The second week of March was dominated by the crumbling fortunes of large US regional banks and European major Credit Suisse. Although this certainly dented investors’ risk appetite, many saw events as an opportunity – especially if major central banks dust off their playbooks from 2008-09 and 2020, opening lines of credit and secured lending facilities and cutting interest rates.

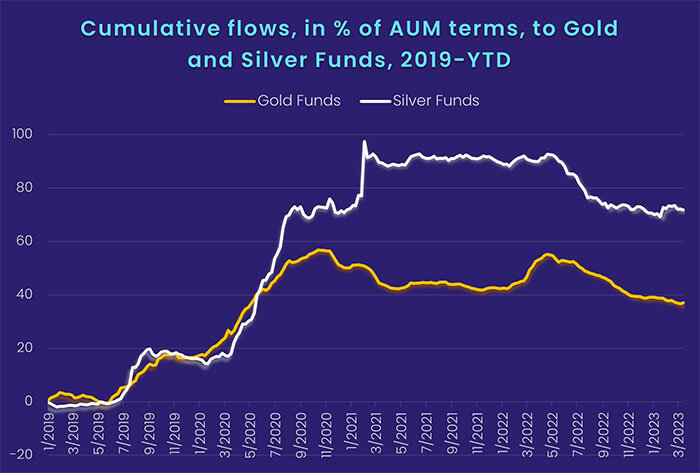

Anxiety about the safety of deposits in Silicon Valley Bank and others saw EPFR-tracked US Money Market Funds absorb over $115 billion, their biggest weekly inflow since early 2Q20, and flows into Gold Funds hit their highest level in over nine months. But US Technology Sector Funds recorded their second biggest inflow year-to-date, flows into Regional Bank Funds hit a record weekly high, US Equity Funds recorded their biggest daily inflow on the final day of the reporting period since mid-December, and Credit Suisse’s woes notwithstanding, Switzerland Equity and Bond Funds both absorbed over $350 million.

China’s economic trajectory remained a point of light for investors. China, Hong Kong (SAR) and Taiwan (POC) Equity Funds extended their current inflow streaks, with Taiwan (POC) Equity Funds recording their biggest inflow in nearly four months despite the increasing speculation about China’s willingness to forcibly reclaim what it regards as a renegade province.

Overall, the week ending March 15 saw EPFR-tracked Bond Funds post their first outflow of 2023 while redemptions from all Balanced and Alternative Funds climbed to 11 and 12-week highs, respectively. Equity Funds recorded a collective outflow of $26 million and Money Market Funds took in a net $112.6 billion. The assets managed by all Money Market Funds, which stood at $5.5 trillion going into the Covid-19 pandemic in 1Q20, now stand at $7.5 trillion.

At the asset class fund level, Bank Loan Funds chalked up their ninth consecutive outflow and 18th in the past 20 weeks, Mortgage-Backed Bond Funds extended their longest inflow streak since 4Q21, and Convertible Bond Funds experienced their heaviest redemptions in over eight months.

Emerging Markets Equity Funds

Faith in China’s resurgent growth was not enough to stop EPFR-tracked Emerging Markets Equity Funds from posting their second outflow of 2023. But it came close, with China-focused fund groups pulling in over $1.5 billion, a figure that fell just short of offsetting redemptions from other groups. Latin America, EMEA and the diversified Global Emerging Markets (GEM) Equity Funds all posted outflows, with the latter seeing their longest inflow streak since 1H21 come to an end.

Redemptions from retail share classes climbed to a 14-week high during a week when flows into EM Dividend Funds hit a level last seen in mid-August and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates took in fresh money for the 17th straight week.

While China Equity Funds posted inflows for the third straight week and ninth time year-to-date, investors appear uncertain about how much of this growth will have a positive impact on other regional economies. The prospect of Chinese firms again competing aggressively for a share of weakening US and European demand, and the internal focus of current Chinese economic policies, suggest that any benefits of stronger growth will – at least initially – accrue to China.

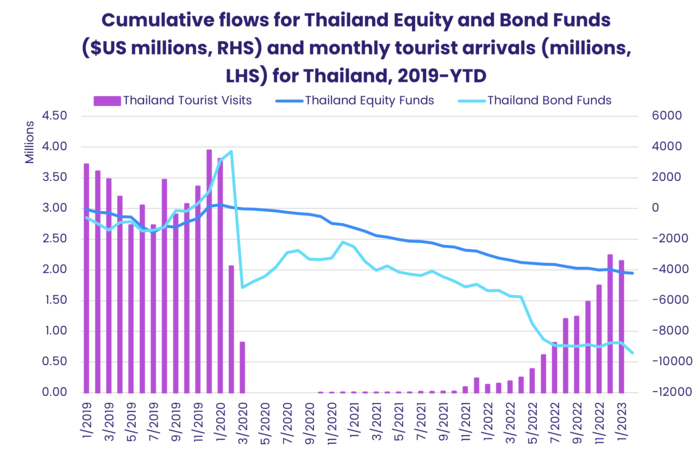

The latest week saw India, Korea, Indonesia, Philippines and Malaysia Equity Funds all post outflows. Redemptions from Korea Equity Funds were the biggest in over nine months. Funds dedicated to Thailand, which is eagerly anticipating the return of Chinese tourists, did post their biggest inflow since mid-December.

Among the Latin America Country Fund groups, Brazil Equity Funds recorded their third inflow over the past four weeks while Mexico Equity Funds recorded their second largest outflow year-to-date. In the case of Brazil, markets are waiting for the release of a new fiscal framework that the government hopes will reassure both foreign creditors and Brazil’s central bank. If the plan is well received, it may allow the central bank to start cutting interest rates which are currently at a six-year high.

After three weeks of support from Turkey’s efforts to bolster its equity markets, EMEA Equity Funds posted their sixth outflow in the past nine weeks as redemptions from South Africa and Turkey Equity Funds hit four and five-week highs, respectively.

Developed Markets Equity Funds

Triggered by a fast-moving series of bank failures in the US, the second week of March saw a sharp reassessment of the outlook for US interest rates and global economic growth. With investors again optimistic that the US Federal Reserve will, in the face of a stalling economy, pivot to cutting interest rates before year’s end, US Equity Funds saw a surge of fresh money at the end of the latest reporting period. That was enough to ensure that EPFR-tracked Developed Markets Equity Funds recorded their second collective inflow since the beginning of February.

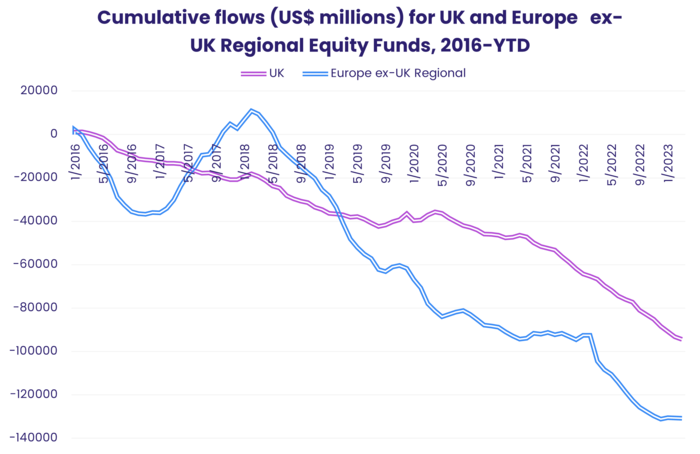

While US Equity Funds absorbed fresh money and flows into Canada Equity Funds hit an 11-week high, redemptions from both Global and Europe Equity Funds hit year-to-date highs while Japan Equity Funds recorded their seventh outflow in the past eight weeks.

With the European Central Bank poised to deliver another 50 basis point rate hike, which it did on March 16, and uncertainty surrounding one of Europe’s biggest banks, investors opted to pull over $1.5 billion out of Europe Equity Funds. At the country level, however, Switzerland Equity Funds recorded a solid inflow and it was UK Equity Funds which posted the biggest outflow on the heels of a budget that raises the headline rate of corporate income tax from 19% to 25% in 2Q24.

Among the major US Equity Fund groups, Large Cap Blend Funds posted their sixth straight outflow but all of the other groups by capitalization and style recorded inflows that hit 11-week highs for Large and Mid-Cap Value Funds, a 13-week high for Small Cap Blend Funds and a 26-week high for Mid-Cap Growth Funds. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did not fare as well, extending their longest outflow streak since 2Q18.

Redemptions from Japan Equity Funds were a seventh of the previous week’s total. Foreign-domiciled funds posted their first collective inflow since late January and biggest since mid-December. Over the past 12 months, the performance of overseas-domiciled funds has lagged that of domestically based ones by over 5%.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, saw a 10-week inflow streak come to an end as modest commitments to Global ex-US Funds were offset by the heaviest redemptions from funds with fully global mandates since the second week of October.

Global Sector, Industry and Precious Metals Funds

With fears of a recessionary end to the year stoked by stress in the US and European banking sectors, investors gave a majority of EPFR-tracked Sector Fund groups the cold shoulder during the week ending March 15. Seven of the 11 reported net outflows in the week that ranged from $56 billion for Infrastructure Sector Funds to $1.5 billion for Energy Sector Funds.

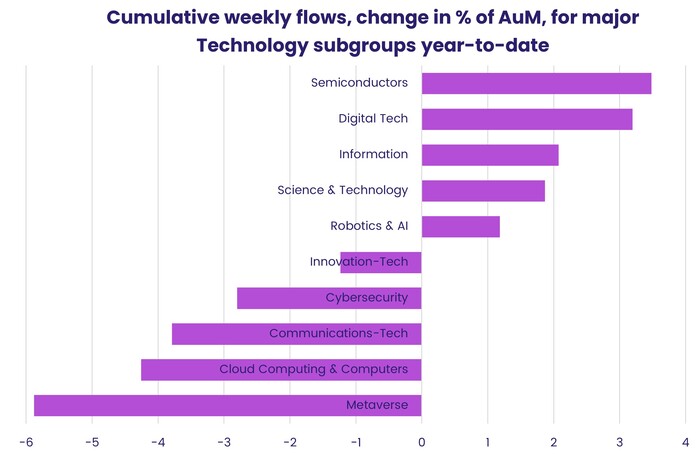

Despite the collapse of Silicon Valley Bank, Technology Sector Funds ended the week with the biggest inflow of any group. US Technology Sector Funds brought in over $400 million, snapping a four-week outflow streak that totaled $1.5 billion, and investors continued to put more money into China, Hong Kong, Korea (South) and Japan dedicated funds.

Technology focused investors have increased flows to Semiconductor Funds relative to other major Technology Sector Fund groups. Metaverse, Cloud Computing and Cybersecurity Funds are among the groups struggling to attract fresh money.

Investors committing $1.3 billion to a single banking related fund was not enough to offset the redemptions from other Financials Sector Funds, as the group posted their first outflow overall in two weeks and only their third in the past 11 weeks. Despite this, a custom grouping of nine Regional Bank Funds found weekly inflows climbed to their highest level since EPFR started tracking them in 2007.

The prospect of a bank-related credit squeeze adding to the headwinds facing the global economy took its toll on flows to Commodities/Materials and Energy Sector Funds, with outflows climbing to 35 and 43-week highs, respectively. Most of the major Energy Sector Fund subgroups posted outflows. Hydrogen Funds ended a 30-week inflow streak, Natural Gas Funds extended their longest redemption run since late 2Q22, outflows for Natural Resources Funds climbed to a 34-week high and Renewable Energy Funds experienced record-setting outflows.

Industrials Sector Funds, too, suffered from the gloomier outlook for credit and growth with redemptions hitting their highest level since early 3Q22. Aerospace & Defense Funds posted their first outflow in 10 weeks.

Bond and other Fixed Income Funds

A few days after US Federal Chair Jerome Powell’s inflation-fighting rhetoric drove the yield on short term Treasuries over 5% another bank crisis sent those yields plunging. With already fragile growth threatened by a squeeze in bank credit, investors rapidly changed – and lowered – their assumptions about peak US interest rates and the timing of a Fed ‘pivot’ to monetary easing.

The market turmoil, and accompanying surge in risk aversion, saw EPFR-tracked Bond Funds post their first outflow of 2023 as a 10-week inflow streak came to an end. Although US and Global Bond Funds eked out modest inflows, those were offset by the over $3 billion redeemed from Emerging Markets Bond Funds and the biggest outflow from Europe Bond Funds since mid-November.

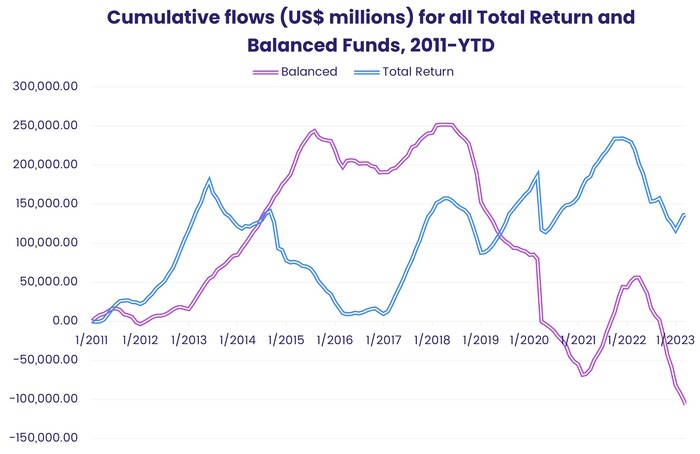

At the asset class level, redemptions from Bank Loan and Convertible Bond Funds hit 11 and 38-week highs, High Yield Bond Funds posted their fourth outflow in the past five weeks and investors pulled money out of Municipal Bond Funds for the fourth week running. Flows into the two major multi-asset groups continue to favor Total Return Funds as another $3.6 billion flowed out of Balanced Funds.

Ahead of the latest rate hike by the European Central Bank, investors steered another $1 billion into Europe Sovereign Bond Funds, with short term the preferred duration for the third straight week. But redemptions from mixed and corporate funds totaled over $1.8 billion, with the latter recording their biggest weekly outflow in nearly six months. At the country level, flows into Germany Bond Funds climbed to a six-week high, Switzerland Bond Funds posted their 10th consecutive inflow and outflows from UK Bond Funds hit a level last seen in mid-October.

Emerging Markets Bond Funds with hard currency mandates bore the brunt of the latest outflows while another week of positive flows for Korea Bond Funds helped Local Currency Funds post a modest collective inflow.

Flows into US Bond Funds favored funds with sovereign mandates over those dedicated to corporate debt. Long Term US Bond Funds posted their biggest inflow since the second week of January while Short Term Funds experienced net redemptions for the first time since the first week of February.

Did you find this useful? Get our EPFR Insights delivered to your inbox.