Investors spent the first few days of the third quarter trying to link the potential outcomes of snap elections in the UK and France, and shifts in the American political landscape with the potential outcomes for those countries’ asset markets. It was an exercise that left them in a more cautious frame of mind than they had been for much of the second quarter.

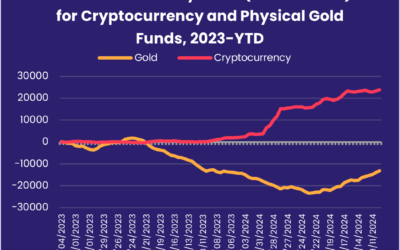

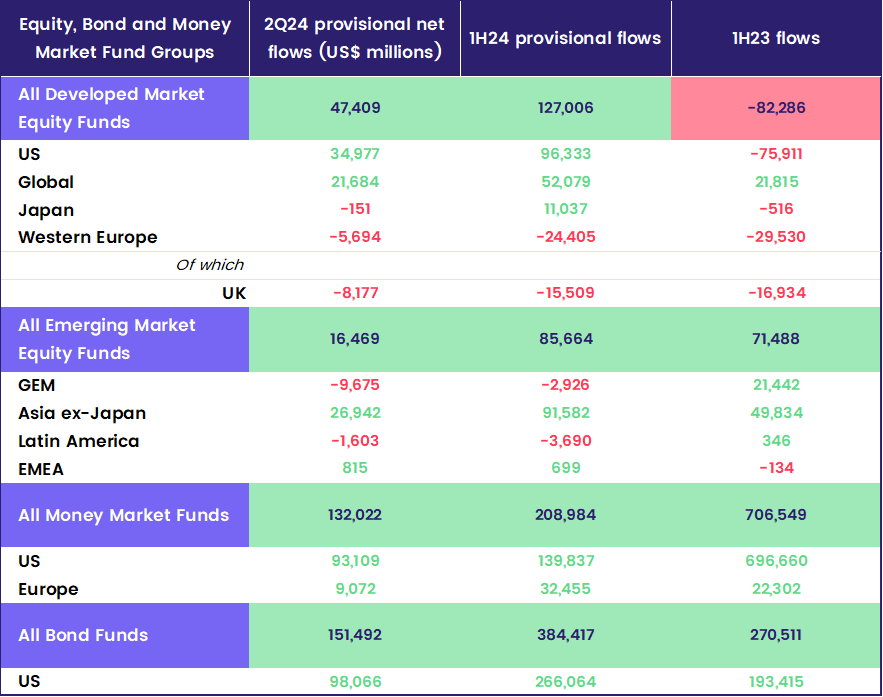

The period between April 1 and June 30 saw those investors recover the appetite for exposure to China, steer $3.4 billion and $8.7 billion into Cryptocurrency and Technology Sector Funds, respectively, and commit fresh money to High Yield Bond Funds for nine of the quarter’s 13 weeks.

During the latest week, however, physical Gold Funds absorbed fresh money for the sixth time during the past eight weeks, over $14 billion flowed into US Bond Funds and inflows to US Money Market Funds hit an eight-week high. Overall, EPFR-tracked Equity Funds absorbed $10.3 billion and Bond Funds $19 billion during the week ending July 3 while Alternative Funds took in $2.2 billion, Money Market Funds $51.8 billion and Balanced Funds posted their first inflow since early January.

Having posted 19 straight outflows between mid-December and mid-April, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted consecutive weekly inflows for only the second time so far this year.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds carried their five-week inflow streak into the third quarter. But this run continues to rest on solid appetite for the major Emerging Asian markets rather than broad enthusiasm for the asset class. The diversified Global Emerging Markets (GEM) Funds posted a sixth straight outflow, thereby extending their longest redemption streak since 4Q23.

Emerging Markets Dividend Funds remain popular, posting their 43rd inflow over the past 11 months, and Leveraged EM Equity Funds recorded their fifth inflow over the past six weeks.

China Equity Funds, which chalked up 11 outflows between late February and late May, posted their fifth consecutive inflow as investors responded to better export data and hopes that Chinese leaders will unveil more stimulus measures after the Central Committee’s Third Plenum policy gathering from July 15 to 18.

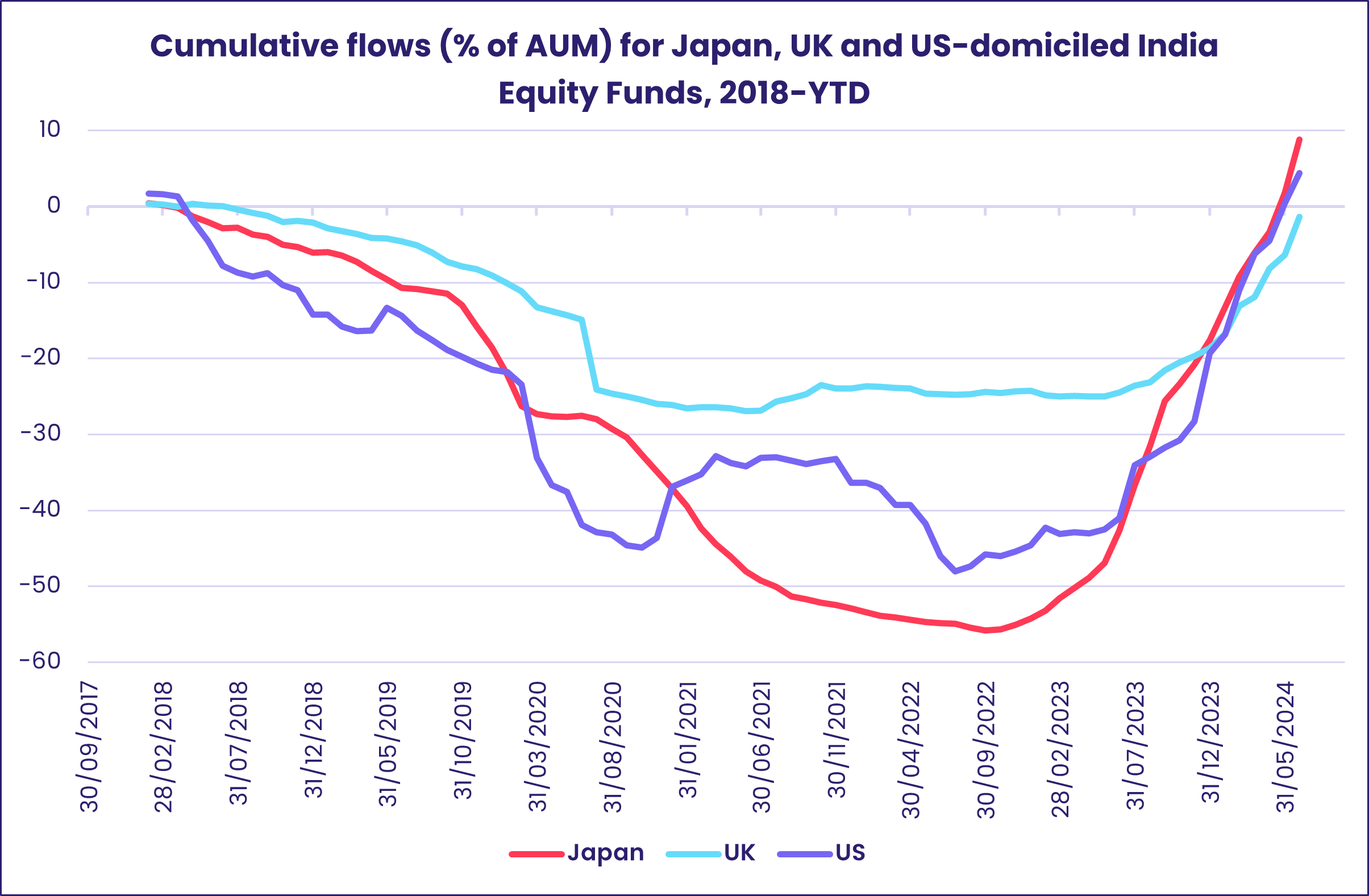

The week ending July 3 saw India key technology index, the Nifty 50, hit a fresh record high and India Equity Funds extend an inflow streak stretching back to late 1Q23. But the latest week’s total was less than a fifth of the previous week’s headline number. Foreign appetite for Indian equity has soared in some developed markets, with Japan, US and UK-domiciled India Equity Funds all seeing inflows accelerate.

Latin America Equity Funds saw outflows jump to a nine-week high as Argentina’s reform story runs out of steam, low copper prices weigh on Chile’s economic story and the rising odds of a second Trump presidency in the US hit sentiment toward Mexico. The latest EPFR Sector Allocations data shows Latin America Regional Equity Fund exposure to the information technology and healthcare sectors at 17 and 19-month highs, respectively, while allocations to consumer staples plays have fallen to a 17-month low.

Hopes that South Africa’s new unity government will improve economic policymaking and provide a check on state corruption helped to boost flows into South Africa Equity Funds to a 91-week high.

Developed Markets Equity Funds

US and Global Equity Funds again anchored another week of inflows for EPFR-tracked Developed Markets Equity Funds that allowed the group to extend their longest inflow streak since 4Q21. Japan, Pacific Regional and Europe Equity Funds posted outflows ranging from $103 million to $2.2 billion.

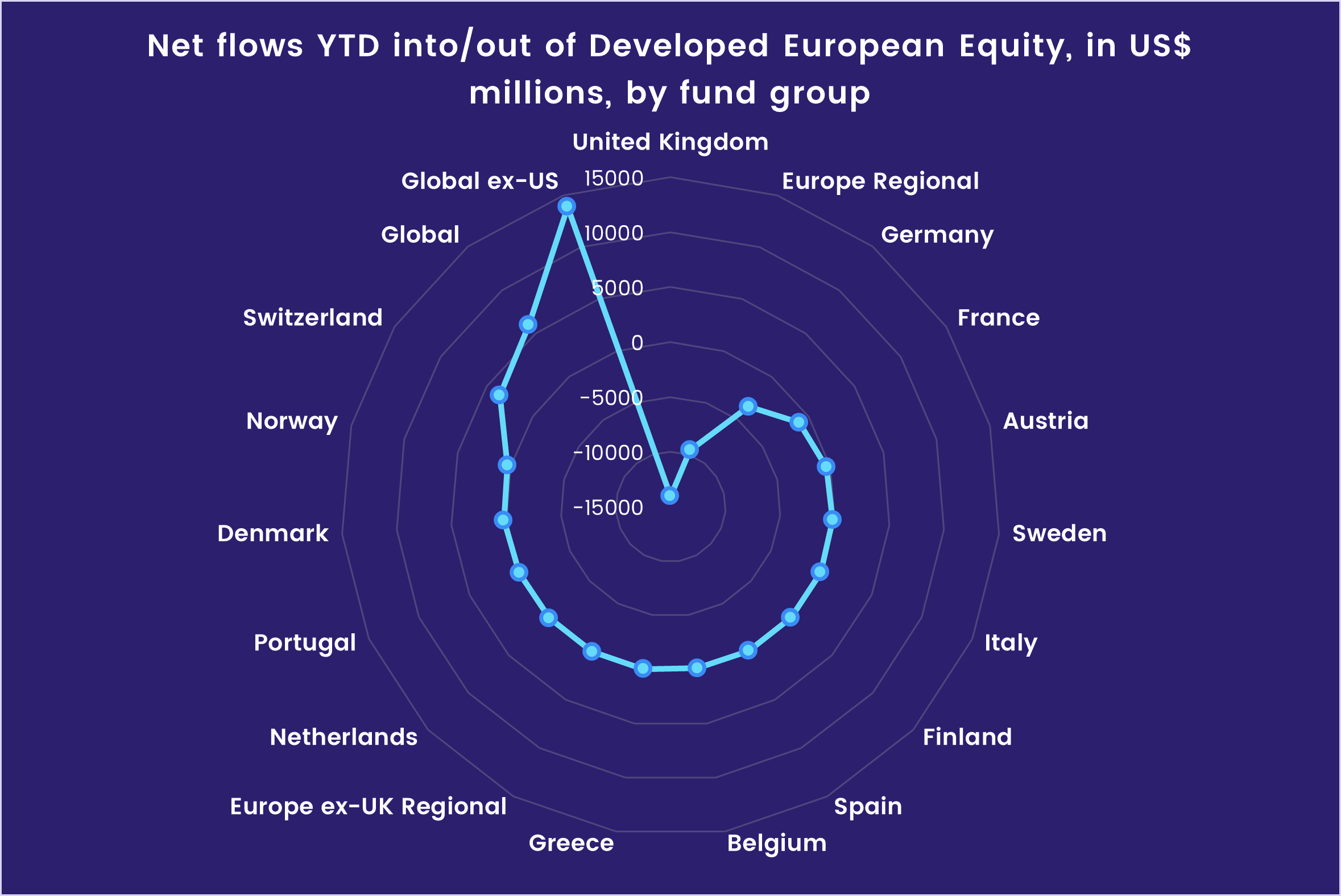

In the case of the latter group, snap general elections in the UK and France kept investors on edge. Again, they seemed more sanguine about the ability of France’s executive-centric constitution to contain the worst policy impulses of any new government. Flows into France Equity Funds climbed to a 12-week high while over $600 million flowed out of UK Equity Funds. But Europe Regional Equity Fund allocations to France have fallen to a 23-month low while exposure to the UK is just shy of the previous month’s 21-month high.

With Europe Equity Funds facing numerous headwinds – and consistent outflows – over the past two years, Global and Global ex-US Equity Funds have emerged as the main sources of support for European stocks. Coming into July the two groups absorbed another $4.9 billion.

US Equity Funds recorded solid inflows that went largely to funds with large cap mandates. Research by EPFR’s Senior Liquidity Analyst, Winston Chua, shows repurchasing of their own shares by US companies on track to set another annual record while issuance of new equity has also started to take off.

Investors pulled money out of Japan Equity Funds for the seventh time during the past eight weeks. Redemptions from retail share classes hit their highest level since mid-November and Japan Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates added to their longest redemption streak in over 11 years.

Global sector, Industry and Precious Metals Funds

With 2024 half over, Technology, Industrials and Financials Sector Funds are the only ones among the 11 major Sector Fund groups tracked by EPFR to post a net inflow over the past six months. Investors have been pulling out of the other eight, with year-to-date redemptions hitting roughly $10 billion apiece for Real Estate, Consumer Goods, Energy and Healthcare/Biotechnology Sector Funds.

After suffering redemptions for two years straight, inflows of $1.6 billion in June for Financials Sector Funds – based on daily cumulative flows – offset redemptions of $1.1 billion during the first five months of the year. Funds with “bank or banking” in their name have seen $2.2 billion flow out in the first half of the year, which currently stands as their third-largest yearly outflow on record.

Tech-oriented investors have rotated out of funds investing in software and internet to those focused on semiconductors and AI. Of the top 20 benchmarks attracting the biggest inflows for Technology Sector Funds in 1H24, six track the performance of companies involved in various aspects of the semiconductor industry and have accounted for a third or $10 billion of the group’s overall inflows. Another six benchmarks have ties to IT, while five focus specifically on artificial intelligence (AI) and big data companies, attracting $8.7 and nearly $4 billion in the first half of the year, respectively. Internet Funds are on track to post their first yearly outflow since 2019, while redemptions for Software Funds have hit a record high of $2.1 billion.

Technology and Industrials Sector Funds haven’t posted inflows on this scale during a six-month period since 2H20. Passively managed US-domiciled funds have been the guiding factor for Industrials Sector Funds with inflows climbing past the $3 billion mark, while Ireland and Korea-domiciled funds have attracted $1.3 billion and $118 million, respectively. Among the major subgroups, year-to-date inflows at 25% of assets for Construction Funds have nearly surpassed their 2021 record of $1.4 billion while Aerospace & Defense Funds – the usual breadwinner – have pulled in just $660 million (5.6% of assets).

Consumer Goods Sector Funds are enduring their heaviest redemptions in over a decade. EPFR Sector Allocations data shows that Global Equity Fund managers are underweight consumer discretionary by 1.7% and overweight consumer staples by 1% as of May. They have been consistently underweight consumer discretionary for the past eight years – a stark change from the prior 10 years – and mostly taking overweight positions on consumer staples since 2012.

Bond and other Fixed Income Funds

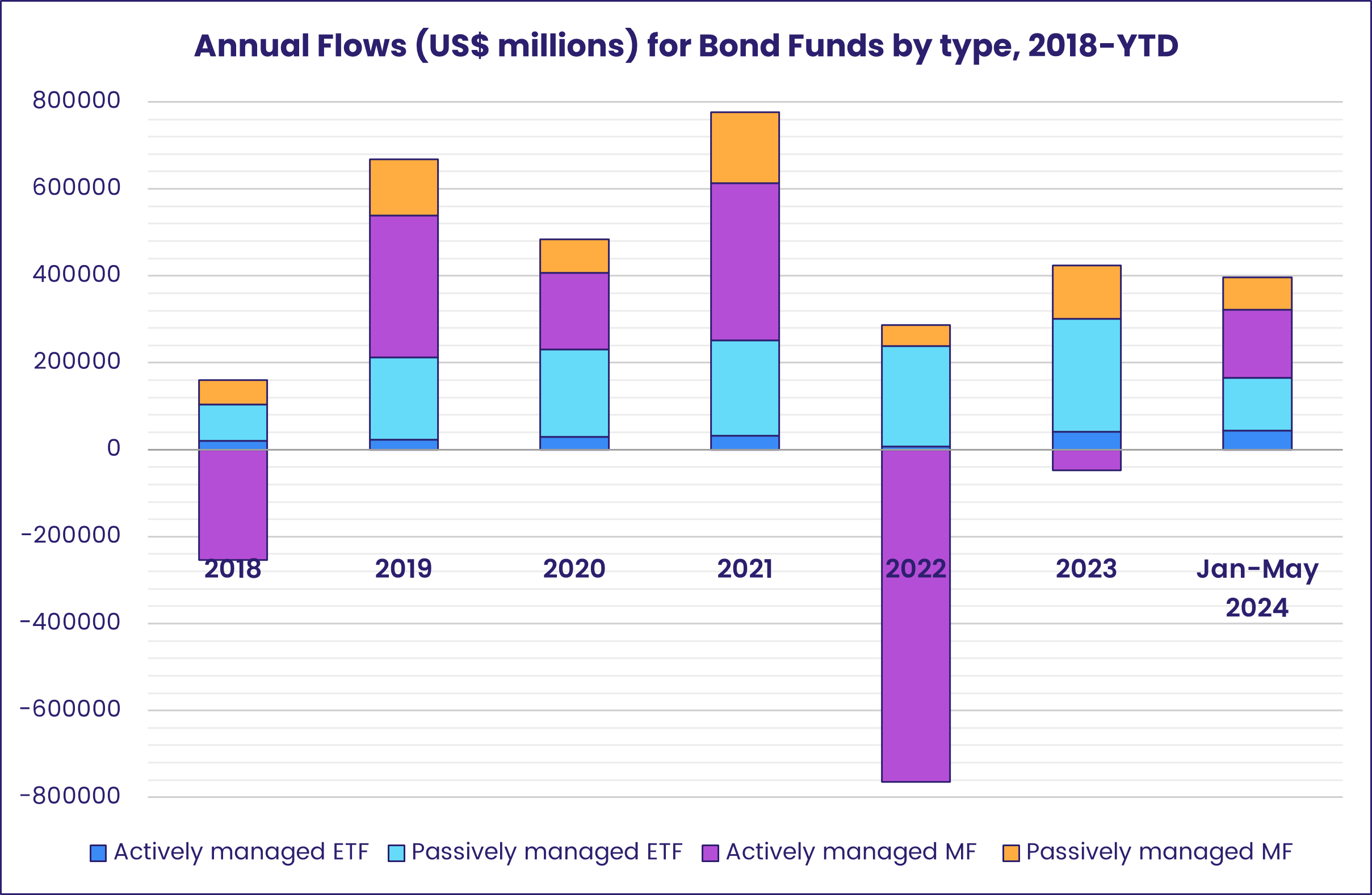

With soft data and dovish-sounding remarks from US Federal reserve Chair Jerome Powell raising hopes of more than one interest rate cut in the second half of the year, EPFR-tracked Bond Funds ended the second quarter with their biggest inflow since the fifth week of 2021.

Europe Bond Funds absorbed over $2 billion despite concerns about the fiscal discipline of the new governments expected to emerge in France and the UK, Global Bond Funds posted their 15th straight inflow and flows into US Bond Funds climbed to a 195-week high. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their third largest inflow of the year so far.

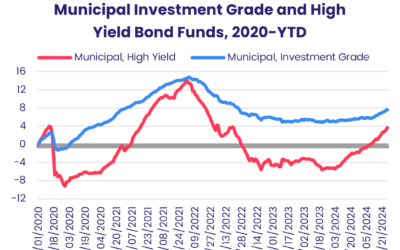

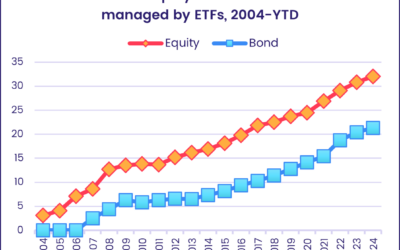

With half of the year gone, net flows to all Bond Funds are now just shy of $400 billion. That is 105% of the full-year total for last year and 51% of the record total set in 2021. Actively managed funds have absorbed the biggest share of the flows so far this year.

At the asset class level, Inflation Protected Bond Funds posted their eighth inflow year-to-date, flows into Bank Loan Funds rebounded to an eight-week high and Mortgage-Backed Bond Funds chalked up their 27th consecutive inflow.

Despite the latest flickers of optimism about US interest rates and the cuts that have already occurred in Europe and Canada, Emerging Markets Bond Funds recorded their fourth outflow over the past six weeks with hard currency-mandated funds taking the biggest hit. But, at the country level, China Bond Funds posted their eighth consecutive inflow.

Fixed income investors looking at Europe also penciled in a better post-election outcome for France than for the UK, with France Bond Funds posting above average inflows for the second straight week while money flowed out of UK Bond Funds for the sixth week running.

Flows into retail share classes for US Bond Funds climbed to an 11-week high. Treasury funds outgained their corporate-mandated counterparts for the fourth straight week and Short Term US Bond Funds posted their biggest inflow since the third week of January.

Did you find this useful? Get our EPFR Insights delivered to your inbox.