Chase old market catalysts or wait for new ones? With the latest corporate earnings season winding down, China’s leadership laying out (some) of their economic policy cards, benchmark equity indexes still climbing and the latest central bank cues coming at the end of the latest reporting period, investors could make a case for either approach during the first week of March.

Fixed income investors showed the greatest conviction, committing over $17 billion – a 60-week high – to EPFR-tracked Bond Funds as they seek exposure to the meaningful yields currently offered by investment grade European and North American debt.

Elsewhere, Cryptocurrency Funds pulled in over $1 billion for the fourth week running while Physical Gold Funds posted their 14th outflow since mid-November, redemptions from Technology Sector Funds hit a record high while Commodities Sector Funds chalked up their biggest inflow in over seven months and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest outflow streak since 2H10 while SRI/ESG Bond Funds recorded their ninth inflow year-to-date.

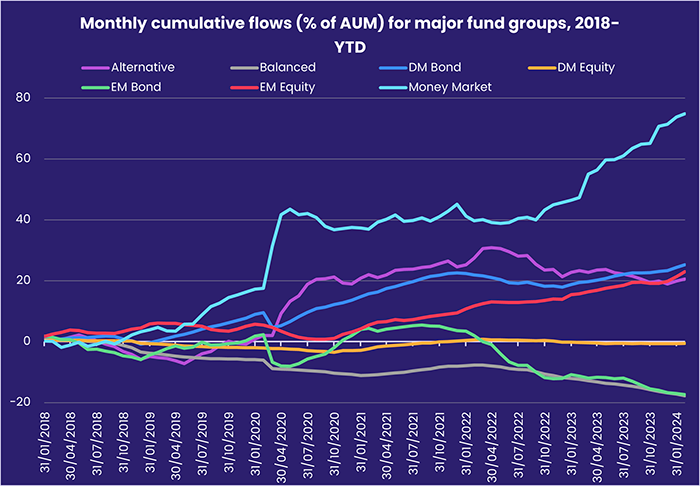

Overall, the week ending March 6 saw Alternative, Equity and Money Market Funds post collective inflows of $976 million, $6.9 billion and $31.9 billion, respectively. Balanced Funds, which have posted only two weekly inflows over the past 12 months, surrendered another $1.8 billion.

At the single country and asset class fund levels, redemptions from Vietnam Equity Funds climbed to a 16-week high, Germany Equity Funds extended an outflow streak stretching back to early 3Q23 and $1.2 billion flowed out of China Money Market Funds. Investors pulled money out of Convertible Bond Funds for the 37th time since the beginning of July, steered another $2.2 billion into Total Return Funds and extended Municipal Bond Funds‘ longest inflow streak since 3Q21.

Emerging markets equity funds

Normal service resumed in early March as EPFR-tracked Emerging Markets Equity Funds posted their ninth inflow year-to-date on the back of strong flows into dedicated China and India Equity Funds. Those flows offset the biggest outflows from the diversified Global Emerging Markets (GEM) Equity Funds since the final week of October and the end of EMEA Equity Funds‘ longest inflow streak in nearly two years.

Retail investors continue to cut their exposure to Emerging Markets Equity Funds, with the latest redemptions from retail share classes hitting a 19-week high.

China Equity Funds absorbed over $3.5 billion during a week when Chinese policymakers set out their stall at the annual meeting of the National People’s Congress. Despite well chronicled headwinds that include deflation, demographic shifts and an ongoing correction in the country’s property markets, officials announced a GDP growth target of around 5%.

GDP growth in Emerging Asia’s other heavyweight, India, is expected to run at over 6.5% and India Equity Funds – which attracted a record-setting $36 billion last year – posted their 51st consecutive inflow.

For EMEA Equity Funds, outflows have been the normal since Russia invaded Ukraine two years ago. In recent weeks enthusiasm for Turkey underpinned a modest inflow streak, but that ended as investors weighed the impact of further cuts in oil production on major suppliers with redemptions from Saudi Arabia Equity Funds hitting a 19-week high.

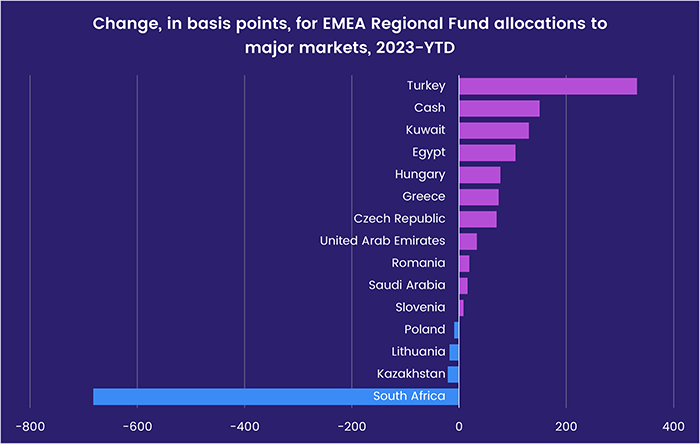

Managers of EMEA Regional Funds share the bullish outlook for Turkey. They increased its average weighting by over 2% during the past 13 months, largely at the expense of South Africa whose anemic growth and rising political risk are deterring both fund managers and investors: South Africa Equity Funds have posted outflows seven of the 10 weeks year-to-date.

Latin America Equity Funds posted their second inflow of 2024 as commitments to both Brazil and Mexico Equity Funds climbed to 11-week highs. In the case of Brazil-mandated funds, those flows snapped a 10-week redemption streak.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds kicked off March with their fourth straight collective inflow. But the latest headline number was a third of the previous week’s as flows to US Equity Funds stalled and Europe Equity Funds racked up their 50th outflow over the past 12 months.

Driving the latest week’s overall number was the more than $4 billion – a 39-week high – absorbed by Global Equity Funds. Among the group, funds with leverage mandates extended their longest inflow streak since 3Q18 while those with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their eighth consecutive outflow.

US Equity Funds posted their fourth outflow of 2024 as a further $2.1 billion flowed out of retail share classes and investors pulled money out of US Dividend Funds for the 11th straight week. Senior Liquidity Analyst Winton Chua notes that, “selling of shares by the officers, directors and major holders required to file Form 4 with the SEC rose sharply last month ….insiders in February sold $22.6 billion worth of their own shares, topping the $20 billion mark for just the second time in more than two years. The last time insider selling topped $20 billion was back in November 2022, and the S&P 500 fell 5% the following month.”

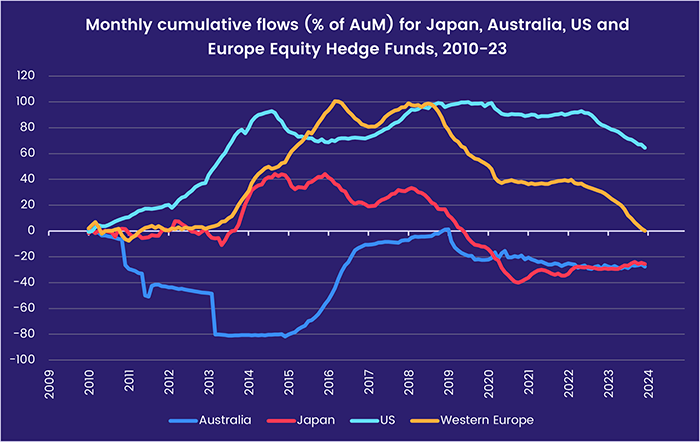

Investors who utilize Hedge Funds for their country exposure have certainly soured on US-mandated funds. Interest in funds dedicated to Japan and Australia have, however, picked up in recent months.

Conventional Japan Equity Funds are also seeing fresh money, with foreign and domestically domiciled funds attracting roughly equal amounts in early March. The record-breaking performance of the country’s stock market appears to be running ahead of the Japanese economy, which is still struggling with the reluctance of consumers to spend rather than save.

Investors are less forgiving when it comes to Europe in general and the UK and Germany in particular. Europe Equity Funds have recorded only one inflow since the beginning of 2Q23, although those domiciled in the US have taken in fresh money for four straight weeks, while Germany Equity Funds last posted an inflow in early July and UK Equity Funds have seen money flow out every week over the past three months.

Global sector, industry and precious metals funds

While five of the 11 EPFR-tracked Sector Fund groups attracted fresh money for the second week running there were only two – Healthcare/Biotechnology and Industrials Sector Funds – that appeared on the list both weeks. Inflows ranged from $37 million for the latter group to $1.2 billion for Real Estate Sector Funds while Technology Sector Funds saw outflows hit a record high.

The same Technology Sector ETF – benchmarked to one of the MSCI US indices – that attracted over $5 billion last week was relieved of a similar amount on March 1, according to EPFR’s daily flow data. While that shaped the headline number early in the reporting period, Technology Sector Funds did absorb $1.7 billion during the final 3 days and seven funds ended the week pulling in over $100 million.

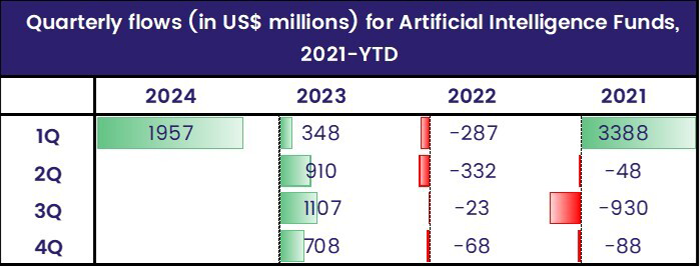

Among the technology sub-groups that ended the week in credit were Artificial Intelligence Funds, which remain a focus of investors heading into March. AI funds extended their current inflow streak to 11 weeks and $2.1 billion, leaving year-to-date flows just $1 billion shy of the full-year inflow total in 2023.

Commodities/Materials Sector Funds snapped a four-week run of outflows totaling $2.26 billion. Of the top 10 funds attracting inflows, four had ties to gold production or mining, one to metals & mining, and another to precious metals. Gold Miners & Mining Funds posted one of the two biggest inflows the group has experienced since late 4Q20. Physical Gold Funds, on the other hand, saw redemptions climb to an eight-week high.

Healthcare/Biotechnology Sector Funds chalked up their biggest inflow in over six months. A subgroup of 18 funds tied to pharmaceuticals – Pharma Funds – saw inflows reach their highest levels since early 4Q21.

With building activity stabilizing and worries about commercial real estate cooling, flows for Real Estate Sector Funds rebounded with over $1.3 billion making its way into US-dedicated funds. REIT Funds recorded their third inflow over the past five weeks, and seventh year-to-date, that came in at or around $200 million.

Bond and other fixed income funds

EPFR-tracked Bond Funds enjoyed a strong start to March, posting their biggest inflow in nearly 14 months, as central bankers in the US and Europe cooled expectations of interest rate cuts in the first half of the year.

Investors stuck to the previous week’s script when it came to allocating their money. US Bond Funds attracted the lion’s share of the inflows, with their weekly total climbing to a level last seen in mid-1Q21, while flows into Canada Bond Funds climbed to a 48-week high. Both Europe and Global Bond Funds added to inflow streaks that are the longest since 1H19 and 3Q20, respectively, and Asia Pacific Bond Funds enjoyed solid inflows for the fifth week running.

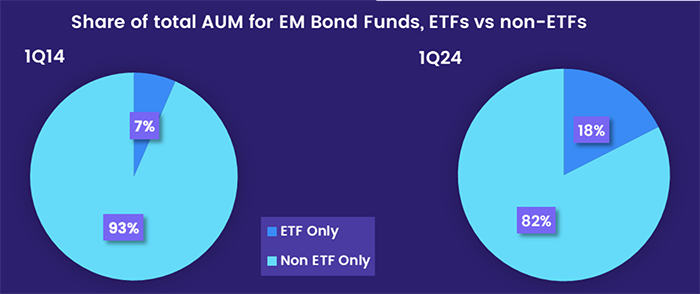

Emerging Markets Bond Funds were again the outlier among the major groups by geographic mandates, with the diversified Global Emerging Markets (GEM) Equity Funds the biggest contributor to the week’s headline number and redemptions from funds with sovereign debt mandates jumping to a 22-week high. Although ETFs have steadily increased the share of EM Bond Fund assets they hold, they have experienced net redemptions five of the past seven weeks and their slice of the pie is smaller than the 20.7% claimed by Developed Markets Bond ETFs.

While unwilling to boost their broad exposure to emerging markets debt, investors have fewer qualms about junk bonds. The latest week saw High Yield Bond Funds chalk up their 17th inflow over the past 18 weeks.

Europe Bond Funds continue to enjoy strong retail support, with retail share classes absorbing fresh money for the 26th straight week going into the European Central Bank’s second policy meeting of the year. At the country level, flows into Switzerland, UK and Germany Bond Funds climbed to 13, 14 and 33-week highs, respectively, while Spain Bond Funds posted consecutively weekly outflows for the first time in over a year.

Long Term Corporate, Intermediate Term Mixed and Intermediate Term Sovereign Funds led the way among US Bond Fund groups, with all three pulling in over $2 billion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.