In mid-June, markets got what they had been hoping for. The US Federal Reserve paused its rate hiking cycle and China’s central bank moved, albeit cautiously, to boost a flagging post-lockdown recovery. But investors, after a brief burst of optimism, signaled that they want more. During the third week of June, both US and China Equity Funds posted outflows, Technology Sector Funds posted their biggest outflow since the second week of April, and towards the end of the reporting period flows to US liquidity funds began to pick up again.

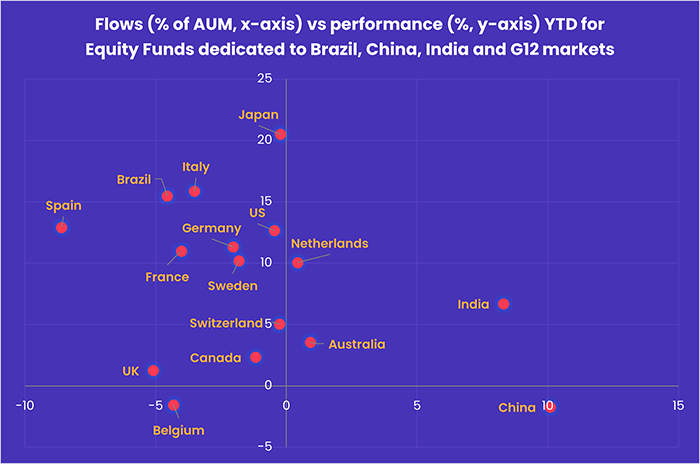

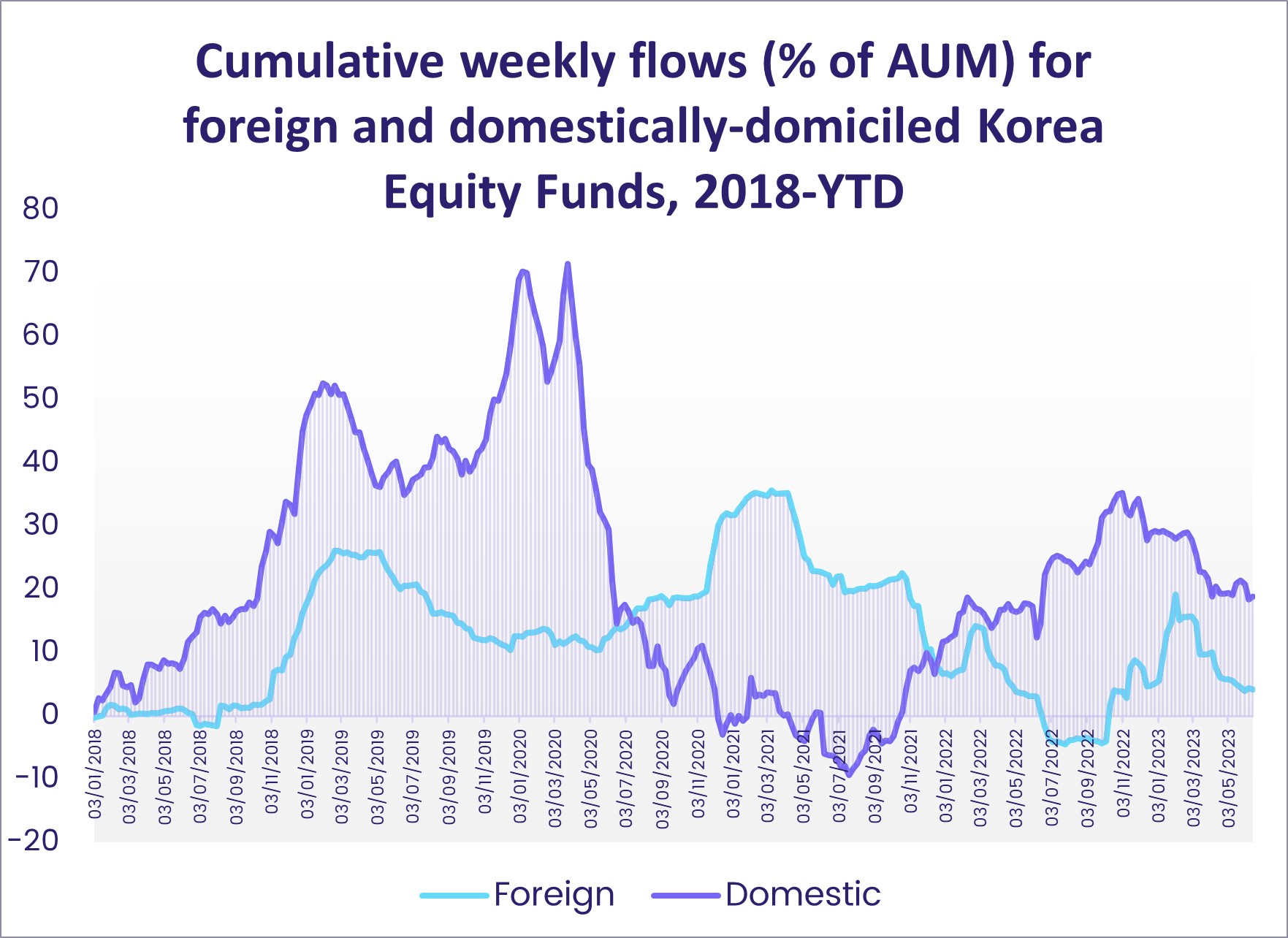

Disappointed with the modest nature of China’s measures, and fearful the Fed will resume hiking rates later this year, equity investors turned their attention to Asia’s second, third and fourth largest economies. Flows into Japan Equity Funds climbed to a 13-week high while India Equity Funds extended their longest inflow streak since 1H17 and Korea Equity Funds took in over $1 billion.

Overall, the week ending June 21 saw a net $5.4 billion flow into all EPFR-tracked Bond Funds and $4.9 billion flow out of Equity Funds. Investors also pulled $398 million out of Alternative Funds, $3.2 billion from Balanced Funds and $13.8 billion from Money Market Funds.

At the single country and asset class fund level, flows into New Zealand Equity Funds hit a 42-week high and Italy Bond Funds posted their biggest inflow since 2Q21 while redemptions from Spain Equity Funds climbed to a level last seen in late 1Q20. Gold Funds experienced their heaviest redemptions in over four months, Municipal Bond Funds posted their biggest inflow since mid-January, Inflation Protected Bond Funds extended their record-setting outflow streak and Convertible Bond Funds posted their 22nd outflow in the 25 weeks year-to-date.

Emerging markets equity funds

Disappointment that Chinese authorities have not deployed more economic stimulus hit flows to EPFR-tracked Emerging Markets Equity Funds during the third week of June. The group posted its sixth outflow year-to-date as redemptions from China Equity Funds jumped to an 18-week high and the diversified Global Emerging Markets (GEM) Equity Funds chalked up their fourth outflow in the past six weeks.

China’s central bank recently made modest cuts to its key lending rates, but investors are underwhelmed given the drags – high youth unemployment, fears of future lockdowns, a growing dependency ratio – on consumer spending. Concerns about a weaker-than-hoped-for rebound on the mainland also hit Taiwan (POC) Equity Funds, which posted their biggest outflow since 3Q21.

While funds dedicated to China struggled, both India and Korea Equity Funds enjoyed robust inflows. The former recorded their biggest weekly inflow since late 1Q18 while flows into Korea Equity Funds climbed to a one-year high as domestically domiciled funds absorbed over $1 billion.

While China’s latest policy steps did nothing for China Equity Funds, they added to the case for Latin America Equity Funds which recorded their biggest inflow in just over a year. Enthusiasm for Brazil has driven recent flows, with stronger demand for raw material exports, easing price pressures, pragmatic economic policymaking and better-than-expected GDP growth translating into over $600 million flowing into Brazil Equity Funds since the second week of May.

Investors again found little to like in the EMEA universe. South Africa Equity Funds eked out their fifth inflow since mid-January but Turkey Equity Funds posted their fourth consecutive outflow since President Recep Tayyip Erdogan won a third term in a runoff election. In a reversal of a key – and much criticized – policy of suppressing interest rates despite high inflation, Turkey’s central bank hiked its key rate by 6.5% the day after the latest reporting period ended on June 21.

Appetite for exposure to the riskiest emerging markets has increased in recent weeks. Flows into Frontier Markets Equity Funds hit a 19-week high as the group posted consecutive inflows for the first time since early April.

Developed markets equity funds

The specter of higher interest rates, which was briefly banished when the US Federal Reserve opted not to raise rates at its latest meeting, reasserted itself during the third week of June. Fed Chair Jerome Powell’s observation that the Fed “has more work to do” and another 0.5% hike by the Bank of England dulled investor appetite for US, Europe and Australia Equity Funds, resulting in the snapping of the longest inflow streak compiled by EPFR-tracked Developed Markets Equity Funds since 4Q22.

With the Bank of Japan even more the outlier when it comes to accommodative monetary policy, Japan Equity Funds absorbed fresh money for the third straight week – their longest since a seven-week run came to an end in mid-January. Both foreign and domestically domiciled funds took in over $1.2 billion and retail share classes recorded net inflows for the first time since the last week of March.

US Equity Funds experienced retail redemptions for the 18th time in the past 20 weeks as they posted their first outflow since the second half of May. US Dividend Equity Funds saw money flow out for the 10th time in the past 11 weeks, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their fifth inflow in the past six weeks and US Equity Collective Investment Trusts (CITs) posted their biggest outflow since the final week of January.

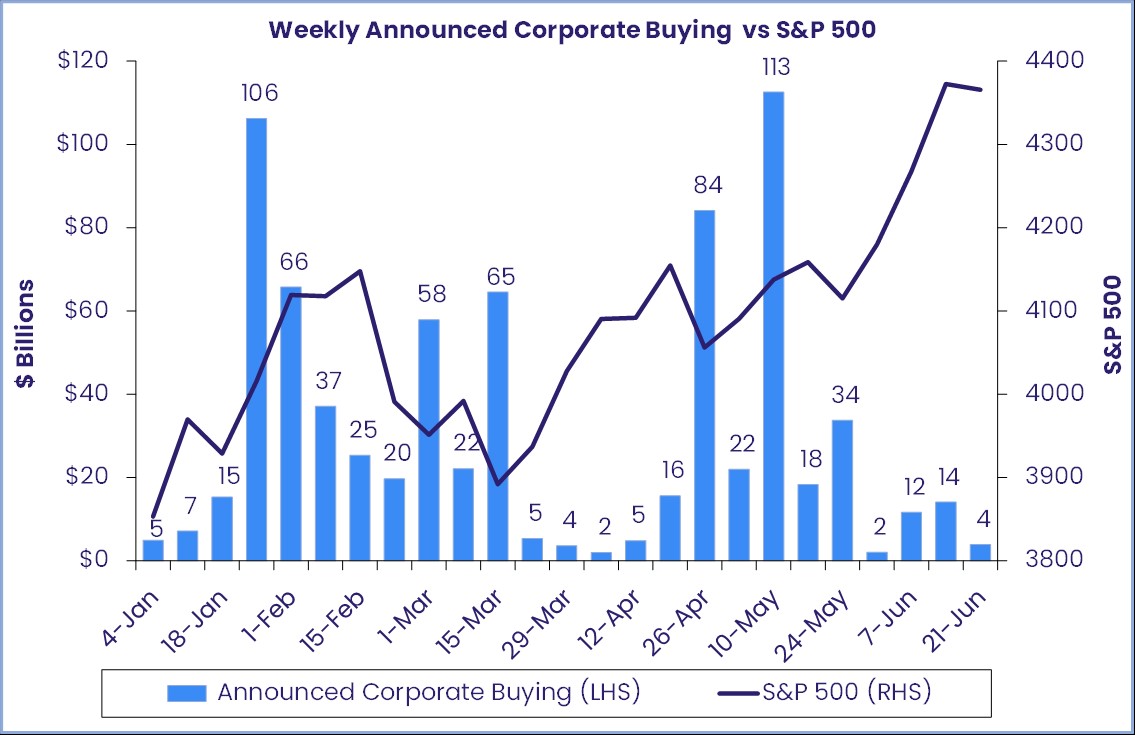

Research by EPFR Liquidity Analyst Winston Chua indicates a marked drop-off in corporate support for their own share prices. According to Chua, “Since the start of May, announced corporate buying (share buybacks and cash takeovers) of $217 billion is 4.4 times the $49.3 billion in new offerings, the lowest buy/sell ratio since December 2021.”

Europe Equity Funds racked up their 15th consecutive outflow as redemptions from Europe Dividend Funds hit their highest level since the third week of 3Q22 and Europe SRI/ESG Funds posted their 10th outflow in the past 11 weeks. Among the major groups by capitalization and style, only Mid Cap Growth and Small Cap Value Funds recorded an inflow while Large Cap Value Funds posted their biggest outflow since mid-3Q22.

At the country level, investors showed little appetite for any bit of the smallest markets. Flows into Ireland Equity Funds hit an 11-week high and Greece Equity Funds posted their 10th straight inflow. But investors pulled over $100 million out of Germany, UK, Switzerland, France and Spain Equity Funds. In the case of the latter, the week’s outflow was the largest in over three years.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, saw flows rebound with the bulk of the fresh money going to funds with ex-US mandates.

Global sector, industry and precious metals funds

The third week of June saw seven of the 11 major EPFR-tracked Sector Fund groups post an outflow as investors digested more interest rate hikes, tried to gauge the likelihood of further increases and positioned themselves for the upcoming corporate earnings season. Of the four recording an inflow, Financials Sector Funds topped the list.

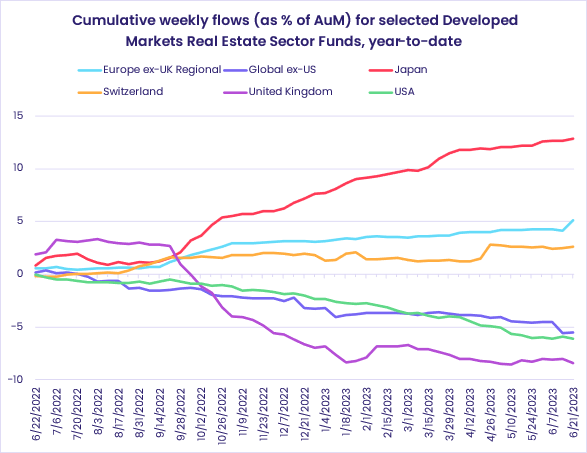

The week also saw the release of monthly data for May, when eight of the 11 groups reported outflows, five of which were multi-month highs: Real Estate (36-month), Commodities/Materials (10), Energy (10), Industrials (8), and Financials (8).

Technology Sector Funds, which ended May with their biggest monthly inflow since March 2022, ended the latest week with their biggest outflow in over two months. Inflows of roughly $800 million for Global Technology Sector Funds and the combined $180 million committed to Korea and Hong Kong (SAR) mandated funds were not nearly enough to offset the $2.2 billion and $588 million flowing out of US and China Technology Sector Funds, respectively.

Elsewhere, Real Estate Sector Funds recorded their third inflow of the past four weeks. The headline number included the biggest inflow since September 2020 for Europe ex-UK Regional Funds. while Switzerland and Japan Real Estate Sector Funds saw inflows reach eight and three-week highs.

Redemptions from Infrastructure Sector Funds increased for the fourth consecutive week as their current outflow streak hit 15 weeks and nearly $2 billion.

Bond and other fixed income funds

The week ending June 21 saw another $5 billion flow into EPFR-tracked Bond Funds as investors responded to decent yields, at least relatively to the past decade, and positioned themselves for capital gains when major central banks shift back to monetary easing.

That pivot is still in the future, with both the European Central Bank (ECB) and US Federal Reserve signaling more rate hikes to come and the Bank of England lifting its key rate by 50 basis points. That reversed the recent bump in risk appetite, with Emerging Markets and Bank Loan Bond Funds posting outflows and flows into High Yield Bond Funds coming in at 0.01% of the group’s AUM.

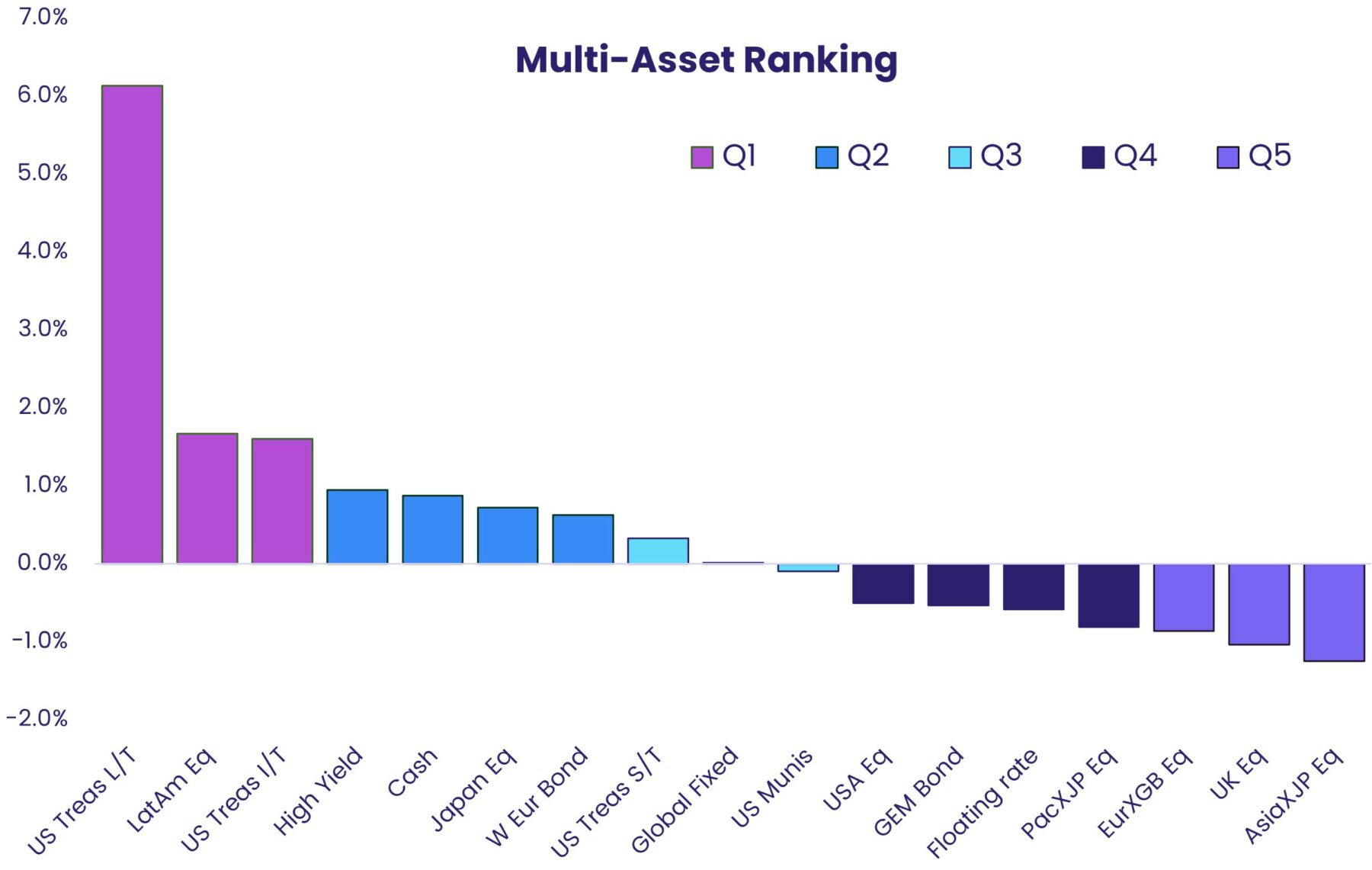

US debt retains some of its safe haven status, with US Bond Funds maintaining their record of posting inflows every week so far this year, with the vast majority of that new money going to funds with sovereign rather than corporate mandates. EPFR’s weekly multi-asset rankings currently have long and intermediate-term treasures in the top quintile.

Both Hard and Local Currency Emerging Markets Bond Funds posted modest outflows during the latest week despite some bullish forecasts for the asset class from investment banks and rate cuts by China and Hungary’s central banks. At the country level, appetite for Korean debt remains strong and flows into India Bond Funds have picked up but redemptions from Thailand Bond Funds jumped to a 57-week high as investors continue waiting for a new government to emerge from last month’s election.

Europe Bond Funds experienced net outflows for the first time in three months, with retail share classes taking their biggest hit since the third week of 3Q22, after recent interest rate hikes in the UK and Eurozone. Appetite for funds with sovereign and SRI/ESG mandates remains solid, with flows into Europe SRI/ESG Bond Funds hitting a 22-week high.

Solid flows into Australia Bond Funds, which extended their longest inflow streak on record, did not prevent Asia Pacific Bond Funds from posting a modest outflow overall. Investors pulled money out of Hong Kong (SAR) Bond Funds for the 24th straight week, with the latest outflow the biggest since 3Q21, and Japan Bond Funds also experienced net redemptions.

Did you find this useful? Get our EPFR Insights delivered to your inbox.