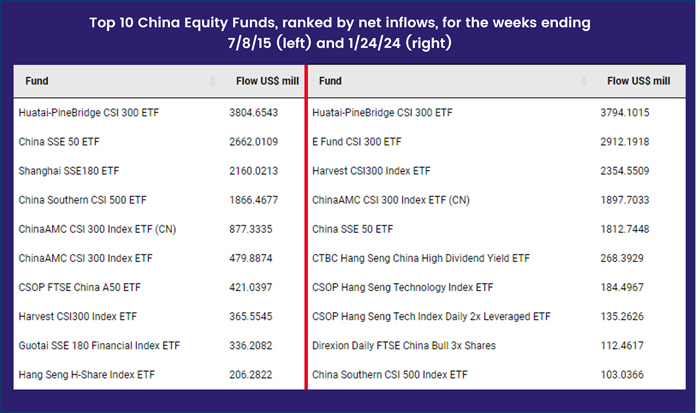

Going into the final week of January, flows into China Equity Funds hit levels last seen during early 3Q15 as Chinese leaders discussed measures to support the country’s slumping equity markets and China’s central bank announced a 50 basis points cut in bank reserve ratio requirements.

Beyond the eye-catching commitments to China Equity Funds, flows to EPFR-tracked funds followed a predictable pattern during the week ending Jan. 24. Emerging Asian country fund groups, Technology Sector Funds, US and Europe Bond Funds and Total Return Funds all recorded fair to strong inflows while Europe Equity, Balanced and Emerging Markets Bond Funds experienced further outflows.

Also experiencing outflows were Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which extended their longest outflow streak since 3Q12, while their fixed income counterparts pulled in fresh money for the fifth week running.

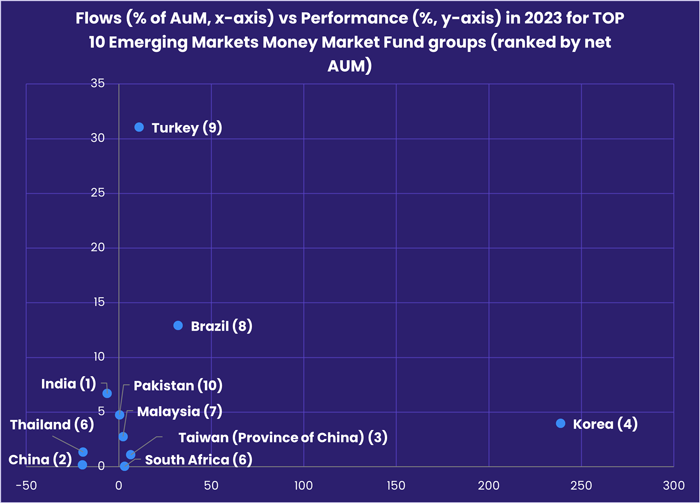

US Money Market Funds, which absorbed a record-setting $1.16 trillion in 2023, posted their fourth inflow during the past five weeks. Among the emerging markets liquidity fund groups, flows into Turkey and China Money Market Funds hit 28 and 30-week highs, respectively.

At the asset class and single country fund levels, flows into Physical Silver Funds hit their highest level in exactly a year, Cryptocurrency Funds recorded their first outflow in over three months and High Yield Bond Funds took in fresh money for the 12th time during the past 13 weeks. Spain Bond Funds absorbed over $250 million for the second week running, Spain Equity Funds posted their biggest outflow since late 2Q23 and Hong Kong (SAR) Bond Funds extended an outflow streak stretching back to the first week of last year.

Emerging markets equity funds

The near record inflows into China Equity Funds during the week ending Jan. 24 allowed EPFR-tracked Emerging Markets Equity Funds to chalk up their biggest collective inflow since EPFR started tracking them weekly in 4Q00.

Retail share classes continued to experience net redemptions, and actively managed EM Equity Funds chalked up their 26th consecutive outflow. But money continues to flow into EM Dividend Funds and Leveraged EM Equity Funds posted their biggest inflow since late 1Q22.

When over $13 billion flowed into China Equity Funds during the first week of July 2015, authorities were trying to put a floor under the bursting three weeks previously of a stock market bubble. The latest inflows have come as Chinese policymakers try to arrest a steady decline in domestic equity markets that began in early 2022.

Funds benchmarked to the CSI 300 accounted for $10.68 billion of the week’s headline number, with China Equity Funds benchmarked to SSE 50 pulling in $1.7 billion and Hang Seng Tech $300 million. EPFR tracks 51 China Equity Funds that are benchmarked to CSI 300 with a total AuM of $60.4 billion, by far the largest benchmark. The next three (MSCI China, Hang Seng, SSE Science and Tech Innovation Board 50), which each track nearly $20 billion in total AuM, posted a collective outflow of $600 million.

Meanwhile, China’s average allocation among the diversified Global Emerging Markets (GEM) Equity Funds has fallen to its lowest level since early 2Q17 while exposure to India has climbed to a fresh record high.

Latin America Equity Funds posted their fifth straight outflow, with both Brazil and Mexico Equity Funds experiencing modest redemptions. But the aggressive reforms being championed by new Argentine President Javier Milei continue to play well with investors. Dedicated Argentina Equity Funds recorded their 10th straight inflow, with the latest week’s total the biggest since 3Q17.

With tensions still running high in the Middle East and Russia’s invasion of Ukraine in its 23rd month, appetite for exposure to EMEA markets remains subdued. The latest sector weightings data shows that, for EMEA Regional Funds, financials remain by far the largest single sector allocation while the average weighting for materials stocks is at its lowest level since 3Q16.

Developed markets equity funds

Flows to EPFR-tracked Developed Markets Equity Funds remained subdued during the latest week as a mixed corporate earnings season rumbled along and investors looked ahead to the Federal Reserve and European Central Bank’s first meetings of 2024. But flows into US, Global, Japan and Australia Equity Funds more than offset further redemptions from Europe, Pacific Regional and Canada Equity Funds, allowing the overall group to post its second inflow of the New Year.

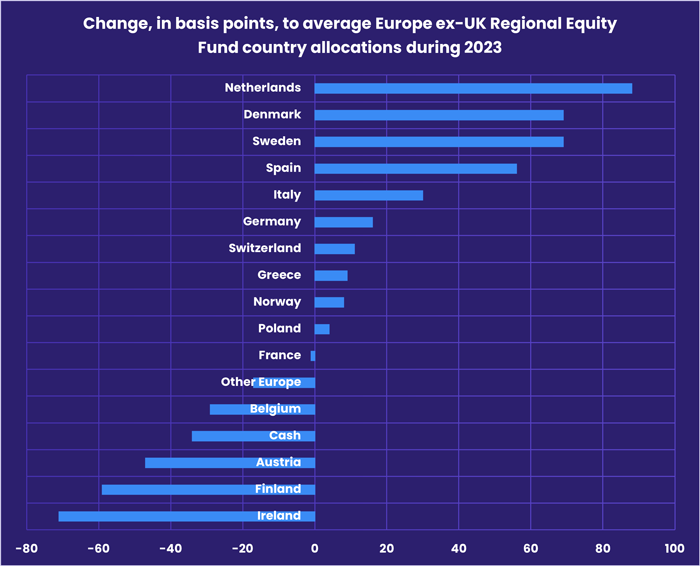

Heading into the ECB’s January meeting, Europe Equity Funds recorded their fourth consecutive outflow, and their biggest since late October, as major regional economies flirt with recession and hopes for an interest rate cut in March or April slip by two to three months. The ECB kept its key rate at a record high when its meeting concluded on Jan. 25. Both of the major regional groups saw money flow out with Europe ex-UK Regional Equity Funds, which shifted exposure to Nordic and ‘Frugal Five’ markets last year, racking up their 38th outflow during the past 40 weeks.

US Equity Funds snapped a two-week run of outflows on the back of fresh flows into Large and Mid-Cap Blend Funds as benchmark stock indexes climbed to fresh record highs. ETFs continue to dominate the flow picture, with actively managed funds recording only two inflows over the past 12 months. Foreign domiciled US Equity Funds did post their 13th collective inflow since the beginning of 4Q23.

Investors steered fresh money into Japan Equity Funds for the second week running. Faced with a government hamstrung by scandal, a rising number of corporate bankruptcies, slowing inflation and subdued consumer confidence, the Bank of Japan took no steps towards normalizing monetary policy at their latest meeting, and markets are beginning to question if any steps away from the BOJ’s ultra-accommodative policies will occur before the second half of the year.

Global sector, industry and precious metals funds

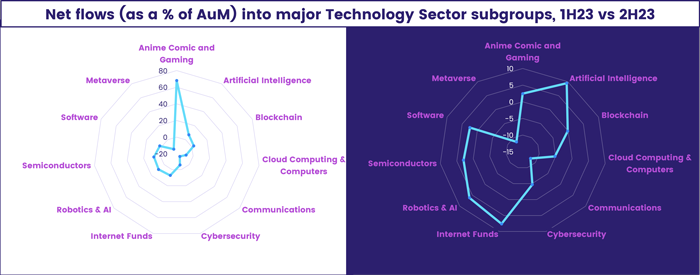

The number of EPFR-tracked Sector Fund groups reporting inflows in the week ending Jan. 24 climbed from three the previous week to four, with Technology Sector Funds again attracting the biggest inflow. So far this year, only three of the 11 major groups have posted net inflows. Technology Sector Funds have absorbed $6.3 billion while Healthcare/Biotechnology and Financials Sector Funds have pulled in roughly $400 million each.

This week, an earnings report focused investors on the intersection between technology and energy. Tesla founder Elon Musk caused a stir in the electric vehicle industry by describing the current price war triggered by cheap Chinese EVs one that Western companies may not be able to win. BYD, the biggest electric car maker in China, surpassed Tesla in global sales recently, selling 8.6% (or 41,000) more cars than Tesla in the final quarter of 2023.

EPFR-tracked Electric Vehicle Funds saw outflows hit a five-week high as the group racked up its 12th outflow of the past 13 weeks. EV Funds recorded five consecutive yearly inflows since EPFR started tracking them in 2018, with a record of $2.8 billion added in 2021, but suffered their first annual outflow last year.

However, other Technology Sector Fund groups continue to pull in fresh money as hopes for the productive use of artificial intelligence (AI) continue to run high.

Among the Energy Sector Fund subgroups, Natural Gas Funds posted their first inflow in five weeks while Nuclear & Uranium Funds have absorbed fresh money 24 of the past 26 weeks. But these two groups swam against the tide during the latest week as Energy Sector Funds overall extended their current outflow streak into record-setting territory at 13 weeks and $7.6 billion.

Elsewhere, Infrastructure and Telecoms Sector Funds saw their latest outflow streaks come to an end. In the case of the former, that streak spanned 13 weeks and $2.2 billion in net while Telecoms Sector Funds brought the curtain down on a three-week and $500 million run.

Utilities Sector Funds posted their heaviest outflow since early June, nearly doubling last week’s redemption as both US and Global-mandated funds brought the headline number down.

Bond and other fixed income funds

EPFR-tracked Bond Funds enjoyed another strong week going into the final seven days of January as investors steered another $14.1 billion into the overall group. Year-to-date all Bond Funds have absorbed a net $53 billion. In January 2023, they took in $74.9 billion while $21.8 billion flowed out during January 2022.

Once again US, Global and Europe Bond Funds saw the biggest inflows, with US Bond Funds pulling in over $11 billion, Global Bond Funds extending their longest inflow streak since a 12-week run ended in mid-March of last year and Europe Bond Funds taking in fresh money for the 12th week running.

At the asset class level, flows turned negative again for Inflation Protected Bond Funds but both Bank Loan and Municipal Bond Funds recorded their third straight inflow and flows into Mortgage-Backed Bond Funds climbed to a 12-week high.

US Sovereign Bond Funds took in $5 for every $2 steered into funds with corporate mandates as issuance on the primary markets ramped up. Both Short and Intermediate Term Funds attracted over $3 billion during the week, and retail share classes posted their biggest collective inflow in over 27 months.

Retail flows to Europe Bond Funds have been consistently positive since the second week of September. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates are also faring well, attracting fresh money eight of the past nine weeks. Overall flows continue to favor funds with corporate mandates while, at the country level, Spain Bond Bonds recorded their biggest inflow in over five months.

Emerging Markets Bond Funds saw another $890 million flow out, with roughly equal amounts of money redeemed from hard and local currency-mandated funds. Frontier Markets Bond Funds posted their fifth straight inflow, the longest such run since 2Q21.

Flows to the two major multi-asset fund groups, Balanced and Total Return Funds, remain on different trajectories with the former posting their 51st outflow during the past 12 months and Total Return Funds chalking up their sixth straight inflow and biggest since mid-2Q23.

Did you find this useful? Get our EPFR Insights delivered to your inbox.