Over $110 billion – a 131-week high – flowed into EPFR-tracked Money Market Funds during the week ending Jan. 4 as investors surveyed an investment landscape still being reshaped by inflation, tighter monetary policy and geopolitical forces. Beyond a desire to stay close to cash, those investors showed little conviction and, when they did, it was usually to cut their exposure to the asset class in question.

Among the exceptions were US Bond Funds, which recorded their biggest inflow since late October, and Vietnam Equity Funds which absorbed above average amounts of fresh money for the 10th week running. Dividend Funds, China Equity Funds and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which ended 2022 strongly, also recorded inflows that were in line with recent weekly averages and Europe Equity Funds came the closest to snapping their record-setting outflow streak since it began in mid-2Q22.

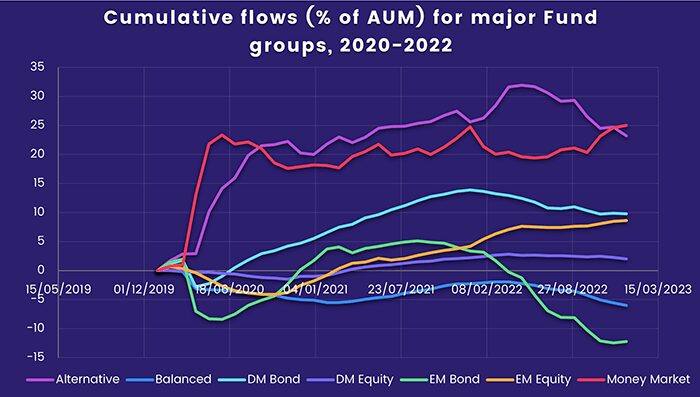

Overall, EPFR-tracked Equity Funds started 2023 by posting a collective outflow of $4.6 billion and Alternative Funds experienced net redemptions for the fifth consecutive week. Balanced Funds absorbed a net $60 million, their first inflow since mid-August of last year, $6.4 billion flowed into Bond Funds and Money Market Funds pulled in $112 billion with US Money Market Funds accounting for three-quarters of the headline number.

At the single country and asset class and single country fund levels, Inflation Protected Bond Funds posted their 19th consecutive outflow, investors pulled money out of Bank Loan Funds for the 29th time in the past 31 weeks, Cryptocurrency Funds recorded their sixth outflow in the past seven weeks and Gold Funds extended their longest inflow streak since 2Q22. Flows into Netherlands, Finland and France Equity Funds hit 21, 33 and 50-week highs, respectively, while Chile Equity Funds posted their biggest weekly outflow on record.

Emerging Markets Equity Funds

It was more of the same for EPFR-tracked Emerging Markets Equity Funds in early January, with solid flows into dedicated China Equity Funds keeping the headline number for all funds in positive territory. At the other end of the scale, investors did show some interest in smaller markets with Frontier Markets Funds chalking up their 10th straight inflow.

The latest flows into China Equity Funds included only the fourth week of retail commitments since late July, and came despite the rapid spread of Covid-19 in the wake of the abrupt easing of zero-Covid policies towards the end of last year. The latest sector allocations for this group show allocations to financial and consumer discretionary stocks climbed sharply in November, with the latter hitting a record high, while weightings for the Consumer Staples and Technology Sectors slipped to 13 and 30-month lows, respectively.

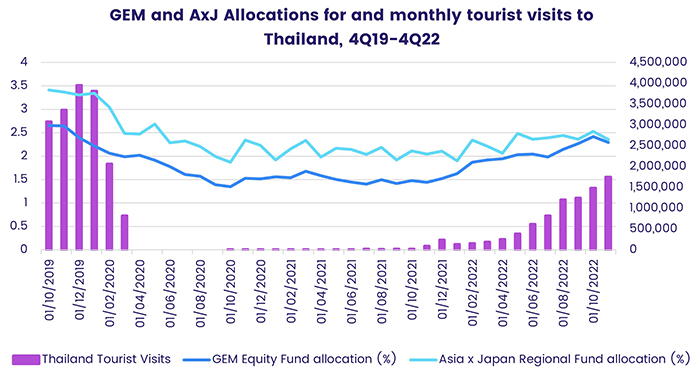

Covid’s rapid spread in China has chilled hopes of a quick boost to Thailand’s key tourism sector, which has regained some of the ground it lost when the pandemic hit in 1Q20. Thailand Equity Funds saw a three-week run of inflows come to an end, with the latest redemptions the biggest since mid-September.

Latin America Equity Funds posted their fifth outflow in the past six weeks as investors pulled over $100 million out of both Brazil and Chile Equity Funds. In the case of Brazil, investors are waiting to see what kind of advantage incoming President Luiz Lula da Silva’s administration will take of the Brazilian Congress’s recent vote to suspend the current spending cap. Redemptions from a single domestically domiciled closed-end fund accounted for the bulk of the record outflow posted by Chile Equity Funds.

Among the EMEA Country Fund groups, South Africa Equity Funds recorded their biggest inflow since the beginning of 4Q22 and flows into Slovak Republic Equity Funds climbed to a 36-week high. Funds dedicated to Israel, where a new conservative government looks set to challenge established norms, posted their biggest outflow since last May.

Developed Markets Equity Funds

Early January saw money flow out of EPFR-tracked Developed Markets Equity Funds for the fifth time in the past seven weeks as the US Federal Reserve’s anti-inflation rhetoric kept US markets on edge. Funds dedicated to the two major North American markets accounted for the overall outflow, offsetting modest flows into Japan and Global Equity Funds.

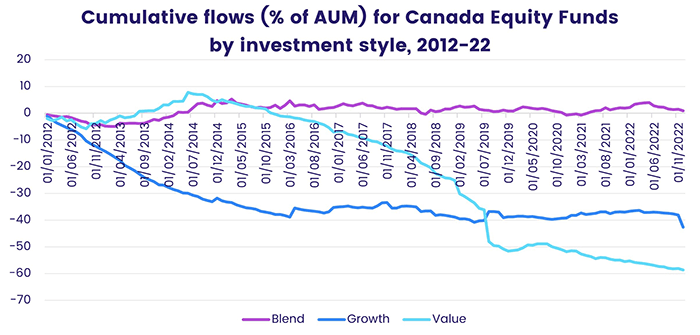

Although Large Cap Value Funds and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their third inflow in the past four weeks, US Equity Funds overall recorded their fifth outflow in the past seven weeks. Canada Equity Funds, meanwhile, posted their fifth outflow in the past six weeks as investors factored in a weaker US economy to their outlook for a country that sends three-quarters of its exports to its southern neighbor. Since 2010, Canada Equity Funds have only posted one full-year inflow (2021).

There were signs that chilly investor sentiment towards Europe may be thawing. During a week when the benchmark EuroStoxx 50 index again traded 20% off its late September low, Europe Equity Funds posted their smallest weekly outflow since their current 47-week redemption streak began. Both of the major regional groups posted modest outflows and over $100 million flowed out of Switzerland Equity Funds. Those outflows were partially offset by above average flows into Finland, Netherlands and France Equity Funds and the first consecutive weekly inflow for UK Equity Funds in over seven months.

Japan Equity Funds extended their longest inflow streak since 3Q21 as retail investors committed fresh money for the eighth straight week. Of the 10 funds recording the biggest inflow for the week, two have ESG mandates, one tracks the TOPIX index and six track the Nikkei 225 with three of those employing leverage.

Global Sector, Industry and Precious Metals Funds

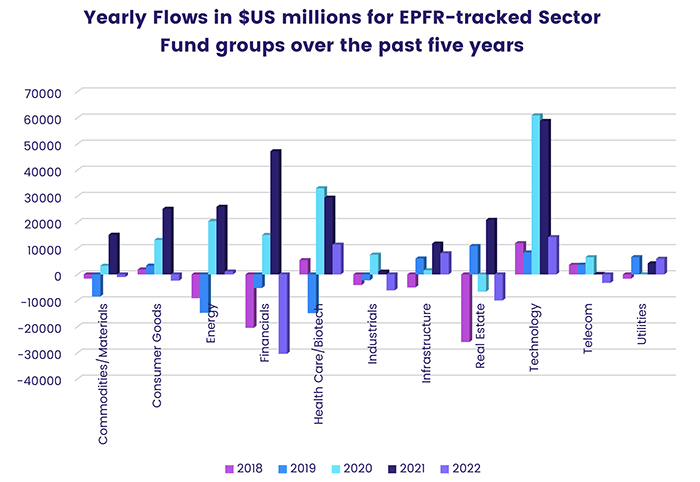

After a week where all 11 of the major EPFR-tracked Sector Funds posted outflows with a combined total of $4.3 billion, 2023 opened on a slightly better note with five groups – Financial, Consumer Goods, Utilities, Commodities and Industrials Sector Funds – chalking up inflows that ranged from $93 million to $331 million.

Financial Sector Funds, which experienced the heaviest redemptions of any group in 2022, recorded only their second inflow of the past seven weeks. Two Asian country groups, China and Japan Financial Sector Funds, stood out with flows to the former hitting a 15-week high and funds dedicated to Japan posting their biggest since 4Q20 following the Bank of Japan’s raising of its yield ceiling on government debt.

Commodities/Materials Sector Funds snapped a four-week, $1 billion run of outflows. Four of the top 10 funds ranked by inflows for the week have natural resources mandates and four have a gold or precious metals focus. With inflation still running well above most central bank target ranges, investors also committed fresh money to dedicated Gold Funds for the third straight week and fifth time in the past seven weeks. Silver Funds, meanwhile, posted their fifth outflow in the past six weeks.

Although Technology Sector Funds ended 2022 with the largest full-year inflow – their sixth straight — among the 11 groups, it was only a quarter of the level achieved in the previous two years.

After a week when Amazon announced letting go of 18,000 employees and Salesforce cutting 10%, while Tesla and Apple struggled with deliveries and production due to Covid’s impact on Chinese production facilities, US Technology Sector Funds racked up their sixth straight outflow. But China Technology Sector Funds absorbed fresh money for the 22nd week running as investors bet on a more supportive stance by Chinese regulators.

Bond and other Fixed Income Funds

After a year when EPFR-tracked Bond Funds surrendered over a third of the $1.26 trillion they absorbed in 2020 and 2021, the group started 2023 with its biggest weekly inflow since early August. US Bond Funds accounted for the bulk of the headline number. Global and Europe Bond Funds also recorded inflows, while Asia Pacific, Emerging Markets and most of the asset class fund groups posted outflows.

The reporting period ended with encouraging preliminary inflation readings for December from Germany and France. While markets are braced for further hikes from the US Federal Reserve and European Central Bank during the first half of this year, they are hoping the terminal rate in both tightening cycles will arrive by mid-year as previous rate hikes take their toll on global growth.

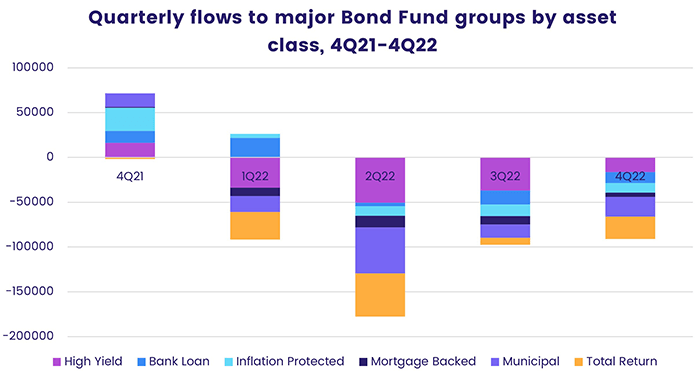

Fixed income investors continue to act as if the tightening that has already taken place is enough to curb inflation and weed out some of the riskier credits in global markets. During the week ending Jan. 4 they pulled another $1 billion out of High Yield Bond Funds, extended outflow streaks for Total Return and Inflation Protected Bond Funds that stretch back to August and hit Bank Loan Funds with their 32nd outflow in the past 35 weeks.

An end to interest rate hikes will be good news for emerging markets borrowers, and recently, Emerging Markets Bond Funds have posted inflows or modest outflows during the past month. The latest week saw retail share classes attract their biggest inflow since the first week of 2Q22, while funds socially responsible (SRI) or environmental, social and governance (ESG) mandates post their first outflow since early November.

At the country level, China Bond Funds posted their 26th outflow in the past 27 weeks and redemptions from Brazil Bond Funds hit a 51-week high. But interest in exposure to Africa debt climbed several notches, with flows into Africa Regional and South Africa Bond Funds climbing to 11 and 13-week highs respectively.

US Bond Funds with sovereign mandates drove the latest week’s flows. Short Term Sovereign Funds recorded their biggest inflow since early October and funds dedicated to Treasuries collectively took in eight times the amount that their investment grade corporate counterparts attracted.

Investors looking at Europe continue to favor funds offering exposure to investment grade corporate debt, which have taken in more money than Europe Sovereign Bond Funds nine of the past 11 weeks. Since mid-October intermediate term has consistently been the preferred duration. Regional funds eclipsed single country funds during the latest week in flow terms. UK Bond Funds did record their eighth consecutive inflow, extending their longest run since 1Q20.

Did you find this useful? Get our EPFR Insights delivered to your inbox.