As we highlighted in the previous post, one of the few investment vehicles likely to profit from the recent Covid-19 rout of European asset markets are hedge funds with short positions.

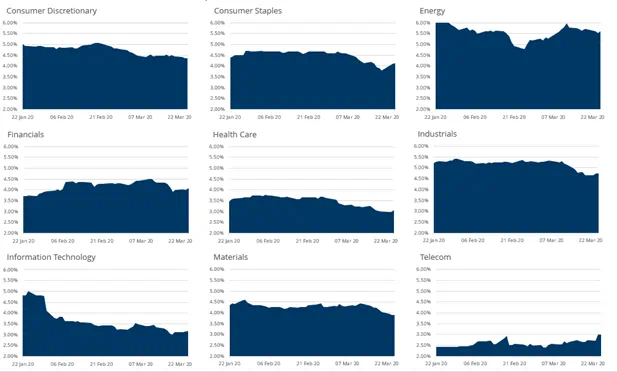

Analyzing data produced by Caretta Research, a surprising pattern has emerged up in the aggregate short positioning on European stocks. The total short positions, which one would expect to increase in this environment as earnings forecasts are being downgraded, is decreasing. The total short positions, as a percentage of total shares outstanding, has dropped from 4.5% on 20 February to 4.1% on 25 March. Moreover, out of eight sectors, seven saw a decrease in the shorted average total shares numbers during the last month.

European Financials were the only sector where the Caretta-tracked hedge funds tended to add to their short positions. Considering the volatility in the market, and the expected reduction in revenues and earnings going forward in areas like European industrials and consumer plays, this shows that not all price actions were related to the change in fundamentals.

Looking at Figure-1, one can see the reduction in short positions in Industrials and Consumer sectors came after March 12 – where the market had bottomed. Arguably this reflects a tendency by hedge fund managers to take profits. A similar pattern was seen mid-February with energy stocks. But, in that instance, hedge fund managers switched course and added short positions as the outlook worsened.

Figure -1 : Evolution of average short positions as % of total shares of outstanding 22.01 and 25

Looking at trends in short positions provides valuable insights into hedge funds managers’ view of the current equity market conditions in Europe. Caretta data opens this window to investors on a daily basis at both at the manager and security level. In future posts, we will continue to analyze Caretta’s manager level data for both European and Asian equities in order to capitalize on the trends that data reveals.

Did you find this useful? Get our EPFR Insights delivered to your inbox.