The first week of June ended with investors digesting the results of general elections in South Africa, India and Mexico, and looking ahead to key central bank policy meetings and further elections in the UK and European Union. They responded by gravitating to Taiwanese (POC) and Indian equity, most bond categories and cash, with EPFR-tracked Money Market Funds absorbing over $45 billion and flows into Bond Funds hitting their second highest weekly total year-to-date.

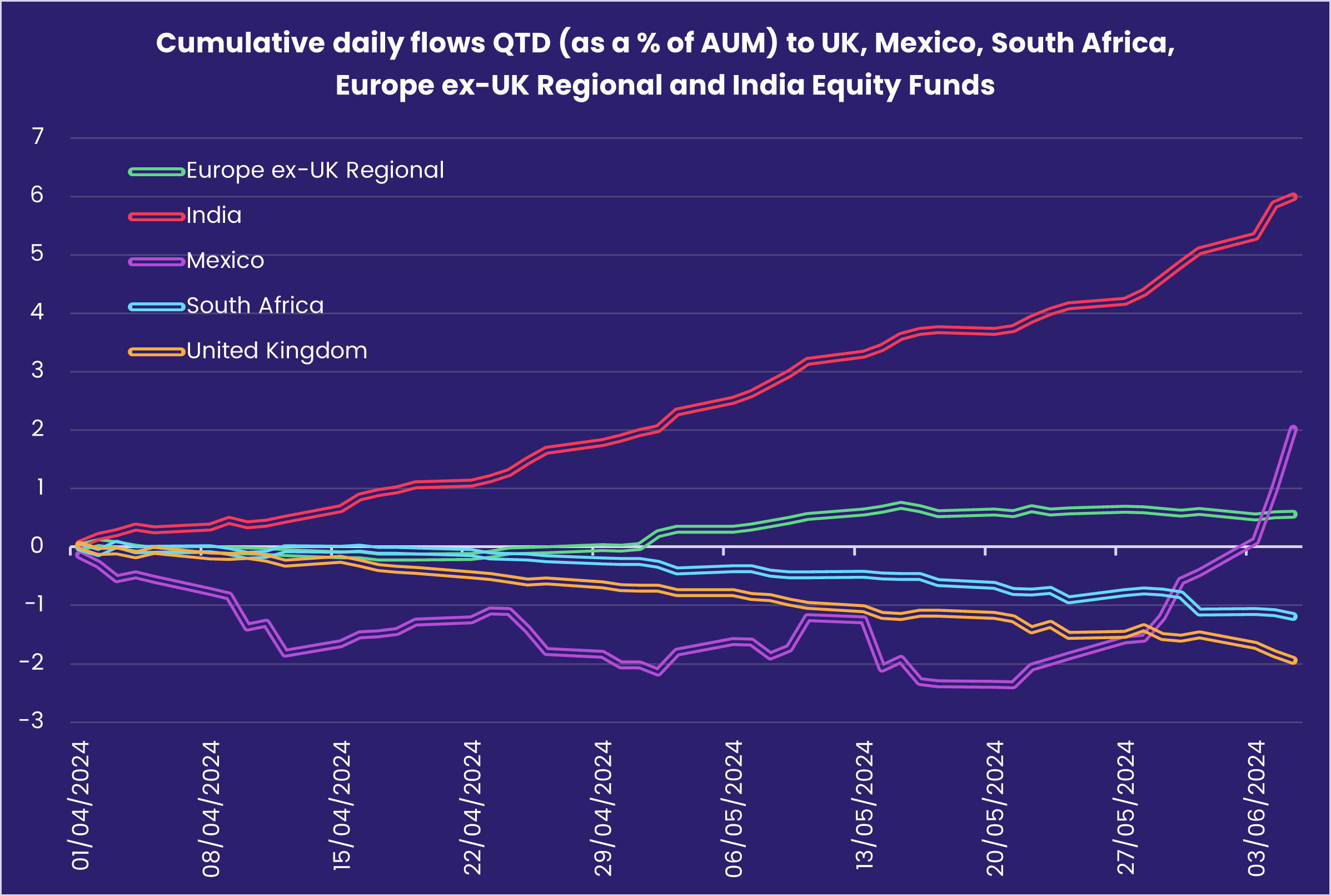

Of the Equity Fund groups dedicated to markets either coming out of or going into major elections, India and Mexico Equity Funds saw inflows take off while money continued to leak out of UK and South Africa Equity Funds. Flows into Mexico and India Equity Funds jumped to seven-year and record highs.

Overall, a net $10.7 billion flowed into all EPFR-tracked Equity Funds during the week ending June 5 while Alternative Funds absorbed $2.7 billion, Bond Funds $17.8 billion and Money Market Funds $46.7 billion. Although US Money Market Funds posted their fifth-largest inflow year-to-date, 2024 has been a different year for the group. Last year, flows into US Money Market Funds averaged $22 billion a week as the group set a new inflow record of $1.16 trillion. So far this year, their weekly average is closer to $5 billion.

At the asset class and single country fund level, Bank Loan Bond Funds posted their 14th inflow over the past 15 weeks, Mortgage-Backed Bond Funds extended their longest inflow streak since a 23-week run ended in 1Q20 and High Yield Bond Funds pulled in over $3 billion. Redemptions from UK Equity and Bond Funds climbed to 46 and 63-week highs, respectively, Indonesia Equity Funds posted their biggest outflow in over 16 months and flows into Switzerland Money Market Funds hit a 68-week high.

Emerging Markets Equity Funds

In a repeat of a common pattern over the past 18 months, the headline number for all EPFR-tracked Emerging Markets Equity Funds during the first week of June was anchored by a handful ofAsia ex-Japan Country Fund groups. What was different, however, was the insignificant role played by dedicated China Equity Funds.

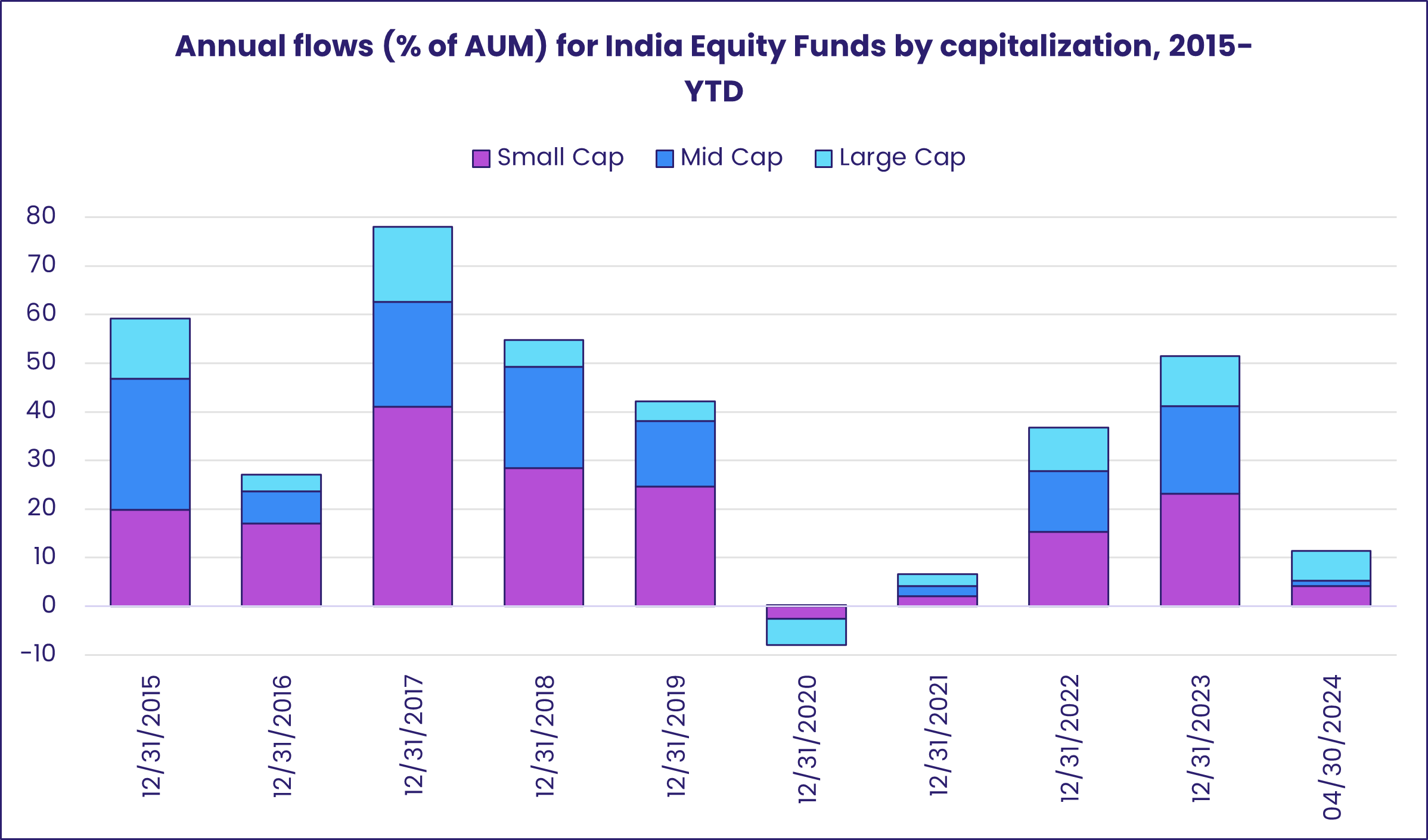

During the latest week, the second largest inflow posted by Taiwan (POC) Equity Funds and record-setting flows into India Equity Funds underpinned the latest total for all EM Equity Funds. Retail share classes chalked up their second-largest inflow during the past 11 months and EM Dividend Funds snapped their longest redemption streak since late 1Q22.

The latest influx of fresh money for India Equity Funds came as results from India’s general election showed incumbent Prime Minister Narendra Modi in pole position to secure a third term but falling well short of the ‘super majority’ he was aiming for. Funds with large cap mandates absorbed the bulk of the week’s inflow.

Taiwan’s semiconductor story continues to exert a strong appeal for investors, who are discounting fears that China will try to forcibly regain what it regards as a renegade province. Taiwan (POC) Equity Funds have now posted inflows for 10 straight weeks and 19 of the 23 weeks year-to-date while the island’s average weighting among the diversified Global Emerging Markets (GEM) Equity Funds is just off the record high set in the final month of 1Q24.

Investors also responded favorably to the outcome of Mexico’s recent election, despite the concerns that the country’s first female president, Morena’s Claudia Sheinbaum, will use her strong legislative majorities to pursue an anti-free market agenda when she assumes office at the start of the fourth quarter. While Mexico Equity Funds pulled in over $250 million, redemptions from Brazil Equity Funds climbed to a 15-week high.

Following South Africa’s contest, which left the ruling African National Congress scrambling for coalition partners for the first time since the end of apartheid, redemptions from South Africa Equity Funds climbed to an 11-week high. But Saudi Arabia Equity Funds took a bigger hit, recording their biggest outflow since early 4Q23, as oil producers struggle to maintain recent supply cuts.

Developed Markets Equity Funds

Although the European Central Bank (ECB) delivered a widely anticipated interest rate cut, its first in five years, the day after the latest reporting period, trade tensions, politics and the uncertain outlook for US monetary policy again weighed on flows to EPFR-tracked Developed Markets Equity Funds. During the week ending June 5, both Europe and Japan Equity Funds posted outflows while flows into US Equity Funds came in at under 0.05% of the group’s AUM.

UK Equity Funds were the biggest contributor to the headline for all Europe Equity Funds as the country prepares for a July 4 election that seems certain to replace the ruling Conservative Party with the left-of-center Labour Party. If the polls are correct, Labour will have the legislative muscle to implement its regulatory, green and taxation policies.

Flows to funds dedicated to Continental European markets were largely subdued as investors digested weak German employment and manufacturing data while looking ahead to European parliamentary elections to the anticipated European Commission ruling on alleged Chinese electric vehicle (EV) subsidies. Europe Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their eighth outflow since the beginning of April.

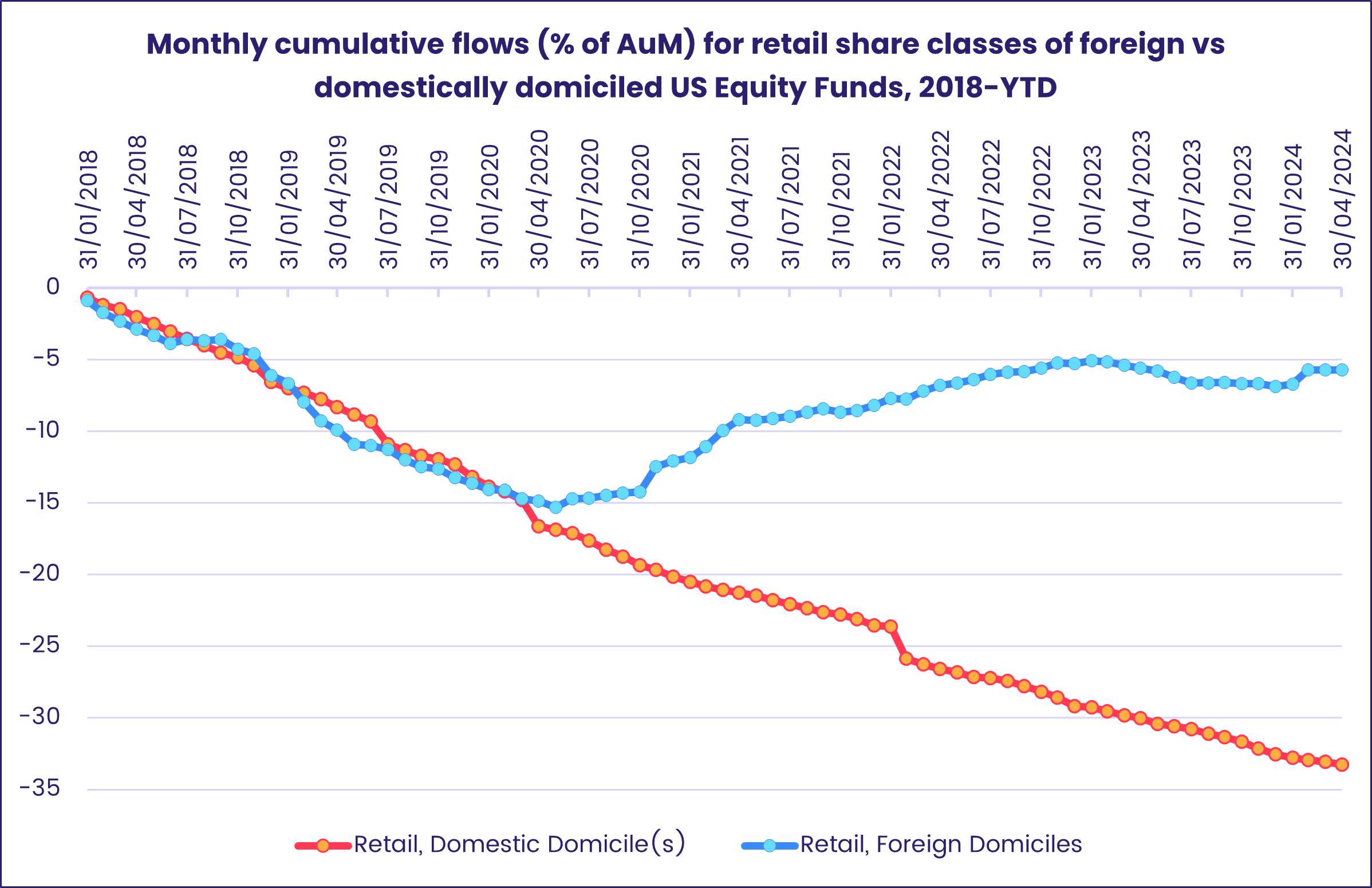

US SRI/ESG Equity Funds also posted outflows, and US Equity Fund retail share classes experienced net redemptions for the 18th time year-to-date. When it comes to retail flows, however, there has been a marked divergence between foreign and domestically domiciled funds, with the former posting inflows 15 of the year’s 23 weeks.

The implications of the latest trade barriers being erected by the US sapped investor appetite for Japanese exposure for the fourth straight week, although the latest redemptions from Japan Equity Funds fell well short of the record-setting outflows seen during the third week of May.

Japan’s average allocation among Global ex-US Equity Funds, which hit a 28-month high coming into February, has now fallen for three straight months. Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, have posted six straight weekly inflows totaling $19 billion.

Global sector, Industry and Precious Metals Funds

In the first week of June, sector-oriented investors shook off their recent lethargy and began allocating fresh money with a purpose. The number of major EPFR-tracked Sector Fund groups reporting inflows climbed to eight, the most in any week since early 3Q23. Trading volume (the absolute value of outflows + inflows) among all Sector Fund groups was the highest in eight weeks.

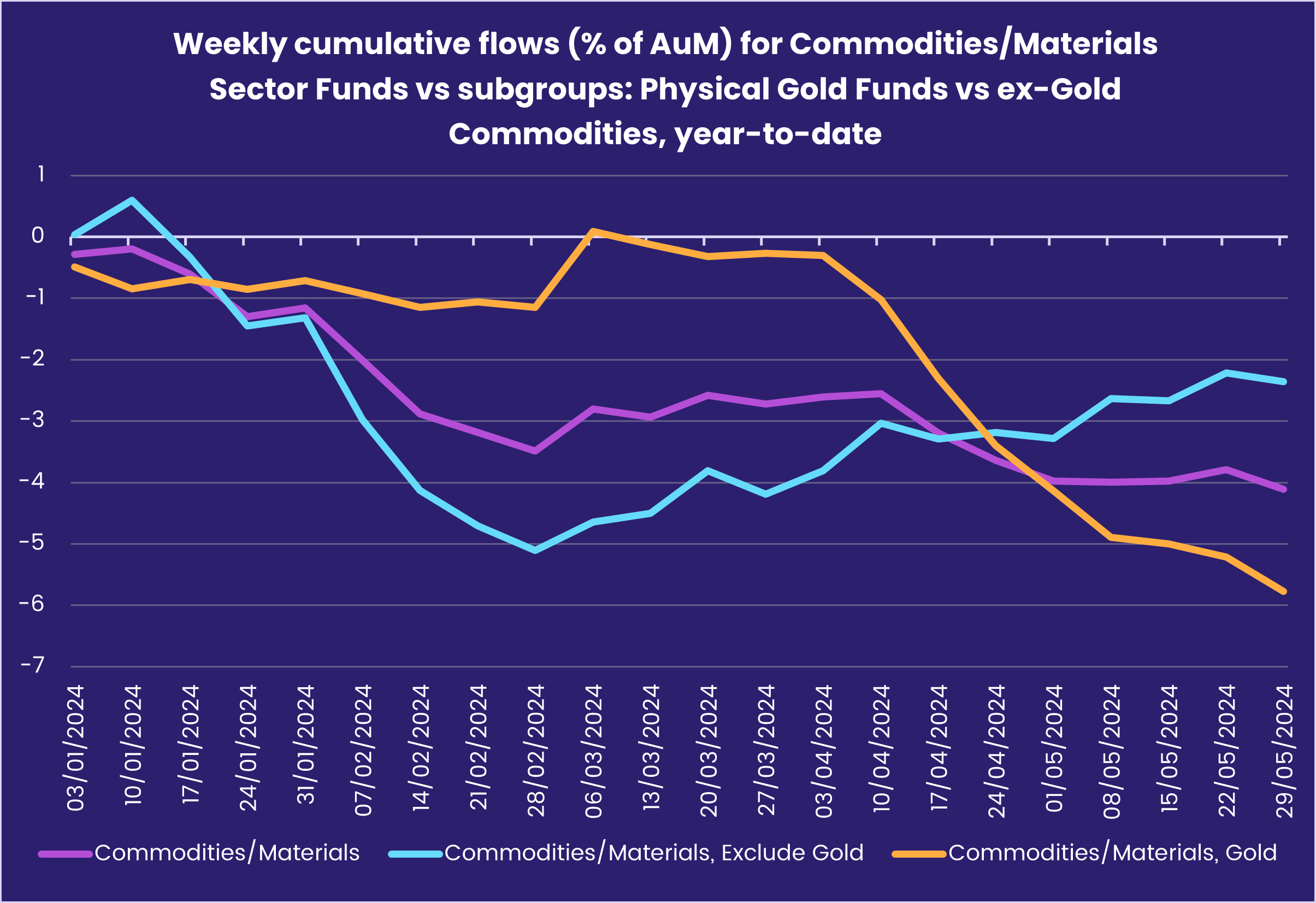

Flows into Commodities/Materials Sector Funds reached an 11-week high as investors took on a more diversified approach. Global-mandated funds absorbed over $300 million, their second inflow of the past three weeks. EPFR’s ability to apply – or exclude – filters gives us key insight on the make-up and drivers of certain sectors. Commodities/Materials Sector Funds excluding those with mandates to that allow investment in gold-related assets have been driving the latest improvement in overall sentiment.

Utilities Sector Funds racked up their biggest weekly inflow since mid-January 2022, with a single passively-managed US ETF accounting for the lion’s share of the overall headline number. Among the other top 10 funds ranked by inflows, three had SRI/ESG mandates, and of those, two had “aqua” in their name. The pattern of flows into Water Funds and SRI/ESG Utilities Sector Funds has been consistent recently, with four inflows in the past five and six weeks, respectively.

Although sentiment towards Industrials Sector Funds moderated during the second half of May, flows regained momentum in the week to June 5 as the group attracted its 13th inflow of the past 15 weeks. Flows into US-dedicated funds represented 60% of the headline number, and those with global mandates 10%, while Europe Regional Industrials Sector Funds posted a 38-week high inflow.

Healthcare/Biotechnology Sector Funds emerged from the shadows with their first inflow in nearly three months (since mid-March) as two ETFs benchmarked to the S&P dominated the headline number. It was purely ETFs that drove this week’s inflow, as non-ETFs posted their 11th straight outflow with just three weeks of inflows since August last year.

Pure Biotechnology Funds posted their third inflow of the past four weeks, but in the past year, every subgroup – from medical devices to vaccines to pharma – except for Medicine & Drug Industry Funds have seen outflows.

Bond and other Fixed Income Funds

Investor appetite for fixed income exposure remained strong in early June, with investors looking to take advantage of current yields or positioning themselves for the capital gains that come with lower interest rates. Year-to-date flows into EPFR-tracked Bond Funds pushed over the $330 billion mark and now stand at 88% of last year’s total and 42% of 2021’s record setting inflow.

Risk appetite is also running at levels that seem incongruous given two major conflicts: global indebtedness and the generally statist direction of economic policymaking worldwide. The latest week saw over $3 billion flow into High Yield Bond Funds while Emerging Markets Bond Funds posted their biggest inflow since the fourth week of 1Q23.

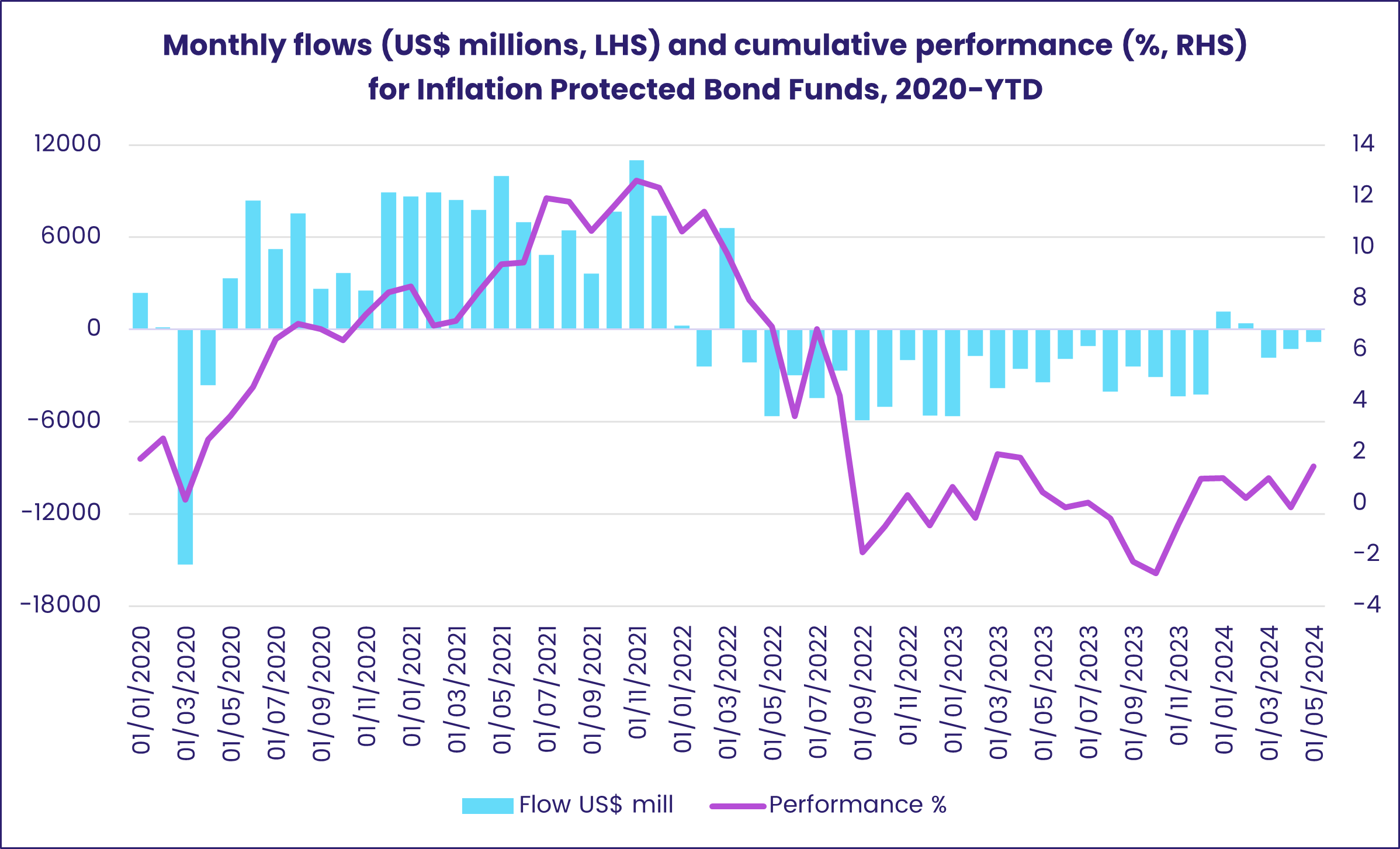

At the asset class level, the strong convictions about the direction of inflation that characterized flows for Inflation Protected Bond Funds from 2Q20 to 4Q23 have since dwindled.

Ahead of the European Central Bank’s first interest rate cut since 2019, Europe Bond Funds recorded their 31st consecutive inflow as solid flows into the two major regional groups and further retail inflows offset heavy redemptions from UK, Switzerland and Spain Bond Funds. Flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates hit their highest weekly total in over 22 months.

US Bond Funds posted their biggest collective inflow since early 4Q20. Flows favored funds with corporate mandates, and intermediate was the preferred duration for the third week running.

Flows into Local and Hard Currency Emerging Markets Bond Funds hit six and seven-week highs, respectively, as funds dedicated to Asian markets stood out at the country level and Global Emerging Markets (GEM) Bond Funds chalked up their second largest inflow so far this year.

Did you find this useful? Get our EPFR Insights delivered to your inbox.