Hopes for an early resolution of the Russian invasion of Ukraine took a hit during the first week of 2Q22 as evidence of Russian war crimes came to light. So did hopes for a measured pace to US interest rate hikes after US Federal Reserve Vice Chair Lael Brainard stated that the Fed needs to pick up the pace of its monetary tightening.

Of the two, Brainard’s remarks about accelerating the reduction of the Fed’s post-Covid balance sheet had a bigger impact on fund flows. The day after she made them, US Bond Funds posted their biggest daily outflow in over two years and Financial Sector Funds recorded their second-largest weekly outflow since EPFR started tracking them in 4Q00. Despite the inflationary implications, investors continue to view the Ukraine conflict as a largely European problem with implications for primary commodities and energy assets and allocations.

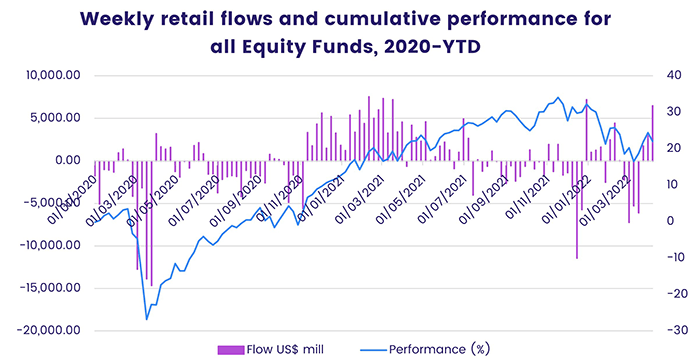

The latest developments came as retail invests stepped up their involvement, with retail commitments to all Equity Funds hitting a year-to-date high and US Equity Funds extending their longest run of retail inflows in just under a year.

Overall, EPFR-tracked Equity Funds took in another $9.1 billion during the first week of April. Investors also steered $1.3 billion into Alternative Funds and $1.6 billion into Balanced Funds. A net $1.3 billion flowed out of Bond Funds, even though funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow since the second half of November, and Money Market Funds saw $7.5 billion redeemed.

At the asset class and single country fund levels, flows into South Africa Equity and Bond Funds hit levels last seen in 1Q21 and 3Q20, respectively, and Sweden Equity Funds posted their biggest inflow in over a year while China Bond Funds extended their current outflow streak to eight weeks and $4.2 billion. Convertible and Mortgage-Backed Bond Funds posted their first inflows of 2022, Municipal Bond Funds chalked up their eighth straight outflow and Bank Loan Funds recorded their biggest inflow since 1Q17.

Did you find this useful? Get our EPFR Insights delivered to your inbox.