Evidence that inflation is falling and global growth is stalling gave EPFR-tracked Bond Funds a shot in the arm during the first full week of January. Ahead of December’s CPI number, which showed US inflation grew at a 13-month low of 6.45% in the final month of 2022, investors committed over $17 billion to all Bond Funds. Driven by the hope monetary policymakers will respond to recent price and growth signals by pivoting from tightening to easing, the latest inflow was the biggest recorded by this group since early 3Q21.

The week ending Jan. 11 also saw an increase in the number of Sector Fund groups attracting fresh money, continued flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates and a shift in favor of diversified fund groups. Flows into Global Emerging Markets (GEM) Bond, Global Bond, GEM Equity and Global Equity Funds hit four, six, 42 and 49-week highs, respectively.

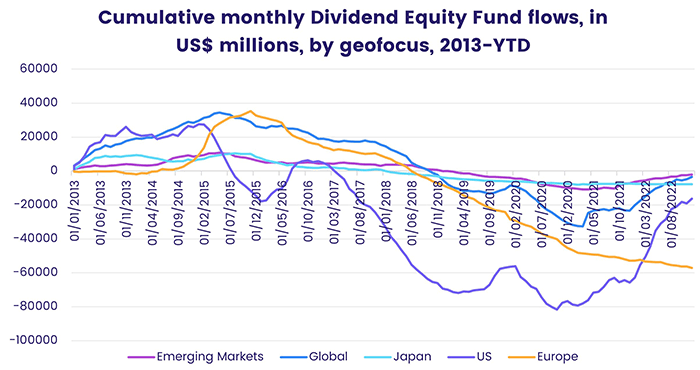

Dividend Equity Funds also remained popular, chalking up their fourth straight inflow and 21st in the past 25 weeks.

Overall, the week ending Jan. 11 saw EPFR-tracked Equity Funds pull in a net $7.1 billion. Balanced Funds posted consecutive weekly inflows for the first time since mid-August, Alternative Funds absorbed $948 million and Bond Funds took in a net $17.4 billion. Flows into all Money Market Funds were less than a 10th of the previous week’s total, with China Money Market Funds extending their longest outflow streak since 1H17.

At the asset class and single country fund levels, flows into UK, Switzerland, Denmark and Greece Bond Funds hit 11, 23, 29 and 53-week highs, respectively, and Switzerland Equity Funds recorded their biggest weekly inflow since late 2Q22. Total Return Bond Funds snapped a 20-week outflow streak, Cryptocurrency Funds recorded their biggest inflow in over three months and Municipal Bond Funds attracted over $2 billion for the first time since mid-November.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds took in fresh money for the 16th time in the past 20 weeks during the week ending Jan. 11. They did so without the support of China Equity Funds, which posted their biggest outflow since mid-2Q22, or funds dedicated to Brazil. Diversified Global Emerging Markets (GEM) Equity Funds accounted for the bulk of the latest headline number, with investors steering over $2.75 billion – a 42-week high – into this group.

Retail flows to all EM Equity Funds climbed to a six-week high during a week when Frontier Markets Equity Funds extended their longest inflow streak since 3Q14, EM Dividend Equity Funds posted their fifth consecutive inflows and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow in nearly six months. EM Equity Collective Investment Trusts (CITs), however, recorded their seventh straight outflow.

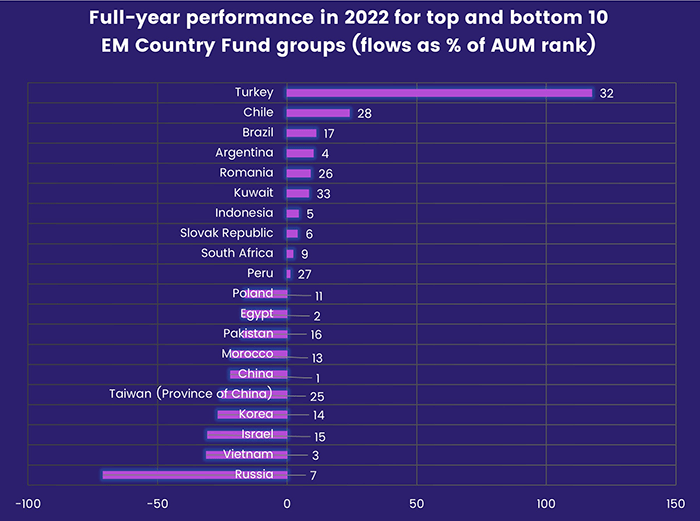

Among the major EM Country Fund groups, last year’s top performer, Turkey Equity Funds, saw their longest inflow streak since 4Q20 come to an end. Turkish equity markets sold off during the past week, triggering ‘circuit breakers’ as local investors tried to cash in some of last year’s gains.

As the chart above illustrates, flows frequently did not follow performance in 2022. China Equity Funds attracted by far the biggest inflows in both cash and % of AUM terms, but were in the bottom sixth when it came to performance. With the Lunar New Year holidays about to mute economic activity and, in the worst-case scenario, serve to accelerate the spread of Covid-19, investors took a step back.

It was a bumpy week for Brazil Equity Funds, which recorded their biggest outflow since late 2Q21 after supporters of former president Jair Bolsonaro stormed the Brazilian legislature and Supreme Court. The protest was rapidly contained but highlighted the challenges facing new left-of-center President Luiz Lula da Silva. Mexico Equity Funds, meanwhile, chalked up their eight inflow in the past nine weeks as investors continue to buy into markets with supply chain relocation stories.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds posted their first inflow of 2023 during the week ending Jan. 11 as solid flows into Global, Japan and Australia Equity Funds offset redemptions from US, Canada and Europe Equity Funds. Investors are currently balancing their optimism about the duration of the current US and European tightening cycles with their growing concern about the growth already lost to higher interest rates, the fallout from Russia’s assault of Ukraine and de-globalization.

With a number of high-profile companies trimming their workforces to cope with the low-growth environment they anticipate for much of this year, investors took a cautious approach to US Equity Funds. Investors committed modest sums to Large and Mid-Cap Blend and Small Cap Value Funds but redeemed money from the other major groups. Foreign-domiciled funds did, however, record inflows for the 11th time in the past 12 weeks.

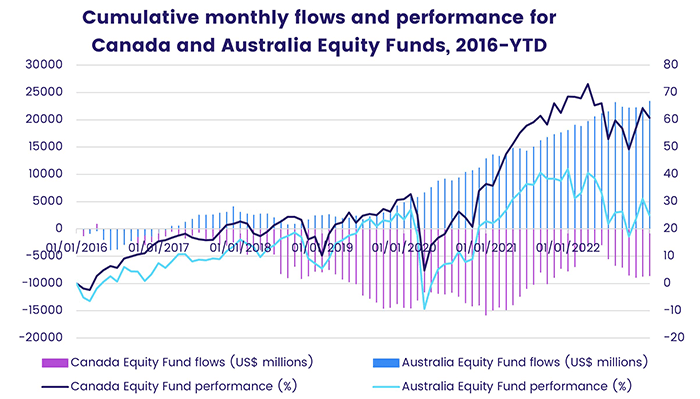

Lackluster expectations for US growth also weighed on Canada Equity Funds, which posted their sixth outflow in the past seven weeks. But the prospect of China fully reopening later this year, and the warmer tone from some Chinese leaders, boosted investor sentiment towards Australia. Flows into dedicated Australia Equity Funds jumped to a 110-week high.

Japan Equity Funds, meanwhile, added to their longest inflow streak in over 19 months ahead of the Bank of Japan’s first policy meeting of the New Year. The country’s central bank is wrestling with market challenges to its yield control policy and the unintended consequences – falling real wages, weaker consumer confidence – that have come with an inflation rate that is finally well north of the BOJ’s 2% target.

Although inflation is slowly moderating and fears of a brutal energy squeeze have ebbed thanks to an unusually warm winter, Europe Equity Funds saw money flow out for the 48th straight week. The end of UK Equity Funds’ short-lived inflow streak was a major contributor to the headline number, more than canceling out the biggest flows to Switzerland and Germany Equity Funds since 2Q22 and 1Q21 respectively.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, recorded their biggest inflow in over 11 months. Funds with fully global mandates absorbed over $3 for every $1 taken in by Global ex-US Equity Funds.

Global Sector, Industry and Precious Metals Funds

With the 4Q22 corporate earnings season kicking off in earnest, flows to EPFR-tracked Sector Funds gathered momentum heading into mid-January. Four of the five groups reporting inflows last week – Commodities, Consumer Goods, Financials and Industrials Sector Funds – saw even stronger interest during the latest reporting period and two other groups – Real Estate and Telecoms Sector Funds – posted inflows just shy of $100 million. On the other hand, five of the 11 major groups experienced net redemptions ranging from $39 million to $989 million.

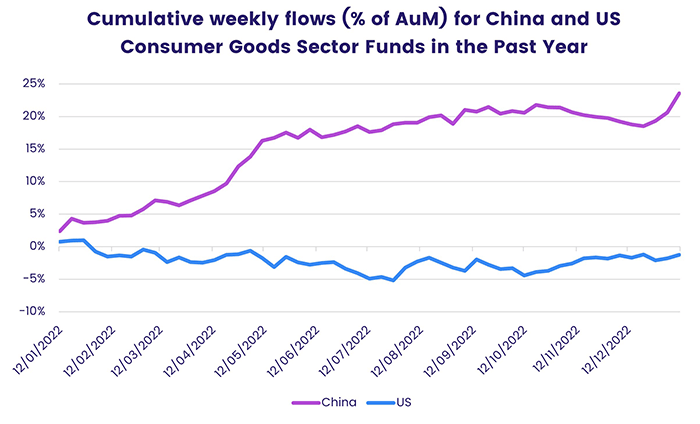

Consumer Goods Sector Funds saw inflows climb to a 17-week high on the back of China and US dedicated funds, which absorbed $445 and $300 million, respectively. Funds dedicated to the makers of these goods also had a good week. Industrials Sector Funds recorded their biggest inflow since mid-4Q21 with US-focused funds accounting for the bulk of the headline number. Of the top 10 individual funds ranked by inflows for the week, eight are ETFs and four have aerospace and defense mandates.

Redemptions for Technology Sector Funds climbed to their highest level in the current seven-week outflow streak. US Technology Sector Funds again bore the brunt of the outflow as investors respond to increasing regulatory scrutiny, high interest rates and slowing economic growth in the world’s largest economy.

Among the major tech subgroups, Cybersecurity Funds extended an eight-week run of outflows and Robotics & AI Funds continued a redemption streak stretching back to August 2022. Meanwhile, Semiconductor Funds recorded their biggest inflow in three months despite an earnings report from industry heavyweight Taiwan Semiconductor Manufacturing Company (TSMC) that undershot revenue estimates and was accompanied by a bearish assessment of consumer demand.

Energy Sector Funds posted their biggest outflow in four months as they extended their redemption streak to eight weeks and $3.1 billion total. Natural Gas Funds posted their fourth straight inflow and Oil & Gas Funds their third straight outflow as a warm winter in Europe and strong output from British renewable sources reduced volatility in this sector.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds continued their strong start to 2023 by taking in another $17.4 billion during the week ending Jan. 11. That was their biggest total since the first week of July 2021 when the rapid spread of Covid’s Delta variant made it unlikely that major central banks would be ending their quantitative easing programs any time soon.

The latest influx is tied to the downward trend in headline inflation, both in the US and Europe, and weaker expectations for growth that markets hope will translate into policy shifts by the US Federal Reserve, European Central Bank, Bank of England and other central banks. The hoped-for pivot from tightening to easing will take some of the pressure off riskier corporate and emerging markets debt.

Flows into Emerging Markets Bond Funds during the latest month climbed to a 10-month high, with Hard Currency EM Funds pulling in over 2.5 times the amount absorbed by their local currency counterparts. At the country level, flows in the Asia ex-Japan universe continue to rotate from China-dedicated Funds to Korea Bond Funds.

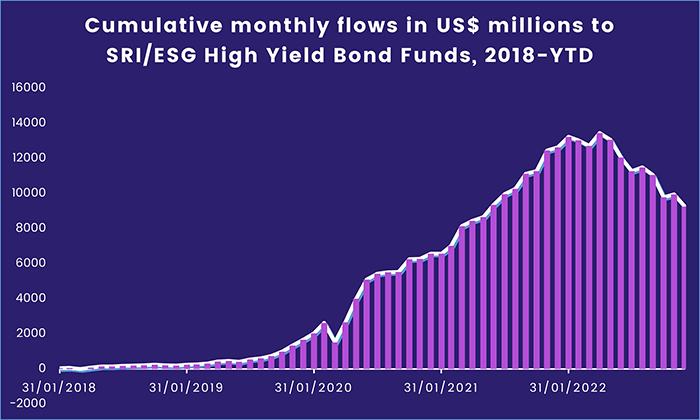

High Yield Bond Funds, meanwhile, posted their biggest inflow since mid-November. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which have struggled to attract fresh money in recent months, posted their sixth inflow in the past eight weeks.

Among the other asset class groups, redemptions from Convertible Bond Funds hit a 15-week high, Mortgage-Backed Bond Funds absorbed over $1 billion for the first time since late October, Inflation Protected Bond Funds posted their 20th consecutive outflow and Bank Loan Funds saw money flow out for the 30th time in the past 31 weeks.

US Bond Funds, which did not post retail inflows once in 2022, extended that run during a week when they posted their biggest overall inflow since mid-1Q21. Long was the preferred duration and Investment Grade Corporate and Mixed Funds completely eclipsed US Sovereign Bond Funds when it came to attracting fresh money.

For the first time since mid-August of last year, both of the major multi-asset fund groups posted inflows during the same week. In the case of Total Return Funds, the inflows snapped a 20-week outflow streak while flows into Balanced Funds hit a 21-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.