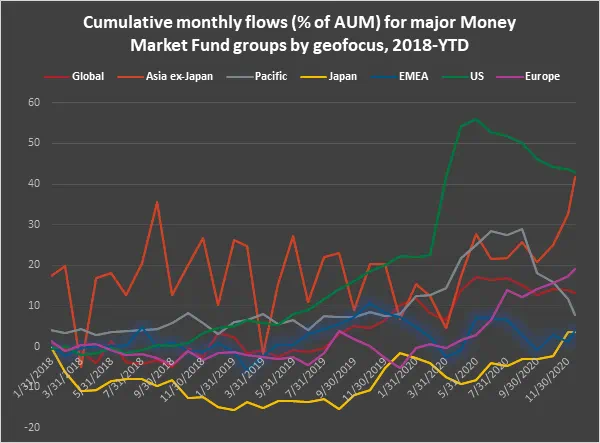

Mid-December saw EPFR-tracked Europe Equity Funds post their 11th outflow in the past 14 weeks and Europe Bond Funds experience their heaviest redemptions since late March as a host of issues, ranging from the impact of recent euro strength on regional exporters to the cost of new measures being rolled out to combat the Covid-19 pandemic’s second wave, sapped investor appetite for exposure to the region. European Money Market Funds, meanwhile, have recorded net inflows seven of the past 11 weeks as investors keep their options open.

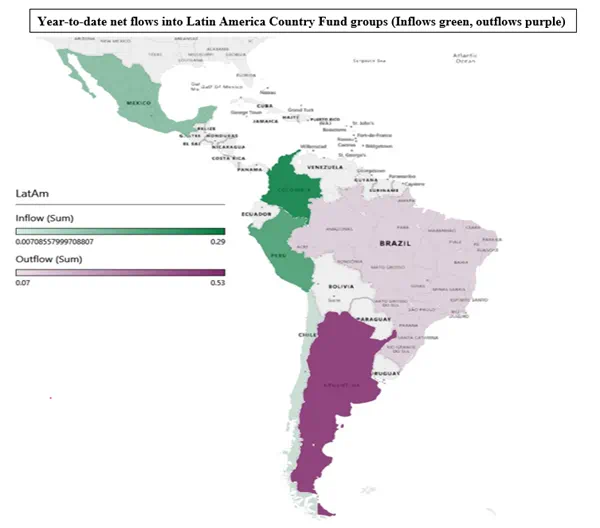

While shunning Europe, investors added significant sums to fund groups dedicated to themes with momentum: diversified exposure to post-vaccine reflation of the global economy, social and environmental justice, emerging markets and hedging against anticipated inflation. Global Equity Funds set a new inflow record, their second in less than a month, and both Emerging Markets Equity and Bond Funds maintained their strong finish to the year with the former pulling in over $2 billion for the sixth straight week while EM Bond Funds absorbing fresh money for the 11th week in a row.

There was also no let-up in the flows to Equity and Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, with investors committing another $10 billion to these groups. The latest inflows lifted the year-to-date total for SRI/ESG Bond and Equity Funds over the $55 billion and $175 billion marks respectively.

Overall, EPFR-tracked Equity Funds posted a collective inflow of $46.4 billion and Balanced Funds took in a net $3 billion during the week ending Dec. 16 while $34 million flowed into Alternative Funds and $795 million into Bond Funds. Redemptions from Money Market Funds totaled $58 billion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.