Do 4.9% third quarter GDP growth, the lowest core CPI reading in two years and an unemployment rate at a 21-month high add up to a soft landing for the world’s largest economy? Recent fund flows suggest that investors are optimistic.

Having committed over $65 billion to US Equity, Bond and Money Market Funds during the first week of November, investors steered another $50 billion into those fund groups during the week ending Nov. 15. Flows into US Equity Funds hit a nine-week high, year-to-date flows into US Money Market Funds pushed past the $1 trillion mark and US Bond Funds recorded their 45th inflow of the past 46 weeks.

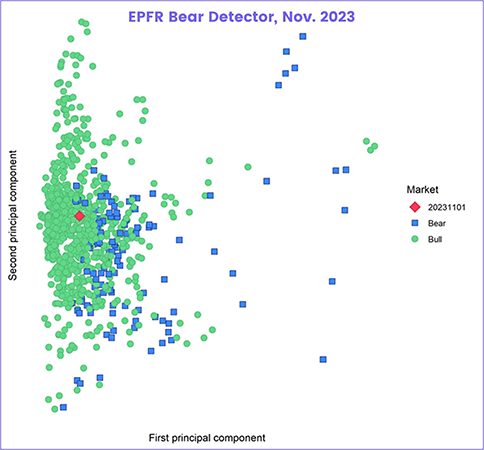

EPFR’s Bear Detector, an in-house model based on four constituent factors that are reduced to their two principal components and plotted against prevailing market trends, suggests that the current reading (red diamond) is still some distance from the frontier (blue squares) that indicates a high risk of bear-market conditions.

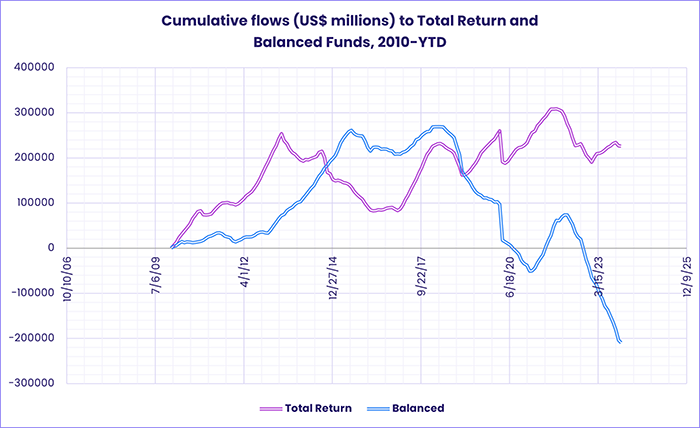

Overall, EPFR-tracked Equity Funds collectively absorbed $23.4 billion during the second week of November while Alternative Funds took in $371 million, Bond Funds $2.5 billion and Money Market Funds $20.5 billion. Balanced Funds, which have not posted an inflow since early April, experienced net redemptions of $3.1 billion.

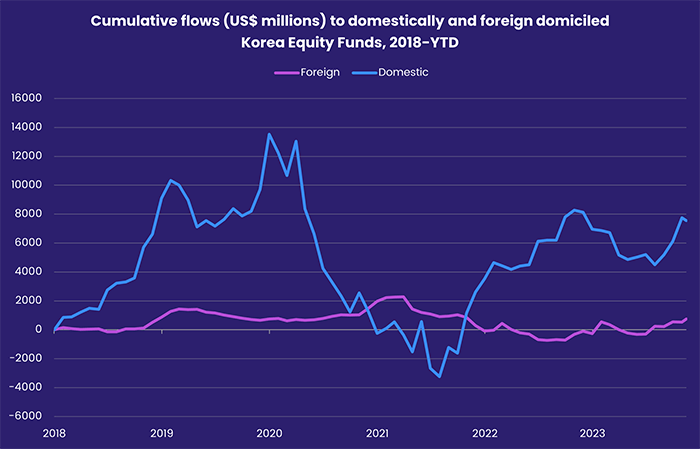

At the single country and asset class fund levels, Denmark Bond Funds posted their second-biggest outflow YTD as they extended their longest outflow streak since early 2Q23, redemptions from Sweden Equity Funds hit a 32-week high and Korea Equity Funds recorded their largest outflow in over three months. Investors pulled money out of Gold Funds for the 24th time since late May, Cryptocurrency Funds ran their current inflow streak to seven weeks and $1.3 billion and Convertible Bond Funds racked up their 20th consecutive outflow.

Emerging markets equity funds

A better-than-expected reading for American inflation in October, bolstering the consensus that the US Federal Reserve will not hike interest rates again, was not enough to stop EPFR-tracked Emerging Market Equity Funds from recording a sixth straight outflow. Retail share classes saw money flow out for the 15th consecutive week, redemptions from Frontier Markets Funds hit a nine-week high and Asia ex-Japan Equity Funds extended their longest run of outflows since early 2Q23.

The flow traffic was, however, not completely one-way. Emerging Markets Dividend Funds remain popular, chalking up their 15th straight inflow, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates took in fresh money for the second time quarter-to-date. Both China Equity Funds and the diversified Global Emerging Markets (GEM) Equity Funds saw their current outflow streaks come to an end and Latin America Equity Funds posted their biggest inflow since mid-July.

Among the fund groups dedicated to the largest Emerging Asian markets, China Equity Funds posted a collective inflow of $6 million, redemptions from Taiwan (POC) Equity Funds jumped to a 15-week high, India Equity Funds posted their 35th consecutive inflow and domestically domiciled Korea Equity Funds recorded their biggest outflow since late July. In the case of the latter, investors are digesting a renewed ban on short selling and the Korean central bank’s recent warning that escalating levels of household debt may trigger interest rate hikes.

EMEA Equity Funds recorded their ninth outflow over the past 12 weeks as fighting in Ukraine and Gaza, the weakness of growth in the Eurozone and the steady slide in oil prices since late September weighed on key markets. At the country level, Saudi Arabia Equity Funds posted their sixth outflow since the beginning of October and redemptions from South Africa Equity Funds hit a 40-week high.

Funds dedicated to both of Latin America’s major markets, Brazil and Mexico, recorded solid inflows. Brazil Equity Funds chalked up their biggest inflow in three months while Mexico Equity Funds posted consecutive weekly inflows for the first time since late August.

Developed markets equity funds

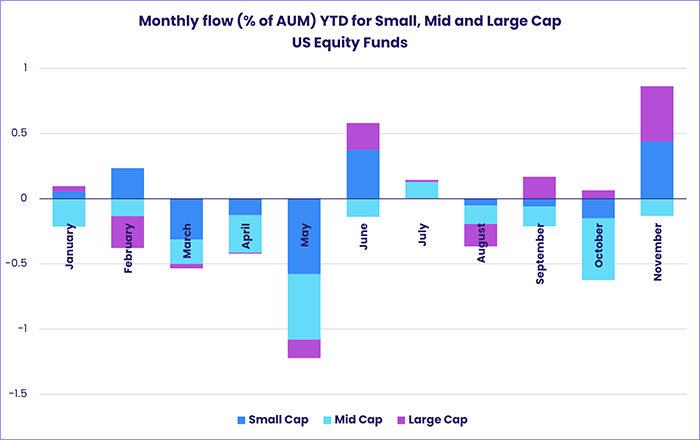

Investors focused on developed markets found little reason to look beyond the US during the second week of November as a strong third quarter GDP number was followed by a further decline in the core inflation rate. Over $20 billion found its way into US Equity Funds while Japan, Europe, Global and Pacific Regional Funds all experienced net redemptions.

The latest flows into US Equity Funds went overwhelmingly to Large Cap Blend Funds. Among the groups managed for growth or value, only Large Cap Growth Funds recorded an inflow. Retail share classes saw money flow out for the seventh week running, Leveraged Funds racked up their biggest outflow since mid-July and US Dividend Funds posted their 10th outflow in the past 14 weeks, but funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow since EPFR started tracking them in 1Q04.

Optimism about US economic prospects spilled over the border, with Canada Equity Funds chalking up their biggest inflow since mid-March despite fears that inflationary expectations in Canada could trigger at least one more rate hike.

Japan Equity Funds posted consecutive weekly outflows for the first time since late May as recent data flagged declines in domestic consumption and business investment during the third quarter. Both foreign and domestically domiciled funds experienced net redemptions – the first time that has happened since late July – but Japan Dividend Funds attracted fresh money for the 28th time in the past 30 weeks.

Money flowed out of Europe Equity Funds for the 36th consecutive week as the Eurozone’s central bank warned of resilient price growth and weak GDP growth, Chinese data sent more mixed signals and Germany’s Constitutional Court blacked government plans to reallocate over $60 billion raised to tackle the fallout from the Covid pandemic.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, posted their sixth outflow of the quarter so far.

Global sector, industry and precious metals funds

Appetite from sector-oriented investors continued to build in mid-November as five of the 11 major EPFR-tracked Sector Fund groups attracted inflows. With the exception of Healthcare/Biotechnology Sector Funds, all the groups that received inflows last week saw more fresh money come in. The inflows ranged from $144 million for Consumer Goods Sector Funds to $1.3 billion for Technology Sector Funds.

Despite redemptions from Semiconductor Funds hitting a 10-week high, Technology Sector Funds managed to pull in a second straight week of inflows that lifted their total over the past four weeks to $3.7 billion. Technology Sector Funds with SRI/ESG mandates recorded consecutive weekly inflows for the first time since early 1Q23. It was the only SRI/ESG-dedicated Sector Fund group to report inflows this week. On the defensive side, investors continued to pour more money into Telecoms Sector Funds, with the latest inflow the biggest in nearly four months.

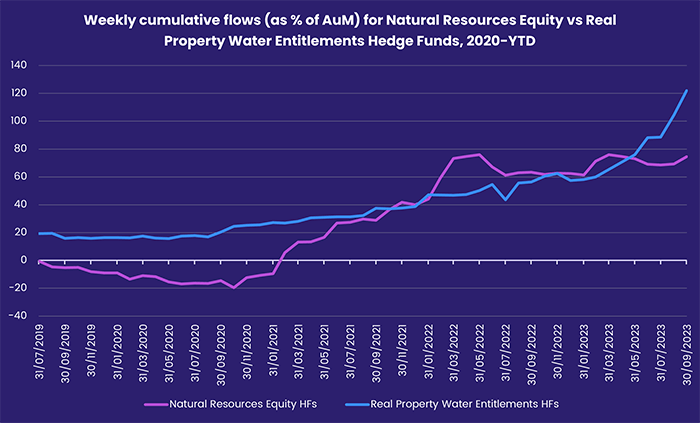

Among the groups struggling to attract fresh money are Utilities Sector Funds, which have now seen $2.5 billion flow out over the past six straight weeks. A subgroup that prospered in 2019 through to early 2022, Water Funds, suffered their 13th consecutive week of outflows. But a Hedge Fund group offering exposure to water entitlements – particularly in Australia – has fared better: Water Entitlements RP Hedge Funds have posted above average inflows every month so far this year, with September’s figure an all-time high.

Consumer Goods Sector Funds recorded their first inflow in seven weeks as two individual funds with retail and consumer discretionary mandates attracted over $200 million each. The headline number was dragged down by non-ETF outflows of $90 million this week, a trend that has continued throughout the year. Consumer Goods ETFs have brought in $1.28 billion so far this year compared to the outflows for non-ETFs (or mutual funds) of $3.72 billion, the second-largest yearly redemption on record.

After a staggering $11.9 billion flowed out over the past 15 straight weeks, Financials Sector Funds also snapped their lengthy outflow streak. US Bank Funds within the financial sector universe saw a second consecutive inflow that was their largest in 18 weeks.

Bond and other fixed income funds

With investors focused on US equity, flows to all EPFR-tracked Bond Funds during the second week of November fell to less than a quarter of the previous week’s level. In the case of US Bond Funds, the latest inflow was less than a 40th of the one recorded the week before.

Fixed income investors continue to steer clear of funds offering exposure to emerging markets debt, inflation protected bonds and multi-asset strategies. They did commit another $2.6 billion into High Yield Bond Funds, which have absorbed two-thirds of the $16.4 billion that flowed out between late September and late October.

While funds offering exposure to junk bonds were posting their third consecutive inflow, US Sovereign Bond Funds posted their first outflow since mid-July and their biggest in over a year. Funds with short duration mandates accounted for the bulk of the redemptions.

Europe Sovereign Bond Funds also saw a spike in redemptions, with total outflows hitting a 40-week high, while flows into Investment Grade and High Yield Corporate Funds climbed to eight and 179-week highs, respectively. At the country level, Netherlands Bond Funds recorded their biggest inflow since mid-May and UK Bond Funds posted the fourth largest outflow year-to-date.

Redemptions from Emerging Markets Hard Currency Funds were six times larger than those experienced by local currency funds as the overall group extended an outflow streak stretching back to the week ending July 26. Funds domiciled in the US recorded a modest collective inflow while over $1.6 billion flowed out of Europe-domiciled funds.

Among the Asia Pacific Country Fund groups, Australia Bond Funds bounced back from their first outflow in over seven months and flows into Japan Bond Funds accelerated for the third week running.

Did you find this useful? Get our EPFR Insights delivered to your inbox.