The first week of December saw US Money Market Funds absorb another $69 billion, lifting their year-to-date total past the $1.2 trillion mark, while flows into US Equity Funds continued to lose momentum and US Bond Funds posted only their second weekly outflow of 2023.

After three weeks where flows heavily favored US-mandated funds, investors cast a slightly wider net in early December. Emerging Markets Equity Funds posted their first collective inflow since early October, flows into Australia Equity Funds hit a 48-week high and Europe Equity Funds again came close to snapping an outflow streak stretching back to early March.

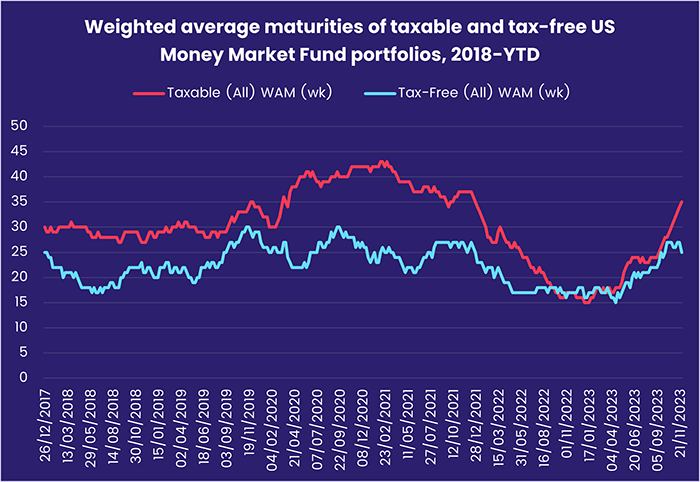

In addition to absorbing large inflows, US Money Market Funds have been increasing the duration of their holdings. Recent data from EPFR’s iMoneyNet group shows the average weighted maturity for taxable funds is at its highest level in nearly a year as average yields hold around 5%.

Overall, a net $93.2 billion flowed into all EPFR-tracked Money Market Funds during the week ending Dec. 6, with flows into Europe MM Funds the third largest year-to-date, while Equity Funds absorbed $6.1 billion and Bond Funds $51 million. Investors pulled $2.8 billion out of Balanced Funds and $986 million from Alternative Funds.

At the asset class and single country fund levels, Physical Gold Funds recorded their 25th outflow since the final week of May and Silver Funds their seventh in the past eight weeks, redemptions from Municipal Bond Funds hit a 10-week high and Inflation Protected Bond Funds posted their biggest outflow since early May. Portugal Equity Funds chalked up their 20th inflow over the past 25 weeks, money flowed out of China Bond Funds for the 15th consecutive week and Greece Bond Funds experienced their heaviest redemptions since late 1Q20.

Emerging markets equity funds

A pick-up in flows to China Equity Funds during the first week of December helped EPFR-tracked Emerging Markets Equity Funds snap their longest outflow streak since 1H20. The collective inflow came despite further redemptions from retail share classes and the 17th outflow from the diversified Global Emerging Markets (GEM) Equity Funds over the past four months.

The latest week also saw flows into Leveraged EM Equity Funds hit a five-week high and Emerging Markets Dividend Funds extend an inflow streak stretching back to early August.

Flows into dedicated China Equity Funds climbed to an 11-week high during a week when major ratings agency Moody’s lowered its outlook on China’s A1 rating from stable to negative. The bulk of this new money was absorbed by the institutional share classes of domestically domiciled funds. Investors also steered over $500 million – a 12-week high – into India Equity Funds as they extended their record-setting inflow streak, and committed fresh money to Taiwan (POC) Equity Funds for the 16th time in the past 18 weeks.

Despite the generally positive flows to China and Greater China fund groups this year, modeling by EPFR partner Quant Insight currently ranks futures indexes dedicated to Chinese and Hong Kong equity as the three most undervalued.

Latin America Equity Funds extended their recent run of inflows as Argentina Equity Funds posted their biggest inflow since the third week of 2018, while Brazil and Mexico Equity Funds added to their longest run of inflows since this summer and last summer, respectively. Over the weekend, the chainsaw-wielding Javier Milei assumed the presidency of Argentina and started to flesh out what he had promised would be a radical overhaul of Argentina’s economic policies.

Money continued to out of EMEA Equity Funds as conflicts complicate the outlooks for the Middle East and central Europe and Africa, which has seen military coups in Gabon and Niger this year, remains unappealing for many investors. During the latest week, Africa Regional Equity Funds posted their biggest outflow in over 17 months and South Africa Equity Funds recorded their fourth outflow over the past six weeks.

Developed markets equity funds

With the benchmark S&P 500 index up some 5% over the past month and yields on 10-year US Treasuries dropping towards 4%, investors continued adding to their US exposure in early December. While Global, Europe, Japan, Canada and Pacific Regional Equity Funds all recorded outflows, US Equity Funds extended their current inflow streak to eight weeks and $64 billion.

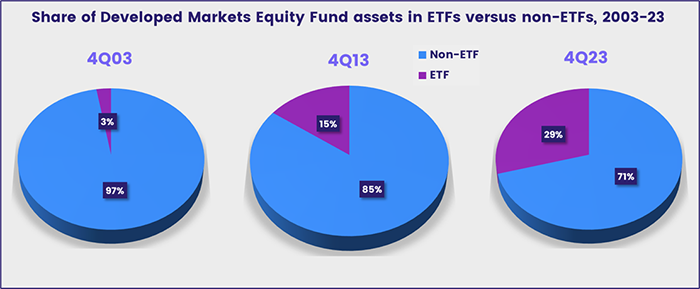

Flows for EPFR-tracked Developed Markets Equity Funds continue to favor ETFs over actively managed funds, with the latter last posting a collective outflow during the second week of January. Assets held by ETFs as a share of all DM Equity Fund assets are up over 1% year-to-date to over 29%.

Although US Equity Funds recorded another solid inflow, the headline number dropped for the third week running as redemptions from retail share classes jumped to a 51-week high, US Dividend Funds saw their brief run of inflows come to an end, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest outflow since the third week of March.

Australia Equity Funds were the other major Developed Markets Equity Fund group to post a significant inflow during the week ending Dec. 6, taking in over $400 million on the back of strong flows into a single domestically domiciled fund. Year-to-date, funds with mixed style mandates have absorbed the bulk of any fresh money while Australia Growth Funds saw 16% of the AUM redeemed between January and October.

Redemptions from Japan Equity Funds slowed but did not stop as both foreign and domestically domiciled funds posted outflows for the fourth straight week. Investors remain uncertain if and when the Bank of Japan will normalize its ultra-accommodative policy and how well Japan’s economy will cope if it does. The BOJ starts its final policy meeting of 2023 on Dec. 18.

Europe Equity Funds posted their 39th consecutive outflow as lackluster – or non-existent – growth in key markets, the ongoing conflict in Ukraine, historically high interest rates in the Eurozone and the recent electoral success of German and Dutch nationalists keep investors on edge. At the country level, Germany Equity Funds extended an outflow streak stretching back to mid-July and money flowed out of Italy Equity Funds for the 19th time in the past 22 weeks while France Equity Funds recorded their biggest inflow of the current quarter.

Global sector, industry and precious metals funds

With the third quarter corporate earnings season largely behind them, sector-oriented investors shifted their focus in early December to the year ahead. For the first time in four months, those investors committed fresh money to six of the 11 EPFR-tracked Sector Fund groups. For three of the six, inflows hit multi-week highs: Industrials, Consumer Goods, and Real Estate Sector Funds recorded their biggest inflows in 18, 20 and 79 weeks, respectively.

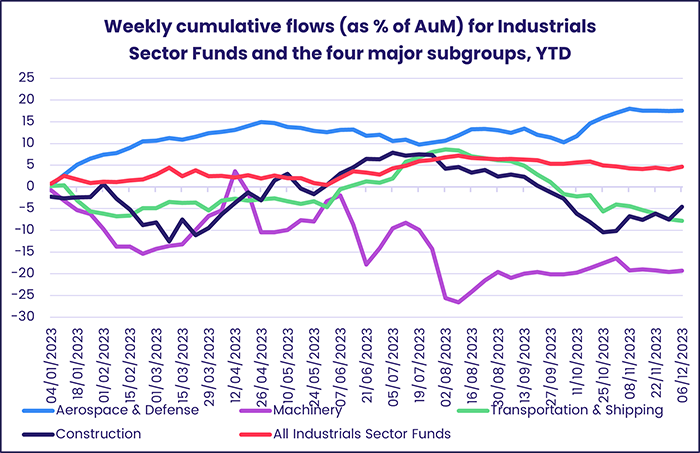

For the second time out of the past three weeks, US Industrials Sector Funds helped lift the headline number for the overall group into positive territory. Of the four major Industrials Sector Fund subgroups, Construction Funds have seen an uptick in interest recently, with the latest week’s inflow north of $100 million. Meanwhile, Aerospace & Defense Funds have seen flows flatten out in recent weeks compared to those in October.

US Technology Sector Funds saw their four-week inflow streak come to an end in early December. But that did not stop the overall group from posting inflows with $1 billion committed to China Technology Sector Funds (a 14-week high), $708 million to globally-mandated funds (24-week high), and $151 million for Hong Kong Technology Sector Funds (23-week high). Investors are also regaining their appetite for SRI/ESG Technology Sector Funds, which have seen four inflows in the past five weeks, with the latest the third largest inflow on record behind a $700 million inflow in October 2020 and close to $1.2 billion in March 2022.

Real Estate Sector Funds, meanwhile, saw flows into US-dedicated funds touch $1 billion, the ninth highest inflow on record and largest since the first week of 2022. Though that helped the group break a five-week outflow streak of nearly $2.5 billion, Global Real Estate Sector Funds brought the headline number down with their heaviest outflow in 29 weeks.

Despite US Banking Funds racking up their third inflow of the past four weeks, with year-to-date inflows reaching past $1.6 billion (or 17.4% of assets), Financials Sector Funds snapped a three-week inflow streak that brought in $2.5 billion as their year-to-date total fell below $7 billion (4.2% of assets).

Bond and other fixed income funds

Appetite for fixed income exposure dipped appreciably during the first week of December, with EPFR-tracked Bond Funds extending their current inflow streak by a fine margin. The week saw US Bond Funds post their second outflow of 2023 and biggest since late 2022, and Emerging Markets Bond Funds rack up their 19th straight outflow, while Canada, Europe and Global Bond Funds recorded inflows ranging from $668 million to $1.6 billion.

Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest weekly inflow since mid-February. These funds, which recorded only three weekly outflows during the first half of the year, have already posted seven outflows since the beginning of July.

At the asset class level, High Yield Bond Funds extended their longest run of inflows since late 4Q21, year-to-date redemptions from Inflation Protected Bond Funds climbed past the $34 billion mark, money flowed out of Convertible Bond Funds for the 22nd week running and Municipal Bond Funds recorded their biggest outflow since late September.

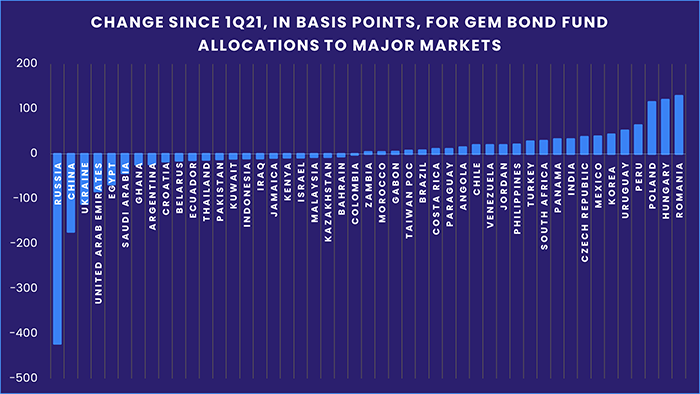

Investors pulled more money out of Emerging Markets Bond Funds in early December as downgrading of the outlook for Chinese debt and fears about the ability of hard currency EM corporate borrowers to weather higher for longer US interest rates weighed on investor sentiment. Redemptions from Emerging Markets Corporate Bond Funds hit their highest level since late 2Q22.

It was a different story for Europe Bond Corporate Funds, which attracted more new money than their sovereign counterparts for the fifth week running. In percentage of AUM terms, flows into Intermediate and Long Term Corporate Funds are running neck-in-neck. At the country level, flows into Switzerland Bond Funds climbed to a 27-week high and Denmark Bond Funds posted their second-largest inflow year-to-date while redemptions from Greece Bond Funds hit their highest weekly total in over three years.

The headline number for US Bond Funds was driven by redemptions from Long Term Corporate, Inflation Protected and Short Term Sovereign Bond Funds which came in at 10, 14 and 57-week highs, respectively.

Did you find this useful? Get our EPFR Insights delivered to your inbox.