How much longer will the war in Ukraine go on? How much further will central banks go before they deem inflation contained? How much damage will the latest US debt ceiling standoff do? How widely will the benefits of China’s anticipated economic rebound be felt? What direction will Japanese monetary policy take?

This uncertainty reflected in these questions, which has been encapsulated in the commentary accompanying many corporate earnings reports, sapped flows to the majority of EPFR-tracked fund groups during the third week of February. Equity Funds recorded their second outflow in the past three weeks, flows into Bond Funds dropped for the sixth week running as outflows from Emerging Markets and High Yield Bond Funds hit 14 and 38-week highs, respectively, and Alternative Funds saw their longest inflow streak in over 11 months come to an end.

The direction of Japan’s monetary policy when current Bank of Japan Governor Haruhiko Kuroda steps down in April continues to weigh on sentiment for Japanese assets. Japan Equity Funds posted their fifth straight outflow while redemptions from Japan Bond Funds climbed to their highest level since late 3Q22.

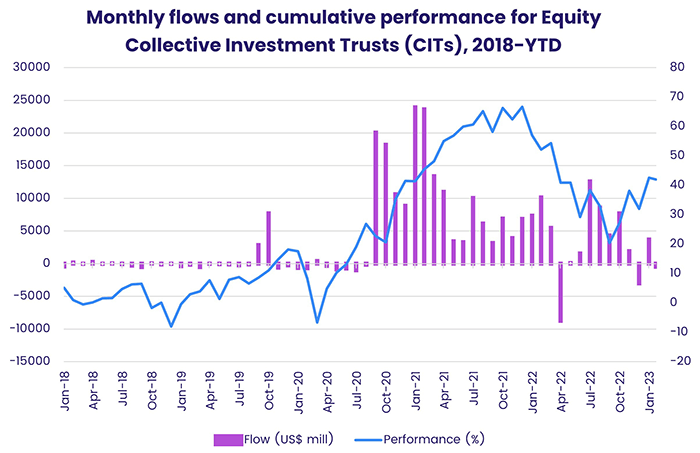

Investors continue to look for ways to keep a lid on investment costs. Flows into both Equity Collective Investment Trusts (CITs) and Bond ETFs touched a five-week high. Redemptions from Equity ETFs, however, were the biggest since the third week of December.

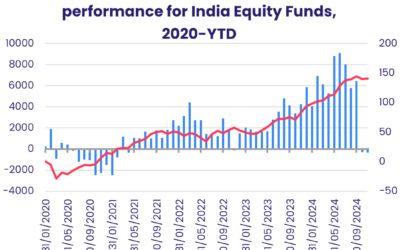

At the asset class and single country fund levels, China Bond Funds posted their 52nd outflow since mid-1Q22, Spain Equity Funds posted their biggest outflow since mid-4Q21, India Equity Funds took in fresh money for the 12th time in the past 13 weeks and Turkey Equity Funds set a new weekly inflow record. Cryptocurrency and Dividend Equity Funds chalked up their sixth and seventh inflows year-to-date, respectively, while Bank Loan Funds chalked up their 35th outflow in the past 37 weeks and Inflation Protected Bond Funds extended their longest run of outflows since 2013.

Emerging Markets Equity Funds

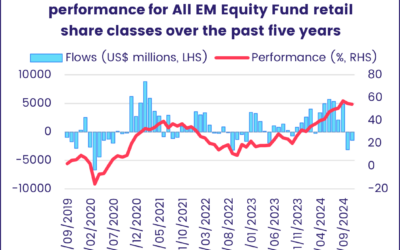

Concern that US interest rates will stay higher for longer did not stop EPFR-tracked Emerging Markets Equity Funds from recording an inflow – their ninth in the past 10 weeks – going into the final week of February. Once again the diversified Global Emerging Markets (GEM) Equity Funds accounted for the biggest share of the week’s headline number. But all three major regional groups attracted fresh money, with EMEA Equity Funds posting their biggest inflow since mid-2Q19 and Frontier Markets Equity Funds extending their longest inflow streak since a 38-week run ended in 1Q11.

The headline number for EMEA Equity Funds was driven by record-setting inflows into Turkey Equity Funds, over 90% of which went to a single manager. Turkey’s equity markets, which closed in the aftermath of two devastating earthquakes earlier this month, gained significant ground when they reopened last week. Some of these gains stem from rule changes making share buybacks more attractive and requiring public pension funds to increase their allocations to domestic equity.

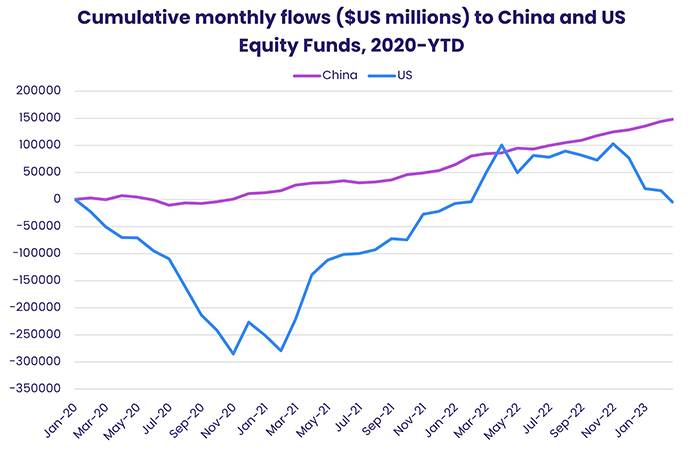

Among the Asia ex-Japan Country Fund groups, India Equity Funds recorded their 12th inflow in the past 13 weeks while China Equity Funds posted a third consecutive outflow for the first time in over 18 months. Despite those outflows, which owe something to the recent spike in Sino-US tensions, they have outgained US Equity Funds over the past three years.

The latest sector allocations data shows that managers of China Equity Funds lifted their allocations to telecoms and consumer discretionary plays to nine and 15-month highs, respectively, during the first month of 2023 while allocations to utilities slipped to a 14-month low. Managers of India Equity Funds, meanwhile, lifted their average exposure to industrials to a 39-month high and cut their allocation to healthcare stocks to a 35-month low.

Flows into Latin America Equity Funds hit their highest level in over three months, with regional funds attracting the bulk of the fresh money.

Developed Markets Equity Funds

The week ending Feb. 22 saw EPFR-tracked Developed Markets Equity Funds post their biggest outflow year-to-date as investors struggled to get a fix on US, Japanese and European monetary policy, prepared to mark the one-year anniversary of Russia’s assault on Ukraine and digested more cautious corporate guidance on the outlook for the rest of the year. Redemptions from US and Japan Equity Funds hit nine and 14-week highs, respectively, while only Global Equity Funds recorded an inflow of more than $1 billion.

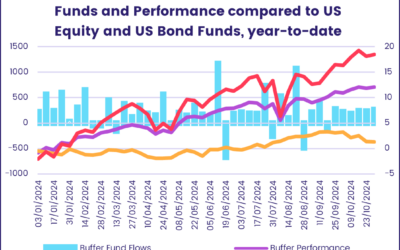

Investors pulled money out of both US Equity ETFs and mutual funds as they questioned current valuations in light of recent corporate guidance and the likelihood that US interest rates may not fall until 2024. US Dividend Funds did record inflows, as did Small and Mid-Cap Value Funds, and flows into Leveraged x3 Funds hit an eight-week high.

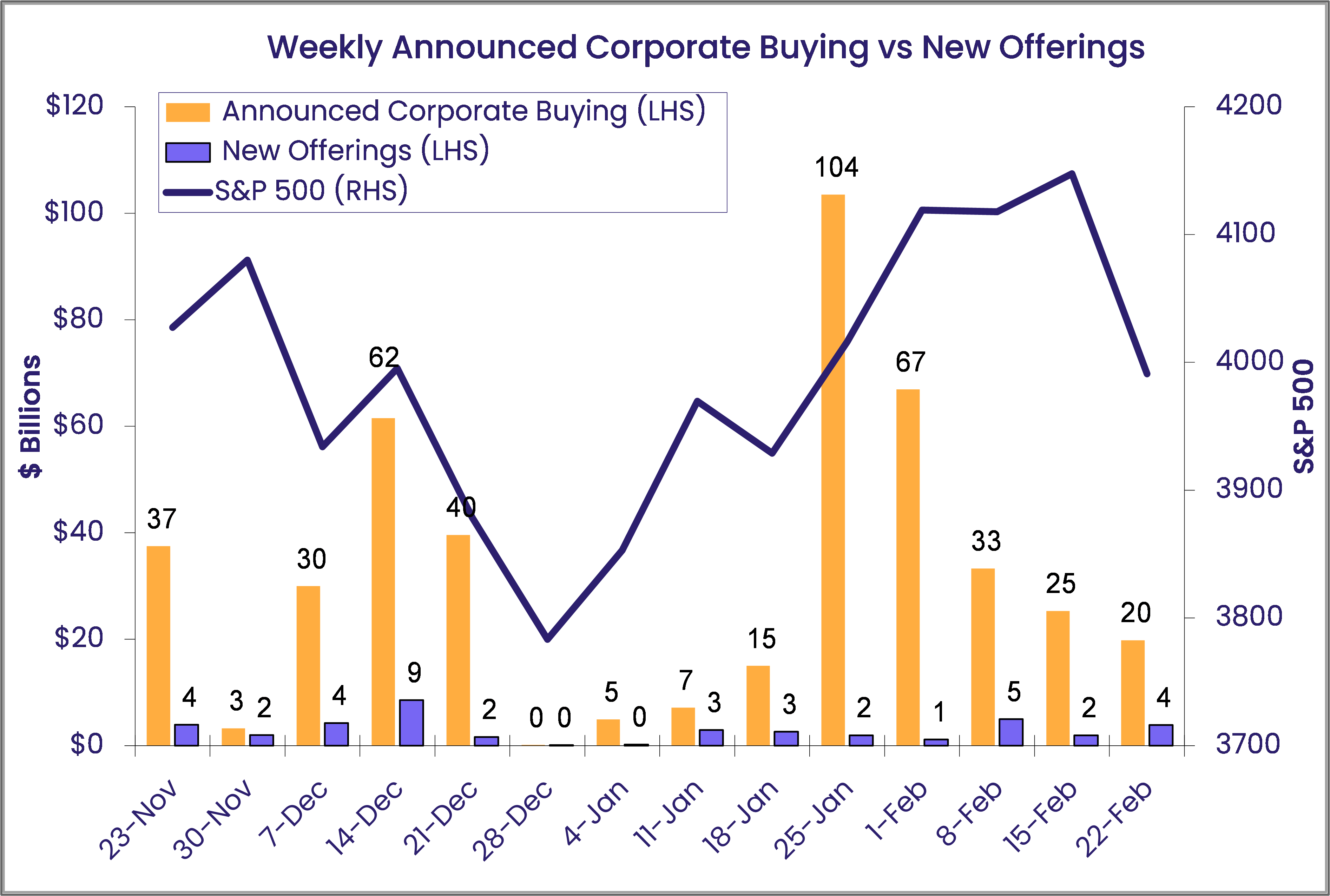

US equities continue to enjoy significant support from the companies whose stocks are traded. Research by EPFR Analyst Winton Chua shows announced share buybacks through the first eight weeks of 2023 totaled $240 billion while new stock offerings total only $20 billion. According to Chua, “Selling of their company’s stock by corporate insiders so far this year is 13 times greater than insider buying, well above the historical average.”

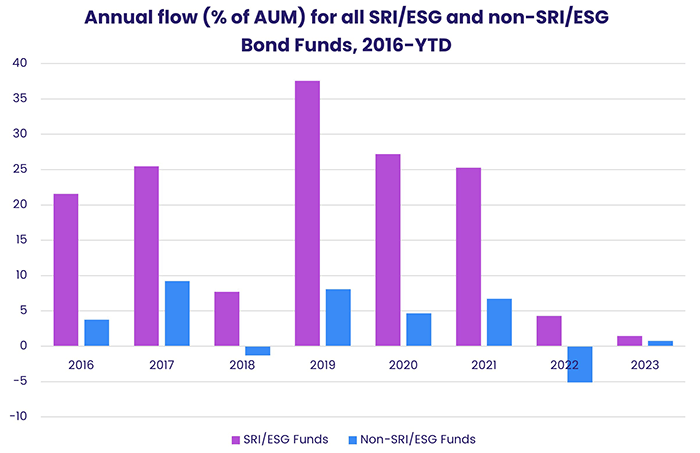

Europe Equity Funds ended the latest week with a minimal collective outflow as redemptions from most dedicated country groups offset solid flows into Switzerland and Europe Regional Funds. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates took in fresh money for the sixth time in the past seven weeks, with the latest inflow the biggest since early December.

At the country level, flows into Sweden Equity Funds hit a 16-week high and Greece Equity Funds extended their longest inflow streak since 1Q22 while Spain Equity Funds posted their biggest outflow in over a year and UK Equity Funds’ current outflow streak hit seven weeks and $4.4 billion.

Redemptions from Japan Equity Funds hit their highest level since early December as investors brace for the impact on corporate profits of rising wage bills and, if the Bank of Japan starts normalizing its monetary policies in the second half of the year, higher capital costs. Foreign domiciled funds have now seen money flow out 10 of the past 12 weeks.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, pulled in another $1.1 billion. Funds with fully global mandates attracted twice the amount of fresh money absorbed by their ex-US counterparts although the latter have modestly outperformed the former year-to-date.

Global Sector, Industry and Precious Metals Funds

With the current earnings season winding down and recent corporate guidance suggesting the need for caution, only two of the 11 major EPFR-tracked Sector Funds, posted inflows during the third week of February. Financial Sector Funds, which saw a four-week inflow streak snapped, posted the biggest outflows and Healthcare, Utilities and Real Estate Sector Funds also surrendered over $400 million.

The redemptions from Real Estate Sector Funds were the largest in nearly two months and came as the average rate for US 30-year mortgages moved north of 6.7%. Meanwhile, sales of existing homes in the US were down over 30% year-on-year in January.

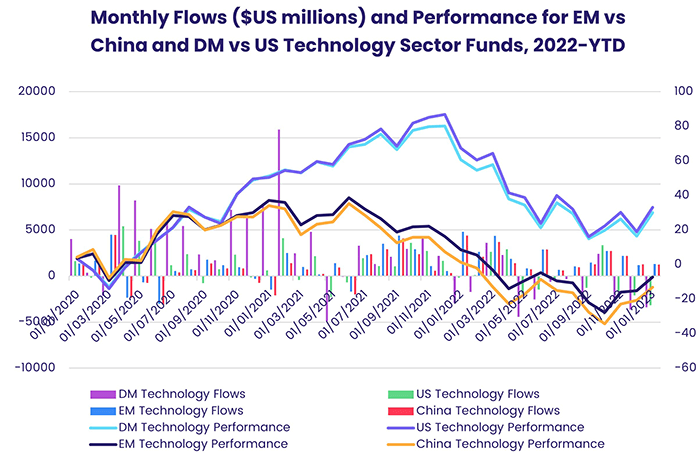

Investors pulled money out of Technology Sector Funds until the final day of the reporting period when $260 million flowed in and took the headline number into positive territory. Those flows came ahead of a stellar earnings report for Chinese tech bellwether Alibaba, with China Technology Sector Funds recording their biggest inflow since late November while US Technology Sector Funds posted their 12th outflow in the past 13 weeks.

Year-to-date, China Technology Sector Funds have absorbed 3% of their AuM coming into January and US Technology Sector Funds have seen 1% of assets flow out. The two countries continue to dominate the developed and emerging market universes: over the past two years, the performance of China Technology Sector Funds has aligned with all EM tech funds and US Technology Sector Funds with all DM funds.

Energy Sector Funds posted the smallest outflow in their current five-week redemption streak. Dedicated Oil Funds posted their fourth inflow in the past five weeks and Natural Gas Funds their fifth straight while Solar Energy Funds racked up their 11th outflow in the past 12 weeks.

Bond and other Fixed Income Funds

Risk aversion among fixed income investors rose another notch during the third week of February, with Emerging Markets and High Yield Bond Funds posting the biggest outflows since mid-4Q22 and late 2Q22, respectively. But EPFR-tracked Bond Funds still attracted enough money to extend their longest run of inflows since 2H21.

Over $11 billion flowed into funds with investment grade mandates. Those dedicated to sovereign debt attracted twice as much new money as those focusing on corporate bonds. US, Europe and Global Bond Funds all took in over $1 billion, more than offsetting redemptions from Emerging Markets and Asia Pacific Bond Funds.

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates continue to attract investors goodwill and cash, posting their 18th straight inflow despite barely outperforming non-SRI/ESG Bond Funds over the past 12 months.

At the asset class level, redemptions from Municipal Bond Funds hit a seven-week high, money flowed out of Inflation Protected Bond Funds for the 27th consecutive week and Bank Loan Funds recorded their 35th outflow in the past 37 weeks while Mortgage-Backed Bond and Total Return Funds added to their longest inflow streaks since 2H21.

Investors pulled $2 out of Hard Currency Emerging Markets Bond Funds for every $1 they redeemed from local currency funds. At the country level, Thailand and China Bond Funds experienced the heaviest redemptions, with the latter posting their eighth straight outflow as investors look to markets with higher yielding debt that may be close to the peak of their tightening cycles.

The latest allocations data for diversified Global Emerging Markets (GEM) Bond Funds shows allocations to Mexico and cash at their highest level since 3Q17 and 1Q09, respectively, while Brazil’s average weighting is at a fresh record low and China’s at a level last seen in late 4Q19.

Europe Corporate Bond Funds attracted more money than their sovereign counterparts for the ninth time in the past 10 weeks as expectations of the terminal rate for European Central Bank (ECB) interest rate hikes continue to climb. Retail flows to Europe Bond Funds were positive for the 12th time since late November.

Among the US Bond Fund groups, flows into Short Term Treasury and Intermediate Term Mixed Funds hit 21 and 36-week highs respectively.

Did you find this useful? Get our EPFR Insights delivered to your inbox.