Risk reduction and defensive positioning remained high on most investors’ lists during the second week of October as the Nasdaq index hit its lowest level since late 3Q20 and US 30-year mortgage rates tested the 8% level. With the UK’s bond market giving investors a reminder of what a collision between recession-fighting fiscal policy and inflation-fighting monetary policy looks like, missiles flying out of Russia and North Korea, the latest US core inflation doing nothing for hopes of restraint by the US Federal Reserve in early November and the third quarter earnings season on the horizon, investors had plenty of other reasons to tack towards safety.

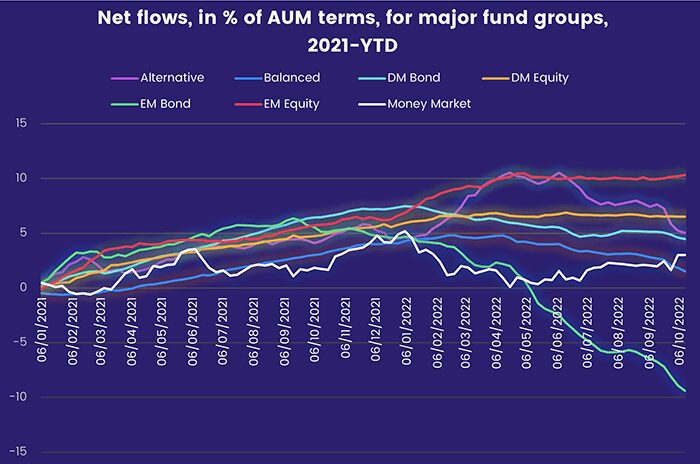

The upshot was another $9.8 billion flowing out of EPFR-tracked Bond Funds, the fourth straight outflow in excess of $1 billion for Alternative Funds, the extension of Europe Equity Funds current outflow streak to 35 weeks and $94.5 billion and a combined $8.4 billion worth of redemptions from the two major multi-asset fund groups.

Investors remain reluctant to abandon some convictions and the pursuit of income streams. Fresh money flowed into Dividend Equity Funds for the 10th straight week, over $1 billion flowed into Technology Sector Funds, Short Term US Sovereign Bond Funds pulled in another $2.7 billion and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates eked out their fifth consecutive inflow.

At the single country fund and asset class and levels, Cryptocurrency Funds recorded their sixth outflow in the past eight weeks, Gold Funds extended a redemption streak stretching back to mid-June, investors pulled money out of Municipal Bond Funds for the 10th week running and High Yield Bond Funds saw another $3 billion flow out. Norway Bond Funds recorded their biggest inflow since mid-2Q19 while flows into Australia and Vietnam Equity Funds climbed to 12 and 19-week highs, respectively.

Emerging Markets Equity Funds

For the third week running, solid flows into China Equity Funds kept the headline number for all EPFR-tracked Emerging Markets Equity Funds in positive territory despite net redemptions from Latin America, EMEA and the diversified Global Emerging Markets (GEM) Equity Funds. Retail support was absent for the sixth straight week and the 15th time in the past 18 weeks.

Investors committed fresh money to EM Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates and EM Dividend Funds for the fourth straight week and flows into Emerging Markets Equity Collective Investment Trusts (CITs) hit their highest level since late 2Q21.

In addition to money absorbed by China Equity Funds, two of the other Asia ex-Japan Country Funds – those dedicated to Korea and Taiwan (POC) – pulled in a combined $800 million. But India Equity Funds posted their biggest weekly outflow in nearly three months during a week when the India economy’s GDP forecast was trimmed by the International Monetary Fund and inflation data for September pointed to another interest rate hike before the end of the year.

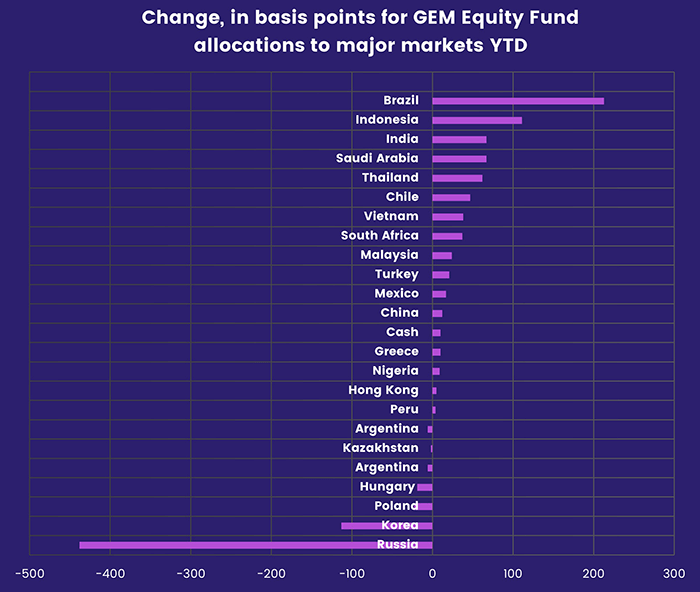

India remains one of the bigger beneficiaries of the scramble by GEM Equity Fund managers to reallocate their Russian exposure earlier this year. Thailand, Indonesia and Vietnam have also seen their average allocations climb, and investors are warming to all three. During the latest week, Thailand Equity Funds snapped an 11-week redemption streak and flows into Vietnam Equity Funds climbed to a 19-week high.

In the Latin American universe, Brazil is currently occupying center stage as voters prepare to go to the polls again later this month to decide the runoff presidential election involving challenger Luiz Inácio Lula da Silva, the top vote-getter in the first round, and populist incumbent Jair Bolsonaro. Brazil Equity Funds posted their third straight inflow. Colombia Equity Funds, however, chalked up their biggest outflow since early March.

EMEA Equity Funds continue to struggle in mid-October as rising US tensions with Saudi Arabia over OPEC’s decision to curb oil production added to the headwinds facing this group. Despite Africa’s physical distance from the fighting in Ukraine, investors are showing little interest in any markets outside of South Africa. The latest redemptions from Africa Regional Equity Funds were the 22nd in past 24 weeks.

Developed Markets Equity Funds

Further redemptions from the diversified Global Equity Funds, which are mired in their longest outflow streak since late 1Q19, meant that EPFR-tracked Developed Markets Equity Funds chalked up their sixth outflow in the past eight weeks. The money pulled out of Global Equity Funds during the second week of October helped offset an inflow of over $5 billion recorded by US Equity Funds.

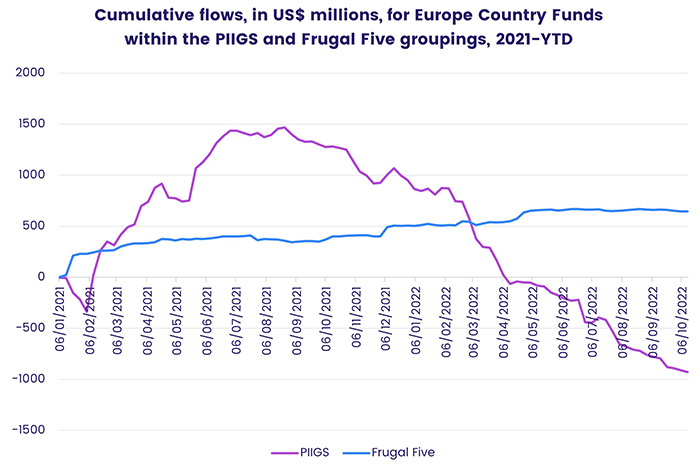

Europe Equity Funds added to their dismal flow record since mid-February, with only three dedicated country groups – Switzerland, Portugal and Sweden Equity Funds – posting an inflow for the week. But the pace of outflows has ebbed significantly in recent weeks, and Europe Equity ETFs have now posted four consecutive weekly inflows.

With the turmoil in UK markets highlighting the problems facing countries that try to fiscally stimulate growth when central banks are trying to tamp down inflation, investors continue to steer clear of markets that struggle to balance their books. Funds dedicated to the so-called ‘frugal five’ markets – Austria, Denmark, the Netherlands, Finland and Sweden – are proving somewhat easier to embrace. The current inflow streak being compiled by Sweden Equity Funds is the longest since 1Q21 while Denmark Equity Funds carried a four-week run of inflows into the latest week.

US Equity ETFs also recorded an inflow, their 10th in the past 13 weeks, while their actively managed peers posted their 26th outflow since mid-April. Funds managed for value outperformed their growth counterparts across all capitalizations, and flows favored Large Cap Funds despite concerns about the impact that the strength of the US dollar will have on their overseas earnings.

The strength of the dollar, which recently hit a 32-year high against the yen, added to the uncertainty surrounding Japanese assets. With interest rates rising elsewhere, will the Bank of Japan capitulate and start tightening its current policies? Will the metaphorical Japanese housewife start moving their savings overseas in search of higher yields and foreign exchange gains? Redemptions from Japan Equity Funds jumped to a seven-week high, with North Korea’s latest round of missile diplomacy adding to general uncertainty.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, experienced retail redemptions for the fifth week running. Between mid-4Q20 and mid-1Q22, this group took in fresh retail money all but four weeks.

Global Sector and Precious Metals Funds

Last year, the week leading into the third quarter earnings season saw eight of the 11 major EPFR-tracked Sector Fund groups post an inflow as investors positioned themselves for more good news. There are no such expectations this year, and only five of the groups attracted fresh money during the week ending Oct. 12.

Real Estate Sector Funds were the only group to chalk up consecutive weekly inflows, while Commodities Sector Funds saw positive flows for the first time in two weeks and Utilities Sector Funds bounced back with their eighth inflow in the past nine weeks. On the other hand, Consumer Goods and Financial Sector Funds saw redemptions for the fourth and sixth consecutive week.

One group, Technology Sector Funds, did pull in over $1 billion as investors digested the latest US Department of Commerce rules aimed at curbing Chinese access to advanced semiconductors on national security grounds. Dedicated US and China Technology Sector Funds both recorded inflows, receiving $749 million and $467 million, respectively, and five of the top 10 individual funds ranked by inflows have semiconductor mandates.

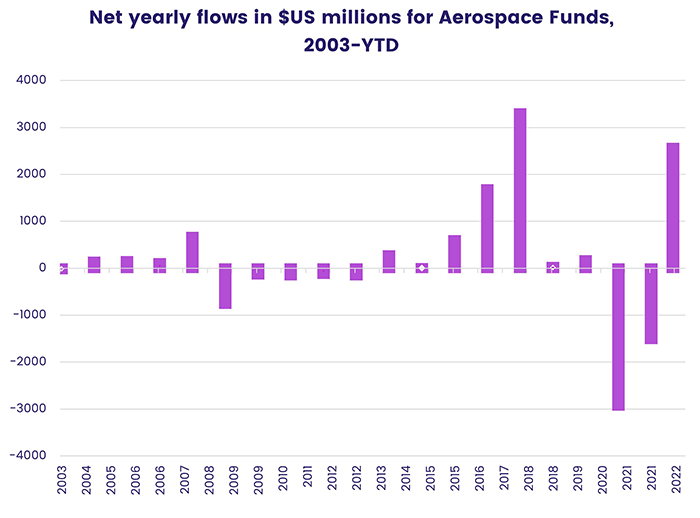

Investors have already had one major earnings report in the transportation space to digest ahead of a raft of major bank reports. Delta Air Lines, which reported record quarterly revenues of $14 billion, noted that revenue growth from international travel outpaced that generated by domestic routes for the first time since the beginning of the pandemic. Year-to-date flows to a custom group of Aerospace Funds suggest that investors anticipated this trend.

Bond and other Fixed Income Funds

The second week of October saw EPFR-tracked Bond Funds rack up a seventh straight outflow as inflation data from several corners of the world pointed to more interest rate hikes ahead and the Bank of England struggled to stabilize the UK’s debt markets. Of the major groups by geographic focus, only a handful of dedicated country groups recorded an inflow, which Europe, Global and Emerging Markets Bond Funds all surrendered over $2 billion.

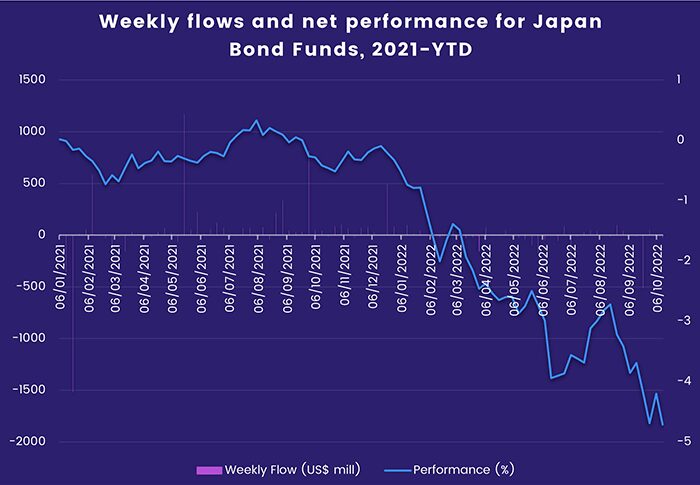

Asia Pacific Bond Funds, which posted their biggest inflow year-to-date the previous week, also experienced net redemptions as investors pulled money out of Japan Bond Funds for the fifth time in the past six weeks.

At the asset class level, redemptions from Total Return Bond Funds hit their highest level since late June, Inflation Protected Bond Funds recorded their 13th outflow in the past 14 weeks, money flowed out of Mortgage-Backed and Municipal Bond Funds for the eighth and 10th straight week, respectively, and Bank Loan Funds added to their longest run of outflows since 1H19.

Investors pulled money out of Emerging Markets Bond Funds for the eighth week running as credit default swaps on Chinese sovereign debt climbed to a five-year high and the US dollars strength triggered a fresh round of warnings about the vulnerability of many emerging markets borrowers. Retail investors reduced their exposure to this asset class for the 27th time in the past 28 weeks.

Europe Bond Funds recorded their seventh outflow in the past eight weeks, with the two major regional groups accounting for the bulk of the headline number. Among the asset class groups, Europe Mortgage Bond Funds posted a collective outflow of over $900 million for the second straight week. The European Central Bank, faced with another record-high inflation number for September, is expected to hike its key rate by another 50 basis points when it meets later this month.

Among the US Bond Fund groups, investor appetite for Short Term Sovereign Bond Funds remains strong, and there was more interest in longer durations: flows into Long and Intermediate Term Treasury Funds hit nine-week and eight-year highs, respectively. None of the corporate groups, regardless of credit quality, managed to attract fresh money.

Did you find this useful? Get our EPFR Insights delivered to your inbox.