Explore these questions and more in the Off the Wire below by EPFR Quant Analyst Vikram Srimurthy, reflecting on The Wall Street Journal article, ‘Japan’s 10-Year Government Bond Yield Breaches New Cap’.

View from EPFR

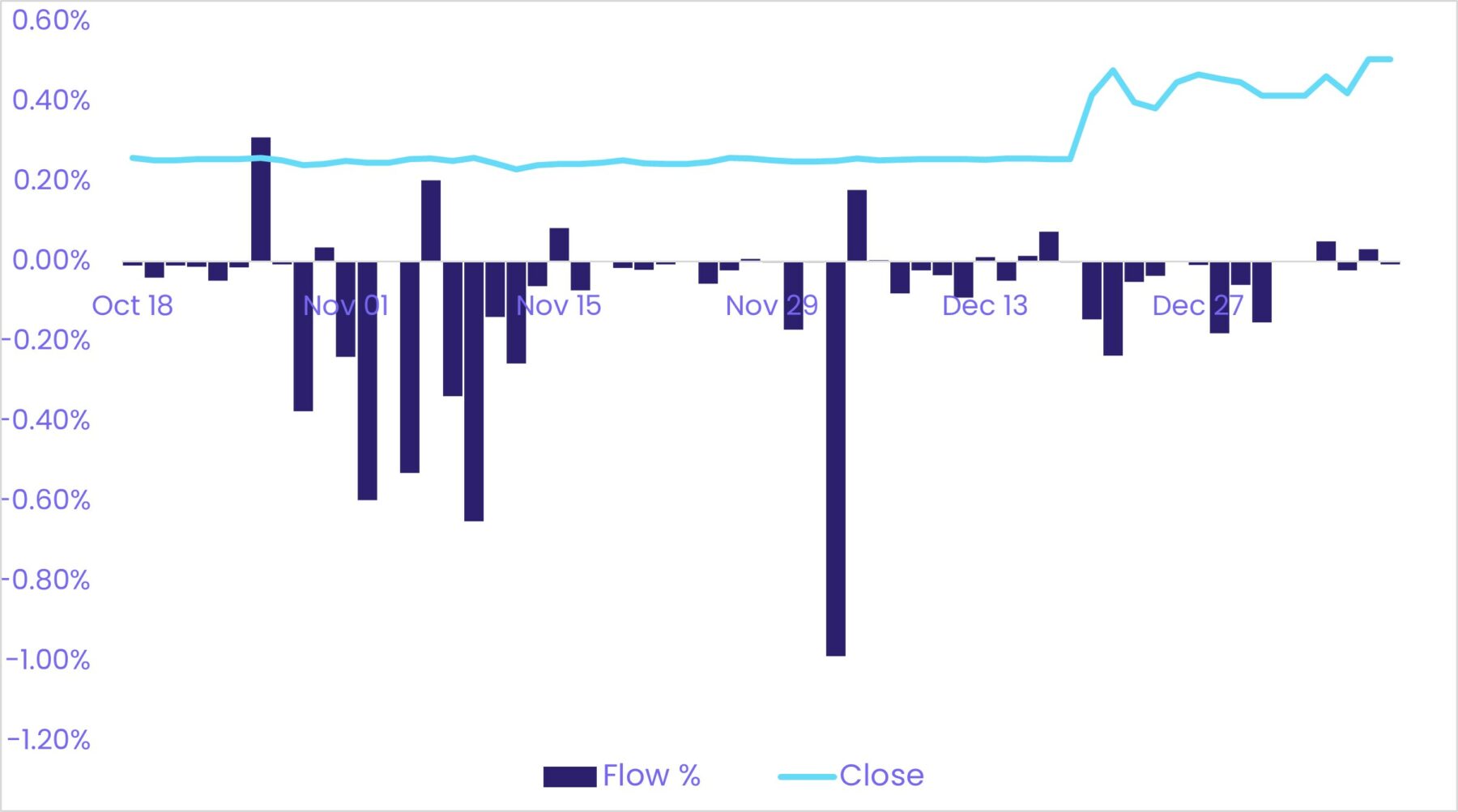

Yields on the 10-year Japan Government Bond first ticked up over 50 bps in December of last year and have remained elevated ever since. In anticipation, money has fled long-dated Japanese government bonds. EPFR defines long-term bonds as funds that primarily invest in bonds with a 6+ year duration. Thus, the 10-year Japan Govt. Bond falls into the bucket of Long-term Japan Bond Funds tracked by EPFR, allowing us to gauge investor sentiment for this group of funds.

The chart above shows daily yield (close) of the 10-year Japan Govt. Bond as a line while the bars indicate daily flows, expressed as a percentage of assets, into Japan-focused Long-Term (LT) Government Bond Funds. As you can see from the chart, investors have been pulling money from Japan-focused LT Govt. Bond Funds since November.

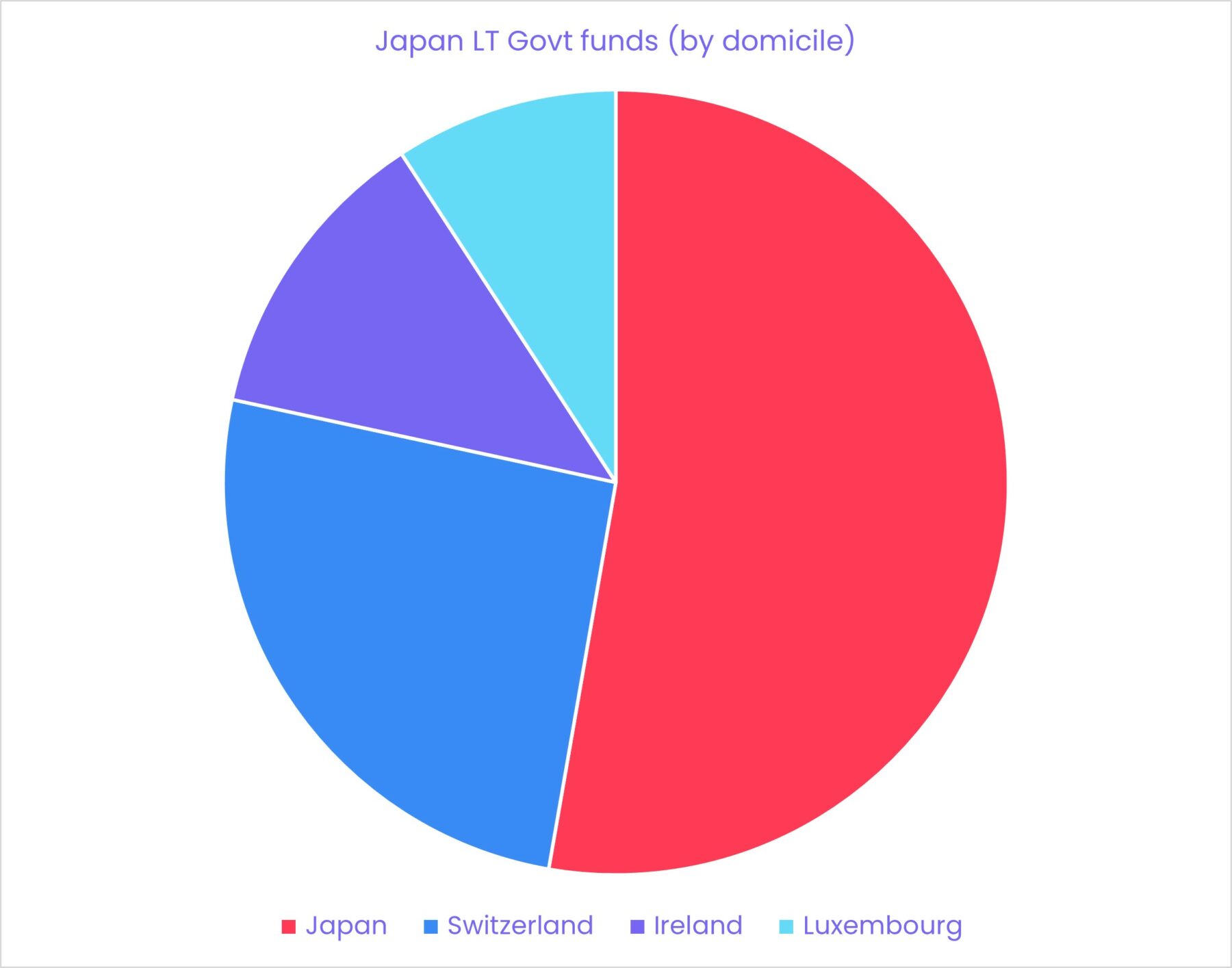

But where might this money go? To answer this we first asked, “Who is the investor?” The chart on the following page shows Japan-focused LT Govt. Bond Funds by domicile. Over half the assets were Japanese.

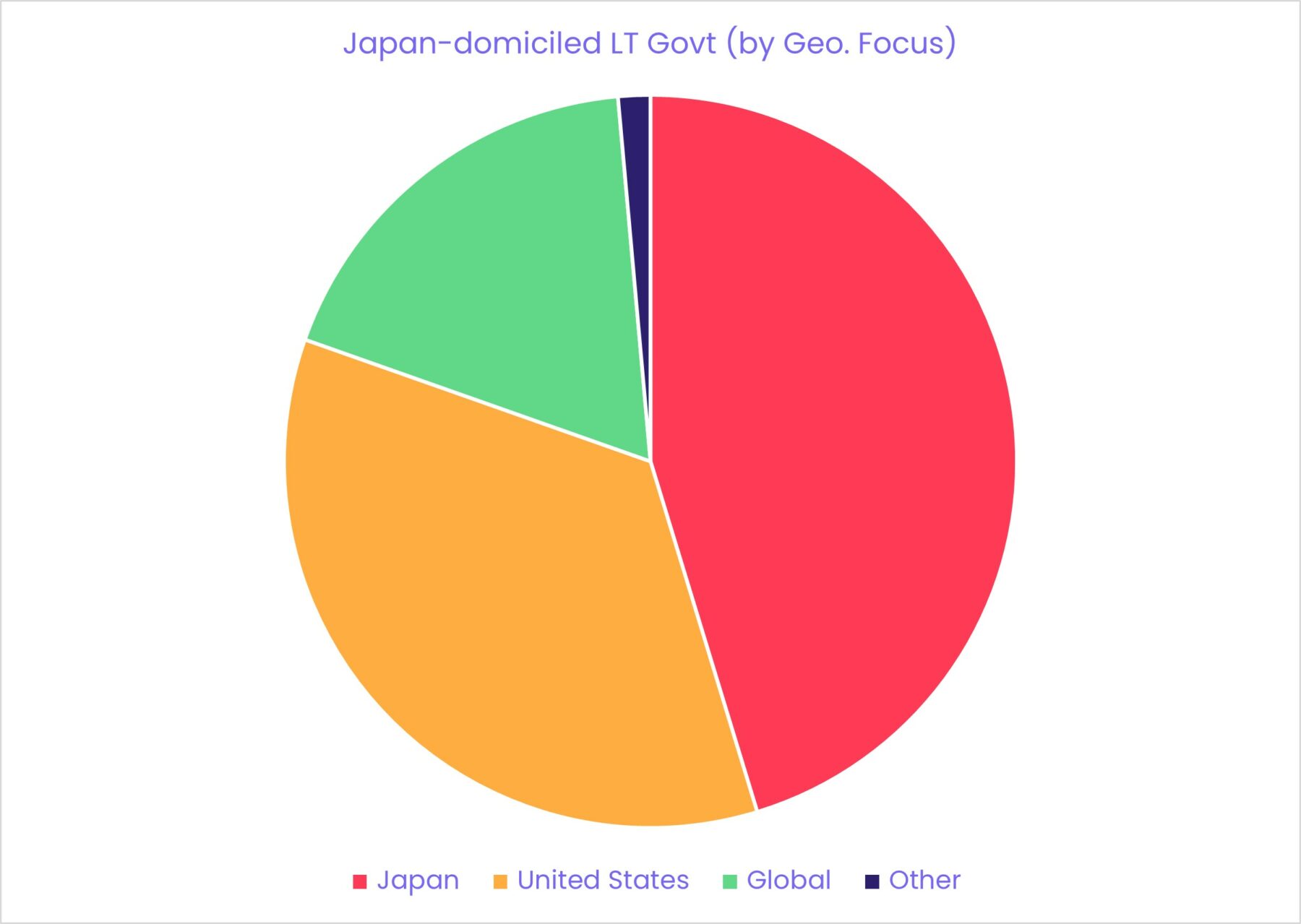

We then looked at where these Japan-focused LT Govt. Bond Fund investors tended to park their money by breaking down the Japan-domiciled Long-term Govt. Bond Funds even further by Geo-Focus (chart below).

As the chart implies, when not investing in Japan, these Japan-domiciled LT Govt. Bond Fund investors mostly tend to stick to U.S. and Global funds. Should we look out for inflows into these regions? That might be a good bet.

Did you find this useful? Get our EPFR Insights delivered to your inbox.