The final week of March saw Russia’s invasion of Ukraine head into its sixth week. But investors appear increasingly comfortable with the idea that it is predominantly a European problem, that its short-term impact on energy prices will be blunted by higher production outside Russia and the end of winter in the northern hemisphere, and that the stalling of Russia’s advance makes a settlement of the conflict increasingly likely.

Flows to EPFR-tracked fund groups reflected this less defensive outlook. High Yield Bond Funds posted their first inflow since the first week of January and biggest since early November, Emerging Market Equity Funds snapped their modest outflow streak, flows into Global Bond Funds hit an 11-week high and investors committed over $3 billion to Technology Sector Funds.

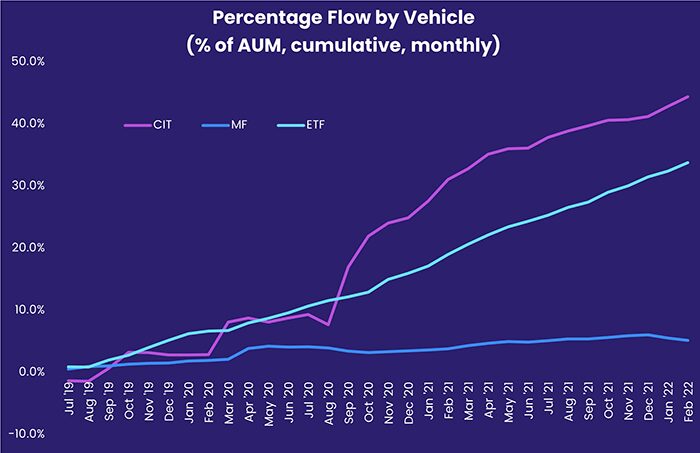

A greater willingness to stretch for yield did not distract mutual fund investors from their pursuit of lower costs. Collective Investment Trusts (CITs), pooled investment vehicles that are not regulated by the SEC and have smaller compliance burdens that allow them to charge lower fees, continue to see money pour in. Actively managed Equity Funds, meanwhile, have seen over $30 billion redeemed year-to-date while lower cost Equity Exchange Traded Funds (ETFs) have absorbed $206 billion.

Overall, a net $18.9 billion flowed into EPFR-tracked Equity Funds in the week ending March 30 while Bond Funds absorbed $6.2 billion, Balanced Funds $1.3 billion, Alternative Funds $2.4 billion and Money Market Funds $12.1 billion. Japan Money Market Funds ended the first quarter with their largest inflow year-to-date and Europe MM Funds with their 10th outflow in the past 13 weeks.

At the single country and asset class fund levels, Convertible and Mortgaged-Backed Bond Funds both recorded their 19th consecutive outflow, Total Return Bond Funds extended their longest redemption streak since 4Q18, Dividend Equity Funds chalked up their 12th weekly inflow of the quarter and flows into Cryptocurrency Funds climbed to a 22-week high. Canada Bond Funds chalked up their biggest inflow since 4Q15, Japan Bond Fund their biggest outflow since 1Q21 and New Zealand Equity Funds their biggest inflow since 2Q21.

Did you find this useful? Get our EPFR Insights delivered to your inbox.