Weaker US job creation numbers and the first interest rate cut by Sweden’s central bank since 2016 gave investor risk appetite a modest boost during the first week of May. Flows to all EPFR-tracked Equity Funds climbed to a six-week high, High Yield Bond Funds recorded their biggest inflow since early November and Europe Equity Funds posted consecutive weekly inflows for the first time in over 14 months.

Despite the Swedish Riksbank’s decision and rekindled hopes of a US rate cut before the end of the year, plenty of investors continued to keep their animal spirits on a short leash. Emerging Markets Equity and Bond Funds both chalked up collective outflows, as did Technology Sector Funds, while flows into US Investment Grade Bond Funds rebounded and over $50 billion flowed into US Money Market Funds.

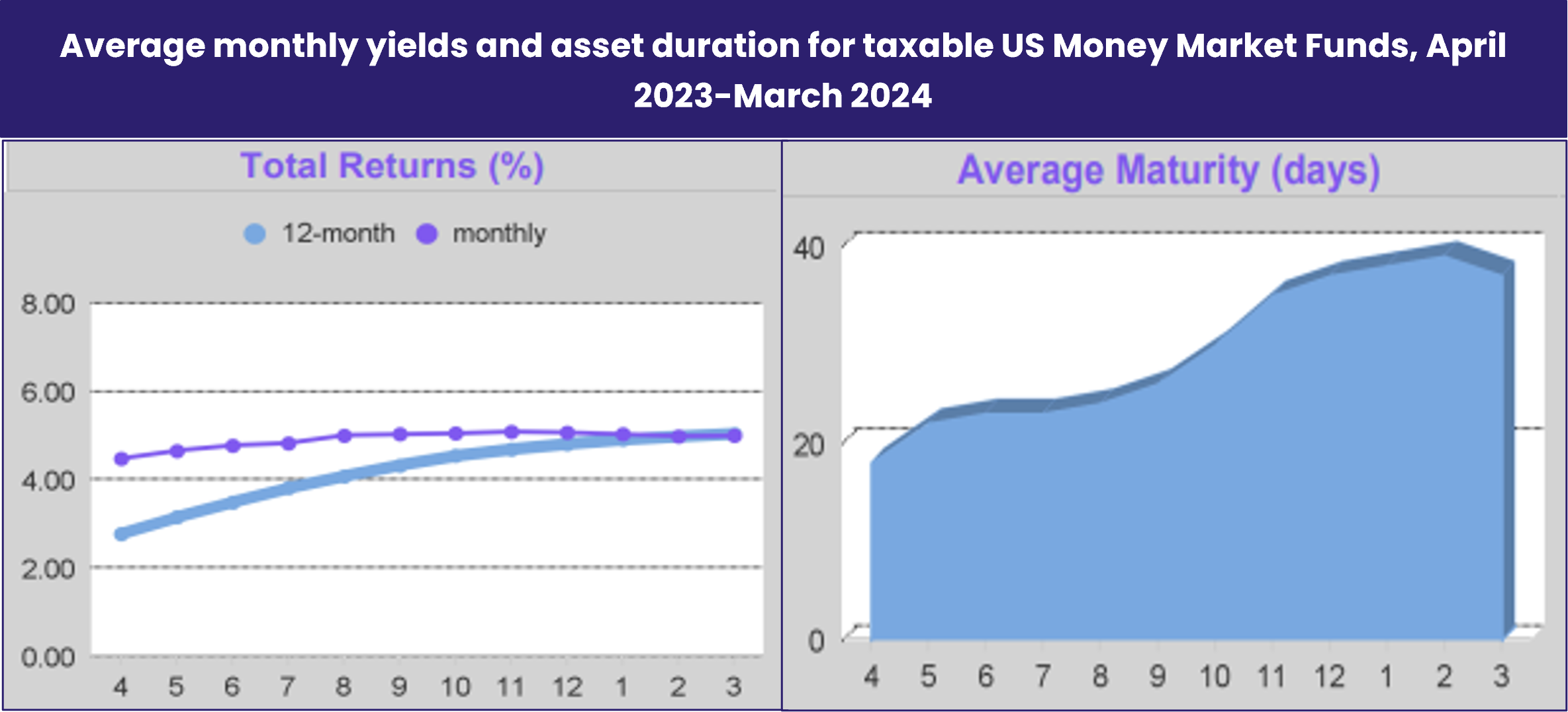

While 2024 has proved, in flow terms, a pale shadow of 2023 for US Money Market Funds, they have absorbed over $85 billion year-to-date and their collective AUM exceeds $7 trillion. Research by EPFR’s iMoneyNet team shows that the yields offered by these liquidity vehicles have peaked in the 4.8% to 5.2% range, and that maintaining yields at those levels has involved a near doubling of average portfolio durations between 2Q23 and 1Q24.

Overall, investors steered a net $67.7 billion into all EPFR-tracked Money Market Funds during the week ending May 8, while Alternative Funds pulled in $988 million, Equity Funds $14.8 billion and Bond Funds $17.8 billion. Balanced Funds posted their 51st outflow over the past 12 months.

At the single country and asset class fund level, New Zealand Equity Funds posted their 16th outflow over the past 18 weeks, Switzerland Bond Funds chalked up their 11th straight inflow and flows into South Africa Money Market Funds climbed to a record high. Money flowed out of Physical Gold Funds for the fifth consecutive week, Cryptocurrency Funds took in fresh money for the 15th time year-to-date and Municipal Bond Funds posted their biggest inflow since early 1Q23.

Emerging Markets Equity Funds

Better Chinese economic data and positive, albeit modest, shifts in the outlook for US and European interest rates were not enough to stop EPFR-tracked Emerging Markets Equity Funds from posting their seventh outflow since the final week of February. Three of the four major regional groups did post inflows, and flows into retail share classes were the largest in over nine months. However, those were offset by redemptions from Asia ex-Japan Equity Funds which were driven by net outflows of over $1.5 billion from China Equity Funds.

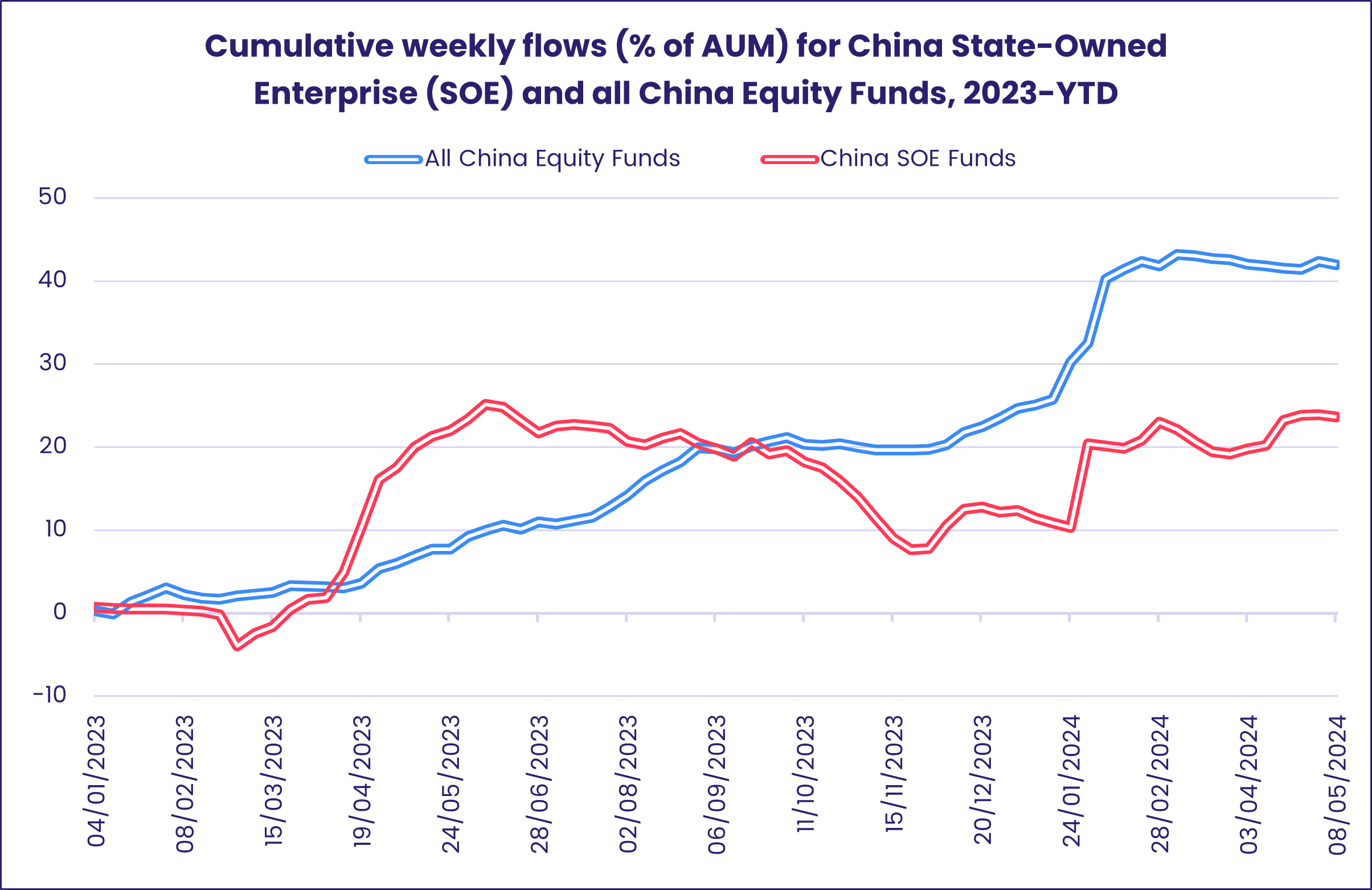

The latest week saw redemptions from domestically domiciled China Equity Funds hit a 10-week high, and foreign domiciled funds post their seventh consecutive outflow or 11th over the past 12 weeks. China Dividend Funds reported their third largest outflow during the past 12 months and funds with a state-owned enterprise (SOE) focus snapped their longest inflow streak in over 10 months.

Other Asia ex-Japan Country Fund groups fared better, with Korea Equity Funds extending their longest inflow streak since a seven-week run ended in mid-February, Taiwan (POC) Equity Funds taking in fresh money for the sixth week running and India Equity Funds adding another $685 million. India is halfway through a general election that will decide if incumbent Prime Minister Narendra Modi’s administration will remain in office for another five years and, if so, whether they will enjoy a legislative ‘super majority’ that opens the door to constitutional amendments.

With elections looming, South Africa Equity Funds posted another outflow. But EMEA Equity Funds overall recorded their biggest inflow since late 1Q23, with the more than $100 million – a 52-week high – committed to Turkey Equity Funds the biggest contributor to that headline number. Turkey’s stock market continues to enjoy strong domestic support as local investors seek to mitigate the impact of an inflation rate still running at over 65%.

Argentina’s energy and reform stories again stood out for Latin America-oriented investors, with flows into Argentina Equity Funds hitting a decade-high for the second week running.

Developed Markets Equity Funds

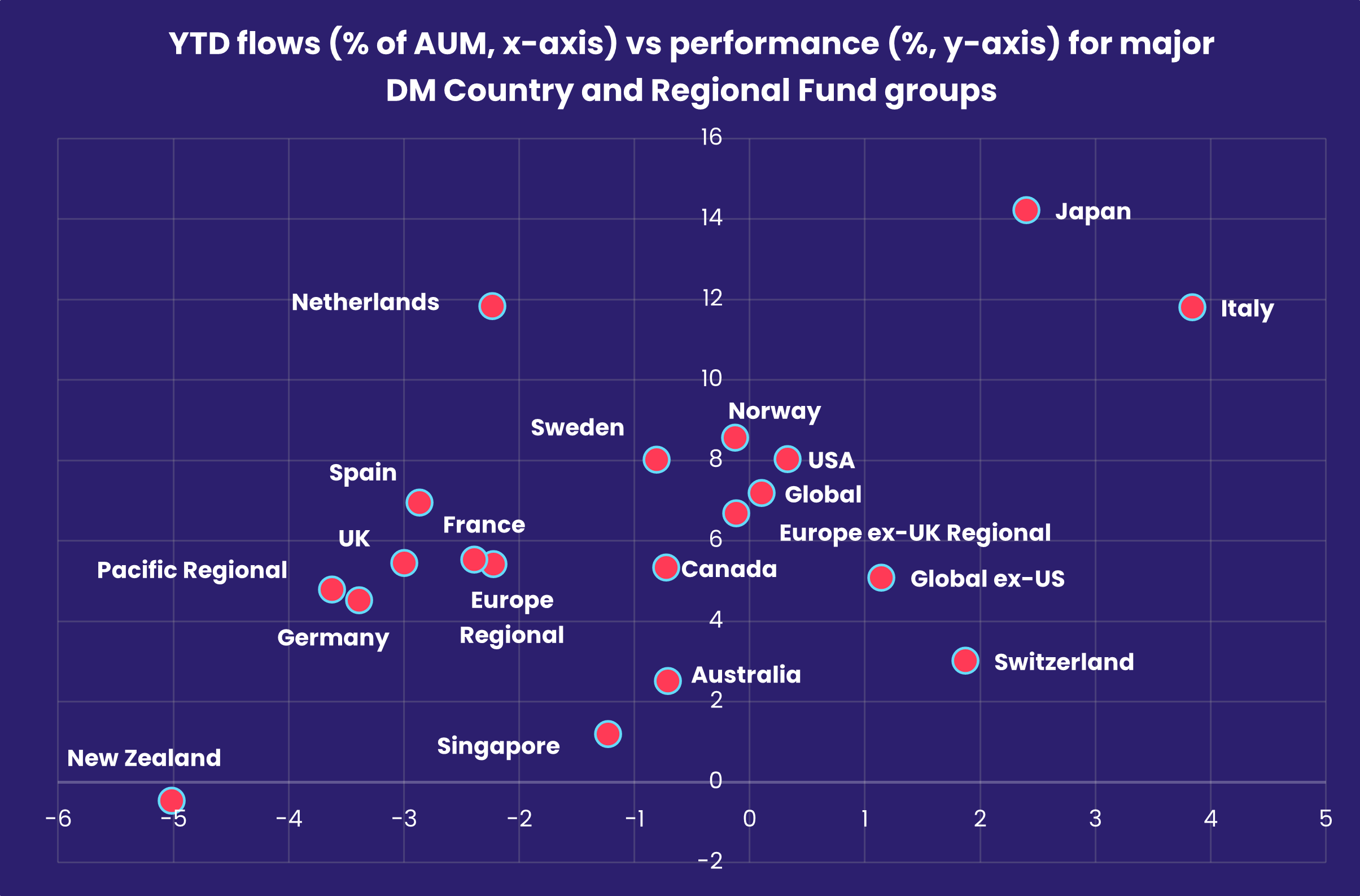

A better-than-expected 1Q24 corporate earnings season and a more optimistic view of interest rate trends in the US and Europe during the remainder of the year helped flows into EPFR-tracked Developed Markets Equity Funds climb to an eight-week high in early May, with all the major groups except Canada and Pacific Regional Equity Funds recording inflows that ranged from $50 million to $9.1 billion.

Japan Equity Funds, which have delivered the best relative combination of positive flows and performance among the major DM groups year-to-date, chalked up their 16th inflow of 2014. Redemptions from foreign domiciled funds did, however, jump to a 17-week high and outflows from retail share classes hit their highest level since mid-January.

Flows to US Equity Funds favored those with large cap mandates during a week when investors were digesting share buyback announcements from technology mega caps Apple and Alphabet totaling $180 billion. US Dividend Funds posted their biggest inflow since early March but funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest outflow streak since 3Q16.

Hopes for easier monetary conditions in Europe got another boost when Sweden’s central bank followed the Swiss National Bank in kicking off an easing cycle with a 25-basis point cut. Europe Equity Funds posted back-to-back inflows for the first time since the final week of January 2023 as flows into Europe ex-UK Regional and Sweden Equity Funds hit 118 and 182-week highs, respectively.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, posted consecutive retail share class inflows for the first time in over 13 months.

Global sector, Industry and Precious Metals Funds

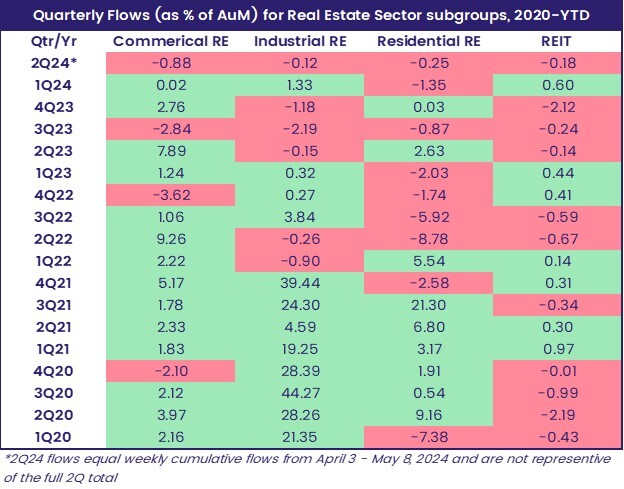

After several weeks where the number of EPFR-tracked Sector Fund groups reporting inflows was stuck at three, the first week of May saw that number jump to five. The inflows ranged from $15 million for Infrastructure Sector Funds to $445 million for Financials Sector Funds. On the other hand, two groups – Real Estate and Technology Sector Funds – saw redemptions escalate to over $1.1 billion.

In the case of Real Estate Sector Funds, they suffered their heaviest outflow in nearly two years and extended their current run of redemptions to five weeks and nearly $3 billion. It was also the group’s third outflow above the $1 billion mark since early November. Despite offering a more liquid option within this universe, REIT Funds recorded their fifth outflow of the past six weeks. Residential and Commercial RE Funds, which both have a total AuM of roughly $2 billion, and Industrial RE Funds with $5.5 billion in assets have all seen flows trail off since late 2021 or early 2022.

Investors also pulled over $1 billion from Technology Sector Funds, nearly reversing what flowed in over the past three weeks. Of the top 10 funds reporting outflows, two semiconductor-mandated funds accounted for over $700 million, seven others saw redemptions above $100 million, eight were ETFs, and two were tied to AI or the artificial intelligent giant, Nvidia. Semiconductor Funds snapped a five-week streak of inflows (their second and largest outflow since the end of February), while Cybersecurity and Internet Funds recorded their ninth and 10th straight outflows, respectively.

Earnings results from major US banks have highlighted “healthy” or even “strong” spending habits, Reynolds Consumer Products reported strong growth this past week, and results from Walmart and Home Depot are on the horizon. Against that backdrop, flows into Consumer Goods Sector Funds brought an end to their nine-week outflow streak that cost the group $4.6 billion.

With a single US staples-focused ETF guiding the headline number this week, US Consumer Goods Sector Funds brought in over $330 million, their first inflow in six weeks, while Global and Asia ex-Japan Consumer Goods dragged the overall headline number down by $100 million each. For the latter group, they recorded their 37th outflow of the past 40 weeks.

Financials Sector Funds returned to positive territory with their fifth inflow of the past six seven weeks as a single ETF pulled in over half a billion. Lagging behind, a subgroup of funds with “bank or banking” in their name reported their second outflow of the past three weeks, and 18th of the past 21 weeks.

Bond and other Fixed Income Funds

A week that included a rate cut by Sweden’s central bank and a decently supported auction of 10-year US Treasuries ended with net flows into EPFR-tracked Bond Funds hitting their highest total since the first week of 3Q21. Year-to-date flows now stand $294 billion versus $178 billion for the comparable period last year and $376 billion for all of 2023.

The week ending May 8 saw the biggest flow into US Bond Funds in over 13 quarters, a 27th consecutive inflow for Europe Bond Funds and the 18th inflow so far this year for Global Bond Funds.

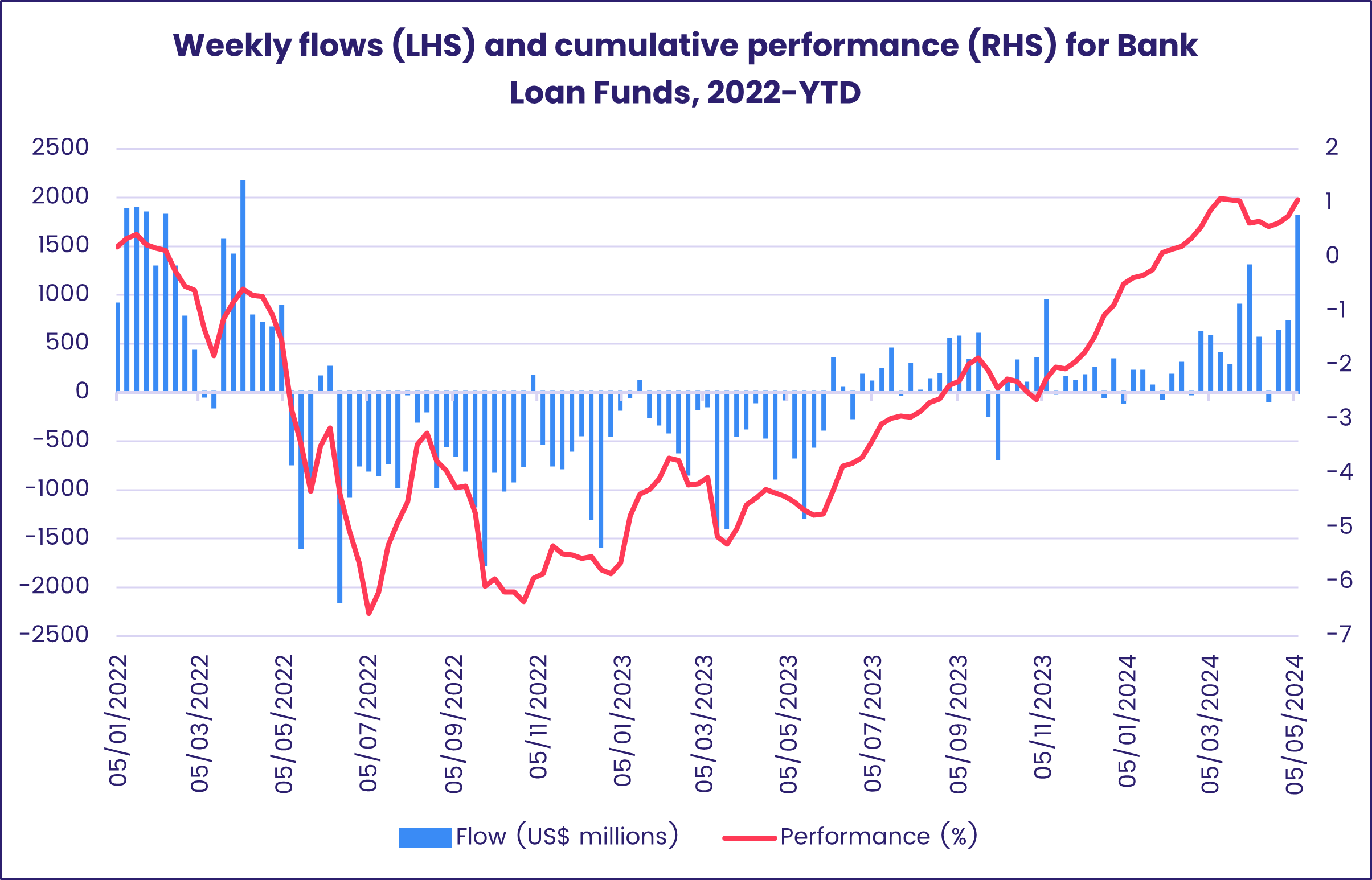

At the asset class level, a desire to lock in current yields helped flows into High Yield Bond Funds hit a six-month high and Bank Loan Funds post their biggest inflow since early 2Q22. Municipal and Mortgage Backed Bond Funds also attracted above average amounts of fresh money and flows to Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates bounced back from their biggest outflow in over a year.

The willingness to take on risk for yield did not extend to most emerging markets asset classes. Emerging Markets Bond Funds racked up their third straight outflow and 12th over the past three months. European domiciled funds, which have only posted two inflows so far this year, again bore the brunt of the redemptions while those based in the US chalked up their fifth inflow quarter-to-date.

US Bond Funds shrugged off a fourth week of retail outflows since mid-April as flows into funds with corporate mandates climbed to a 17-week high. Funds dedicated to short, intermediate and long-term debt all recorded solid inflows. Leveraged US Bond Funds attracted fresh money for the seventh straight week.

Country-mandated funds shaped the headline number for Europe Bond Funds, with over $600 million flowing into Switzerland Bond Funds while investors pulled over $200 million out of Germany, Denmark and Spain Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.