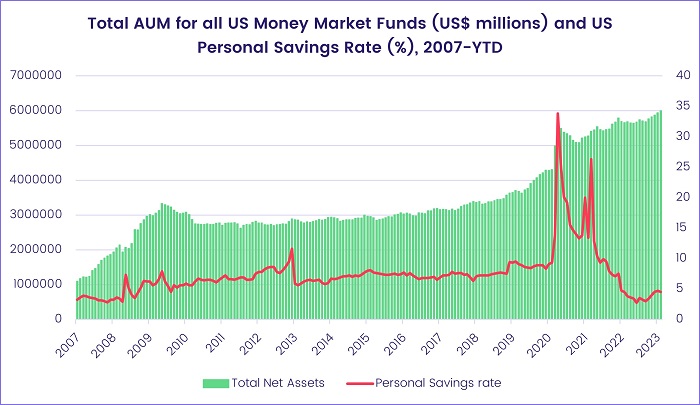

The week ending March 22 saw flows into EPFR-tracked Money Market Funds hit a 155-week high, with US-mandated funds absorbing over $100 billion for the second week running. The assets managed by US Money Market Funds are now north of $6 trillion, up from $5.5 trillion in 2Q20. Data from EPFR’s iMoneyNet offering shows that the AUM of taxable US MM Funds has moved past $5 trillion, with the average seven-day yield offered by this group at 4.28% and the average weighted maturity of their portfolios standing at 14 days versus 2.6% and 16 days at the beginning of 4Q22.

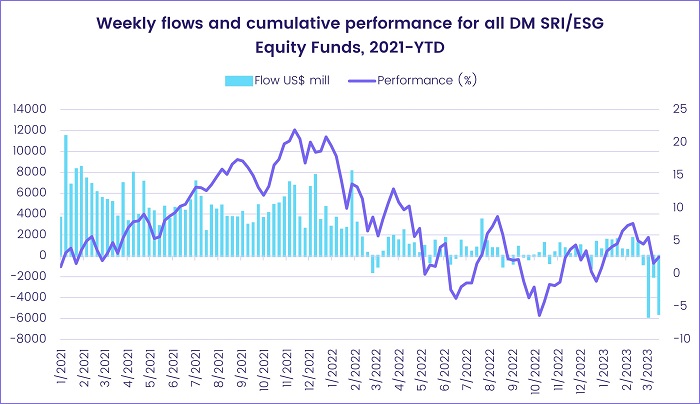

The latest dash-to-cash did not spare funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. SRI/ESG Equity Funds posted their second largest outflow on record as they extended their longest redemption streak since 4Q13 and SRI/ESG Bond Funds recorded their biggest outflow in over eight months.

Overall, net flows into EPFR-tracked Equity Funds during the week totaled $2.6 billion after $8.3 billion was redeemed on the final day of the reporting period when the US Federal Reserve boosted short-term interest rates by another 0.25%. Investors pulled $479 million from Alternative Funds, $1.1 billion from Bond Funds and $2.9 billion from Balanced Funds.

At single country and asset class fund level, Korea Bond Funds posted their first outflow since mid-November, China Bond Funds recorded their 12th outflow year-to-date, redemptions from Austria Equity Funds hit their highest level since 2Q18 and UK Equity Funds saw money flow out for the 38th time in the past 40 weeks. Commitments to Gold Funds hit their highest level since early 2Q22, Inflation Protected Bond Funds added to their longest run of outflows since 2013 and Derivatives Funds chalked up their 10th inflow in the past 12 weeks.

Emerging markets equity funds

Flows into China Equity Funds climbed to a seven-week high during the week ending March 22. That allowed EPFR-tracked Emerging Markets Equity Funds to record their 10th inflow in the 12 weeks year-to-date despite growing uncertainty about the chances of a ‘soft landing’ for the US and European economies.

The latest flows into China Equity Funds extended their current run to four weeks and $6.2 billion. Coming into March, managers of these funds lifted their allocations to the consumer staples, technology and telecommunications sectors to five, six and 26-week highs, respectively. Funds dedicated to Taiwan, which China views as a renegade province, continue to pick up a tailwind from the expectations for Chinese growth. Taiwan (POC) Equity Funds have posted inflows for nine straight weeks and 23 of the past 26.

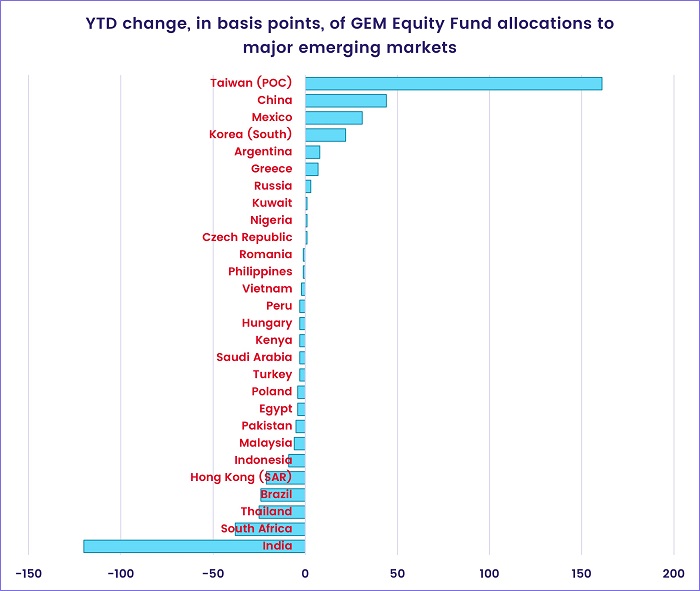

Managers of the diversified Global Emerging Markets (GEM) Equity Funds have warmed to both China and Taiwan this year. Those markets have seen the biggest increase in their average weightings, while India and most of the smaller regional markets have seen their allocations trimmed.

EMEA Equity Funds posted another eye-catching headline number. But, once again, it was driven by flows into Turkey Equity Funds. Authorities in Turkey are pushing domestic investors to support the country’s equity markets. The bulk of the more than $200 million committed to this fund group went to Turkish-domiciled funds, although foreign-domiciled Turkey Equity Funds did post consecutive inflows for the first time since early January.

Both Brazil and Mexico Equity Funds experienced net redemptions, the first time that has happened in the same week since mid-September. Mexico’s growth has been picking up in recent months, helped by solid domestic demand and business investment, but investors are concerned that the statist policies of President Andrés Manuel López Obrador’s administration and high levels of drug-related violence will undermine that growth.

Developed markets equity funds

Hopes that the previous week’s turmoil among regional banks would give the US Federal Reserve reason to pause its current tightening cycle did not survive the latest reporting period, which ended on March 22. The Fed’s decision to hike rates by another 0.25% triggered a rush out of US Equity Funds, which had been on track for their biggest inflow year-to-date, and condemned EPFR-tracked Developed Markets Equity Funds to their fourth outflow in the past five weeks.

Among the headwinds facing the group is the waning appetite for exposure to the socially responsible (SRI) or environmental, social and governance (ESG) themes. Funds with those mandates were reliable money magnets, week in and week out, until Russia’s assault of Ukraine in 1Q22. Since then, flows have become increasingly choppy with over $5 billion flowing out of all DM SRI/ESG Equity Funds in two of the past three weeks.

The third week of March did see Japan Equity Funds rack up their biggest inflow since early 4Q21, with ETFs absorbing 10 times the amount of fresh money that flowed into actively managed funds. Japan Dividend Funds, meanwhile, recorded their biggest inflow in over 22 months. Recent wage agreements that hike compensation by 8% have boosted hopes that deflationary risks are waning and the outlook for Japanese domestic consumption is improving.

Investors focused on Europe spent the week factoring the European Central Bank’s latest 50 basis point rate hike into their forecasts and bracing for the Bank of England to continue tightening. Europe Equity Funds saw another $1.3 billion flow out, with regional and dedicated UK Equity Funds the biggest contributors to the headline number. In France, the latest reforms to the country’s pension system have triggered violent protests. But flows into France Equity Funds hit a six-week high.

US Equity Funds posted their sixth outflow in the past seven weeks as strong flows into Large Cap Blend and Growth Funds, with the latter posting their biggest inflow since late 4Q21, were offset by redemptions from other groups. Canada Equity Funds, meanwhile, extended their longest inflow streak since mid-3Q22.

Global sector, industry and precious metals funds

A brief flowering of optimism among sector-oriented investors during the third week of March ended with a whimper after the US Federal Reserve did what markets hoped they would not and boosted interest rates by another 25 basis points. Through March 21, cumulative flows into Technology, Consumer Goods and Financial Sector Funds were at or around $1 billion. On March 22, however, all 11 of the major EPFR-tracked sector Fund groups experienced net redemptions, and the week ended with five of the 11 groups posting outflows.

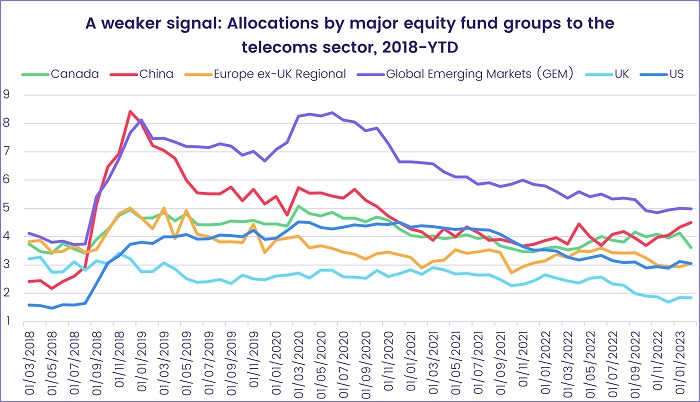

Among the groups posting inflows were Telecoms Sector Funds. Although the group has taken in modest amounts of fresh money six of the past seven weeks, the overall story has been one of declining interest from investors and fund managers as the excitement surrounding fifth-generation (5G) service has given way to more hard-headed analysis of the costs and benefits. Having posted several monthly inflow records between 2018 and 2021, Telecoms Sector Funds have suffered outflows 14 of the past 17 months.

Elsewhere, flows into Consumer Goods Sector Funds climbed to a 10-week high of $365 million and Financials Sector Funds posted their third inflow during the last four weeks with over $1 billion going into US Financials Sector Funds.

Among the Technology Sector Fund sub-groups, Artificial Intelligence (AI) Funds have racked up inflows as the excitement about ChatGPT and potential competitors continues to build. Monthly flows in February rose to a 22-month high of $400 million. Overall flows for all Technology Sector Funds strengthened for the fifth straight week as more companies took a hard look at staffing and expenses.

With investors on both sides of the fence leading into the latest Fed policy meeting, Gold Funds recorded their first consecutive weekly inflows and their biggest since mid-April 2022. Silver Funds, however, experienced their heaviest outflow since the end of July 2022.

Bond and other fixed income funds

EPFR-tracked Bond Funds posted consecutive weekly outflows for the first time in 2023 going into the final week of March as the aftershocks of the latest bank crisis, and the determination of major central banks to squeeze the life out of inflation, unsettled investors.

A combination of flight-to-safety and hopes the bank crisis would stay the US Federal Reserve’s rate-setters, saw over $5 billion flow into US Bond Funds. But those inflows were offset by the sixth straight outflow from Emerging Markets Bond Funds, the biggest outflow from Global Bond Funds since late October and the first consecutive outflows from Europe Bond Funds in five months.

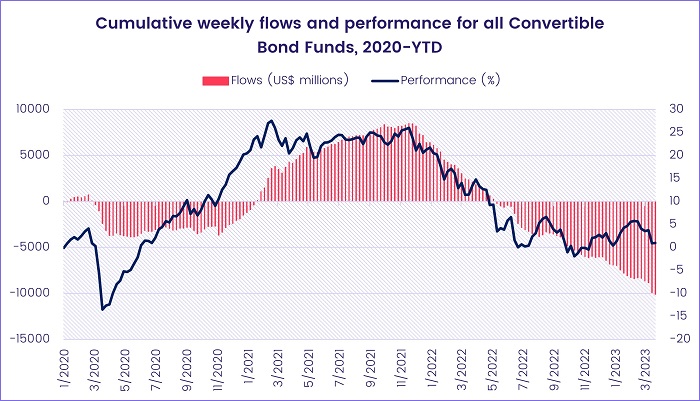

At the asset class level, the questions surrounding the health of regional US banks and the extinguishing by regulators of Credit Suisse’s convertible contingent (CoCo) bonds hit investor appetite for Bank Loan and Convertible Bond Funds. The former posted their ninth straight outflow and 38th in the past 40 weeks while Convertible Bond Funds experienced net redemptions for the 11th time year-to-date.

Both Hard and Local Currency Emerging Markets Bond Funds saw money flow out during a week when redemptions from EM High Yield Bond Funds hit a 21-week high. The overall group did enjoy modest retail inflows while flows into Sharia Bond Funds were the biggest since the third week of November. At the country level, Korea Bond Funds’ 17-week, $5 billion inflow streak came to an end, Colombia Bond Funds posted their biggest inflow in over 33 months and redemptions from South Africa Bond Funds were the second biggest YTD.

Flows into US Bond Funds strongly favored those with sovereign rather than corporate mandates, with Intermediate Term Sovereign Bond Funds posting their biggest weekly inflow since 1Q14. Funds dedicated to US municipal debt continue to struggle with the competition from rising sovereign yields, posting their fifth consecutive outflow.

Outflows from Europe Bond Funds hit a 23-week high in the wake of the European Central Bank’s latest 0.5% interest rate hike on March 16. Funds with corporate mandates experienced the biggest hit, with redemptions hitting a level last seen in late 2Q22. Among the country fund groups, outflows from UK Bond Funds climbed to a five-month high as high food prices kept the headline inflation rate north of 10% in February.

Did you find this useful? Get our EPFR Insights delivered to your inbox.