Fed policymakers trimmed their key rate by 50 basis points following a string of relatively benign inflation reports and some less benign labor market datapoints. Although the latest flow data captures more of the anticipation than the reaction, an influx of fresh money at the end of the week lifted Emerging Markets Bond Funds, Global Equity and Technology Sector Funds into the inflows column.

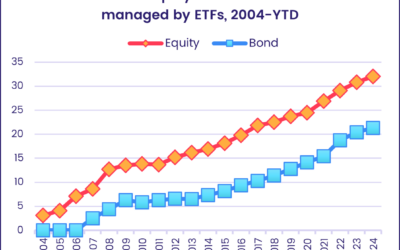

While the rate cut, and signals that more are coming, gave the US economy ‘soft landing’ narrative a boost, it did not chase money out of Bond Funds which added another $15.4 billion to their already impressive year-to-date total.

Also doing well so far this year, despite low savings rates, are US Money Market Funds which have pulled in a net $314 billion. But the latest week saw them post their first outflow since late July and biggest in nine weeks.

Overall, the week ending Sept. 18 saw investors steer a net $38.5 billion into EPFR-tracked Equity Funds while Alternative Funds took in $1.2 billion. Balanced Funds experienced redemptions totaling $1.2 billion and $7.5 billion was pulled out of all Money Market Funds.

At the single country and asset class fund level, flows into Dividend Equity Funds climbed to a 24-week high, Physical Gold Funds chalked up their 14th inflow over the past 16 weeks and Cryptocurrency Funds recorded their biggest inflow in nearly two months. Thailand Bond Funds posted consecutive weekly outflows for the first time since late May, Thailand Equity Funds chalked up their 38th consecutive outflow and Turkey Equity Funds snapped a seven-week redemption streak.

Emerging Markets Equity Funds

Flows into Asia ex-Japan Equity and the diversified Global Emerging Markets (GEM) Equity Funds again drove the headline number for all EPFR-tracked Emerging Markets Equity Funds in mid-September. In addition to a 16th straight inflow for the overall group, the week ending Sept. 18 saw Latin America Equity Funds snap an outflow streak stretching back to the second week of June as lower interest rates bolstered the credibility of the US ‘soft landing’ story.

EM Equity Fund retail share classes posted their 14th collective outflow since early June. But funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates chalked up their sixth inflow over the past eight weeks.

The latest flows into Latin America Equity Funds saw inflows for Mexico and Brazil Equity Funds hit 13 and 22-week highs, respectively, while Argentina Equity Funds attracted above average amounts of fresh money for the second week running. Brazil Equity Hedge Funds, however, have not enjoyed meaningful inflows since late 2021 and had posted outflows for 20 straight months before recording a minimal inflow in July.

Interest in India Equity Hedge Funds has mirrored that directed towards conventional funds, with July’s inflow the biggest since December 2022. Regular India Equity Funds have not posted a weekly outflow in nearly 18 months as emerging Asia’s second-largest economy continues to grow at a 6% clip.

Both Taiwan (POC) and China Equity Funds posted solid totals that were well off their recent pace but extended their current inflow streaks to 14 and 16 weeks, respectively. In the case of China, many investors are translating mixed macroeconomic data as a catalyst for further stimulus measures, and the recent cut in US interest rates opens the door to corresponding moves by China’s central bank.

EMEA Equity Funds again struggled to attract fresh money as South Africa Equity Funds posted their second-biggest weekly outflow so far this year and Emerging Europe Regional Funds posted consecutive outflows for the first time since late June. But Turkey Equity Funds snapped their latest outflow streak and flows into Russia Equity Funds climbed to a 14-week high.

Developed Markets Equity Funds

A week after posting their first outflow in nearly five months, EPFR-tracked Developed Markets Equity Funds recorded their biggest inflow since mid-July and their third biggest year-to-date. Buoyed by the prospect of the first US rate cut in four-and-a-half years, which was realized to the tune of 50 basis points, US, Global, Canada and Japan Equity Funds attracted sums that ranged from $308 million to $33.7 billion.

In the case of US Equity Funds, the week of Sept. 18 led into the latest ‘quadruple witching’ date when multiple options expire, an event which often sees flows swing from strongly positive to negative over the course of a few days. But the US Federal Reserve’s decision to cut rates gave equity markets a strong boost as more investors buy into the ‘soft landing’ scenario for the world’s largest economy. Overseas domiciled funds posted their 22nd straight inflow and flows into US Leveraged Equity Funds climbed to a six-week high.

Although US Large Cap Blend Funds attracted by far the biggest amount in US$ terms, Mid Cap Blend Funds led the way in flows as a % of AuM terms. Overall, flows into Small Cap Growth, Mid Cap Value, Large Cap Growth and both Small and Large Cap Value Funds hit eight, 12, 13 and 40-week highs, respectively.

Hopes for any kind of soft landing for major European economies remain at a low ebb as the Eurozone’s keystone market, Germany, struggles in the face of geopolitical, demographic and energy headwinds. Europe Equity Funds posted their 46th weekly outflow over the past 12 months.

At the country level, with the new Labour government signaling a taxing budget next month, post-election goodwill towards the UK continues to fade. The latest week saw dedicated UK Equity Funds post their eighth consecutive outflow and biggest since early June. Those redemptions were partially offset by the strongest flows into Switzerland Equity Funds since the first week of March.

Japan Equity Funds enjoyed solid inflows that went primarily to domestically domiciled ETFs ahead of the Bank of Japan’s September policy meeting. Japan Dividend Funds extended their longest run of outflows in over 18 months but flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates jumped to a 20-week high.

Global sector, Industry and Precious Metals Funds

In the four days leading up to the US Federal Reserve’s latest interest rate decision, seven of 11 EPFR-tracked Sector Fund groups were heading into negative flow territory for the week ending Sept. 18. But flows on the final day of the reporting period moved two of those groups – Technology and Commodities/Materials Sector Funds – into positive territory.

Of the six groups posting an inflow, Consumer Goods Sector Funds topped the list as investors translated the Fed’s 50-basis point cut into an even greater willingness on the part of American consumers to open their wallets. This has not been a good period for this group, which has posted outflows for 13 straight months coming into September. But month-to-date inflows currently total $1.5 billion.

Elsewhere, Healthcare/Biotechnology Sector Funds saw inflows climb to a five-week high. The group, which has seen a net $42 billion flow out since the end of 2022, enjoyed broadly-based inflows with two ETFs leading the way. At the bottom, in terms of flows during the latest week, was a medical device ETF. A custom group of 23 Medical Devices & Healthcare Equipment Funds extended their run of collective outflows to 21 weeks.

Redemptions for Energy Sector Funds moderated, dropping below $100 million. Those dedicated to Master Limited Partnerships (MLPs), a tax-efficient investment vehicle focused on US midstream assets, recorded their biggest inflow since mid-July. Although US government money continues to flow into the clean energy space, outflows from ESG Low Carbon Equity Funds have reached $5 billion (4.7% of assets) so far this year. This would mark the first yearly outflow since 2015 and is by far a record.

Flows into Gold Funds doubled compared to the previous three weeks, while redemptions for Silver Funds more than reversed the inflows of the past two weeks as the group posted their second-largest outflow year-to-date.

Bond and other Fixed Income Funds

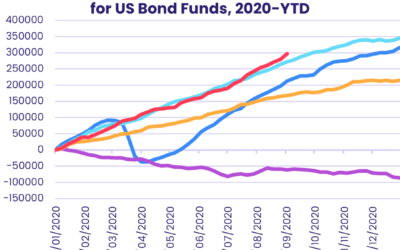

With just under a quarter of 2024 left, EPFR-tracked Bond Funds remain on track to set a new full-year inflow record as the year-to-date climbed over the $590 billion mark in mid-September. Although the latest US rate cutting cycle is finally underway, fueling talk of a pivot away from bonds to stocks, the latest week saw all of the major groups by geographic focus post inflows that ranged from $139 million for Asia Pacific Bond Funds to $10.8 billion for US Bond Funds.

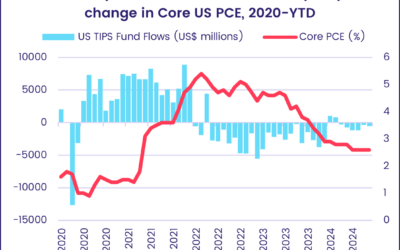

At the asset class level, Inflation Protected Bond Funds extended their longest inflow streak of 2024, flows into Convertible Bond Funds hit their highest level in over two years and High Yield Bond Funds absorbed over $1 billion for the fourth time during the past five weeks. Investors steered fresh money into Municipal Bond Funds for the 12th straight week. During that run, funds with investment grade mandates have consistently attracted bigger inflows than their high yield counterparts in cash terms but lagged them in % of AuM terms.

With the focus on US interest rate setters, US Bond Funds enjoyed strong flows that favored funds offering exposure to corporate over sovereign, intermediate term over other durations and investment grade over high yield. While conventional US Bond Funds have recorded inflows every week so far this year, Collective Investment Trusts (CITs) dedicated to US debt have posted outflows 47 of the past 52 weeks.

The latest week started with the European Central Bank cutting rates by 0.25% for the second time since June and ended with Europe Bond Funds posting their biggest collective inflow in nine weeks despite redemptions from Europe Sovereign Bond Funds hitting a 14-week high. The group continues to attract strong retail support.

Emerging Markets Bond Funds recorded their second biggest inflow of the third quarter as flows into EM Bond ETFs climbed to their highest level since late January.

Among the Asia Pacific Country Fund groups, Japan Bond Funds chalked up their third consecutive inflow and Australia Bond Funds their 25th while Hong Kong Bond Funds posted only their third weekly inflow over the past 12 months.

Did you find this useful? Get our EPFR Insights delivered to your inbox.