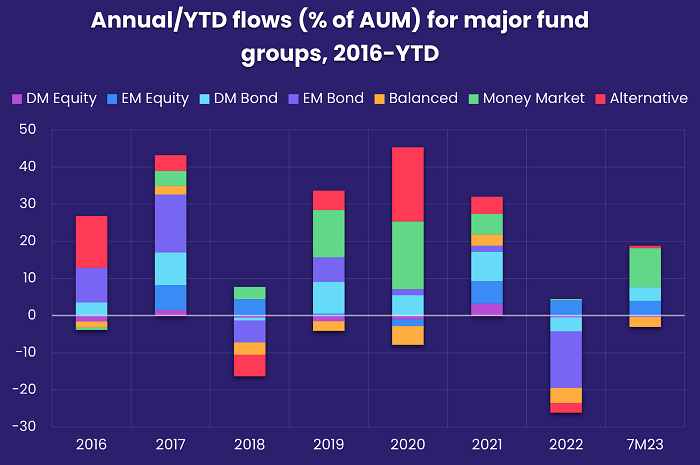

With the next US Federal Reserve and European Central Bank policy meetings still a month away and the 2Q23 earnings season beginning to wind down, flows to EPFR-tracked funds during the second week of August ranged – with a few exceptions – from negative to lackluster.

The exceptions featured the usual 2023 suspects. US Money Market Funds pulled in another $35 billion, taking their total inflow since the beginning of July to over $140 billion, China Equity Funds added $4 billion to their year-to-date total and Technology Sector Funds attracted another $1.9 billion.

On the other side of the coin, the week ending August 16 saw Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates post their fourth outflow over the past five weeks. Several fund managers were recently subpoenaed by the US Securities and Exchange Commission for documents relating to the ESG disclosures and marketing.

Overall, a net $2 billion flowed out of all EPFR-tracked Equity Funds while Bond Funds extended an inflow streak stretching back to late March. Investors pulled $931 million out of Alternative Funds and $2.4 billion out of Balanced Funds while Money Market Funds absorbed over $28 billion.

At the single country and asset class fund levels, Sweden, Spain and Italy Bond Funds posted inflows for the ninth, 14th and 16th consecutive week, respectively, while Hong Kong (SAR) Equity Funds extended an inflow streak stretching back to the final week of January and redemptions from Vietnam Equity Funds hit a record high. Outflows from Inflation Protected Bond Funds climbed to an 11-week high, Bank Loan Funds posted their ninth inflow in the past 11 weeks and investors pulled money out of Gold Funds for the 12th week in a row.

Emerging markets equity funds

EPFR-tracked Emerging Markets Equity Funds chalked up their 26th inflow so far this year in mid-August on the back of strong flows into China, Taiwan (POC) and Brazil Equity Funds which offset the biggest weekly outflow from the diversified Global Emerging Markets (GEM) Equity Funds since early December.

Money flowed out of retail share classes for the second straight week and Frontier Markets Equity Funds posted their biggest outflow in over a year. EM Dividend Funds, meanwhile, recorded their second biggest inflow of the quarter to date.

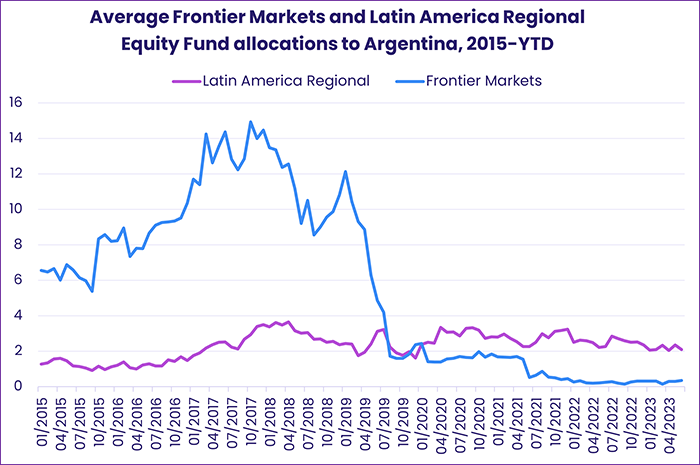

The latest flows into all Latin America Equity Funds were the ninth of the past 10 weeks, with Brazil Equity Funds accounting for the lion’s share of the headline number as inflows hit a level last seen in late 2Q22. Brazil’s central bank cut its key interest rate in early August by 0.5% after raising it by 1,125 basis points between 1Q21 and 3Q22. Elsewhere, Argentina Equity Funds recorded their biggest outflow since the first week of the second quarter as investors digested the unexpected victory of libertarian candidate Javier Milei in the August 13 presidential primary contest.

Among the Asia ex-Japan Country Fund groups, China Equity Funds absorbed another $4 billion despite a steady drip of discouraging data for exports, producer prices, youth employment and the country’s property sector. Flows for Taiwan (POC) Equity Funds rebounded to a 10-week high, India Equity Funds extended their longest inflow streak since 1H15 and Korea Equity Funds absorbed fresh money for the seventh time in the past nine weeks. Vietnam Equity Funds, however, experienced record-setting redemptions as investors questioned some of the rosier assumptions about the country’s export growth.

EMEA Equity Funds eked out a modest inflow as Israel Equity Funds extended their longest inflow streak since 1Q21 and flows into Saudi Arabia Equity Funds climbed to a nine-week high.

Developed markets equity funds

With many investors on vacation and others digesting the minutes of the US federal reserve’s July policy meeting, EPFR-tracked Developed Markets Equity Funds ended the second week of August by posting their biggest outflow since mid-May. Of the major regional and country groups, only Japan and Canada Equity Funds recorded an inflow while redemptions from US, Europe and Global Equity Funds ranged from $135 million to $5.2 billion.

Outflows from US Equity Funds hit an eight-week high, with US Equity ETFs experiencing net redemptions for the first time since the third week of June and US Dividend Equity Funds racking up their 19th outflow since the beginning of the second quarter. Foreign domiciled funds did record an inflow for the fifth straight week, the longest such run year-to-date.

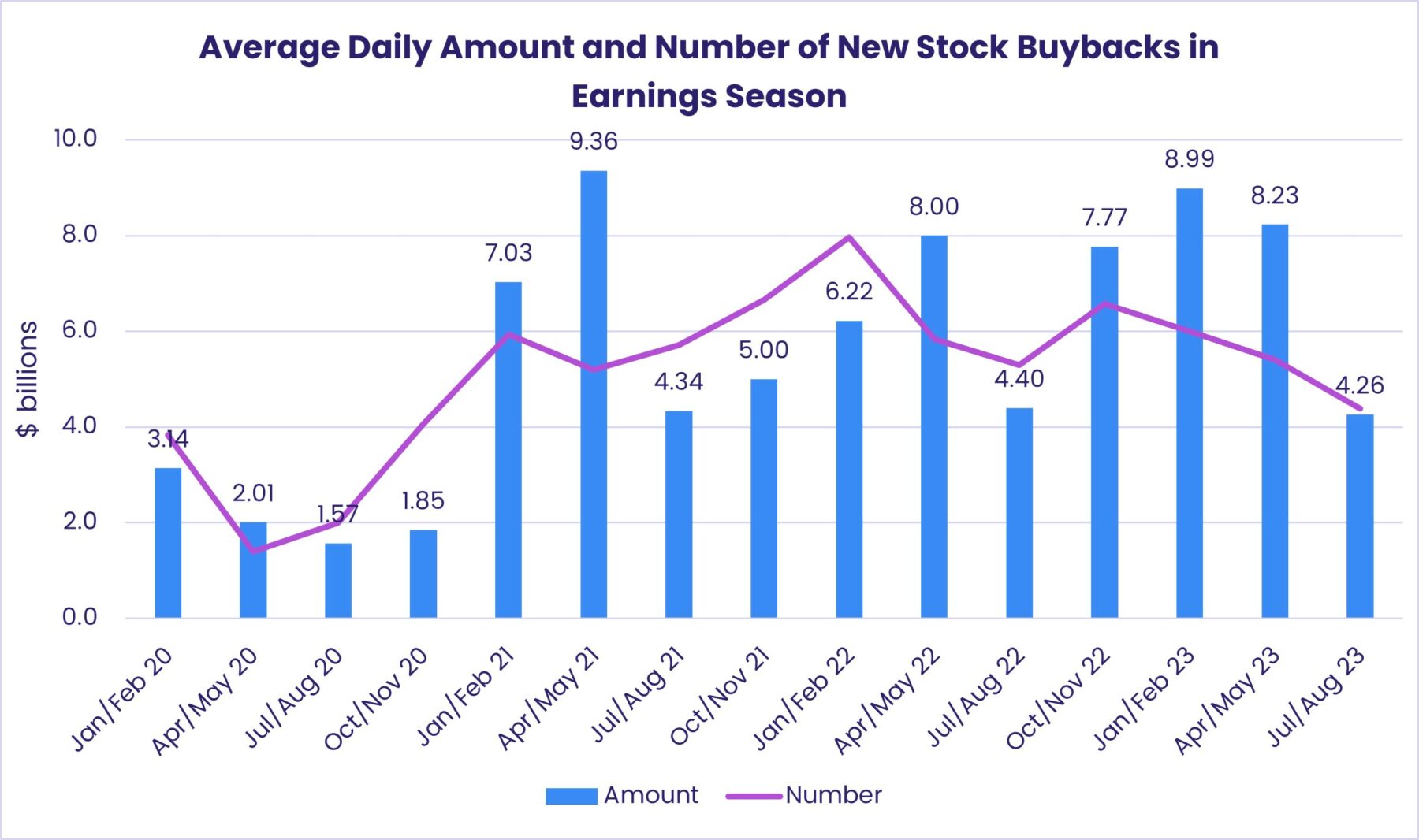

In addition to the summer doldrums and ripples of unease about the fight-is-not-won message in the Fed minutes, appetite for US equity was hit by the relative lack of corporate support. Research by EPFR Liquidity Analyst Winston Chua pegs the pace and volume of announced share buybacks at their lowest level since the 3Q20 earnings season. Quarter-to-date, the buy/sell ratio for major US companies is running at 4.9 to 1. During 1Q23 those corporations were buying 10 times the number of the shares that they were selling.

For Europe Equity Funds, the flow doldrums arrived in mid-March and have yet to break. This fund group recorded its 23rd consecutive outflow as Russia’s assault of Ukraine passed the 500-day mark, more mixed data raised fresh doubts about China’s appetite for European exports and demand for loans continues to shrink. At the country level, UK Equity Funds saw money flow out for the 32nd straight week, France Equity Funds recorded their 13th outflow during the past 15 weeks and redemptions from Netherlands Equity Funds climbed to a 23-week high.

Japan Equity Funds chalked up their 10th inflow since the beginning of June, with foreign-domiciled funds absorbing more fresh money than their Japan-based counterparts. Flows to Japan Equity Hedge Funds were also on the upswing coming into the third quarter, with May and June’s totals the biggest since late 1Q22.

Investor appetite for diversified developed markets exposure was subdued, with Global Equity Funds recording consecutive weekly outflows for the first time since the second half of April. The retail support this group enjoyed from 1Q20 to 2Q22 has been absent for much of this year: retail share classes have been hit with redemptions in 18 of the past 23 weeks.

Global sector, industry and precious metals funds

Sector-oriented investors looking to relax in mid-August were jolted by the possibility of even higher US interest rates, China’s suspension of its youth unemployment rate data, and another round of mixed 2Q23 corporate earnings reports.

Only three of the 11 major EPFR-tracked Sector Fund groups during the week ending August 16, with outflows ranging from $150 million for Infrastructure Sector Funds to $826 million for Financials Sector Funds while flows into Technology Sector Funds hit a five-week high, Energy Sector Funds posted consecutive weekly inflows for the first time since mid-April and Telecoms Sector Funds posted their fifth straight inflow.

Funds dedicated to China had a mixed week. At the end of the first quarter, when Chinese technology major Alibaba announced its split into six divisions, investors bailed out of China Technology Funds for three straight weeks, taking a net $4 billion with them. But this time around, they appear to accept the official, positive, line that the reorganization has allowed the company to focus on creating and adopting artificial intelligence products. Inflows for China Technology Sector Funds climbed to a 14-week high of $1.8 billion, accounting for the bulk of the headline number for all Technology Sector Funds.

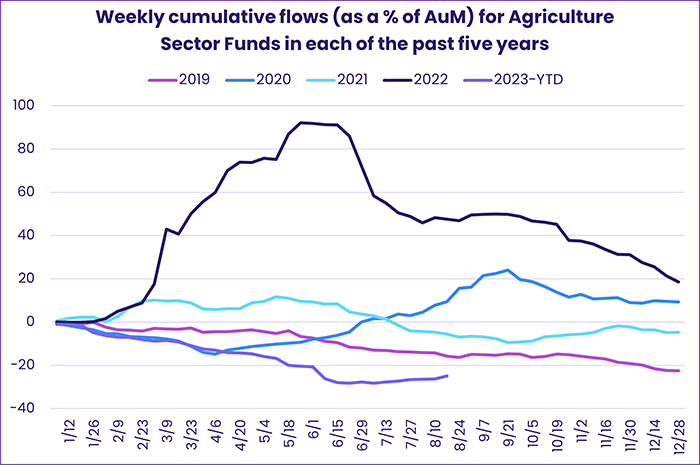

While Commodity Sector Funds racked up another outflow, it was a different story for one sub-group. With India restricting rice exports and drought hitting farmers in multiple countries, investors are positioning themselves for higher food prices. Flows into EPFR-tracked Agriculture Funds shot to their highest level in a year, reaching $43 million and extending their inflow streak to six weeks, the longest since March of 2022.

A tighter supply versus demand picture is also being penciled in for energy as Saudi Arabia and Russia reduce their output of oil and natural gas. With over $500 million flowing into funds with US mandates and China-dedicated funds also posting solid inflows, Energy Sector Funds collectively posted their third inflow during the past five weeks. The overall headline number was pulled down by the largest outflow on record for Canada Energy Sector Funds.

Bond and other fixed income funds

Although EPFR-tracked Bond Funds posted their 21st consecutive inflow during the week ending August 16, the latest headline number was the smallest since the current streak began in late March.

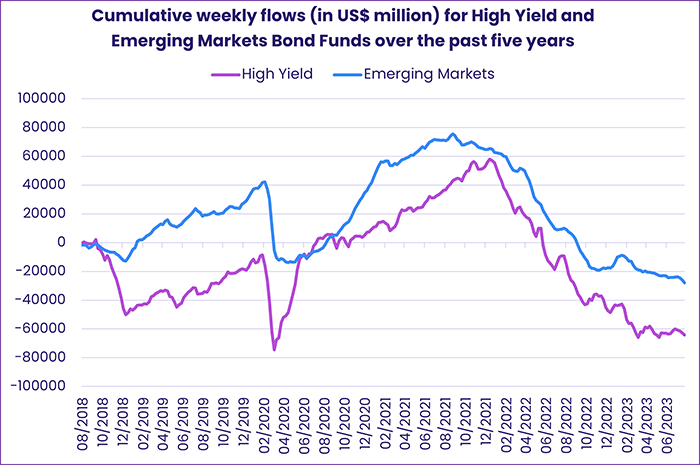

With the minutes from the US Federal Reserve’s July policy meeting pointedly highlighting the Fed’s willingness to push interest rates higher if inflation proves too sticky, fund groups associated with riskier debt classes were hit with further redemptions. Having surrendered a combined $1.5 billion the previous week, Emerging Markets and High Yield Bond Funds saw another $3.4 billion flow out this week.

The latest redemptions from Emerging Markets Bond Funds were the largest since mid-March, with hard and local currency funds both seeing over $1 billion flow out. Funds with corporate mandates posted their 26th outflow since mid-February while EM Sovereign Bond Funds posted their biggest collective outflow in over 10 months. Sharia Bond Funds did post their sixth inflow over the past seven weeks and flows into Frontier Markets Bond Funds edged up to a six-week high.

US Bond Funds recorded their 33rd straight inflow despite further redemptions from retail share classes and Collective Investment Trusts (CITs) dedicated to US debt. Investors favored funds with sovereign mandates over their corporate counterparts. At the asset class level, US Treasury Inflation Protected Securities (TIPS) Funds posted their biggest outflow since late June.

Investors steered fresh money into Europe Sovereign Bond Funds for the 27th straight week. Retail share classes posted their fifth straight inflow while, at the country level, redemptions from Switzerland Bond Funds hit a 39-week high and Germany Bond Funds posted their biggest inflow since 1Q20.

Did you find this useful? Get our EPFR Insights delivered to your inbox.