February was a bumpy month for investors and markets. Interest rates climbed higher in the US, Europe and Australia, the benchmark Dow Jones Industrials stock index shed over 4%, inflation numbers for January disappointed and Sino-US tensions climbed a notch. But the month did end on another positive note: Chinese factory output is growing at its fastest pace since 2012.

This tangible sign that China’s post-Covid lockdown recovery is firmly underway helped EPFR-tracked China Equity Funds snap their longest outflow streak since early 3Q21, with flows into China Technology and Healthcare/Biotechnology Sector Funds hitting 13 and 17-week highs, respectively, while Hong Kong Equity Funds recorded their biggest inflow in nearly a year. The desire to put money to work was also reflected in the $1.6 billion that was pulled out of China Money Market Funds.

Investors focused on the US took the opposite tack, with commitments to US Money Market Funds hitting their second-highest weekly total in the past 24 months and US Equity Funds racking up their biggest outflow year-to-date.

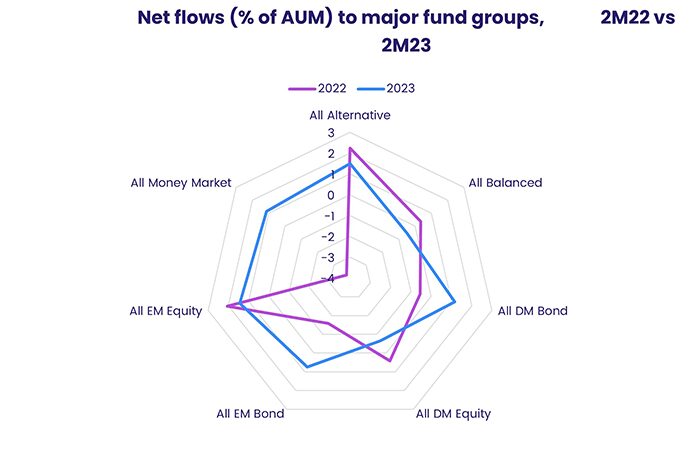

Overall, the week ending March 1 saw all Equity Funds post a collective net outflow of $7.4 billion. Investors also redeemed $1.5 billion from Alternative Funds and $3.4 billion from Balanced Funds while Bond Funds absorbed $8.4 billion and Money Market Funds $68 billion.

At the single country and asset class fund levels, Inflation Protected Bond Funds chalked up their 28th consecutive outflow, Mortgage-Backed Bond Funds added to their longest inflow streak since 4Q21, redemptions from Dividend Equity Funds hit a YTD high and Silver Funds posted their biggest outflow in over five months. Greece Equity Funds added to their longest run of inflows since late 2Q21, flows into Brazil Equity Funds climbed to a 17-week high and Turkey Equity Funds enjoyed another week of above average inflows.

Emerging Markets Equity Funds

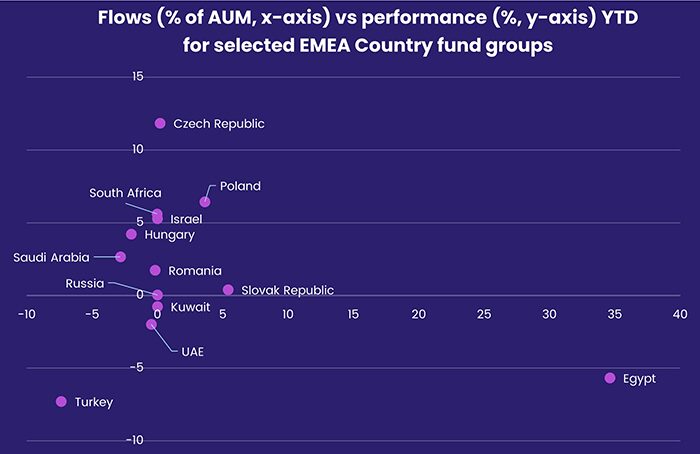

Going into March, EPFR-tracked Emerging Markets Equity Funds saw flows improve for the third straight week as hopes for a strong rebound in China were bolstered by strong data from the country’s manufacturing sector. For the second week running, all four of the major regional groups recorded inflows that ranged from $91 million for EMEA Equity Funds to $1.4 billion for Asia ex-Japan Equity Funds.

EM Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates racked up their 15th straight inflow, their longest such run since 2H21, and retail share classes absorbed fresh money for the eighth week running.

The final week of February did see an end to the longest inflow streak Frontier Markets Equity Funds have compiled since 2010-11. Funds dedicated to Vietnam, which is the biggest single country allocation among Frontier Markets Funds, posted their first outflow since late September and redemptions from Africa Regional Equity Funds hit a level last seen in late 2Q22.

The lack of interest in Africa – this was the 35th outflow in the past 40 weeks for Africa Regional Funds – is one of the multiple headwinds facing EMEA Equity Funds as a whole. But, for the second week, Turkey’s determination to pump up its battered stock market helped keep overall flows in positive territory.

While the latest country allocations data for Global Emerging Markets (GEM) Equity Funds shows average exposure to both South Africa and Turkey fell coming into February, China’s weighting climbed to a seven-month high. Investors, meanwhile, recovered their optimism about Chinese economic growth in late February with over $1.3 billion flowing into dedicated China Equity Funds.

The prospect of stepped-up demand by Chinese manufacturers for raw materials gave Brazil Equity Funds a lift, as did expectations that Brazil’s lackluster economic growth is setting the stage for a shift to interest rate cuts in the fourth quarter. The bulk of the latest inflows went to ETFs, which posted their biggest weekly inflow since early November, and were local currency denominated.

Developed Markets Equity Funds

Redemptions from EPFR-tracked Developed Markets Equity Funds climbed to a 10-week high in late February, dragged down by fresh outflows from US Equity Funds as investors adjusted their hopes for peak interest rates in the world’s largest economy. Over $10 billion flowed out of US Equity Funds, offset by some margin modest flows into Global, Japan and Pacific Regional Equity Funds.

The latest redemptions from US Equity Funds again hit both mutual funds and ETFs, and Large Cap Blend Funds were again the biggest contributors to the headline number. Mid Cap Blend and Small Cap Value Funds both recorded inflows during a week when funds managed for value outperformed their growth counterparts across all capitalizations. US Dividend Funds, meanwhile, posted their biggest outflow since mid-December and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates their biggest in nearly four months.

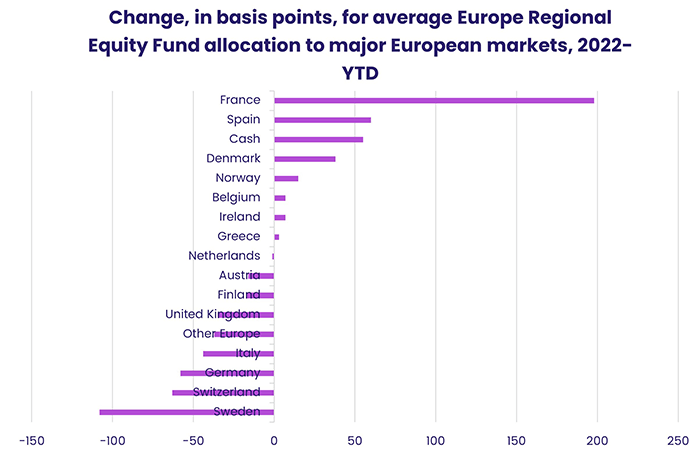

Europe Equity Fund flows mirrored those of the previous week, with flows into Europe Regional Funds narrowly canceled out by redemptions from a majority of the major dedicated country fund groups. These included record-setting outflows from Ireland Equity Funds, over $500 million flowing out of Switzerland Equity Funds, the 34th outflow in the past 36 weeks from UK Equity Funds and the third outflow in excess of $150 million from France Equity Funds during February.

While investors have been pulling money out of France Equity Funds, average allocations to France by Europe Regional Equity Funds hit a record high coming into February. At the other end of the scale, weightings for the UK and Sweden fell to 18 and 36-month lows, respectively.

Flows for the two biggest Asia Pacific Country Fund groups headed in opposite directions, with Australia Equity Funds posting their biggest outflow since early September despite the burst of optimism about China’s economic trajectory while Japan Equity Funds snapped their longest outflow streak in over five months.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, extended their current run of inflows to nine weeks and $23 billion.

Global Sector, Industry and Precious Metals Funds

The final week of February saw investors revisit their sector bets as they factored in a rebounding Chinese economy, their projections for 1Q23 earnings and the likely trajectory of interest rates on both sides of the Atlantic. Seven of the 11 EPFR-tracked Sector Fund groups reported inflows that ranged from $70 million for Commodities Sector Funds to $437 million for Industrials Sector Funds while four groups – Consumer Goods, Healthcare/Biotechnology, Real Estate and Telecoms Sector Funds – experienced net redemptions.

Energy Sector Funds posted their biggest inflow in over three months, snapping a five-week outflow streak, as commitments to Europe-dedicated funds hit their highest level since mid-1Q22. Among the Energy Sector Fund subgroups, Natural Gas Funds suffered their heaviest redemption since Jan 2018 and Oil Funds saw their three-week inflow streak come to an end.

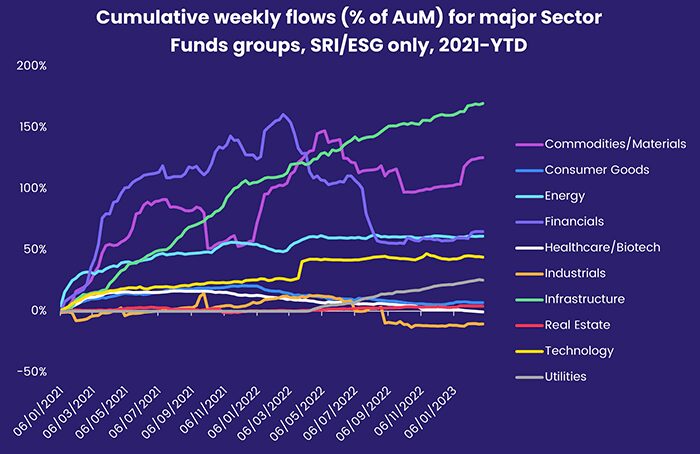

Although the growing focus on green energy and climate change has helped, Energy Sector Funds are not the leaders – in relative terms – when it comes to Sector Funds occupying the socially responsible (SRI) or environmental, social and governance (ESG) spaces. Over the past 25 months, it has been SRI/ESG Infrastructure and Industrial Sector Funds that have claimed the top two slots.

Flows into China and Hong Kong Technology Sector Funds climbed to 13 and 51-week highs, respectively, but the overall group’s headline number was just shy of $400 million as US and Global Technology Sector Funds were both hit with redemptions in excess of $250 million.

Industrials Sector Funds recorded their biggest inflow since mid-January as they took in fresh money for the third week running. Of the top 10 funds ranked by inflows for the week, all but one were ETFs, three had Aerospace & Defense mandates, and two were construction related. Investors committed fresh money to Aerospace & Defense Funds for the ninth straight week and 19th time in the past 20 weeks.

Despite silver’s industrial applications, redemptions for Silver Funds reached a 24-week high of $220 million as investors contemplated the impact of even higher US interest rates on the strength of the dollar and future economic growth. Gold Funds also surrendered another $712 million.

Bond and other Fixed Income Funds

With US Treasuries offering yields in the 4% to 5% range and the US Federal Reserve’s ‘pivot point’ looking increasingly distant, fixed income investors continued to rotate from riskier asset classes to US Bond Funds during the final week of February. Flows to that fund group hit a seven-week high as EPFR-tracked Bond Funds collectively extended their longest inflow streak since 2H21.

Bond ETFs attracted more fresh money than mutual funds for the second straight week, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their 19th straight inflow, retail flows to all Bond Funds were positive for the fourth time in the past five weeks and 3x Leveraged Bond Funds chalked up their 15th inflow since mid-November.

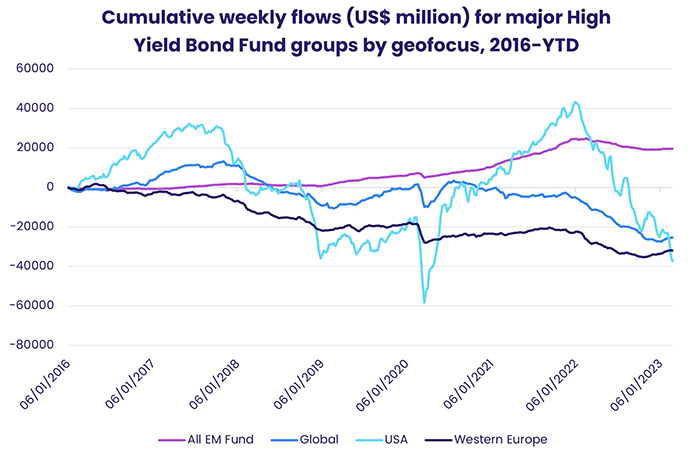

Emerging Markets and High Yield Bond Funds bore the brunt of the risk reduction, with redemptions from the former hitting a 17-week high and High Yield Bond Funds extending their current outflow streak to three weeks and $12.4 billion with the bulk of that money coming from US-mandated funds. Default rates for US junk bonds are expected to more than double this year, from last year’s 1.4% to around 3.4%

Emerging Markets High Yield Bond Funds posted their second straight, albeit small, outflow and Sharia Bond Funds recorded their first outflow since late January. But Frontier Markets Bond Funds posted their fourth inflow in the past six weeks and, at the country level, investors steered over $300 million into Korea Bond Funds.

Flows into US Bond Funds favored the short end of the yield curve, with US Short Term Sovereign Bond Funds recording their biggest inflow since late September. But the appeal of higher yielding short-term Treasuries is doing Municipal Bond Funds no favors: since the beginning of 3Q22 over $435 billion has flowed out of this group.

Europe Bond Funds pulled in another $1.5 billion as funds with sovereign mandates absorbed four times the amount of fresh money channeled into Europe Corporate Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.