Interest rates in both the Eurozone and US hit a 22-year high during the fourth week of July as the Federal Reserve and European Central Bank continued their drive to bring inflation down to – or below – 2%. The latest hikes were clearly telegraphed and, barring some extraordinary event, rates will be unchanged until the Fed and ECB meet again in mid-September.

For investors, the key questions are whether current rates will stay unchanged beyond the next policy meetings and how much economic growth will be sacrificed before they start heading in the other direction.

For now, the bullish consensus for global growth, based on a ‘soft landing’ for the US economy, China’s willingness to deploy additional economic stimulus, strong Indian growth and the impact of enhanced artificial intelligence on corporate productivity is holding. During the latest week, EPFR-tracked US Equity Funds posted their third inflow of the past four weeks, Technology Sector, India Equity and US Bond Funds extended their current inflow streaks to five, 19 and 30 weeks, respectively, and flows into China Equity Funds hit an eight-week high.

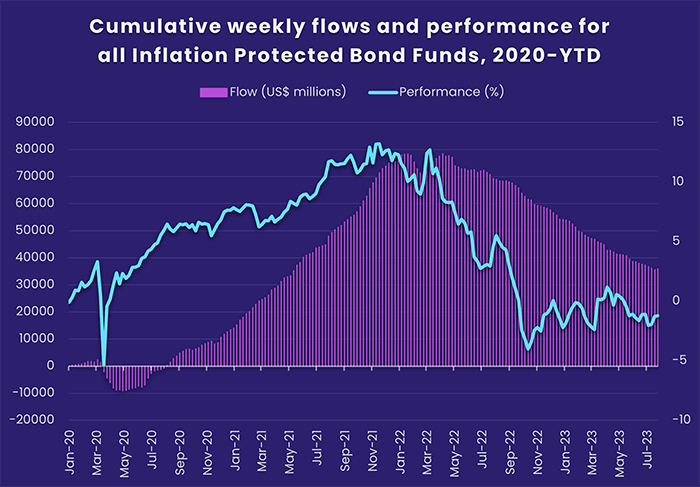

Investors still expect a hard landing for Europe. They are also alive to the possibility that the factors underlying the bullish consensus could allow inflation, which has fallen steadily in recent months, to regain momentum. Money flowed out of Europe Equity Funds for the 20th consecutive week while Inflation Protected Bond Funds posted their first weekly inflow in over 11 months.

Overall, the week ending July 26 saw all EPFR-tracked Equity Funds pull in a net $13.8 billion despite the biggest outflow in nearly four months from funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. Investors also steered $27 million into Alternative Funds, $10.9 billion into Bond Funds and $40.5 billion into Money Market Funds.

Emerging markets equity funds

Appetite for exposure to Latin America and Emerging Asia propelled all EPFR-tracked Emerging Markets Equity Funds to their 12th inflow since mid-April during the fourth week of July. Asia ex-Japan Equity Funds saw total inflows year-to-date climb past the $54 billion mark, versus $21.6 billion for all Global Emerging Markets (GEM) Equity Funds, while Latin America Equity Funds extended their longest inflow streak since 4Q20.

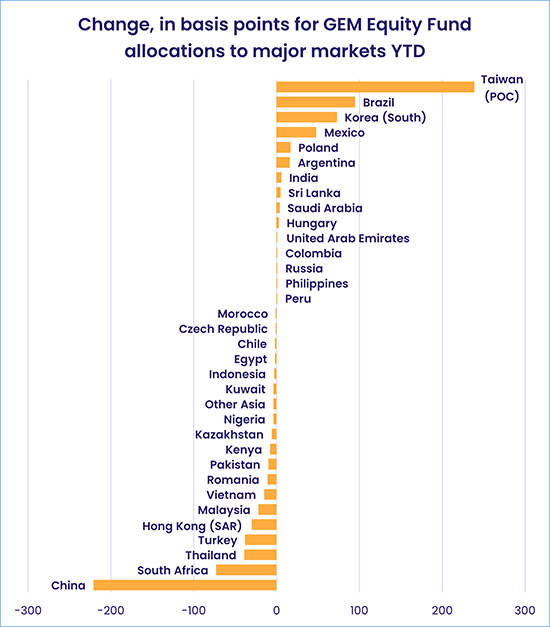

While central banks in the US and Eurozone continued to hike interest rates, China’s policymakers are signaling further stimulus measures to boost the current post-Covid recovery and prevent deflation from getting a grip on the world’s second-largest economy. Investors are more optimistic about China’s prospects than managers of diversified GEM Equity Funds are, with the latter on average cutting their exposure to China by over 200 basis points so far this year.

Similar differences of opinion appeared during the latest week at the other end of the scale. Funds dedicated to the three markets that have seen the biggest increase in average GEM Fund allocations YTD – Brazil, Korea and Taiwan (POC) – posted outflows ranging from $109 million to $583 million.

While dedicated Brazil Equity Funds saw a six-week run of inflows come to an end, Chile Equity Funds recorded their biggest inflow since the first week of September 2022 as investors pencil in higher demand for copper from China and from countries stepping up the transition to clean energy.

Collective flows into EMEA Equity Funds were just the right side of neutral as South Africa Equity Funds posted their fourth inflow in the past six weeks and flows into Israel Equity Funds hit a 27-week high despite the turmoil caused by the government’s efforts to limit the power of the country’s supreme court to review and reject legislation.

Frontier Markets Equity Funds chalked up their seventh straight inflow. But weekly totals during the current run are averaging $33 million compared to an average for the first eight weeks of the year of $84 million. Vietnam remains the largest single country allocation for this group followed by Kazakhstan and Saudi Arabia.

Developed markets equity funds

With key corporate earnings beating admittedly modest expectations and some chance of the latest US interest rate hike being the last, flows into US Equity Funds during the latest week exceeded $9 billion for the fourth time in the past five weeks. Allied with solid flows into Global Equity Funds and modest flows into Japan Equity Funds, this allowed EPFR-tracked Developed Markets Equity Funds to record their third inflow of the third quarter.

The bulk of the latest flows into US Equity Funds went to Large Cap Blend Funds during a week when funds managed for value outperformed their growth counterparts across all capitalizations. Against a backdrop that included earnings reports from Alphabet, Microsoft and Meta, Large Cap Growth Funds posted their biggest outflow since the first week of December 2022 and their worst collective performance since the fourth week of April.

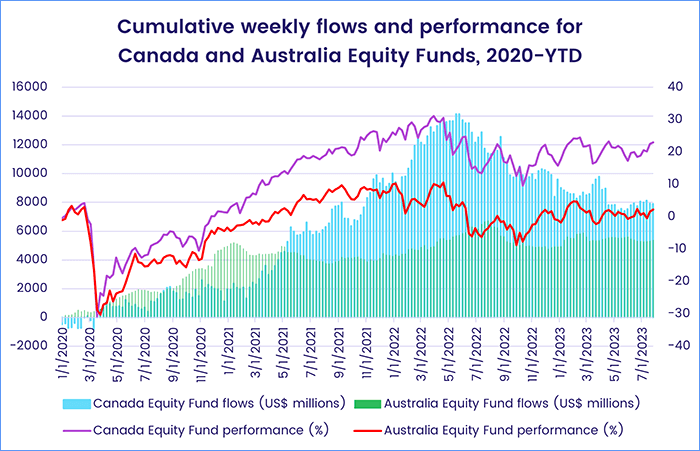

Canada Equity Funds, the other major North American group, recorded their third outflow quarter-to-date. The country’s central bank raised interest rates again during the second week of July as core inflation remains outside its target range. In recent weeks, investors seeking exposure to developed markets commodities plays have favored Australia Equity Funds. Australian trade with China has rebounded after last year’s deep freeze and the Reserve Bank of Australia is expected to keep interest rates on hold when it meets at the end of the month.

Another $1.2 billion flowed out of Europe Equity Funds during a week when Spain’s general election ended with an inconclusive result, forest fires triggered major evacuations in Greece and the European corporate earnings season gathered momentum. At the country level, money flowed out of Germany Equity Funds for the 15th time in the past 18 months, Austria Equity Funds posted their biggest outflow since the third week of March and UK Equity Funds extended a redemption streak stretching back to the second week of January.

Flows to Japan Equity Funds continued to ebb, with the group posting its first outflow in eight weeks. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their 22nd inflow of the past 24 weeks, with the latest total a six-week high.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, absorbed another $1.5 billion even though retail share classes were hit with redemptions for the 10th time since early May.

Global sector, industry and precious metals funds

It was a choppy week for EPFR-tracked Sector Funds as earnings reports and interest rate decisions shifted investor perceptions. It ended with five of the 11 major groups reporting inflows ranging from $138 million for Technology Sector Funds to $648 million for Commodities/Materials Sector Funds.

Commodities/Materials Sector Funds saw their second consecutive weekly inflow reach a 28-week high. But that was owing more to the fact it was only their 10th inflow of the 30 weeks year-to-date than to the volume of fresh money coming in. A single ETF accounted for the bulk of the headline number, with funds dedicated to gold mining, chemicals and natural resources rounding out the week’s top 10 ranked by inflows. Meanwhile, Gold Funds – which consist primarily of physical gold & derivatives funds – have seen nine straight weeks of outflows.

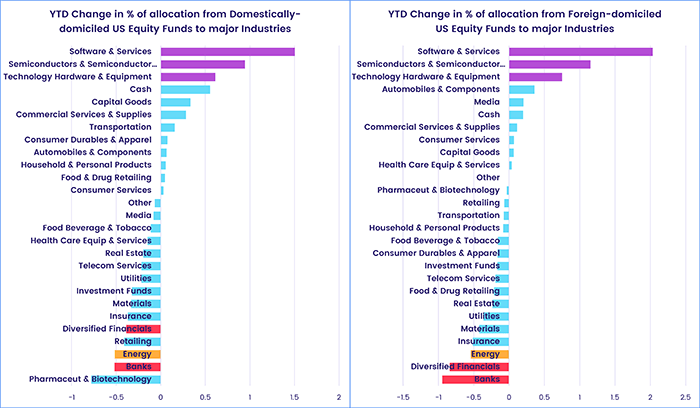

With China Financials Sector Funds reporting a $500 million outflow, and Regional Bank Funds snapping a three-week run of inflows with their largest redemption in eight weeks, Financials Sector Funds saw collective inflows dwindle to a third of the previous week’s $1.1 billion figure. Helping to keep the three-week streak alive were US and Canada Financials Sector Funds. EPFR’s Industry Allocations data shows that both foreign and domestically-domiciled US Equity Fund managers have been decreasing their exposure to financial industries (Banks & Diversified Financials) this year while increasing their tech industry exposure (Software & Services, Semiconductors, Tech Hardware).

Technology Sector Funds recorded their second smallest inflow year-to-date as flows for China and US-dedicated funds headed in opposite directions. The $1.6 billion committed to China Technology Sector Funds – an 11-week high – combined with the biggest inflow for South Korea Technology Sector Funds since December 2021 was just enough to offset the redemptions from US Technology Sector Funds.

Quickly retreating to the norm of the past three months, Energy Sector Funds racked up their 14th outflow of the past 15 weeks as one Oil & Gas ETF accounted for roughly half of the $347 million outflow. Investors looked to second-quarter results trickling in at the tail end of the week from US and European energy giants – Shell, TotalEnergies, BP, Exxon Mobil, Chevron – for intelligence on price pressures, climate targets, and continued impacts from Russia’s invasion of Ukraine.

Bond and other fixed income funds

Money kept flowing into EPFR-tracked Bond Funds during the fourth week of July, lifting the group’s year-to-date total north of $300 billion, as investors bought into the highest yields they have seen in over a decade and positioned themselves for the capital gains that will come when major central banks start cutting interest rates.

The latest week saw Emerging Markets Bond Funds post consecutive weekly inflows for the first time since early February, flows into Europe and Global Bond Funds hit seven and 22-week highs, respectively, and US Bond Funds rack up their 30th consecutive inflow.

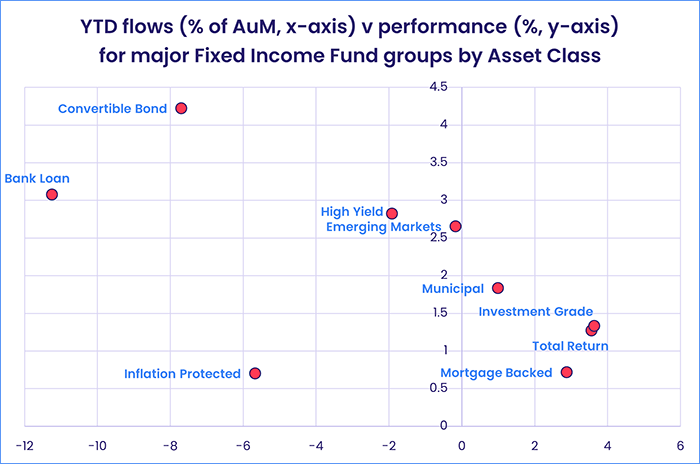

At the asset class level, Inflation Protected Bond Funds posted their first inflow since August of last year, Bank Loan Funds’ longest inflow streak since 2Q22 came to an end, Mortgage-Backed Bond Funds absorbed fresh money for the eighth week running and High Yield Bond Funds recorded their biggest outflow since late May.

Long Term Sovereign, Intermediate Term Mixed and Short Term Corporate Funds recorded the biggest inflows among US Bond Fund groups as the Federal Reserve lifted short-term US interest rates to a 22-year high. Collective Investment Trusts (CITs) dedicated to US debt posted their eighth consecutive outflow and 28th in the past 30 weeks while US Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest inflow streak since 1Q22.

Interest rates in the Eurozone are also at a 22-year high following the European Central Bank’s latest hike. Flows into funds with corporate mandates were the biggest in eight weeks and exceeded those going to Europe Sovereign Bond Funds by a 5-to-3 margin. The latest Country Allocations data shows that Europe Regional Bond Fund exposure to the UK has climbed to its highest level since EPFR started tracking this data while Italy’s average weighting is at a record low.

Flows into Emerging Markets Hard Currency Bond Funds hit a 25-week high going into the final days of July. Funds domiciled in Europe took in more fresh money than those based in the US for the first time since late January.

Did you find this useful? Get our EPFR Insights delivered to your inbox.