Omicron? The grinch that stole the global growth story before Christmas? Or the angel of disinflation that will banish the specter of interest rate hikes? The first week of December saw investors weighing both interpretations of the latest Covid-19 variant and making cautious guesses about which one is more credible.

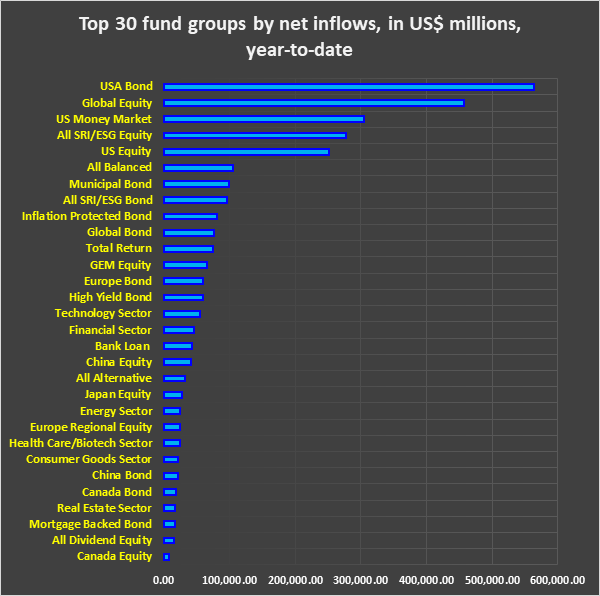

Flows to EPFR-tracked fund groups during the first week of December tilted towards the positive – at least for the US. Investors steered money into US Equity Funds for the 11th straight week, US Bond and Global Equity Funds rebounded from their first outflows in over seven and 17 months, respectively, and US Money Market Funds took in fresh money for the seventh time in the past eight weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.