This week’s Quant’s Corner is written by Mike Simcock, CEO of ClearMacro, a London-based fintech company. ClearMacro helps clients bridge the gap between systematic and discretionary investment processes by transforming raw data into investible signals, and is partnering with EPFR to stage a panel discussion on monetary and other risks to the global economy on October 9 at The Shard in London.

In 2Q18, ClearMacro released a paper, ‘Trade is the Lifeblood of the Global Economy’, in which we argued that the tariffs spawned by the current Sino-US trade tensions would only partially reverse the post-war reduction in barriers that accompanied a vast expansion in global trade. But, we noted, some major exporters in both the emerging and developed economies would be hard hit. Hong Kong and Singapore we predicted would be hit especially hard.

But how to quantify the impact of the tariffs imposed over the past 18 months? And where are we now?

Macro themes are notoriously difficult to quantify. At ClearMacro, we have developed an approach that utilizes multiple angles – both subjective and objective – to generate actionable recommendations based on the way they align.

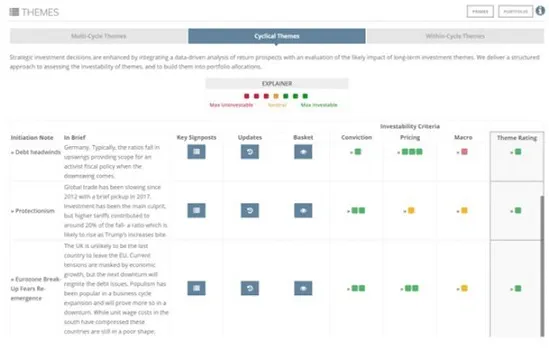

When analysing relevant theme signals (or signposts), we generate three key ratings. These are:

- A Conviction Rating – How likely is the theme to impact market returns over the next 12 months?

- A Pricing Rating – How much is the theme already discounted by the market?

- A Macro Rating – Is the macro outlook a headwind or a tailwind for the theme?

These ratings are then aggregated and the theme is dynamically scored based on capital allocation metrics. We recommend the largest prudent allocation possible to a theme when:

- We have a very high conviction that the theme will be relevant for markets in the short-term;

- It’s hardly priced in at all;

- There is a strong macro tailwind.

How did this approach play out when we applied it to our protectionism thesis? To put a framework in place, we focused on a basket of countries with a heavy exposure to global trade, weighting them by the ratio of exports to GDP and looking at other ClearMacro ‘signposts’ such as leading and sentiment signals. Our investment recommendation, which came with a ‘High’ conviction rating, was to short this basket against the MSCI World in our Model Thematic Portfolio.

We updated our model in mid-3Q19, finding that key signposts were signalling a greater likelihood of the market taking fright at trade war tensions. We consequently raised our conviction level from High to Very High (See Figure 1 below).

Figure 1: Signpost scores justify a Very High Conviction Rating

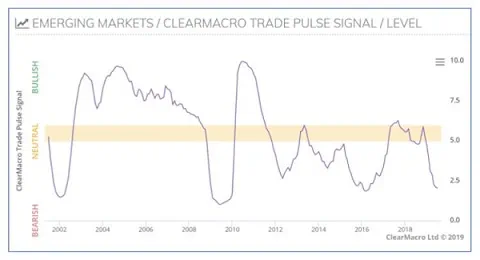

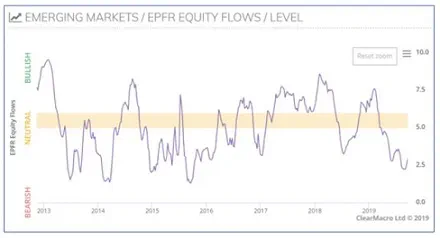

These conclusions were rapidly validated by our data and the signals it produces, such as our Emerging Market Trade Pulse (See Figure 2) and by EPFR’s Fund Flow signal (See Figure 3).

Figure 2: Key trade signals remain negative

Figure 3: And investors remain very skittish about investing into EM equities

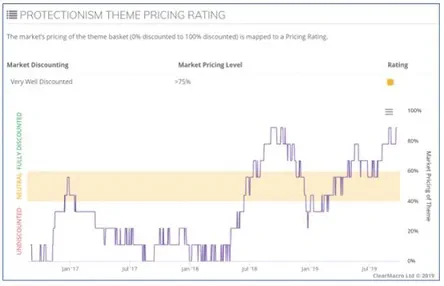

The investment strategy based on shorting our Protectionism Theme Basket has returned 18% since it was launched in April 2018. But further upside may be limited: our thematic algorithm estimates that the underlying themes it is based on are now 90% priced in (see Figure 4). Moreover, our macro rating is currently neutral, suggesting that the macro drivers for the theme are neither bullish nor bearish.

Figure 4: Our algorithm calculates that the protectionism theme is now 90% priced in

Our model suggests that, whilst our conviction rating for the theme is at maximum level, the protectionist theme is almost fully priced in and our macro theme rating is neutral. The upshot is a moderately bullish overall rating. (See Figure 5)

Figure 5: Our overall theme rating is moderately bullish (one green square)

This conclusion may be questioned by some on the grounds that a Sino-US trade deal will dramatically shift many of the signposts used in our analysis. However, that analysis factored in a key observation – that, for all the lurid headlines, the tariffs have not cancelled out six decades of progress on free trade – so overreacting to any deal could well prove unrewarding.

Did you find this useful? Get our EPFR Insights delivered to your inbox.