With the latest US inflation numbers coming the day after the latest reporting period ended, flows to Equity and Bond Funds with North American and Global mandates during the week ending August 9 were muted. Those numbers, when they arrived, suggest that price pressures in the US remain subdued, with a modest increase in the consumer index offset by a further drop in the producer index.

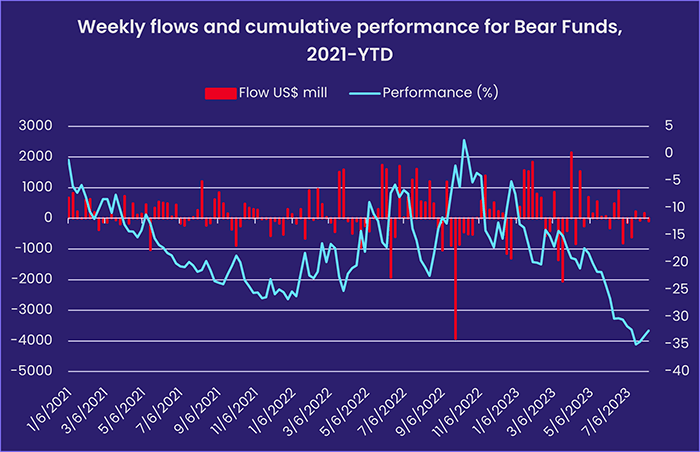

Also subdued are flows to Bear Funds, which seek to profit from declining markets. Flows, which peaked in early April at their highest level since late 1Q20, have since waned as hopes of a ‘soft landing’ for the US economy have hardened into a consensus.

Overall, the week ending August 9 saw EPFR-tracked Equity Funds absorb $1.4 billion, Bond Funds $6.8 billion and Money Market Funds $20.5 billion. A net $372 million flowed out of Alternative Funds while Balanced Funds saw year-to-date redemptions hit $86.6 billion, 62% of the full-year outflow record set in 2020.

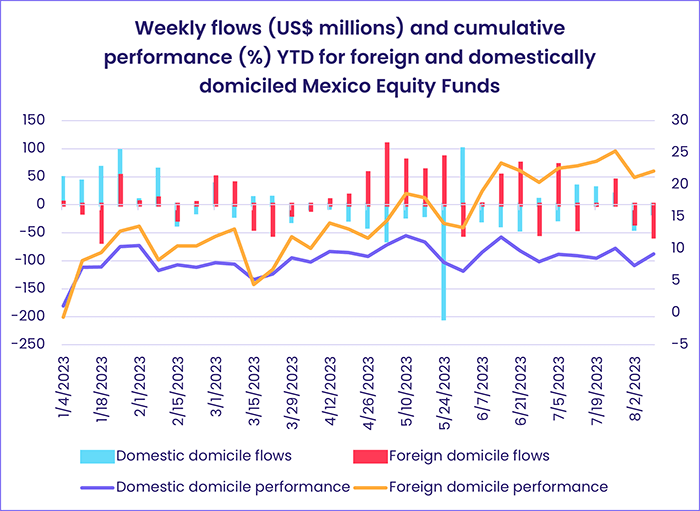

At the asset class and single country fund level, High Yield Bond Funds posted their biggest outflow since late May, investors pulled money out of Cryptocurrency and Gold Funds for the third and 11th straight weeks, respectively, while Mortgage-Backed Bond Funds extended their longest inflow streak since 4Q21. Redemptions from Mexico Bond Funds climbed to an 18-week high, Mexico Equity Funds posted consecutive weekly inflows for the first time since early April and Hong Kong Bond Funds extended an outflow streak stretching back to the first week of the year.

Emerging markets equity funds

Flows into EPFR-tracked Emerging Markets Equity Funds retained their strong Asian bias in early August as China, Taiwan (POC), Korea and India Equity Funds took in $6.6 billion between them. That lifted the headline number for all EM Funds, which have posted inflows 25 of the 32 weeks year-to-date, to a 15-week high.

The week ending August 9 also saw retail redemptions hit a two-month high, money flow out of actively managed funds for the 16th time in the past 18 weeks and Latin America Equity Funds snap their longest inflow streak in over four years.

China Equity Funds posted their biggest inflow since late April as investors continue to translate poor macroeconomic data into greater pressure on Chinese policymakers to deploy aggressive stimulus measures. Chinese exports were down 14% year-on-year in July, inflation has turned to deflation and another missed bond payment revived fears about the health of the country’s property sector. Elsewhere, India Equity Funds chalked up their 21st consecutive inflow and Taiwan (POC) Equity Funds their first inflow since late June and their biggest since early June.

An inflow streak driven by expectations of lower inflation and interest rates, growing demand for minerals needed for clean energy systems and a positive re-evaluation of Brazil’s economic team came to an end for Latin America Equity Funds in early August. Funds dedicated to Brazil, whose average allocation among Global Emerging Markets (GEM) Equity Funds is above 7% for the first time since last October, posted their third straight outflow.

Mexico Equity Funds also experienced net redemptions during a week when second quarter GDP growth came in at a healthy 3.6%. Foreign domiciled funds, which have strongly outperformed their Mexico-based counterparts over the past 19 months, posted their biggest collective outflow since the third week of January.

EMEA Equity Funds recorded their 14th weekly outflow since the beginning of the second quarter. Fund groups dedicated to major oil producers have, for various reasons, gained little from the recent efforts by Russia and Saudi Arabia to boost oil prices. Quarter-to-date, Saudi Arabia, Russia, Nigeria, Kuwait and United Arab Emirates (UAE) Equity Funds have all experienced net redemptions ranging from 0.2% to 9.2% of their AUM at the beginning of July.

Developed markets equity funds

Investors, already digesting a sovereign ratings downgrade and former President Donald Trump’s seemingly unbreakable grip on America’s political center stage, spent much of the first week of August waiting for the latest inflation data from the US. While they waited, they pulled a combined $4 billion out of US and Global Equity Funds, extended Europe Equity Funds current outflow streak to 22 weeks and steered over $2.9 billion – a 96-week high – into Asia Pacific Equity Funds.

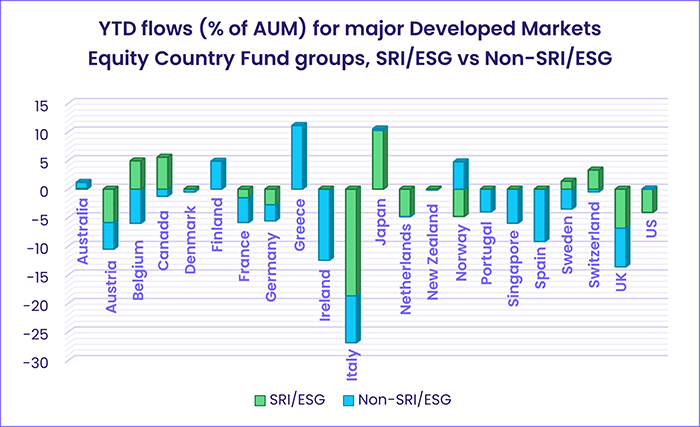

Among the Asia Pacific Equity Fund groups, flows into Pacific Regional, Japan and Australia Equity Funds hit six, 20 and 26-week highs, respectively. A strong corporate earnings season, expectations of more stimulus in China and optimism about Australian interest rates all contributed to the positive investor sentiment. In the case of Japan Equity Funds, retail commitments climbed to a year-to-date high and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their 24th inflow over the past 26 weeks.

Investor sentiment towards Europe remains depressed by a slate of issues that range from the war in Ukraine – now in its 18th month – to the European Central Bank’s efforts to tame an inflation rate still running at more than double the ECB’s 2% target. Redemptions from Europe Equity Funds during the latest week hit a quarter-to-date high, with outflows from UK Equity Funds accounting for nearly a third of the headline number. Large Cap Funds experienced the heaviest redemptions in both cash and percent of AUM terms while funds managed for growth posted their biggest collective outflow since the third week of May.

US Equity Growth Funds also posted outflows, their eighth in a row, and US Equity Funds overall racked up their second outflow of 3Q23 as investors waited for clarity on inflation and labor market trends. The week also saw 10 US regional banks hit with ratings downgrades and major trucking company Yellow Corporation file for bankruptcy.

The largest of the major diversified Developed Markets Equity Fund groups, Global Equity Funds, chalked up their biggest outflow since mid-December. There were 36 funds which absorbed over $40 million and 38 that experienced net redemptions of $40 million or more.

Global sector, industry and precious metals funds

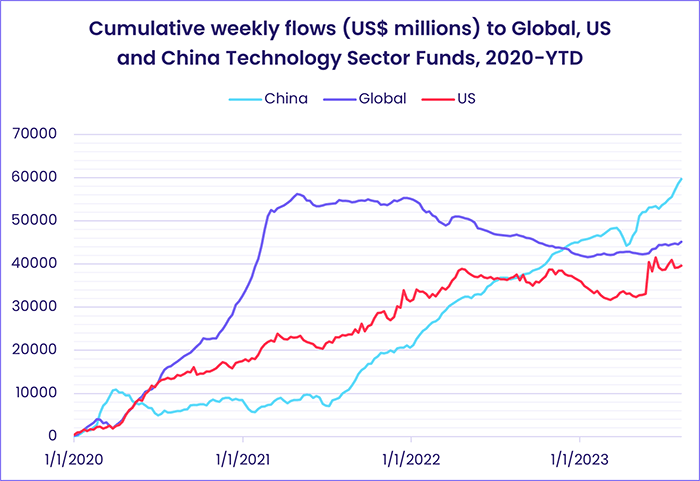

With earnings reports from corporate heavyweights still rolling in and US interest rates assumed to be at, or near, their peak, investors again had plenty to factor into their sector-level decisions during the week ending August 9. By week’s end, six of the 11 major EPFR-tracked Sector Fund groups had posted inflows that ranged from $30 million for Consumer Goods Sector Funds to $1.4 billion for Technology Sector Funds.

The latest flows into Technology Sector Funds favored those dedicated to China, which are proving resilient despite the tougher environment for global trade, new US technology transfer restrictions and tighter control by the ruling Communist Party. All 10 of the best performing China Technology Funds over the past 12 months are dedicated to anime, comic and gaming assets while the best performers among dedicated US offer leveraged exposure to AI play Nvidia.

Another group in the money during the first week of August were Healthcare/Biotechnology Sector Funds, which recorded their biggest inflow since mid-April. Funds dedicated to the US and China also dominated the flow picture for this group, with China Healthcare/Biotechnology Sector Funds posting their 10th straight inflow and US Healthcare/Biotechnology Sector Funds recording their biggest inflow since 2Q22.

Investors steered fresh money into Industrial Sector Funds for the sixth straight week, the longest such run since 1H21, with higher military spending a key driver. Dedicated Defense Funds posted their fourth inflow in the past five weeks and the latest week’s total was the biggest in nearly six months.

Financials Sector Funds were, for the second straight week, the group hit with the heaviest redemptions as investors digested Italy’s move to impose a windfall tax on its banking system, the latest ratings downgrades among US regional banks and growing fears about the long-term health of Chinese banks.

Bond and other fixed income funds

Ratings downgrades. Corporate bankruptcies and defaults. Central bank balance sheet reduction. Over $1 trillion in new issuance alone to fund this year’s US budget deficit. This wall of fixed income worry remains, for the moment, something investors are willing to climb. The week ending August 9 saw EPFR-tracked Bond Funds pull in another $6.8 billion that took their year-to-date total past the $310 billion mark.

The pattern of flows did reflect diminished risk appetite, with redemptions from Emerging Markets and High Yield Bond Funds hitting six and 10-week highs, respectively. But Leveraged Bond Funds racked up their 24th inflow over the past six months and retail share classes absorbed fresh money for the second week running.

At the asset class level, Inflation Protected Bond Funds posted their 50th outflow in the past 52 weeks despite modest flows into funds with US and European mandates. Flows to Municipal Bond Funds bounced back, largely reversing last week’s outflow, while Bank Loan Funds recorded their eighth inflow in the past 10 weeks.

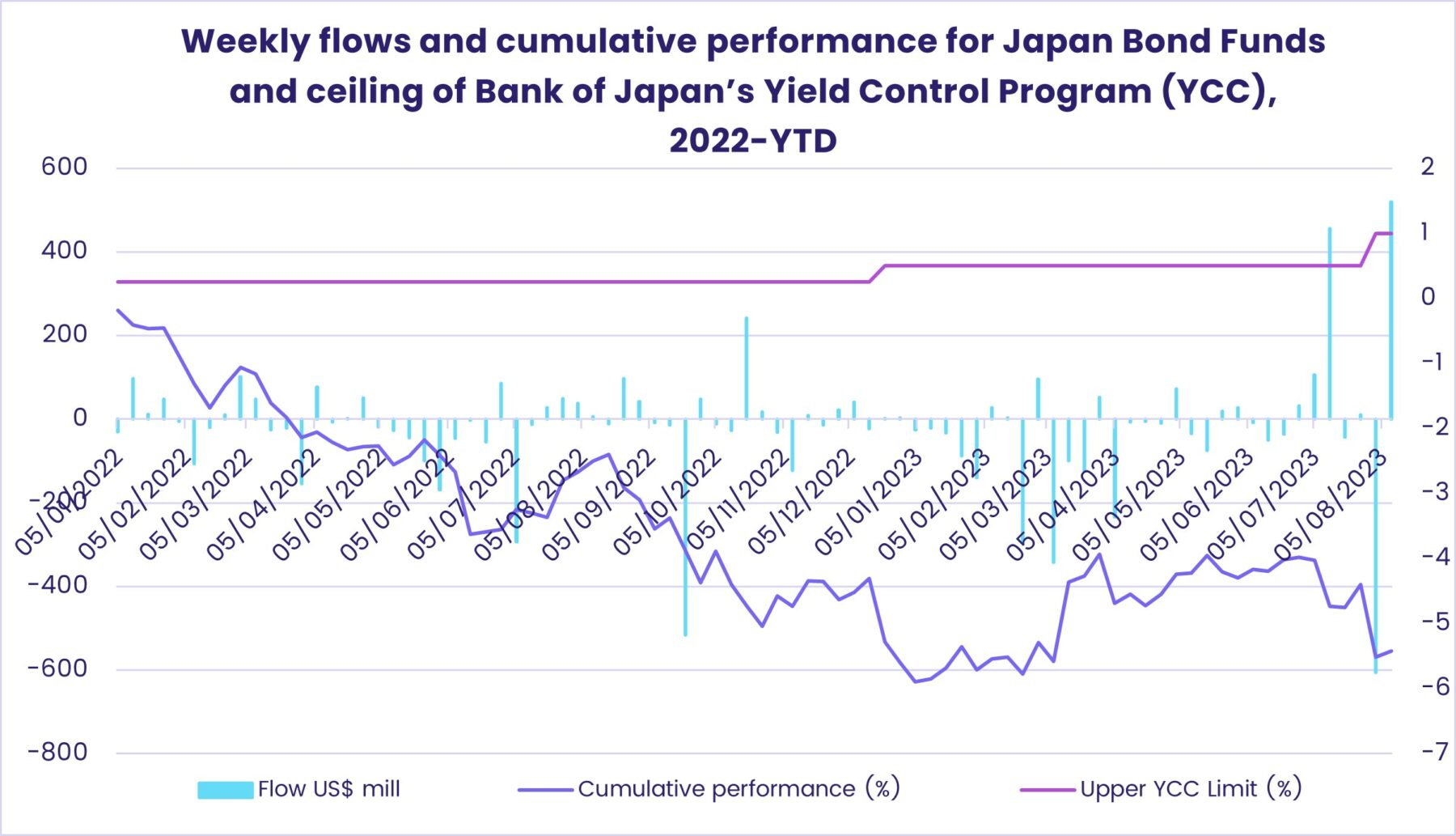

Also bouncing back were flows into Japan Bond Funds, which had posted their biggest inflow in over two years the previous week. The latest inflow was the biggest since late 3Q21. Among the other Asia Pacific Country Fund groups, Australia Bond Funds chalked up their 17th straight inflow and Hong Kong Bond Funds their 31st consecutive outflow.

Emerging Markets Hard Currency Bond Funds posted their second straight outflow of more than $800 million in early August. But appetite for EM corporate debt took a turn for the positive despite Chinese property major Country Garden missing payments. China Bond Funds posted their fifth straight outflow and 12th in the past 15 weeks while flows into Korea Bond Funds hit a 19-week high.

Flows into Europe Bond Funds were boosted by interest in SRI/ESG debt: funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which posted their biggest inflow in nearly a year the previous week, pulled in another $933 million.

US Bond Funds have maintained their record of posting an inflow every week of the year so far. During the latest week, intermediate term was the preferred duration, and funds with sovereign mandates attracted most of the latest inflows.

Did you find this useful? Get our EPFR Insights delivered to your inbox.