In this blog, EPFR’s Olivia Blaszkowski expands on a recent Bloomberg article, Long-Dated Treasury Futures Rally in Wake of Debt-Ceiling Accord.

View from EPFR

With the notable exceptions of China and Japan, G20 countries (and others) have spent the past 16 months raising interest rates to combat inflation. The article published by Bloomberg highlights that investors, with hopes of policy ‘pivots’ notwithstanding, anticipate at least one more hike by the US Federal Reserve. That hike, if it happens, will lead to opportunities in the treasuries futures market.

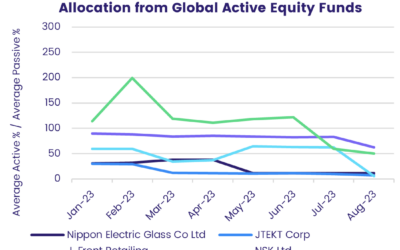

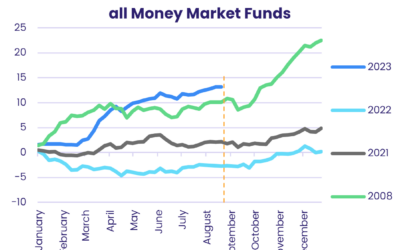

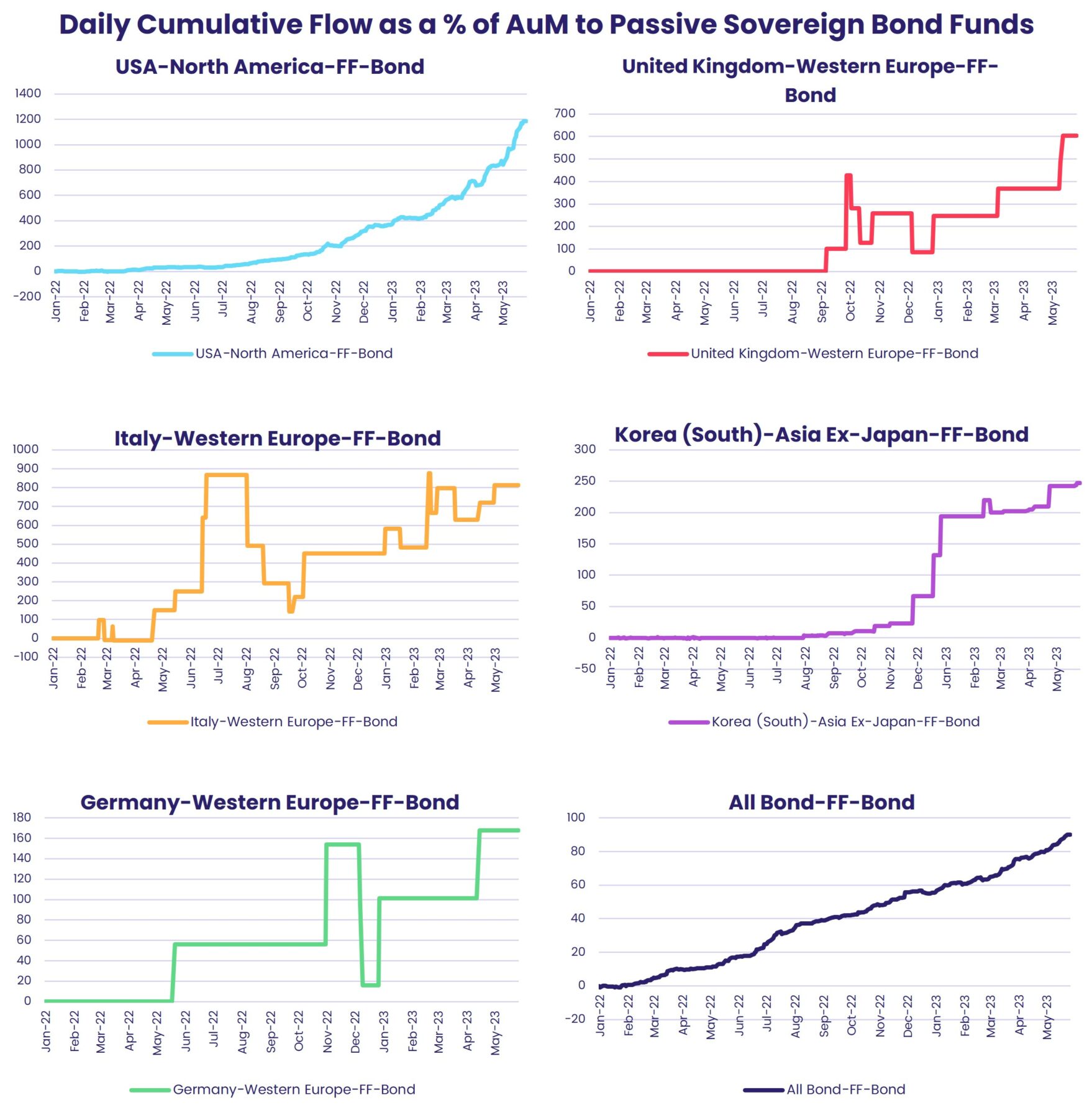

Using EPFRs daily fund flow data, we can apply leveraged filters to passively managed sovereign bond funds with a long duration (6+ years) to get a picture of investor expectations of rates, both overall and for individual G20 countries throughout 2022 and year-to-date.

Based on the above visual (top left-hand corner) showing percentage flow to all passively managed Sovereign Bond Funds, overall interest in these funds has yet to peak. By narrowing the focus to only those funds with a leverage tagging, net percentage flows are amplified by over 10x, confirming even higher interest – expressed through ETFs and mutual funds – in the treasuries and other sovereign debt futures markets.

Again, splitting our view of flows by those going into the fund groups dedicated to selected G20 countries, flows to these funds have increased since rate hikes began in 2022. Looking at more recent dates, flows to these individual asset classes do seem to be slowing down. However, flows to individual countries such the US and UK, show leveraged tagged sovereign bond funds still have momentum and account for the majority of net flows into this group of funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.