There were some unwelcome additions to the “higher for longer” list during the first week of April as geopolitical risks and energy prices joined US interest rates on the tally sheet. Fears that Iran will become directly involved in Israel’s war with Hamas in Gaza and Ukraine’s drone campaign against Russian refineries pushed oil prices towards a six-month high. Recent US price data, meanwhile, prompted markets to cut the number and timing of US interest rate cuts.

With the odds of a harder landing for the US and global economies moving higher, the week ending April 10 saw over $19 billion flow out of EPFR-tracked Equity Funds, redemptions from Real Estate Sector and High Yield Bond Funds hit nine and 24-week highs, respectively, Technology Sector Funds post their third outflow since the beginning of March and Total Return Funds their first outflow since mid-December. Meanwhile, flows into Energy Sector Funds hit their highest level in over five months.

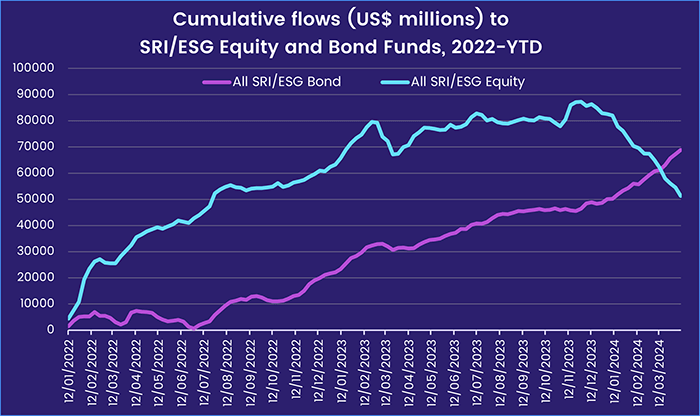

The shifting expectations kept the pressure on Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. The group posted their 17th consecutive outflow and third largest year-to-date.

Overall, redemptions from Equity Funds during the first full week of the second quarter totaled $19.5 billion while $304 million flowed out of Alternative Funds and $2.5 billion from Balanced Funds. Investors steered $13.2 billion into Bond Funds and a net $543 million into Money Market Funds.

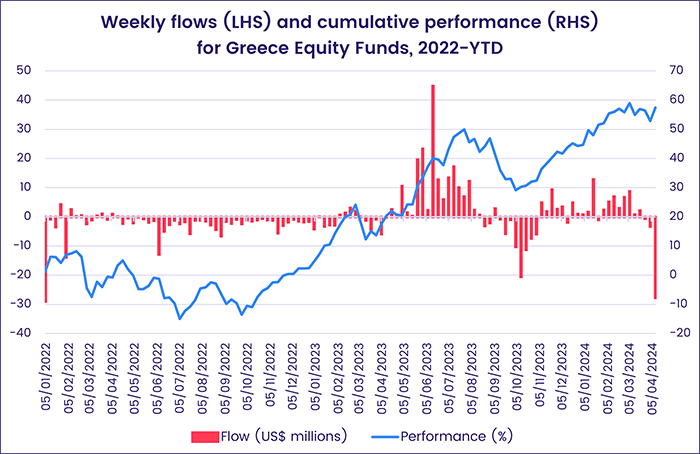

At the single country and asset class fund levels, flows into UK Bond and Canada Money Market Funds hit 32 and 40-week highs, respectively, redemptions from Korea Bond Funds climbed to a year-to-date high and Greece Equity Funds posted their biggest outflow since the first week of 2022. Bank Loan Funds took in fresh money for the seventh week running, Cryptocurrency Funds chalked up their 14th inflow YTD and Physical Gold Funds recorded their 14th outflow of 2024.

Emerging markets equity funds

With the glide path for US interest rates now looking even shallower than markets feared in March, EPFR-tracked Emerging Markets Equity Funds ended the week of April 10 by posting their fifth outflow over the past seven weeks and their biggest since late October. All four of the major regional groups posted outflows that ranged from $57 million for EMEA Equity Funds to $693 million for the diversified Global Emerging Markets (GEM) Equity Funds.

The group did record its first net inflow of the year – and the biggest since mid-3Q23 – for all retail share classes, and EM Dividend Funds posted their 47th inflow over the past year.

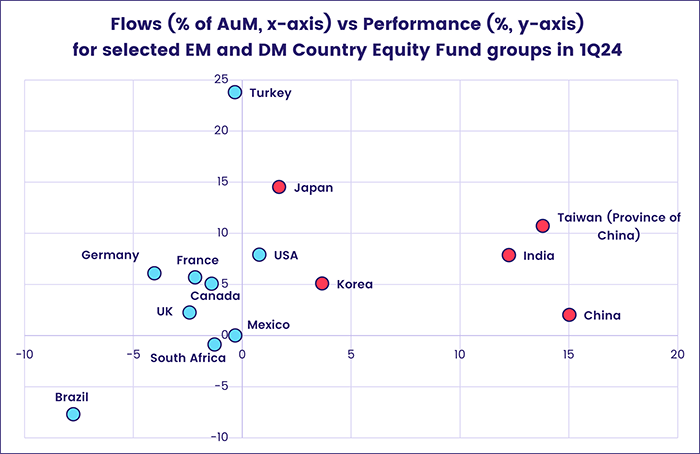

Although major Asia ex-Japan Country Fund groups are, in relative terms, among the biggest money magnets year-to-date, momentum has faltered in recent weeks. The latest data shows India Equity Funds recording their smallest weekly inflow in over 10 months, China Equity Funds extending their longest redemption streak since 2Q20 and Korea Equity Funds posting their seventh outflow during the eight weeks leading into the latest legislative elections.

EMEA Equity Funds continue to struggle as several key markets are embroiled in or threatened by the conflicts in Ukraine and Gaza. The latest outflow was the biggest since mid-December as investors pulled money out of South Africa Equity Funds, record gold prices notwithstanding, for the eighth time over the past 10 weeks and UAE Equity Funds posted their biggest outflow on record.

Flows have also bypassed Latin America Equity Funds for much of 2024, with the latest week’s outflow the biggest in nearly seven months. Redemption pressures for US-domiciled funds have eased since peaking during the third week of February.

Developed markets equity funds

Disappointment about recent US inflation data, and the implications for hoped for interest rate cuts, triggered a sell-off during the latest week that was mirrored in US Equity Fund flows. The group saw over $16 billion flow out – the second largest outflow since the beginning of 4Q23 – which ended the latest inflow streak for all EPFR-tracked Developed Markets Equity Funds at two weeks.

US Equity Funds were not the only groups hit by the latest shift in expectations for US interest rates and rising tensions in the Middle East. Europe Equity Funds recorded their 15th consecutive outflow and redemptions from Japan Equity Funds hit their highest level since late November.

In the case of Europe mandated funds, Europe Equity ETFs absorbed fresh money for the 11th time during the past 12 weeks. But money continues to pour out of retail share classes and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest outflow in over two years. At the country level, funds dedicated to two of the major Mediterranean markets struggled, with outflows from Spain and Greece Equity Funds hitting 42 and 119-week highs, respectively.

Foreign-domiciled Japan Equity Funds, which have usually set the course for flows to the overall group during the past year, posted their 10th inflow over the past 13 weeks. But those flows were offset by the biggest outflow from domestically domiciled funds since late November. Leveraged Japan Equity Funds chalked up their sixth inflow since the third week of February.

Large Cap Blend and Growth Funds were the biggest drivers for the headline number for all US Equity Funds as investors reassessed the prospects of large technology plays in light of the diminishing expectations for interest rate cuts in 2024.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, swam against the tide when it came to flows. The group pulled in another $2.2 billion.

Global sector, industry and precious metals funds

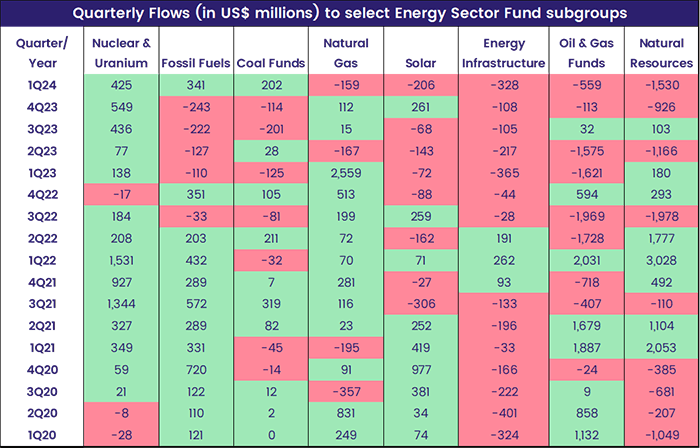

With another US corporate earnings season kicking off, investors sought to match the intelligence gleaned from quarterly reports with the latest producer and consumer price data. Flows into – and out of – EPFR-tracked Sector Funds during the week ending April 10 intensified in both directions as investors position themselves for news they expect. Of the 11 major groups, five reported inflows ranging from $62 million for Commodities/Materials Sector Funds to $929 million for Energy Sector Funds while four posted outflows in excess of $600 million.

Investors flipped the ‘on’ switch when it came to Energy Sector Funds, which chalked up their biggest collective inflow in over five months. US-dedicated funds drove the headline number with their fourth consecutive inflow, a run that has pulled in nearly $2 billion to these funds. While a single ETF brought in $690 million, EPFR’s fund-level data revealed two Oil & Gas Exploration & Production and two Uranium-focused ETFs sitting in the top 10 funds reporting inflows this week.

Drilling down, Nuclear & Uranium Funds recorded their 11th inflow year-to-date, with the latest total a 12-week high. Investors have pumped roughly $6.5 billion into this group since 3Q20, and it led the pack of major Energy Sector Fund subgroups in terms of flows in the first quarter of 2024.

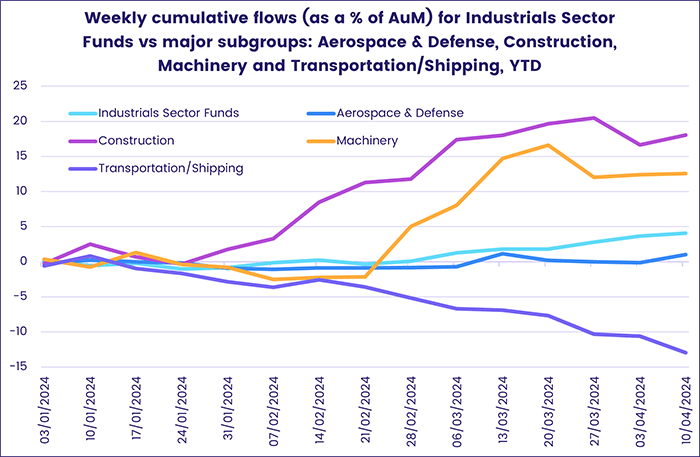

Industrials Sector Funds added to their longest inflow streak since an 11-week run starting mid-1Q21. Construction Funds enjoyed their 10th inflow of the past 11 weeks and Aerospace & Defense Funds snapped a three-week outflow streak, while Transportation/Shipping Funds suffered their 32nd outflow of the past 36 weeks. At this point last year, all subgroups were posting outflows except for Aerospace & Defense Funds, but this year, all subgroups are posting inflows except for Transportation/Shipping Funds. Year-to-date, flows in % of AUM terms have been led by Construction Funds, climbing more than 18%.

Flows into Infrastructure Sector Funds touched a 10-week high and brought an end to their three-week outflow streak. While recent positive sentiment is being driven mainly by funds with US mandates, India Infrastructure Funds have posted inflows for 70 consecutive weeks, absorbing nearly $900 million in that time.

Bond and other fixed income funds

EPFR-tracked Bond Funds continued their strong start to 2024 in early April, adding to a year-to-date tally for all funds that exceeds $225 billion, as yields on US 10-year Treasuries crept back over 4.5% and another rating agency lowered its outlook for Chinese debt.

Fitch’s change in China’s outlook, from stable to negative, did not stop overall flows into all Emerging Bond Funds from hitting a 60-week high. But the specter of US interest rates staying at current levels into the third quarter – or beyond – saw US High Yield Bond Funds post their third outflow over the past four weeks.

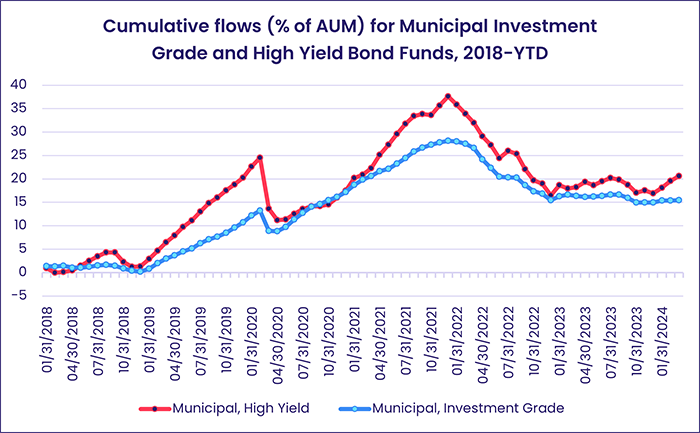

At the asset class level, Bank Loan and Mortgage Backed Bond Funds extended their current inflow streaks and Municipal Bond Funds pulled in over $1 billion while Inflation Protected Bond Funds posted their fifth outflow since the beginning of March.

Contingent Convertible (CoCo) Bond Funds started 2023 with 15 consecutive weekly inflows. In 2Q23, however, some $17 billion worth of CoCo bonds issued by Switzerland’s then second-largest bank, Credit Suisse, were written down to zero at the behest of regulators after the company was hit by sustained deposit flight. Investors dumped CoCo bonds, but the yields offered by this asset class have tempted investors to cautiously increase their exposure during the first three months of 2024.

Emerging Markets Bond Funds are also seeing more interest, with the overall group posting consecutive weekly inflows for only the third time since the beginning of 3Q23 as flows into Frontier Markets and Global Emerging Markets (GEM) Bond Funds hit 14 and 62-week highs respectively. But the collapse of major Chinese developers continues to cast a major shadow over Asia ex-Japan Corporate Bond Funds. Over the past 12 months the group has posted outflows four out of every five weeks, and the latest redemptions hit a level last seen in late 4Q22.

Flows into Europe Bond Funds breached the $3 billion mark for the third time so far this year ahead of the European Central Bank’s latest policy meeting. That meeting concluded with the ECB signaling its confidence that inflation is on track to fall back into the central bank’s target range, kindling hopes the ECB will join Switzerland in cutting rates ahead of the US Federal Reserve.

Did you find this useful? Get our EPFR Insights delivered to your inbox.