Russia’s assault on Ukraine, which started on Feb. 24, sent investors scrambling for cover while they adjusted to the rapidly changing outlook for energy and financial markets, global supply chains and the security of Europe. Going into March they pulled record-setting sums out of Europe Equity Funds, extended Europe Bond Funds longest outflow streak since 4Q18 and redeemed more than $5 billion from Europe Money Market Funds.

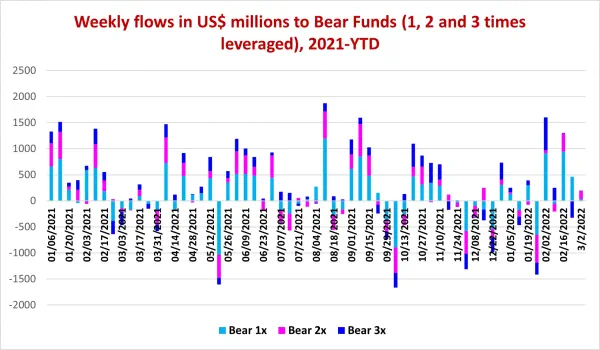

With Federal Reserve policymakers expected to kick off a new tightening cycle in less than two weeks, there was no rush into US Equity and Bond Funds. Instead, investors steered money into funds dedicated to Japanese and Greater Chinese equity, gold, energy and commodities plays and alternative asset classes. Leveraged Bear Funds, which give investors the opportunity to profit from falling markets, posted modest inflows.

Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their first collective outflow since mid-3Q20 and their largest since EPFR started tracking them in 2005.

Overall, the week ending March saw EPFR-tracked Alternative Funds take in a net $3.7 billion – their biggest inflow since 3Q20 — and Money Market Funds absorb a net $46.3 billion. Investors removed $2.9 billion from Balanced Funds, $4.9 billion from Equity Funds and $10.5 billion from Bond Funds.

At the single country and asset class fund levels, Municipal Bond Funds posted their biggest weekly outflow since late 1Q20, Mortgage-Backed Bond Funds extended their longest redemption streak since a 38-week run ended in 1Q14 and flows into Inflation Protected Bond Funds climbed to an eight-week high. Redemptions from Romania Bond Funds were the largest in over 23 months, outflows from Italy Equity Funds hit a 105-week high and investors pulled money out of UK Equity Funds for the 22nd time in the past 24 weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.