At the turn of the century, investing in China was viewed as a risky proposition. Foreign access to a notoriously volatile, retail-driven equity market was heavily restricted. The lack of a credible regulatory framework and legal protections deterred US venture capitalists from making direct investments in Chinese companies. In many cases, Chinese banks and the country’s fledgling private equity industry also balked. So, when Chinese technology firm Alibaba received its first $25 million investment from Goldman Sachs in 1999, investors sat up and took notice.

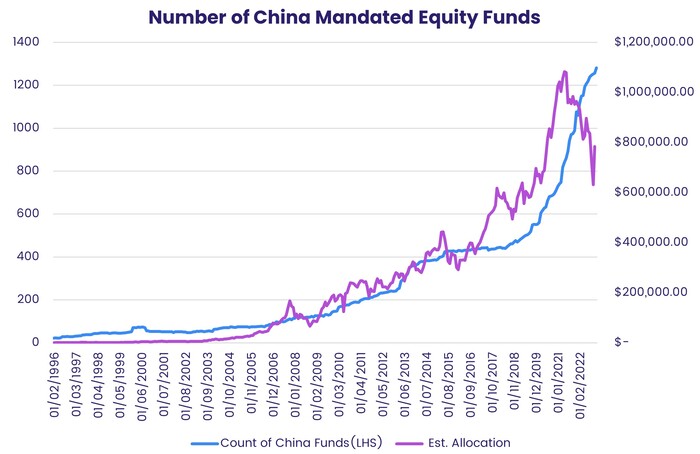

Over the next 20 years, the surprise at Goldman Sachs’ boldness has been replaced with a hunger for, and comfort with, exposure to Chinese assets. EPFR has seen dramatic growth in both the total mutual fund and ETF allocation to China and the number of dedicated China Equity Funds.

The estimated allocation of EPFR-tracked mutual funds and ETFs to Chinese equities surpassed $1 trillion in 2019 before the Covid-19 pandemic hit in 1Q20. Meanwhile, the number of funds that have a mandate to invest in China has grown significantly.

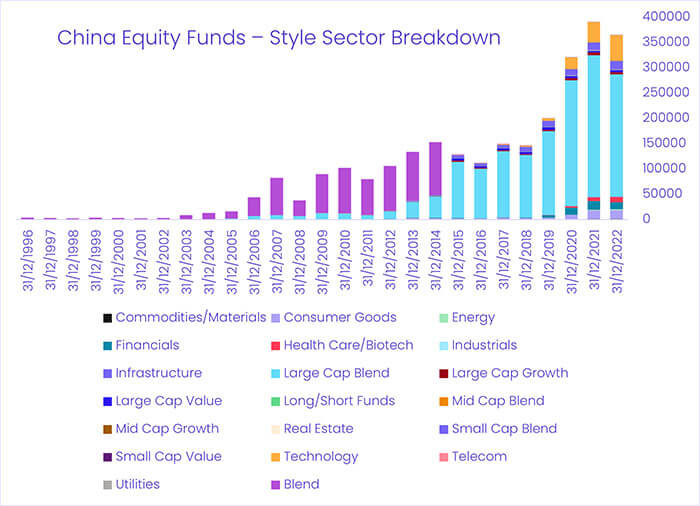

This increase in the number of funds coincided with the rise in various investment styles and sectors. Since 2005, the number of styles and sectors available to investors seeking China exposure has tripled. Beyond the large-cap stock funds that were their first option, investors now have the option to invest specifically in sectors like technology, healthcare, energy, real estate or finance with different sizes and mandates.

Breaking free of the emerging markets pack

Fifteen years after its first injection of foreign capital, a heavily oversubscribed IPO in 2014 crowned Alibaba’s success story. Interestingly, this IPO was not made through a domestic exchange: the regulatory and legal frameworks were still more favorable.

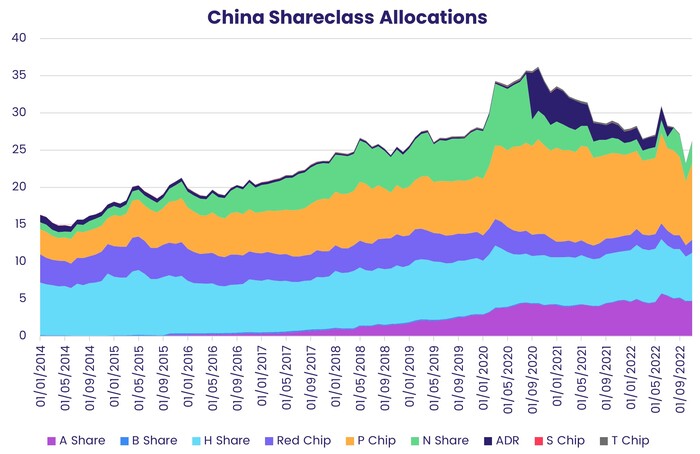

With other Chinese companies following a similar path, a wide variety of share class types emerged for Chinese corporates. Mutual funds investing in China have utilized these different share class types to mitigate risk and get exposure to companies that might otherwise be inaccessible.

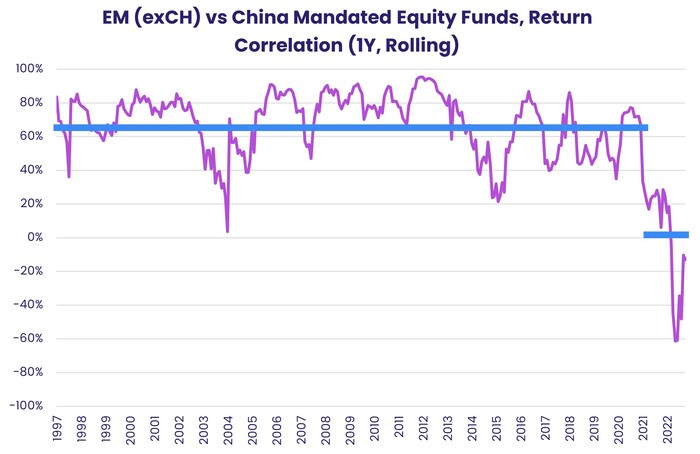

The growing range of share classes, investment styles and dedicated sector funds for China has been a positive development for asset allocators. It is a development they have taken advantage of. But the sheer volume of these inflows has changed some of the historical relationships between China and the rest of the emerging markets universe.

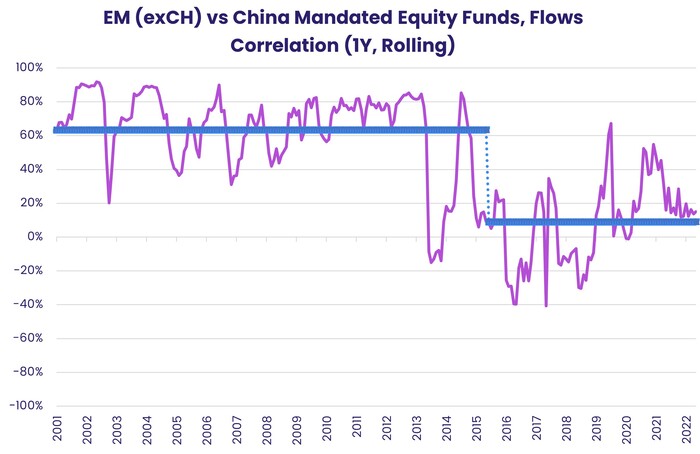

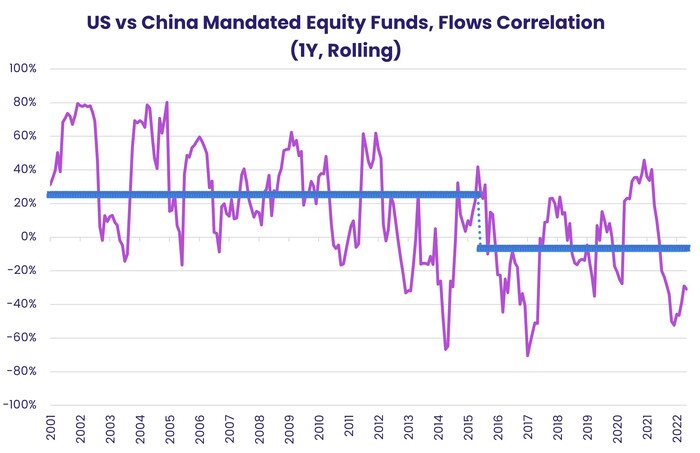

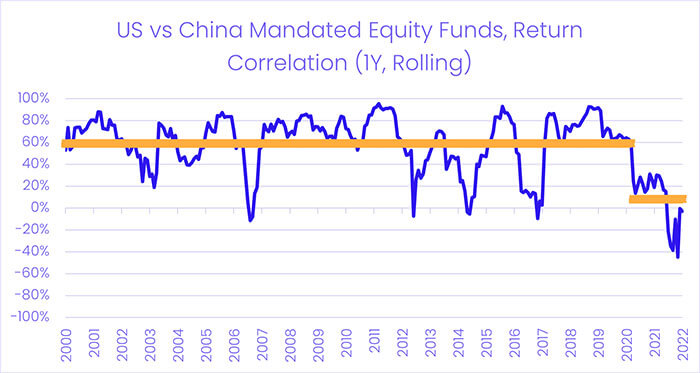

In the case of the fund flows tracked by EPFR, the flows to dedicated China Equity Funds became noticeably less correlated with the rest of EM – and the US – from 2013 onward.

There has also been a shift in the investment narrative towards China during the last two decades. That narrative has evolved to the point where it is now like the one surrounding global equity. Indeed, Chinese equities and funds have been a good source of diversification within limits.

This narrative held through the initial stages of the Covid-19 pandemic. But, as the rest of the world re-opened, returns for Chinese markets decoupled further from the rest of the world. The average return correlation between China and the rest of the EM is now close to zero.

This puts China in a different place as an asset class.

Time for new buckets?

A classical multi-asset portfolio optimization relies on covariance matrices and works on long-term correlation assumptions. So, if this significant correlation breakdown with other emerging markets persists, Chinese equities might be considered an independent source of return and risk for most asset allocators.

In portfolio theory, this development is regarded as a good thing that might lead to greater inflows from asset allocators. On the other hand, however, the underlying reasons for this decoupling might have the potential to withhold discretionary investors from investing in Chinese equities.

One solution, already adopted by Global Fund managers in recognition of the US’s outsized footprint in world equity markets, is to divide the global part of emerging markets fund universe into Global Emerging Markets (GEM) Equity Funds and GEM ex-China.

This may be an idea whose time has come.

Did you find this useful? Get our EPFR Insights delivered to your inbox.