India sold its first sovereign “green” bonds on Wednesday, a debut that was well-received by the market. In this short Off the Wire piece, EPFR’s Steven Xinlei Shen will look at investor sentiment towards Developed Markets (DM) and Emerging Markets (EM) Equity and Bond Funds with SRI/ESG mandates, expanding on Financial Times’s article, India raises $1bn in maiden green bond.

View from EPFR

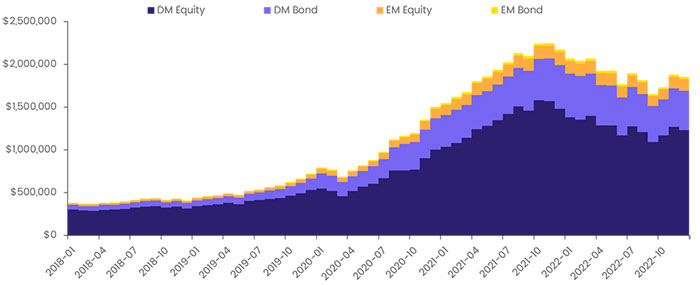

Recent years have seen a significant increase overall in the number of SRI/ESG funds, but the trajectory has differed for EM and DM funds. While the new trend is already proving to be significant for asset markets in developed countries, it has had less of an impact when it comes to emerging markets. At the end of last year, the total AuM – assets under management – for all Developed Markets Equity and Bond Funds with SRI/ESG focus stood at $1.7 trillion. For all Emerging Markets Equity and Bond SRI/ESG Funds the total combined AuM was $163 billion.

From a flow perspective (measured as percentage of total AuM), however, it is EM Bond Funds that catch the eye with flows over the past five years a whopping 737% of their AUM on January 1, 2018. The other three asset classes are neck and neck in relative terms.

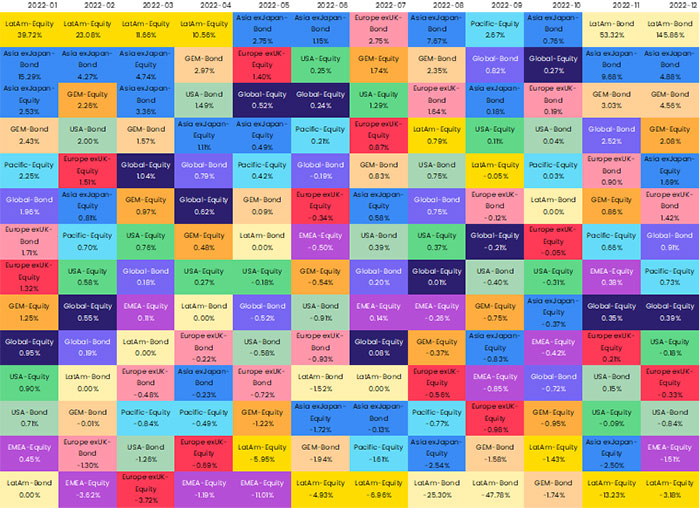

Investors have a clear preference for SRI/ESG focused bond funds. The fund flows quilt on the following page includes major asset class fund groups with SRI/ESG focus ranked by flows as percentage of AuM on a monthly basis. It seems SRI/ESG Bond Funds, especially funds with an Emerging Markets geographic mandate are climbing up the ranking. According to monthly data as of Dec 2022, Latin America, Asia ex-Japan and GEM SRI/ESG Bond Funds rank one, two and three among the asset classes.

Did you find this useful? Get our EPFR Insights delivered to your inbox.