Insights

Proprietary market data and analysis

Quant Insights

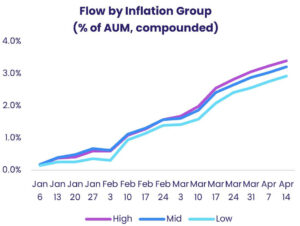

Quants Corner – Getting ready for the ‘transitory’ guest

The US Federal Reserve believes the recent gains made by inflation will be temporary, and that the headline rate will be at or around its 2% level...

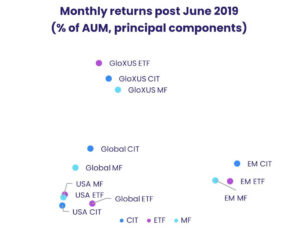

Collective investment trusts: The latest wrinkle in fund time

EPFR currently tracks over 133,400 shares classes offered by mutual, ETF, hedge funds and other vehicles that encompass over $46 trillion worth of...

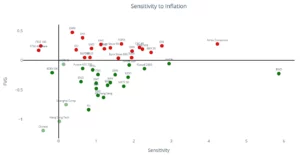

Quants Corner – Inflation, real yields and the million dollar question

Austrian equities look an efficient choice given the dilemma facing investors today. Empirical analysis shows they benefit from rising...

Economist Insights

Risk appetite climbs in early July

With US inflation behaving itself, French and British elections in the rearview mirror and another corporate earnings season that is expected to...

At the halfway point, glass half full

Investors spent the first few days of the third quarter trying to link the potential outcomes of snap elections in the UK and France, and shifts in...

First outflow in 10 weeks for US Equity Funds

Last week, investors homed in on recent data showing labor markets easing and price growth moderating and boosted flows to US Equity and Bond Funds....

Multimedia

Market Insights: Money market

As we head into Q2 2023, EPFR’s iMoneyNet team shares key trends we’re seeing on asset allocation, yields and maturities for money market...

Weekly fund flows highlights – 17th April 2023

Kirsten Longbottom, Research Associate at EPFR, is in charge of delivering our fund flows highlights this week. Using our Fund Flows and Allocations...

Weekly fund flows highlights – 10th April 2023

Join EPFR’s Steve Muzzlewhite for his weekly investor sentiment update. This week, we cover equity fund flows, bond flows and money market...

Papers

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.