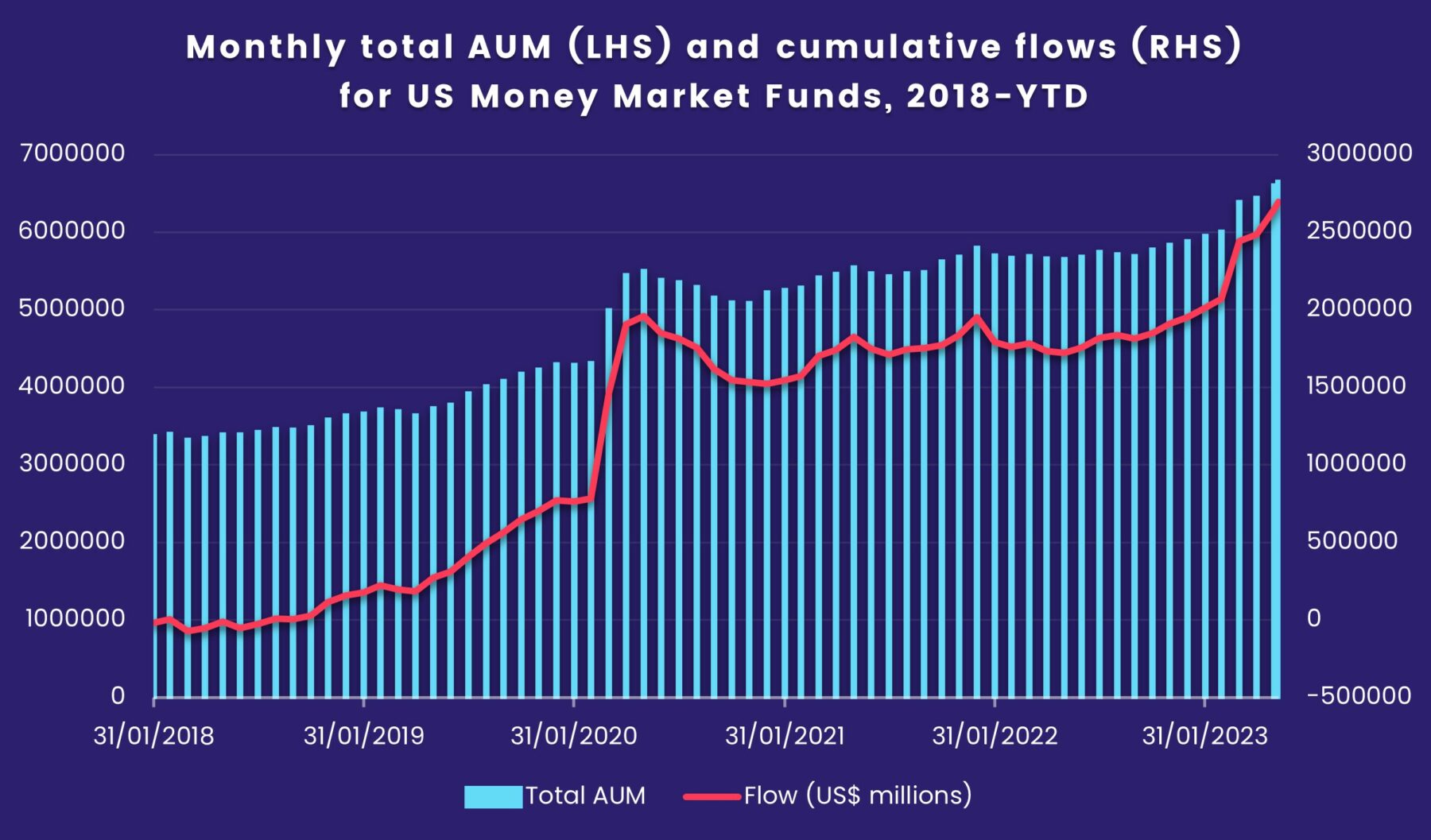

The end of the latest debt ceiling standoff and expectations that the US Federal Reserve will keep interest rates on hold when it meets next week gave riskier asset classes a boost in early June. Meanwhile, as the hikes that have already happened feed into higher yields, investors continue to steer large sums into US liquidity funds.

The assets managed by all EPFR-tracked US Money Market Funds passed the $6 trillion mark in February and are now well on their way to the $7 trillion mark as another $46 billion flowed in during the week ending June 7. Some of the funds tracked by EPFR’s iMoneyNet division, which covers a smaller universe in greater detail, are now offering seven-day annualized yields of over 5%.

During the latest week, however, the flows into US Money Market Funds did not come at the obvious expense of fund groups dedicated to other asset classes. Both US Equity and Bond Funds recorded a collective inflow for the week, flows into Global Equity Funds hit a 21-week high and Emerging Markets Equity Funds took in fresh money for the seventh time in the past eight weeks.

While the presumed trajectory of US interest rates remained the dominant market theme, investor sentiment was also swayed by other events. During a week when Russia stood accused of blowing up a major dam in Ukraine, US regulators charged cryptocurrency exchange operator Binance with misusing its clients’ funds and smoke from Canadian wildfires spread over the northeastern US, investors pulled another $2.6 billion from Europe Equity Funds, extended Cryptocurrency Funds’ longest redemption streak in over two years and boosted flows SRI/ESG Equity Funds to a seven-week high.

At the single country and asset class fund level, Korea and Canada Bond Funds recorded inflows for the ninth and 10th time, respectively, in the past 11 weeks while flows into Italy Equity Funds climbed to a 13-week high and Switzerland Equity Funds posted a third straight weekly inflow for the first time since late 4Q22. High Yield Bond Funds took in over $3 billion while Bank Loan Funds posted their first inflow in over four months and biggest since mid-2Q22.

Emerging markets equity funds

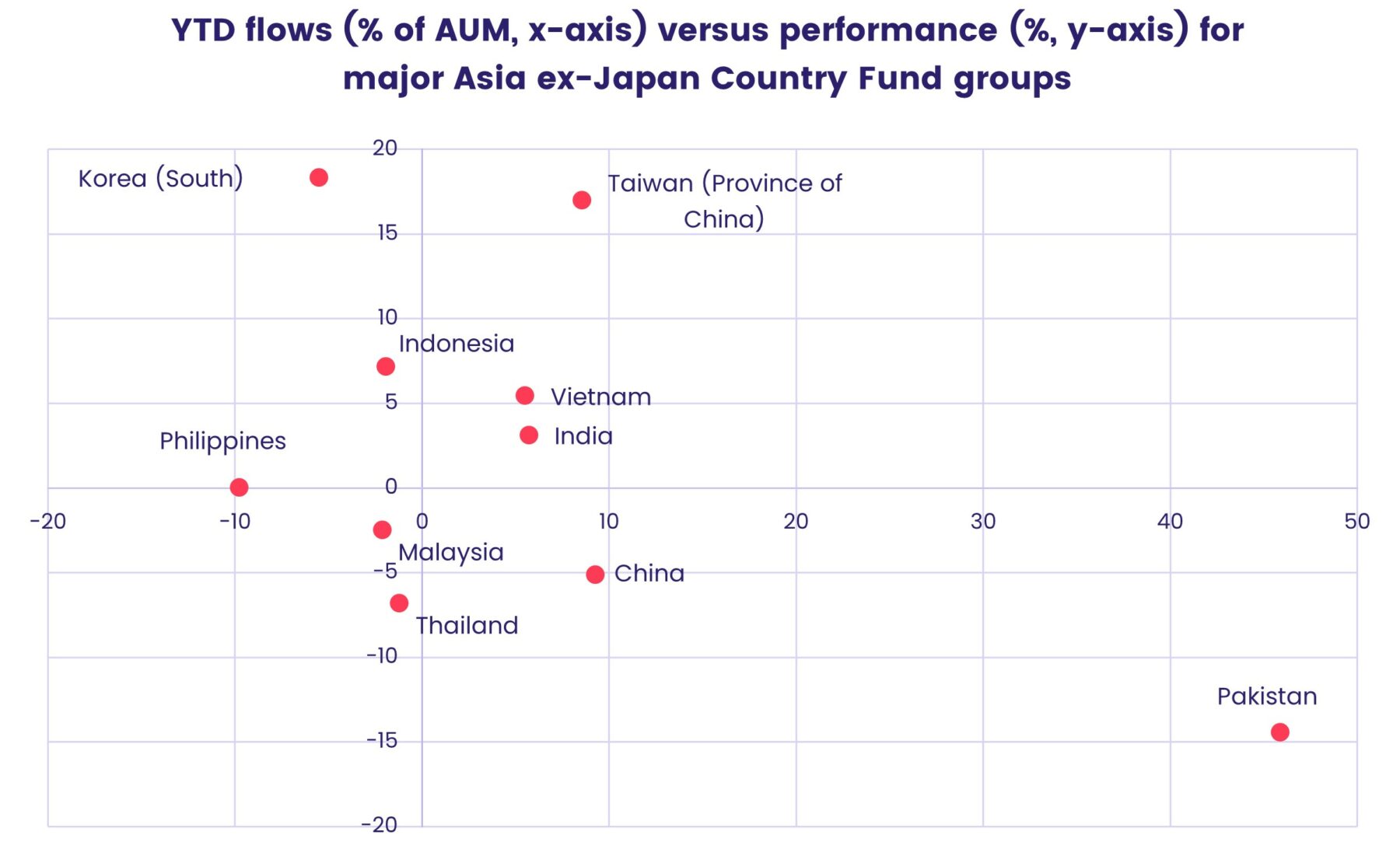

Despite the lackluster performance of Chinese equity indexes since early May, investors parked another $2.3 billion into China Equity Funds during the first week of June. That underpinned the eighth inflow recorded by all EPFR-tracked Emerging Markets Equity Funds since the beginning of the second quarter. The group took in fresh money for 11 of the 13 weeks in the first quarter.

EM Equity ETFs took in more money than their mutual fund counterparts for the ninth straight week, retail share classes attracted fresh money for the third time in the past five weeks and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates snapped their longest run of outflows – two weeks – since 4Q22.

Why the current interest in Chinese equity and China Equity Funds? “For external equity investors, China’s post-Covid-lockdown rebound is one of only a handful of broadly bullish stories out there at the moment,” observed EPFR Research Director Cameron Brandt. “While that rebound has underwhelmed so far, it has historically been a good bet that China’s government will move to make the economic numbers match expectations. Furthermore, the domestic investor base is short of better options. There’s still a lot of stress in the Chinese bond and property markets, China’s official stance towards wealth management products is chilly and bank savers are about to have their returns trimmed again.”

Investor appetite for exposure to India remains high. India Equity Funds recorded their 12th straight inflow, with the latest total a 19-week high, as the annual monsoon rains began – belatedly – to fall. Full-year GDP growth forecasts for India continue to come in around 6%, and the inability of producers to light a fire under oil prices is another tailwind for India which imports over 80% of what it consumes.

Less-than-buoyant oil prices are a headwind for many markets in the EMEA universe, and EMEA Equity Funds ended the first week of June by posting their ninth collective outflow in the past 10 weeks. Funds dedicated to Saudi Arabia, which recently announced another 1 million barrels a day cut in production, did climb to a 15-week high. Poland Equity Funds were the week’s other winner, recording their biggest inflow since the second week of January as the country’s benchmark equities index climbed to a 13-month high.

Flows to Latin America Equity Funds stalled, with investors pulling over $100 million from Brazil Equity Funds.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds began June by posting consecutive weekly inflows for the first time since late January as the end of the US debt ceiling standoff and benign short-term expectations for both energy prices and further US rate hikes offset concerns fueled by a stalling Eurozone, fresh rate hikes in Canada and Australia and the growing intensity of the conflict in Ukraine.

The week’s biggest inflow was recorded by Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups. Investors committed $10 to Global ex-US Funds for every $1 that found its way into funds with fully global mandates.

Having recorded their biggest inflow year-to-date the previous week, US Equity Funds narrowly kept their latest streak alive on the back of the biggest weekly flows into Small Cap Blend Funds in just under a year. US Dividend Funds extended their longest run of outflows since 2Q18 and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their 10th outflow in the past 16 weeks.

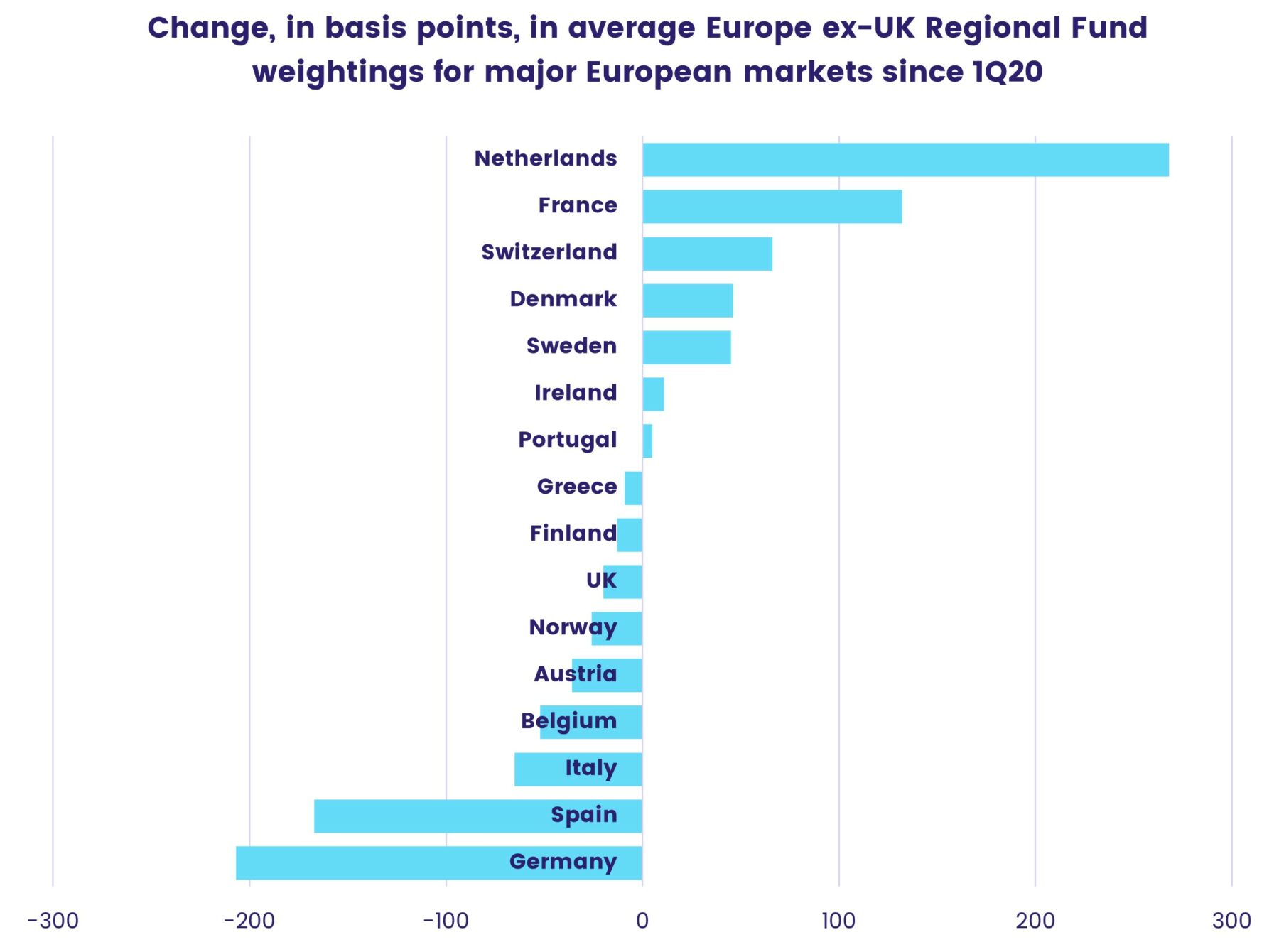

Investors pulled money out of Europe SRI/ESG Funds for the ninth time since early April as they took the latest outflow for all Europe Equity Funds to 13 weeks and $26 billion. Recent data shows the Eurozone in technical recession, and the European Central Bank (ECB) looks set to keep hiking interest rates in the face of stubbornly high core inflation. At the country level, Portugal Equity Funds experienced record-setting redemptions, money flowed out of UK Equity Funds for the 22nd straight week and Sweden Equity Funds posted their 13th outflow since late February.

After two consecutive outflows, Japan Equity Funds recorded their biggest inflow in 11 weeks as the benchmark Nikkei-225 index touched a 33-year high. Foreign-domiciled funds, which recorded their biggest collective inflow since 1Q18, outgained domestically domiciled funds for the fourth week in a row. Meanwhile, money flowed out of retail share classes for the 10th straight week.

Money also flowed out of Australia Equity Funds as doubts about the strength of China’s economic rebound persist and the Australian central bank surprised markets with another 0.25% interest rate hike.

Global sector, industry and precious metals funds

A week after they set a new inflow record, Technology Sector Funds again led the way among the 11 major EPFR-tracked Sector Fund groups. This time it was in the opposite direction, posting the biggest outflow among the seven groups that experienced net redemptions during the first week of June.

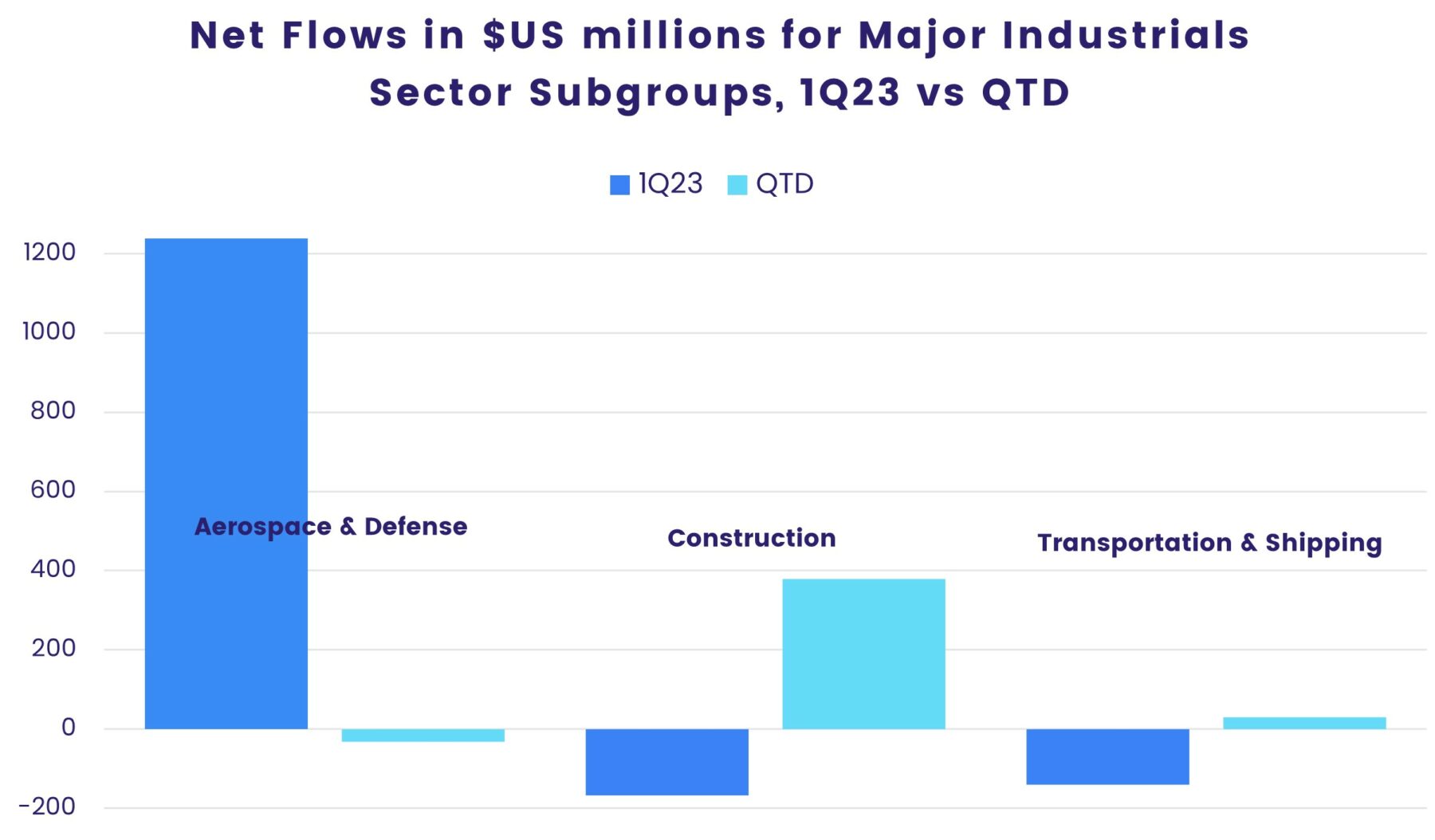

Among the four that attracted fresh money were Financials and Industrial Sector Funds. In the case of the latter, flows heading into US Industrials Sector Funds were the largest since the second week of the year and guided the overall group’s headline number to a 13-week high. Within the overall universe of Industrials Sector Funds, a custom grouping of Transportation & Shipping Funds saw inflows climb to their highest level since late October 2021. Elsewhere, Construction Fund attracted solid flows while Aerospace & Defense Funds extended their current outflow streak to six weeks. Flows to all three sub-groups are trending opposite to their 1Q23 totals.

Flows into Financials Sector Funds hit an eight-week high, with US Financials Sector Fund inflows double those of China-dedicated funds and Europe ex-UK Regional Financials Sector Funds seeing their largest outflow since the first week of the year.

Utilities Sector Funds posted their biggest outflow since mid-1Q21, redemptions from Infrastructure Sector Funds jumped to a 19-week high and Energy Sector Funds’ outflow streak hit eight-weeks and $6.4 billion — twice the amount that was redeemed during their previous eight-week run of outflows that started mid-4Q22.

Bond and other fixed income funds

The settling of the latest US debt ceiling standoff saw flows into EPFR-tracked Bond Funds rebound briskly during the week ending June 7. Overall inflows jumped to a nine-week high of $13.3 billion and risk appetite jumped several notches. Flows into High Yield and Bank Loan Bond Funds climbed to seven and 56-week highs, respectively, and redemptions from Emerging Markets Bond Funds were less than 0.02% of AUM.

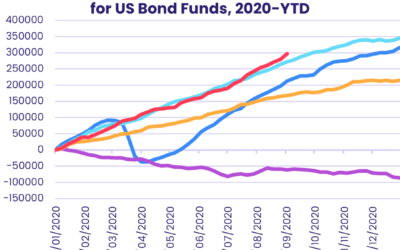

Among the groups by geographic mandate, US Bond Funds recorded the biggest inflow as they maintained their unbroken year-to-date. The latest flows were the biggest since early April, and included the largest weekly total for retail share classes in over 20 months while flows to US Municipal Bond Funds climbed to a six-week high.

While conventional US Bond Funds are enjoying a strong start to 2023, hedge funds dedicated to US debt carried a 13-month outflow streak into the second quarter. Funds pursuing long-short credit strategies have been particularly hard hit, in terms of redemptions, over that period.

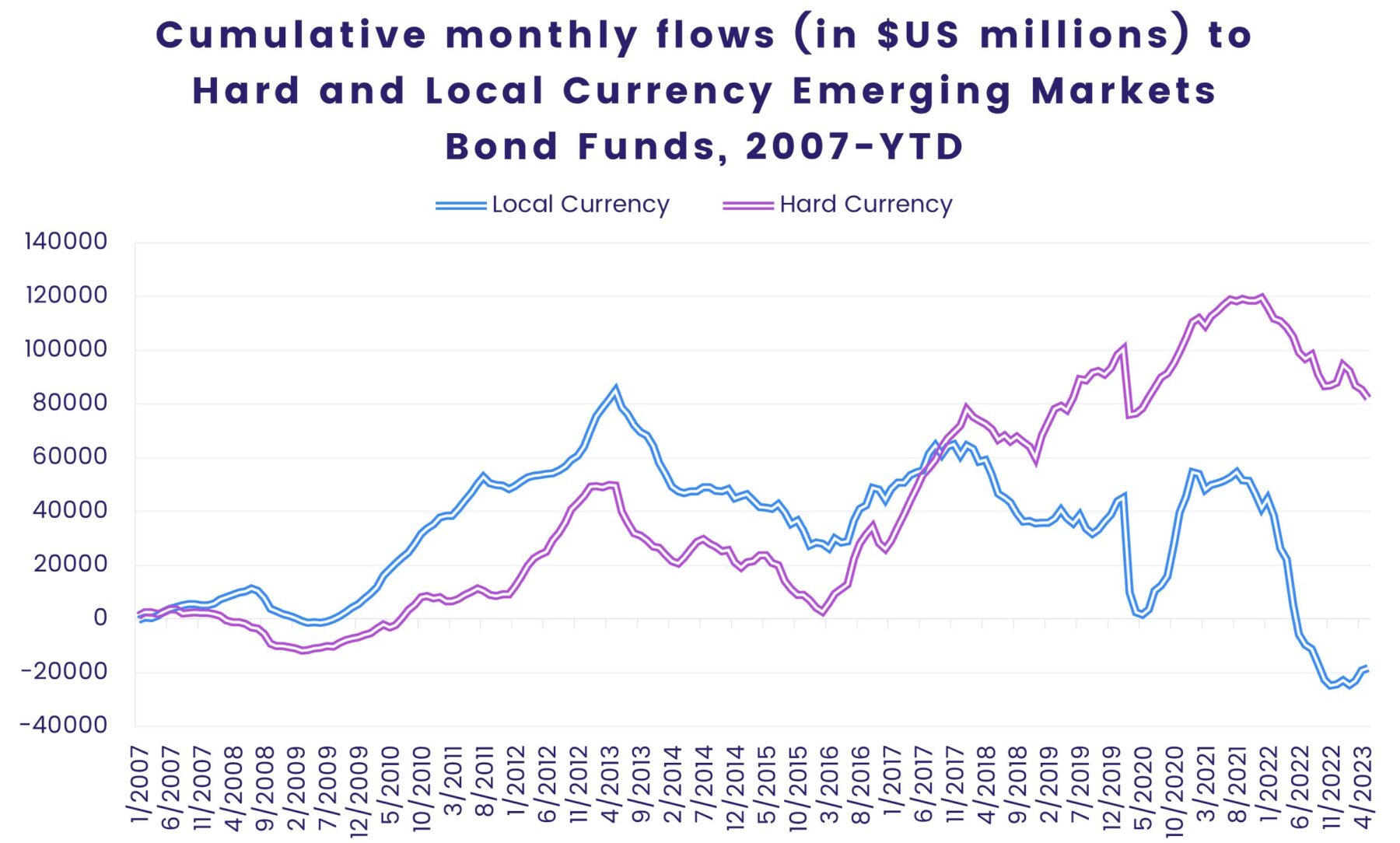

Emerging Markets Bond Funds again posted outflows overall as flows into funds with local currency mandates were offset by redemptions from EM Hard Currency Funds. At the country and thematic levels, redemptions from Frontier Markets Bond Funds hit a 16-week high, Korea Bond Funds posted their ninth inflow in the past 10 weeks and flows into China Bond Funds hit a 10-week high.

Flows into Europe Corporate Bond Funds were larger than those directed to funds with sovereign mandates for the second time in the past three weeks as Europe Bond Funds collectively chalked up their 11th straight inflow and 20th year-to-date. Investors committed fresh money despite the likelihood of another rate hike this month from the European Central Bank, the Eurozone’s slide into a technical recession and the negative outlooks for France’s credit rating. UK Bond Funds posted their biggest weekly inflow since late 3Q21.

Did you find this useful? Get our EPFR Insights delivered to your inbox.