Quantitative Analyst Azalea Micottis discusses a recent CNN Business article: US inflation falls to lowest level since May 2021.

View from EPFR

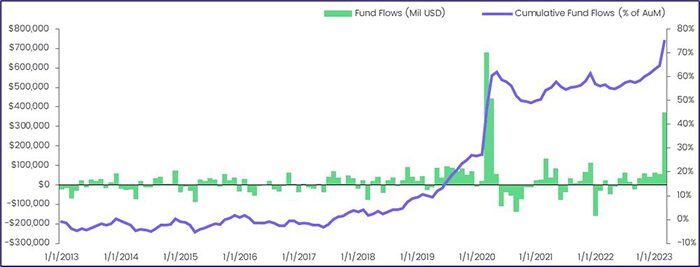

According to CNN, annual inflation dropped in March 2023 for the ninth consecutive month, and grocery prices fell month-on-month for the first time since September 2020. While the CPI has cooled off – at least temporarily — investors are not treating the news as a green light for the road back to riskier asset classes. With fear far from banished, cash remains king. As EPFR has spotlighted over the past month, investors are gravitating to Money Market Funds amidst this fearful environment. Monthly data – available on the 16th – shows US Money Market Funds absorbed a net $372 billion during March. By comparison, the biggest monthly inflow the group recorded last year was $61.8 billion in July.

Flows into US Money Market Funds, 2013-YTD

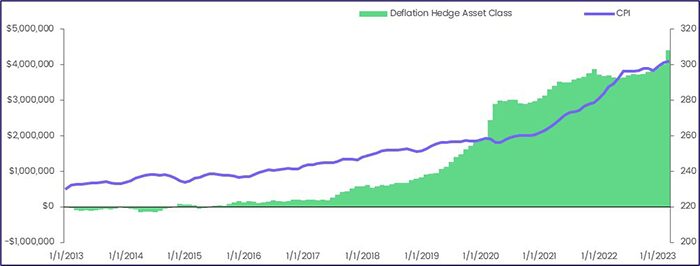

With the fear of another market correction still widespread among investors, they have poured assets into deflation hedging vehicles including Investment-Grade Bond Funds, Consumer Goods Sector Funds, Dividend Equity Funds and the cash-equivalent Money Market Funds. Collectively, during the period between 1 January 2020 and 31 March 2023, these funds received an astonishing $1.44 trillion inflow.

Flows into Deflation Hedge Assets vs CPI, 2013-YTD

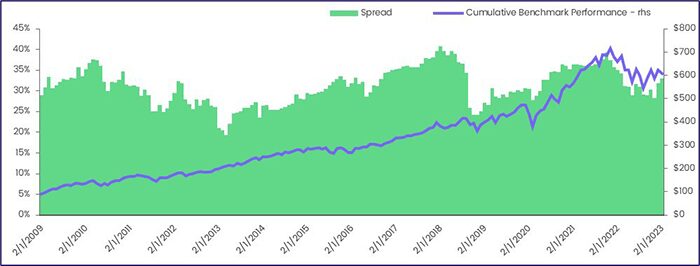

When it comes to longer-term asset allocation, EPFR’s sector allocation data is telling a similar story. The spread between cyclical sector allocation (consumer discretionary, financial, industrial, tech, materials) and defensive sector allocation (consumer staples, energy, healthcare, telecom, utility) is usually considered as an indicator of the market performance. When fund managers tilt assets towards cyclical sectors, market performance tends to be positive and vice-versa. The level of the spread has fallen to pre-COVID levels. We do see a small bounce in January and February 2023 as the market tumbled. Sector Allocation data for March will be released in a couple of days, and by then, we shall have a better fix on the willingness of active fund managers to take on riskier asset classes.

Benchmark performance of and spread between Cyclical vs Defensive Sector Allocations, 2009-YTD

Did you find this useful? Get our EPFR Insights delivered to your inbox.