 15 weeks. But YTD net flows into all Equity Funds have already exceeded the current full-year record of $358 billion set in 2013. Three out of every four dollars committed by equity investors so far this year have gone to Equity ETFs.

Did you find this useful? Get our EPFR Insights delivered to your inbox.