With the Bank of England and the European Central Bank widely expected to follow the example of their Swedish and Swiss counterparts, and start cutting interest rates at their June policy meetings, investors waded a little deeper into the European equity pool during the second week of May.

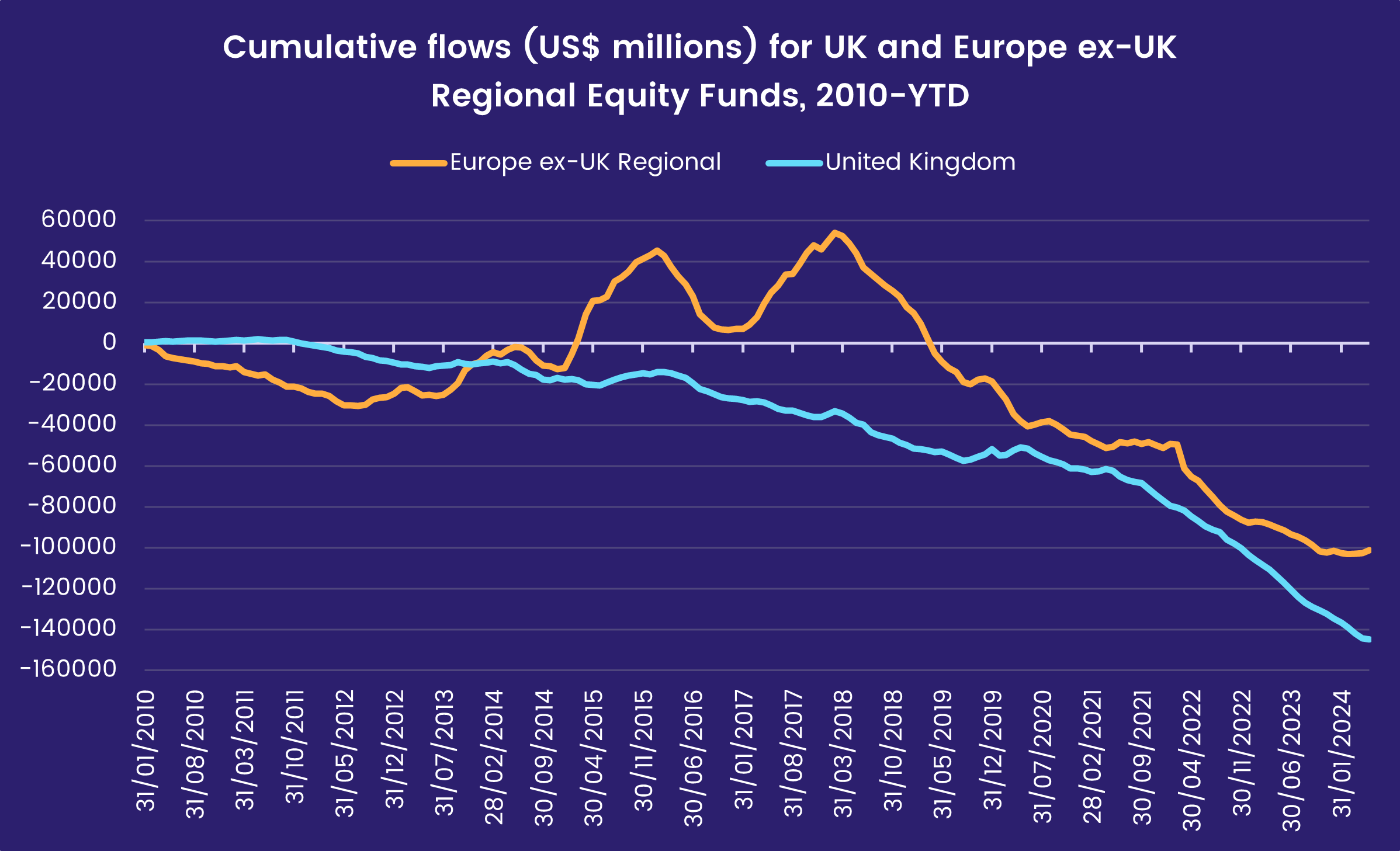

Flows into EPFR-tracked Europe Equity Funds climbed to a 65-week high as the group extended its longest run of inflows since early 1Q22. Europe ex-UK Regional Equity Funds, which chalked up their biggest inflow in over two years the previous week, absorbed another $1.1 billion while UK Equity Funds experienced net redemptions for the 24th week in a row.

Elsewhere, better – from an interest rate cutting perspective – US labor market and inflation readings helped US Equity Funds extend their longest inflow streak since 4Q23 and the suggestion of massive state intervention in China’s struggling property sector contributed to the fifth inflow posted by China Bond Funds over the past seven weeks.

Overall, the week ending May 15 saw a net $11.6 billion flow into all EPFR-tracked Bond Funds while Alternative Funds absorbed $1.1 billion and Equity Funds $11.9 billion. Balanced Funds surrendered another $1.3 billion and Money Market Funds $3.6 billion. In the case of the latter, Europe ex-UK Regional MMFs were the biggest contributor to the headline number as they posted their biggest weekly outflow since late 3Q21.

At the asset class and single country fund level, Physical Gold Funds snapped their five-week outflow streak, flows into Cryptocurrency Funds climbed to a five-week high and High Yield Bond Funds chalked up their 16th inflow year-to-date. Both Mexico and Netherland Bond Funds experienced record-setting redemptions, Austria Equity Funds posted their 48th outflow since the beginning of 2Q23 and investors pulled money out of Thailand Equity Funds for the 19th week in a row.

Emerging Markets Equity Funds

Investors with an emerging market focus again looked to Asia during the week ending May 15. But flows to that region again bypassed China-mandated funds, which experienced net redemptions for the third week running. That, in turn, underpinned the biggest collective outflow recorded by EPFR-tracked Emerging Markets Equity Funds since the final week of October.

The second week of May also saw Emerging Markets Dividend Funds post their second outflow since mid-3Q23 and their biggest in over nine months, flows into retail share classes climb to a 46-week high and Japan-domiciled EM Equity Funds extend an inflow streak stretching back to mid-4Q22.

Sentiment towards Chinese stocks was hit by US President Joe Biden’s decision to slap a 100% tariff on electric vehicles manufactured in China, a significant escalation of trade tensions between the world’s two largest economies. China Equity Funds posted their biggest weekly outflow in over 14 months.

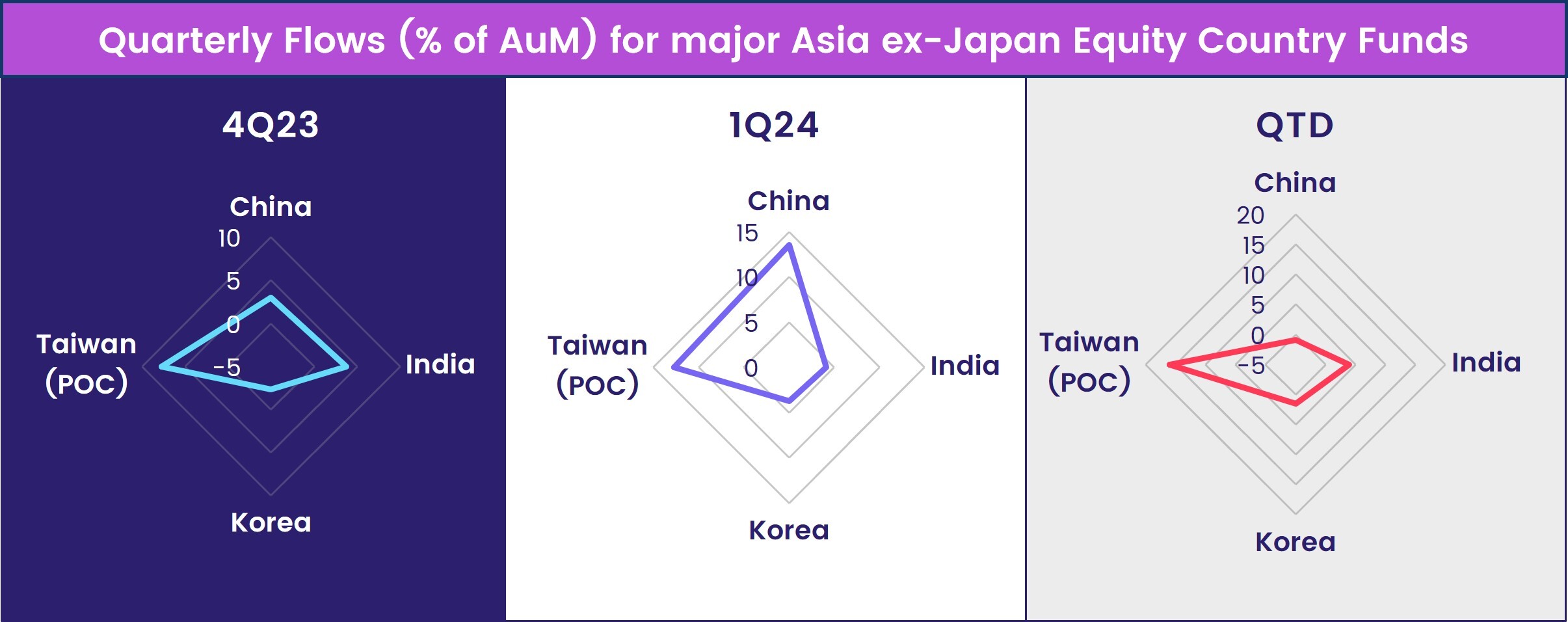

The other major Asia ex-Japan Country Fund groups enjoyed net inflows during the second week of May, with India Equity Funds adding to their record-setting inflow streak, Korea Equity Funds attracting fresh money for the fourth week running and year-to-date flows into Taiwan (POC) Equity Funds climbing past the $12 billion mark.

Among the Latin America Country Fund groups, Argentina Equity Funds continued to stand out as investors gravitate towards the reform story driven by new president Javier Milei. Flows into these funds during the latest week eclipsed the former record set during the third week of 3Q14. Brazil Equity Funds, meanwhile, posted another outflow with those domiciled outside Brazil collectively experiencing net redemptions for the 15th straight week as heavy flooding and a slowing in the pace of interest rate cuts weighed on investor sentiment.

Flows to EMEA Equity Funds mirrored those of the previous week, with strong flows to Turkey Equity Funds keeping the overall headline number north of $100 million.

Developed Markets Equity Funds

Corporate earnings and expectations for lower interest rates continued to buoy global equity markets going into the second half of May, with America’s benchmark Dow Jones Industrials index breaking through the 40,000 point level on its way to a fresh record high. EPFR-tracked Developed Markets Equity Funds also benefited from these tailwinds, absorbing another $14 billion as US, Global and Europe Equity Funds posted solid inflows that offset redemptions from Japan, Canada and Pacific Regional Equity Funds.

The latest flows into Europe Equity Funds were the biggest in over 14 months and extended the groups longest inflow streak since 1Q23. Although retail share classes posted their 41st consecutive outflow, the latest redemptions were the smallest since the second week of January, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow since the first week of 2Q23. At the country level, UK Equity Funds extended an outflow streak stretching back to mid-November and France Equity Funds chalked up their 17th outflow year-to-date.

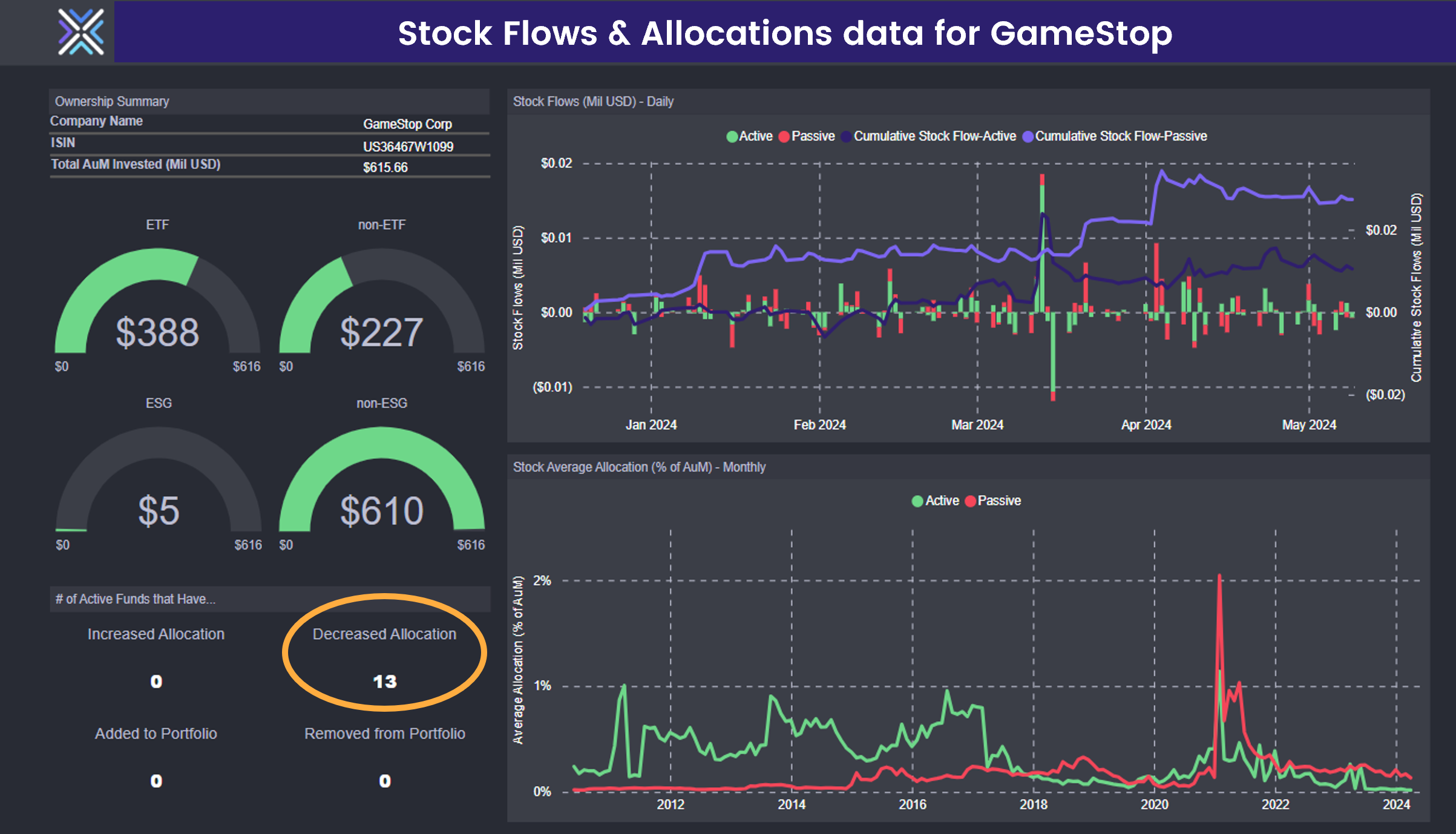

Despite the flurry of interest in ‘meme stocks’ such as GameStop – which has not been shared by US Equity Fund managers who have been decreasing their exposure to the gaming retailer – flows to the institutional share classes offered by Large Cap Funds drove the headline number for all US Equity Funds. The latest week also saw US SRI/ESG Equity Funds post their first inflow since the final week of February.

Buying of their own shares by US companies slowed in mid-May, but the ratio of corporate buying (cash purchases and new share buybacks) to new share issuance so far this quarter is running at an eye-popping 13.5-to-1.

The twin shocks of new US tariffs on Chinese exports and unexpectedly poor first quarter GDP numbers let some of the air out of Japan’s “this time it’s different” narrative going into the second half of May. Japan Equity Funds posted their fourth outflow so far this year as investors digested the implications on the trade-dependent nation of the latest US action.

Among the major diversified Developed Markets Equity Fund groups, a short-lived flurry of retail interest ended for Global Equity Funds and Pacific Regional Equity Funds racked up their 12th consecutive outflow.

Global sector, Industry and Precious Metals Funds

During the second week of May, the number of Sector Fund groups reporting inflows outweighed those reporting outflows for the first time in over a month. In contrast to the risk appetite evident in their approach to other asset classes, sector-oriented investors showed a preference for groups with defensive attributes. Among the 11 major groups tracked by EPFR, inflows ranged from $15 million for Commodities Sector Funds to $674 million for Utilities Sector Funds while Technology and Healthcare/Biotechnology Funds experienced the heaviest redemptions.

Investors have done a U-turn when it comes to Utilities Sector Funds, which extended their current inflow streak to three weeks and nearly $1 billion total after experiencing outflows for a 15-week period that saw nearly $6 billion exit. This week’s inflow was the largest since mid-4Q22, with a single US ETF accounting for over $570 million, and Water Funds posting a second straight week of inflows.

Among other groups with defensive reputations, Consumer Goods Sector Funds posted a second consecutive week of inflows for the first time since mid-July and Infrastructure Sector Funds recorded their biggest inflows since mid-July 2022. Behind the headline number for the latter group, Aerospace & Defense Funds and Construction Funds attracted their sixth and third consecutive inflows, respectively.

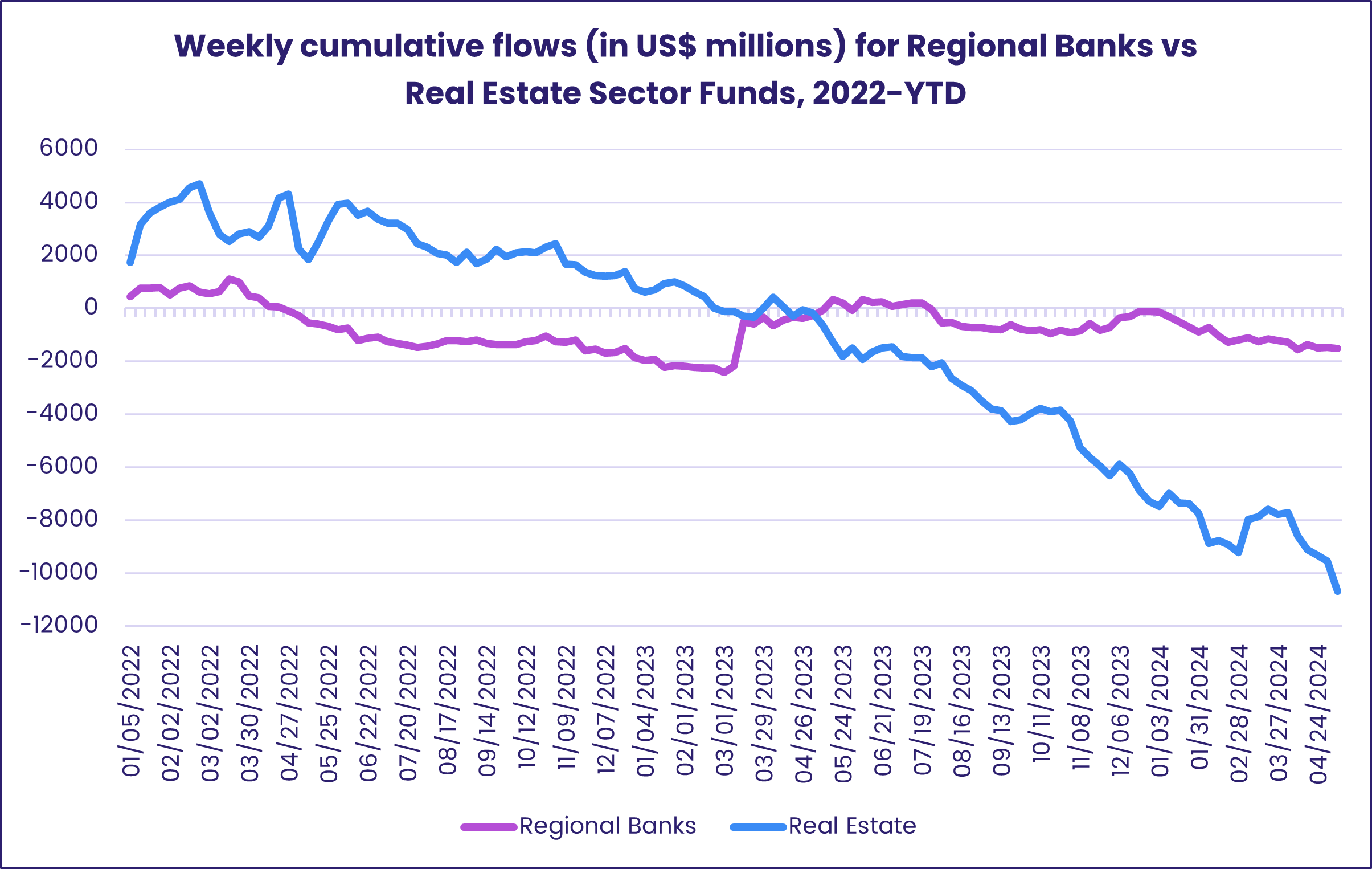

Meanwhile, Real Estate Sector Funds’ six-week run of outflows surpassed the $3 billion mark. With trillions of dollars in commercial real estate loans due over the next 36 months and post-pandemic work patterns leaving offices empty, fears of further stress for US regional bank balance sheets remain high. Regional Bank Funds have seen nearly $1.5 billion flow out so far this year.

Redemptions for Energy Sector Funds soared to a 10-week high, more than doubling the average outflows of $200 million experienced over the past four weeks. Physical Gold Funds absorbed their first inflow in five weeks, while Physical Silver and Copper Funds posted their sixth and second straight outflows, respectively. Copper Mining Funds – those within the Commodities/Materials Sector universe – have racked up nine straight weeks of inflows, a run that kicked off with their second-largest inflow on record.

Bond and other Fixed Income Funds

The money kept on flowing into EPFR-tracked Bond Funds during the week ending May 15 as total inflows so far this year passed the $300 billion mark. Risk appetite remains high, with High Yield and Bank Loan Bond Funds enjoying solid inflows and Emerging Markets Bond Funds snapping their three-week run of outflows.

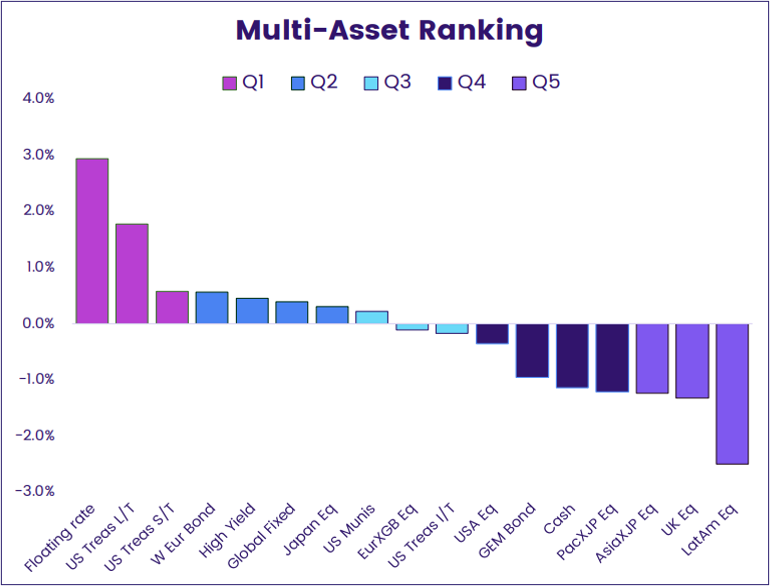

Bank loans, often referred to as floating rate debt, have now climbed to the top of EPFR’s weekly Multi Asset rankings with junk bonds and European debt in the second quintile. Cash, which at the beginning of the year was the highest ranked asset class, has slipped down to the fourth quintile.

In their latest Financial Stability Report, the European Central Bank (ECB) highlighted the general insensitivity to geopolitical and other risks reflected in tight yield spreads between investment grade and non-investment grade assets, low market volatility levels and overall risk premia. European Bond Funds, meanwhile, posted their 27th straight inflow despite redemptions from UK, Switzerland and Netherlands Bond Funds hitting nine, 14 and record highs, respectively.

Global Bond Funds posted their biggest inflow since 2Q20 as funds with ex-US mandates, which on average allocate over a third of their portfolios to developed European markets, took in record-setting amounts of fresh money.

Both Hard and Local Currency Emerging Markets Bond Funds chalked up modest inflows, much of which found its way into China, Malaysia and Thailand-mandated country funds. In the case of China, the possibility of the Chinese government acting as a buyer of last resort for distressed real estate lifted sentiment. Monthly data, meanwhile, showed India Bond Funds recorded their second biggest inflow since the beginning of 2021 during April as investors position themselves for India’s inclusion – starting in late June – in JP Morgan’s widely followed EM Bond indexes.

While money gravitated towards Asia, Mexico Bond Funds chalked up a record-setting outflow ahead of the country’s general election on June 2.

Flows into US Bond Funds were solid rather than spectacular, with Sovereign Bond Funds taking in $2 for every dollar committed to their corporate counterparts. Intermediate Term Corporate Funds posted their biggest outflow since mid-2Q22.

Did you find this useful? Get our EPFR Insights delivered to your inbox.