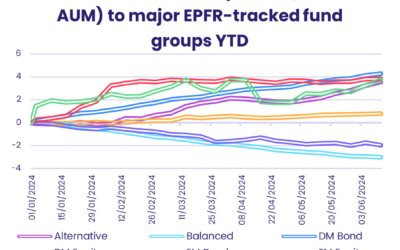

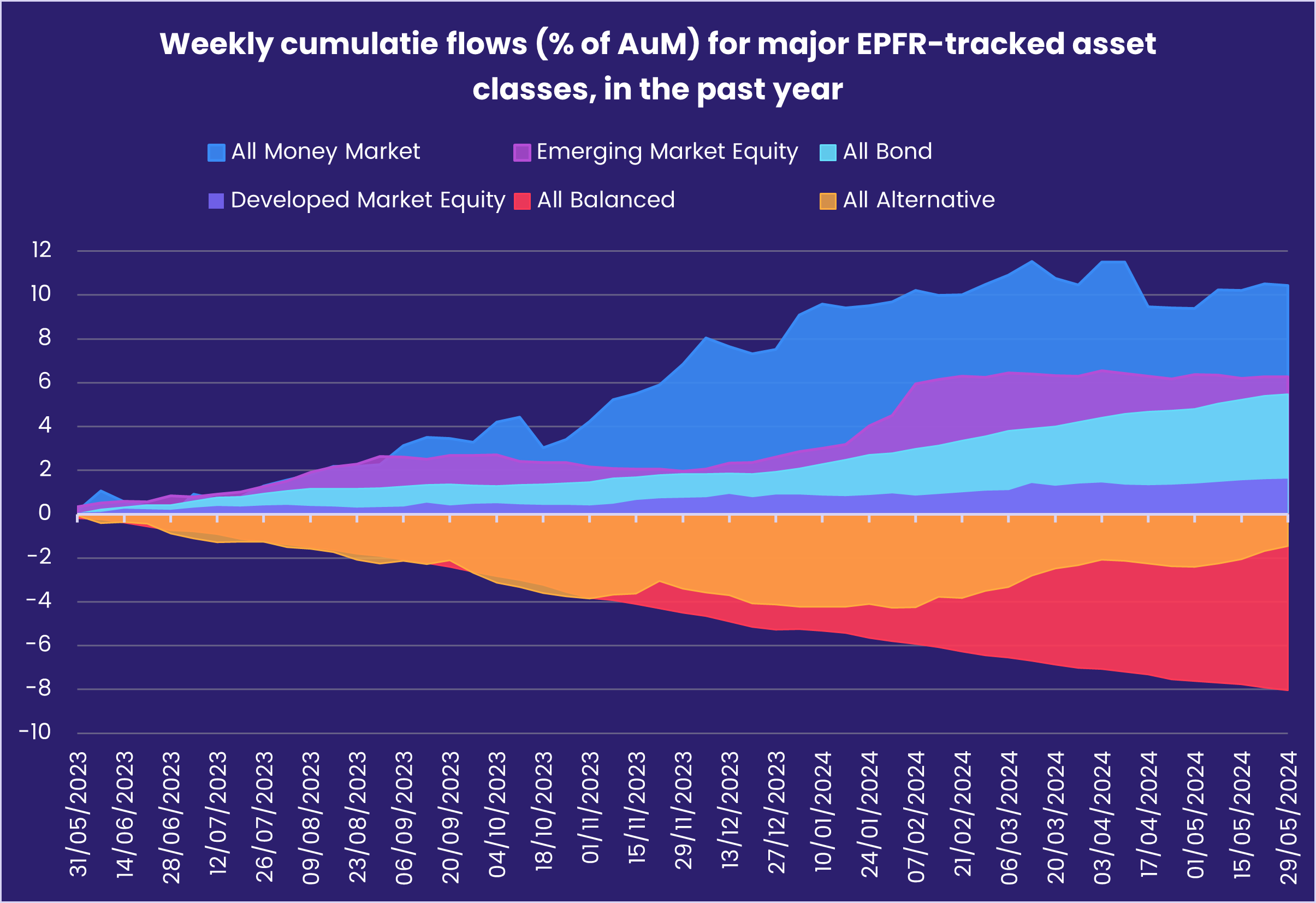

With election results for South Africa, India and Mexico looming and key central bank meetings on the horizon, investors generally took a wait-and-see stance in late May. Net flows, in % of AUM terms, for all Equity, Bond and Money Market Funds came in at 0.01%, 0.07% and 0.08%, respectively. Only two of the 11 major Sector Fund groups posted inflows for the week and both the major multi asset groups, Total Return and Balanced Funds, experienced net redemptions.

The latest round of US tariff hikes on Chinese electric vehicle and green technology exports continued to reverberate. Fund groups dedicated to markets with significant trade stories remained under pressure going into June. Investors pulled another $2.4 billion from Japan Equity Funds, pinned the 12th outflow since the beginning of March on China Equity Funds and hit Europe Equity Funds with their biggest outflow in six weeks.

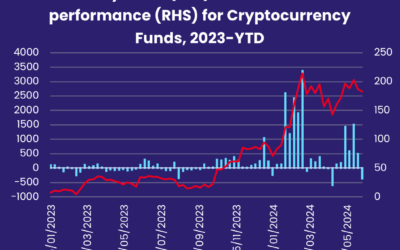

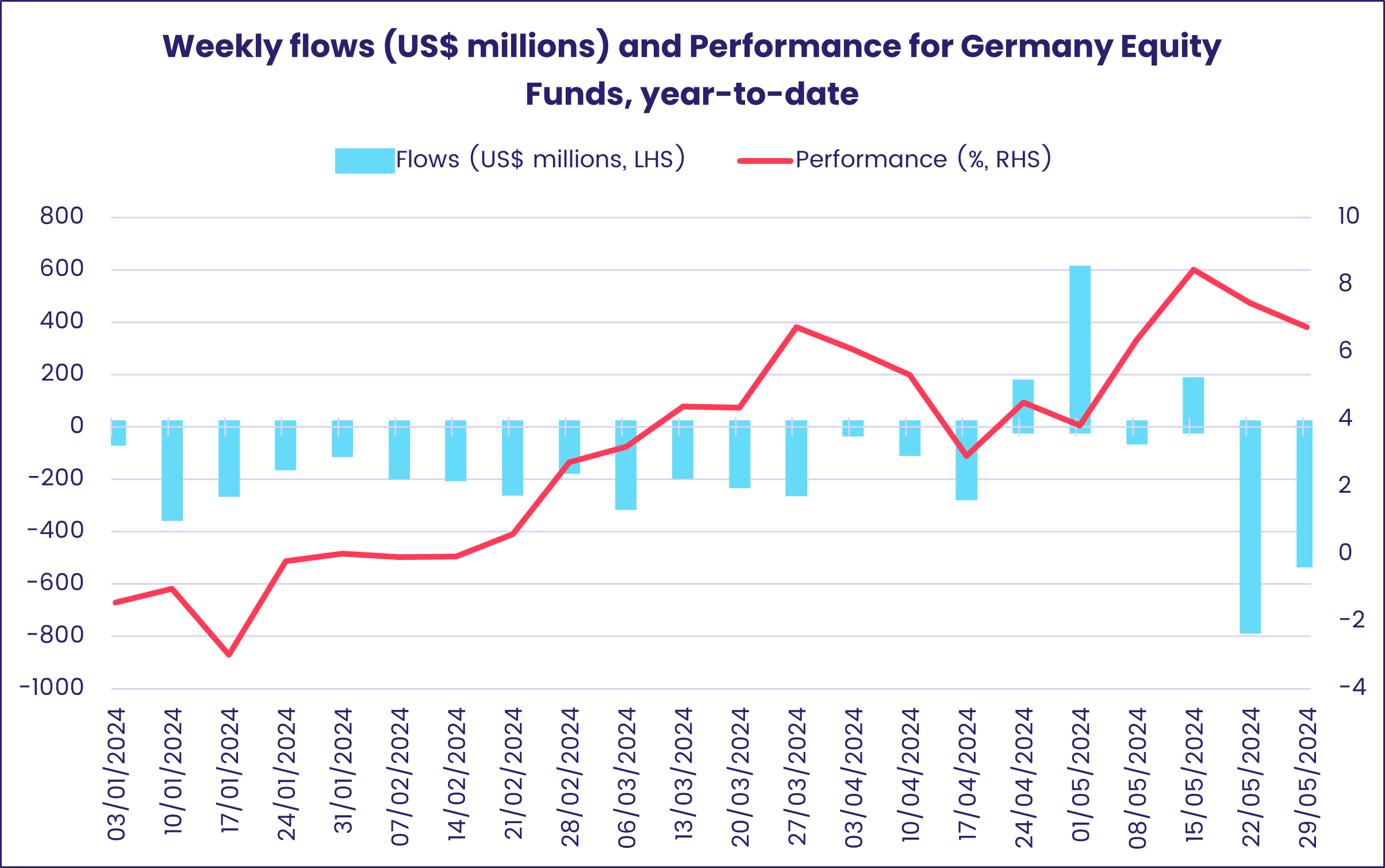

At the asset class and single country fund level, redemptions from Italy Equity Funds climbed to a 44-week high, over $500 million flowed out of Germany Equity Funds for the second week running and India Equity Funds extended an inflow streak stretching back to late 1Q23. Cryptocurrency Funds took in fresh money for the eighth time during the past 10 weeks, Mortgage-Backed Bond Funds extended their current inflow streak to 22 weeks and $14.3 billion and Bank Loan Funds posted their 18th inflow of the year-to-date.

Overall, the final week of May saw a net $5.1 billion flow into all EPFR-tracked Bond Funds while Equity and Alternative Funds absorbed roughly $1.7 billion each. For the latter group, two ETFs benchmarked to Bitcoin accounted for half of the headline number. Investors pulled $2.5 billion from Balanced Funds and Money Market Funds posted a six-week high outflow of $6.8 billion.

Emerging Markets Equity Funds

Ongoing appetite for exposure to India and another $100+ million boost for EMEA Equity Funds this week was not enough to keep the headline number for all EPFR-tracked Emerging Markets Equity Funds on the right side of zero. Flows were negative for the 10th time in the past 14 weeks as outflows from institutional investors barely outweighed inflows for retail.

- Asia ex-Japan: Inflows for India Equity Funds did offset outflows for China Equity Funds, both of which were above the $500 million mark. But money flowing into Korea (South) Equity Funds for the sixth consecutive week and Greater China Equity Funds posting their biggest inflow since mid-1Q23 did little to move the needle on further redemptions from Asia ex-Japan Regional Equity Funds.

- EMEA: Turkey Equity Funds extended their inflow streak to six weeks and $370 million total, the longest run since late 4Q21. Flows into Romania Equity Funds remained steady while redemptions for Saudi Arabia Equity Funds climbed to a 12-week high.

- Latin America: With Chinese exports under more scrutiny, investors looked to other emerging markets with manufacturing plays. Mexico Equity Funds racked up a 12-week high inflow and Argentina Equity Funds enjoyed a sixth consecutive inflow.

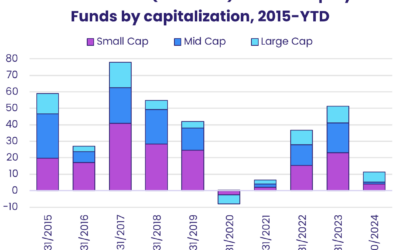

Developed Markets Equity Funds

Inflows for Developed Markets Equity Funds were the smallest in six weeks, but trends mostly matched those seen in the previous week. Redemptions for Europe Equity Funds spiked to a six-week high of $1.5 billion and Asia Pacific dedicated funds saw a third straight week of outflows. Meanwhile, a fifth consecutive inflow for Global Equity Funds and flows into the two major North American dedicated fund groups guided the headline number into positive territory.

- Asia Pacific: Japan Equity Funds suffered a third consecutive outflow, but it was less than half of the record redemption seen last week. Hong Kong (SAR) Equity Funds brought in their second inflow of the past three weeks, and seventh of the past 11 weeks.

- Global: Flows into Global Equity Funds over the past five weeks have exceeded $11 billion, showing investors preference for a diversified approach. The last time monthly flows for this group surpassed $10 billion was in June 2023.

- North America: Inflows to US dedicated funds dropped from an average of $11 billion over the past three weeks to just $4.2 billion this week. Canada Equity Funds snapped a three-week outflow streak.

- Europe: Significant challenges ahead for German automakers to maintain their market share and technological advantage in the increasingly competitive automotive industry weighed heavily again. Germany Equity Funds saw another $500 million flow out this week while redemptions for Switzerland and Italy Equity Funds were the largest since late June and mid-July last year, respectively. Funds dedicated to major Nordic countries posted a fourth consecutive inflow, driven by flows into Norway and Sweden Equity Funds.

Global sector, Industry and Precious Metals Funds

In the week to May 29, just two EPFR-tracked Sector Fund groups reported inflows – Energy and Utilities Sector Funds – while redemptions from the remaining nine groups ranged from $6 million for Infrastructure Sector Funds to $1.03 billion for Technology Sector Funds.

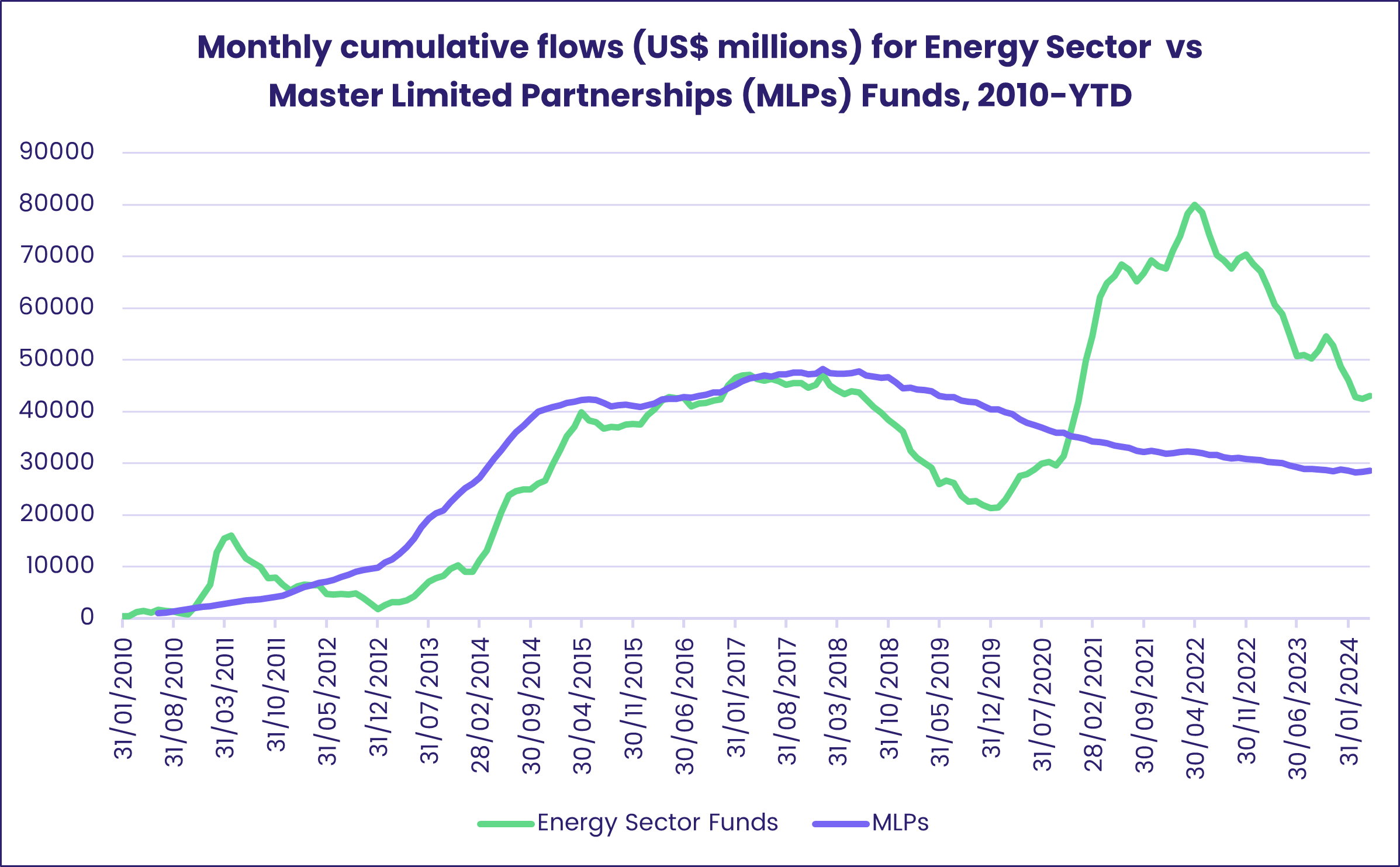

- Energy Sector Funds snapped their six-week outflow streak that totaled $1.36 billion as institutional flows guided the headline number to positive territory this week. Of the top 10 funds reporting inflows for this group, nine were ETFs and five funds attracted between $42 and $96 million each, including ones with Oil & Gas, Uranium, and MLP in their name. A custom grouping of 46 Energy Sector Funds with “MLP” in their name – aka Master Limited Partnership Funds – revealed inflows of over $100 million this week.

- Utilities Sector Funds also saw inflows purely backed by institutional assets, but it was a single passively-managed US ETF attracting the lion share of fresh money this week. The group racked up their fourth inflow of the past five weeks.

- Industrials Sector Funds saw a second straight week of outflows for the first time since mid-4Q23. These redemptions, which hit an 18-week high and nearly doubled the size of the previous week’s outflow, came despite inflows for Construction Funds climbing to a 12-week high of $142 million.

- Technology Sector Funds have seen a change of pace in the past month compared to the first 18 weeks of the year where inflows averaged $1.16 billion. With three outflows in the past four weeks, the group has seen net redemptions of $2.7 billion.

- Despite retails flow being positive for the first time in four weeks, Financials Sector Funds saw a second straight outflow overall as institutional outflows jumped to a 12-week high. Real Estate Sector Funds saw a similar imbalance but in the opposite directions as seven-week high retail outflows offset a second consecutive inflow for institutional assets.

- Outflows for Commodities Sector Funds spiked to a five-week high and snapped a two-week inflow streak as investors pulled nearly $300 million from Gold Mining Funds. Within the alternative universe, Physical Commodity Funds – which include funds investing in Bitcoin – racked up a third straight week of inflows totaling $2.5 billion, while Physical Gold Funds snapped a two-week inflow streak, and Physical Silver Funds posted a six-week high outflow.

Bond and other Fixed Income Funds

More money flowed into EPFR-tracked Bond Funds during the final week of May, but the headline number was well shy of their $12 billion and $10 billion weekly averages during the first quarter and second quarter so far, respectively.

- By Geofocus: Inflows for Developed Market Bond Funds of $6.2 billion outweighed the heaviest outflow for Emerging Market Bond Funds in five weeks at $1.1 billion.

- EM: Though GEM-dedicated funds directed most of the headline number this week with their sixth outflow of the past seven weeks, it was inflows to Latin America and each of its major country bond fund groups that were the exception. Inflows for Brazil Bond Funds hit above $100 million for the second time this year. Asia ex-Japan Bond Funds snapped a three-week inflow streak as redemptions from Thailand, Malaysia and Asia ex-Japan Regional Bond Funds averaged $135 million and offset inflows of nearly $200 million for China Bond Funds. EMEA Bond Funds saw their first outflow in two weeks.

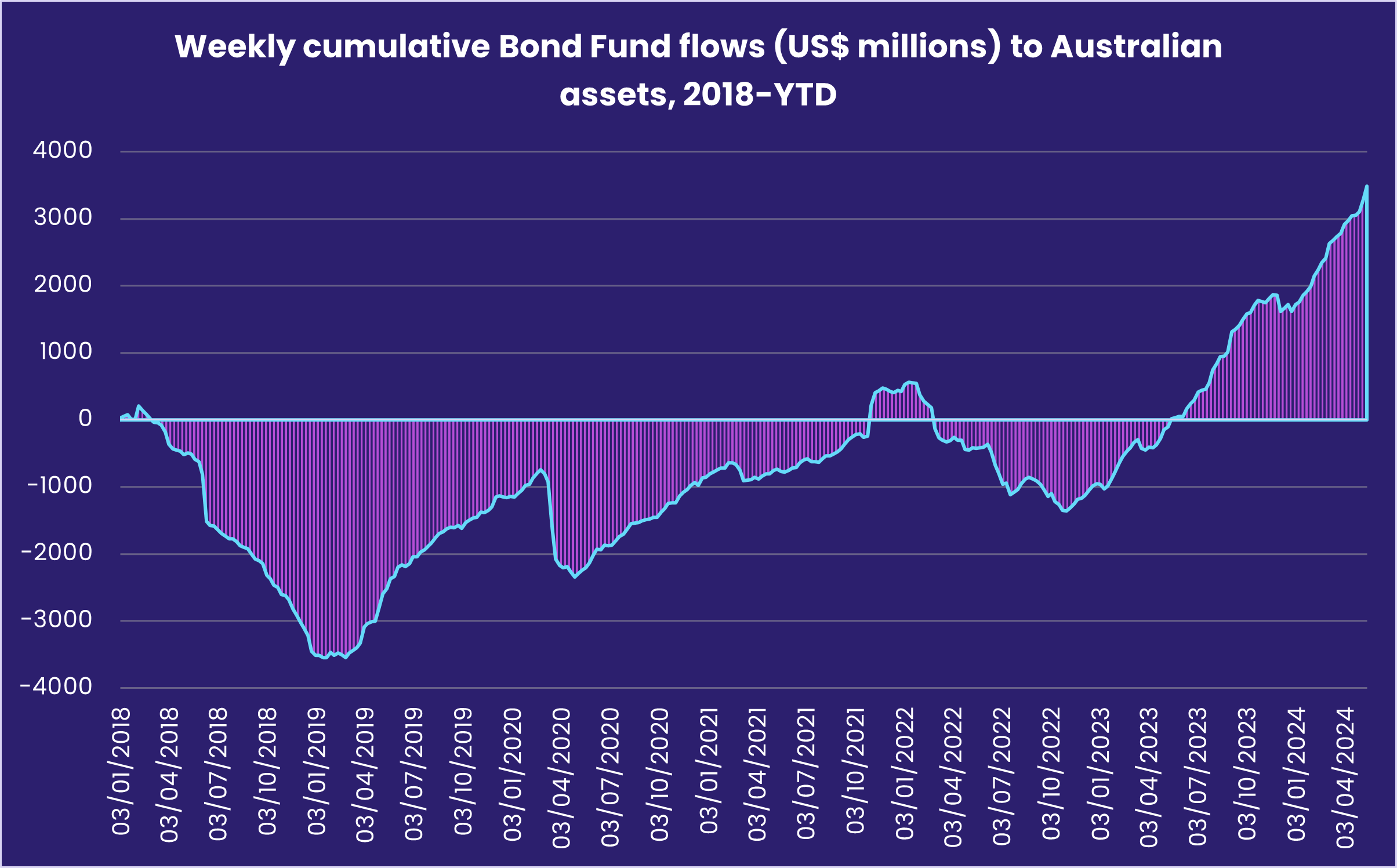

- DM: The only region to see money flow out were Asia Pacific Bond Funds as all major country fund groups – except Australia Bond Funds – saw outflows. Allocations from Global ex-US and Asia ex-Japan Regional to Australia Bonds both hit roughly 72-month highs at the end of the first quarter. Japan Bond Funds were the hardest hit but it was just their second outflow of the past five weeks. US and Europe ex-UK Bond Funds extended their lengthy inflow streaks to 23 weeks and 15 weeks. Inflows to Switzerland and Sweden Bond Funds reached three and five-week highs, respectively, while Norway Bond Funds snapped a three-week outflow streak.

- Corporate vs Sovereign: Flows into bond funds with corporate and sovereign mandates fell significantly from the heights seen over the last three weeks. For every $1 million committed to Corporate Bond Funds, investors committed another $2.5 million to their sovereign counterparts. For the former group, a single long-term investment grade bond dragged the headline number down with over $1.5 billion pulled out, whereas three intermediate term IG Bonds took on the most fresh money.

- By Quality: Investment Grade Bond Funds managed to keep their 17-week inflow streak alive, and High Yield Bond Funds posted a sixth straight inflow, though it was nowhere near the $2-4.5 billion range seen over the last three weeks.

- By Duration: Intermediate and Short-Term Bond Funds were the preferred duration in the final week of May. Flows for Short Term Bond Funds have remained in positive territory for eight straight weeks, attracting $14.6 billion total. It is the group’s longest inflow streak since one that ran from end of 1Q21 to mid-4Q21.

- By Style: Investors continued to show preference for Mortgage-Backed and Bank Loan Bond Funds, extending 22 and six-week inflow streaks, respectively. Inflation-Protected Bond Funds saw a second straight week of inflows for the first time nearly two years, and Municipal Bond Funds but since the beginning of this year. Total Return Bond Funds, meanwhile, snapped a four-week run of inflows with their heaviest redemption since mid-4Q23.

Did you find this useful? Get our EPFR Insights delivered to your inbox.