Worries about the impact a two-pronged credit squeeze, driven by quantitative tightening and the pressure on regional bank loan books, will have on the US economy kept investors in a defensive frame of mind during the week ending May 17.

In keeping with the pattern in place since mid-March, those investors pulled money out of High Yield and Bank Loan Bond Funds, US and Europe Equity Funds and cyclical Sector Fund groups. Meanwhile, China Equity Funds absorbed over $2 billion for the fourth time in the past five weeks, Gold Funds extended their longest inflow streak since a 14-week run ended in 2Q22 and Money Market Funds saw net inflows since the beginning of March push past the $470 billion mark.

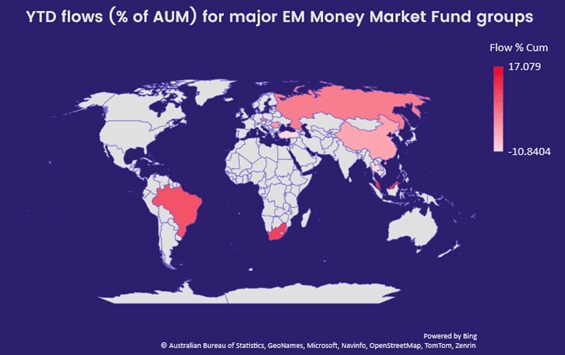

Although US Money Market Funds remain by far the biggest contributors to the headline numbers for all funds, Emerging Markets MM Funds have posted inflows in four of the past six weeks. During the latest week, flows to China MM Funds hit their highest level since 2Q22 and Korea MM Funds posted their eighth inflow since the beginning of March.

Overall, flows into all EPFR-tracked Money Market Funds during the latest week totaled $25.1 billion. Bond Funds pulled in $5.3 billion and Alternative Funds $121 million while a net $1.8 billion was redeemed from Balanced Funds and $7.6 billion from Equity Funds.

At the asset class fund level, Inflation Protected Bond Funds’ current outflow streak became the longest on record, redemptions from Bank Loan and Total Return Bond Funds hit seven and eight-week highs, respectively, and Convertible Bond Funds posted their 21st outflow in the past 23 weeks.

Emerging markets equity funds

Although data for April painted a mixed picture, investors continued buying into the China economic rebound story in mid-May. That helped all EPFR-tracked Emerging Markets Equity Funds chalk up their 16th inflow in the 20 weeks year-to-date. Of the $48 billion absorbed by all EM Funds so far this year, over 85% has gone to exchange traded funds (ETFs).

EM Dividend Equity Funds chalked up their 22nd inflow since mid-December and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended an inflow streak that started in the third week of November.

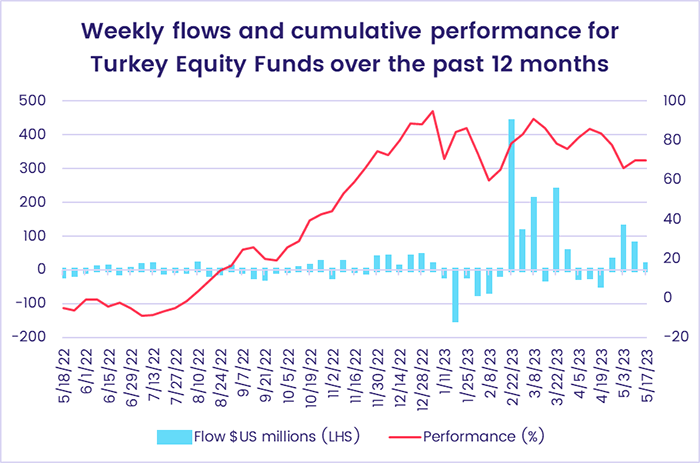

The latest week was marked by closely watched elections in Thailand, where the opposition won, and Turkey where they forced a run-off but received fewer votes than the ruling party and its leader, President Recep Tayyip Erdogan. Despite the latter result, Turkey Equity Funds still posted their fourth straight inflow, but redemptions from other groups meant that EMEA Equity Funds recorded their sixth collective outflow quarter-to-date.

Thailand Equity Funds, meanwhile, posted their fifth outflow in the past eight weeks as investors wait to see if the country’s politically active military will honor the result. Other Asia ex-Japan Country Fund groups fared better. India Equity Funds recorded their ninth straight inflow ahead of the monsoon rains, a key determinant of rural incomes and food prices, which are now expected in early June. Investors also steered over $400 million – a 25-week high – into Korea Equity Funds after headline inflation fell to a one-year low.

Both of the major Latin America Country Fund groups attracted solid inflows, with Mexico Equity Funds posting their fourth straight inflow and Brazil Equity Funds pulling in over $100 million.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds marked the mid-point of the second quarter with their sixth straight outflow and biggest year-to-date. Europe, Global, Pacific Regional and US Equity Funds all experienced net redemptions that offset modest flows into Japan and Canada Equity Funds.

US Equity Funds were the biggest contributors to the week’s headline number, posting their 13th outflow in the past 15 weeks. That took their year-to-date total past the $40 billion mark compared to an inflow of over $75 billion during the comparable period last year. Large Cap Blend and Value Funds experienced the heaviest redemptions while Small and Mid-Cap Blend Funds recorded the biggest inflows.

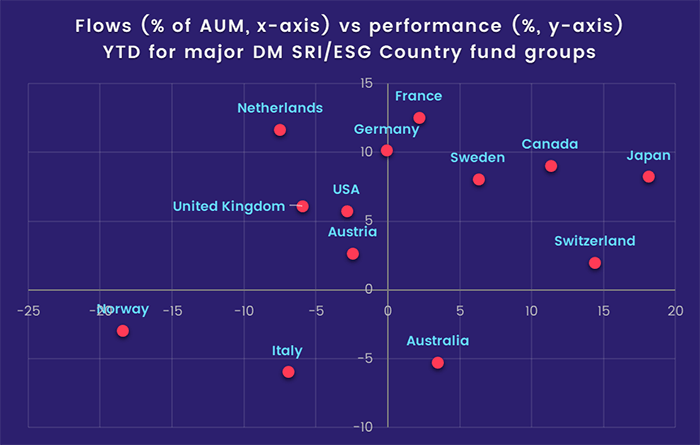

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did snap a three-week run of outflows. But US SRI/ESG Equity Funds have struggled so far this year to attract fresh money despite being in the upper half of the country fund pack in terms of performance.

The YTD performance of Japan SRI/ESG Equity Funds has been rewarded with decent inflows. During the latest week, all Japan Equity Funds posted consecutive weekly inflows for the first time since late March as the latest quarterly report showed better-than-expected GDP growth in the first three months of 2023. Foreign domiciled funds recorded their biggest inflow since the first week of 4Q21 and have outgained their domestically domiciled counterparts five of the past six weeks.

Europe Equity Funds saw another $2 billion flow out, with groups dedicated to non-EU markets again the biggest drivers. Investors have pulled over $2 billion from Switzerland Equity Funds over the past three weeks and $1.7 billion from UK Equity Funds.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, chalked up their third outflow in the past five weeks as redemptions from funds with fully global mandates hit a 31-week high.

Global sector, industry and precious metals funds

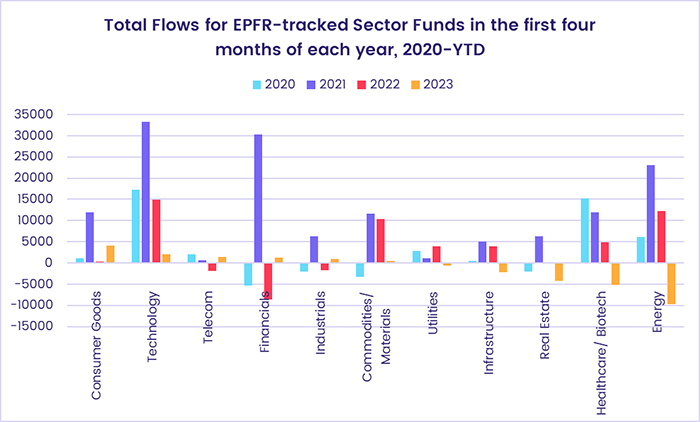

Sector-oriented investors continued to play defense in mid-May, with Telecoms and Utilities Sector Funds among the four major EPFR-tracked Sector Fund groups to attract fresh money. The other seven, which included Commodities and Energy Sector Funds, posted outflows ranging from $26 million to $789 million.

Investors continued to seek exposure to artificial intelligence (AI) and, to a lesser extent, China’s growth story. They also bet that regional banking stocks are oversold, with Regional Bank Funds attracting over $400 million – a nine-week high – when Financial Sector Funds overall posted an outflow in excess of $700 million.

Energy Sector Funds extended their current outflow streak to five weeks and $4 billion, making it their worst run since a seven-week one ended in July of last year. With only five weekly inflows in the past 26 weeks, Energy Sector Funds chalked up their 10th monthly outflow in the past year during April. Looking at the first four months of 2023 versus the first four months of prior years, the contrast is stark: the last time Energy Sector Funds reported an outflow in the first four months of the year was in 2019.

US-dedicated funds weighed heavily on Energy and Financials Sector Funds, while they pulled in over $100 million for just a single sector – Telecoms – and the most significant flow to China-dedicated funds was the over $900 million absorbed by China Technology Sector Funds.

Real Estate Sector Funds posted their biggest outflow in over six months. It was their third consecutive outflow and fifth in the past six weeks. While Japan, South Africa and UK Real Estate Sector Funds absorbed fresh money during the week ending May 17, those inflows amounted to less than $100 million combined. On the other side of the ledger, investors pulled over $100 million from both US and Global Real Estate Sector Funds.

Bond and other fixed income funds

Fixed income investors continued in mid-May to show a remarkable lack of concern about the chances that the US debt ceiling standoff will turn from smoke to fire. US Bond Funds maintained their record of posting an inflow every week of the year to date as year-to-date flows into all EPFR-tracked Bond Funds hit $190 billion.

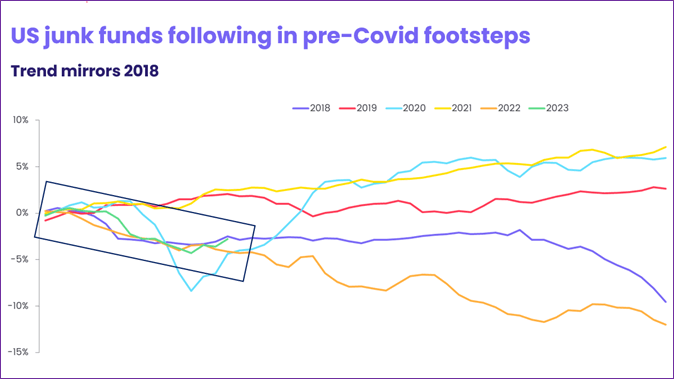

Concerns about the likelihood of a recession in the second half of the year did weigh on fund groups dedicated to riskier debt classes. Emerging Markets, High Yield and Bank Loan Bond Funds all posted outflows that ranged from $216 million to $2.5 billion. In the case of US Junk Bond Funds, YTD flows are – so far – following the same path they followed in 2018.

With the focus on a potential recession and inflation trending lower in the US, Inflation Protected Bond Funds posted their 38th consecutive outflow, passing the 37-week streak they compiled in 2013. Recent data showed US inflation dropping below 5% for the first time in two years.

The emerging markets universe still boats some eye-catching inflation numbers, among them Argentina (104%), Turkey (44%), Lebanon (264%) and Zimbabwe (75%). But many markets have been more aggressive than their developed counterparts in tackling price pressures, and Local Currency Emerging Markets Bond Funds have posted inflows in four of the past five weeks. At the country level, India Bond Funds posted their biggest outflow in nearly two years while Korea Bond Funds racked up their 22nd inflow since the beginning of December.

Among the Asia Pacific Bond Fund groups, Australia Bond Funds stood out with their biggest weekly inflow in over seven months. The inflow came despite the Austrian central bank’s decision earlier this month to hike interest rates by another 0.25% as inflation remains north of 7%.

Fresh money flowed into Europe Bond Funds for the ninth straight week, with flows favoring sovereign funds over their corporate counterparts for the fourth week running. Spain and Denmark Bond Funds posted their biggest inflows since mid-2Q22 and late 1Q22, respectively, and flows into Italy Bond Funds climbed to a 27-week high.

US Bond Funds continue to garner fresh money without much retail support. Flows to retail share classes have only been positive once in the past 11 weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.