During the first week of April benchmark US equity indexes climbed to new record highs, the IMF forecast full year growth of 6.4% for the world’s largest economy — which added over 900,000 jobs in March – and US Federal Reserve officials reiterated their commitment to highly accommodative monetary policy.

Against this backdrop, mutual fund investors headed in opposite directions. EPFR-tracked US Money Market Funds took in fresh money for the eighth time in the past nine weeks, a run that has seen these liquidity vehicles pull in over $170 billion, while flows to Emerging Markets and High Yield Bond Funds during the first week of the second quarter hit eight and 41-week highs respectively.

Investors not stretching for yield or going liquid stuck with established reflationary and inflationary themes or looked to cut costs. Through the week ending April 7, Equity Funds with global mandates have posted inflows every week year-to-date, as have equity and bond funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. Meanwhile Inflation Protected Bond Funds have absorbed fresh money for 21 straight weeks and Bank Loan Funds, traditionally used to play rising short-term interest rates, for 14 consecutive weeks.

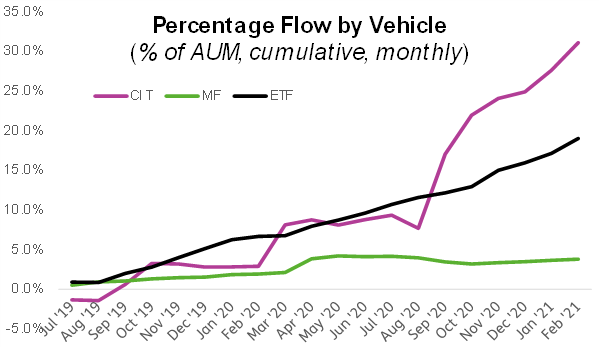

On the cost cutting front, there has been growing interest in Collective Investment Trusts (CITs). Like ETFs and mutual funds, CITs are pooled investment vehicles, but are not regulated by the SEC and have cost structures akin to separately managed accounts. EPFR’s coverage of CIT assets has grown fourfold over the past three years to over $850 billion, and in % of AUM terms these vehicles have been more popular with investors than ETFs or mutual funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.