In early October two of the major ratings agencies downgraded the outlook for British sovereign debt from stable to negative. For investors it was a familiar story. For much of 2022 stability has turned to instability, certainty to uncertainty and hope to fear across most asset classes. The result has been growing market volatility and a growing defensiveness on the part of those investors.

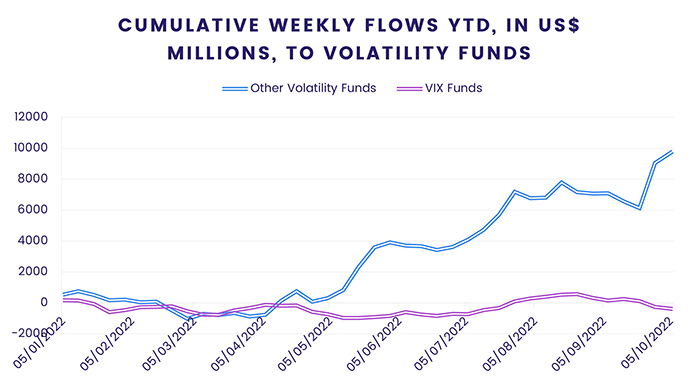

The first week of October saw EPFR-tracked Volatility Funds post consecutive weekly inflows for the first time since mid-August while High Yield Bond, Alternative, Europe Equity and Bond, Emerging Markets Bond and Technology Sector Funds all posted outflows.

Europe in general and the UK in particular, remains a focal point for investor angst as leading indicators on the continent roll over, ratings agencies review UK credits and Ukraine’s stunning advances fuel fears of a desperate Russian backlash. Against this backdrop UK and all European Money Market Funds both set new weekly inflow records.

The promise of income retained its allure, with Dividend Equity Funds chalking up their ninth consecutive inflow and Short Term US Treasury Funds extending their current inflow streak to seven weeks and $29.6 billion.

At the asset class and single country fund levels, the week ending Oct. 5 saw both Sweden Bond and Equity Funds absorb over $120 million, with flows into the latter hitting an 89-week high, while Australia Bond Funds recorded their biggest inflow since mid-4Q21 and flows to Colombia Equity Funds hit a level last seen in 4Q20. Investors pulled money out of Municipal Bond Funds for the ninth week in a row and redeemed over $2 billion from Mortgage-Backed Bond Funds.

Emerging Markets Equity Funds

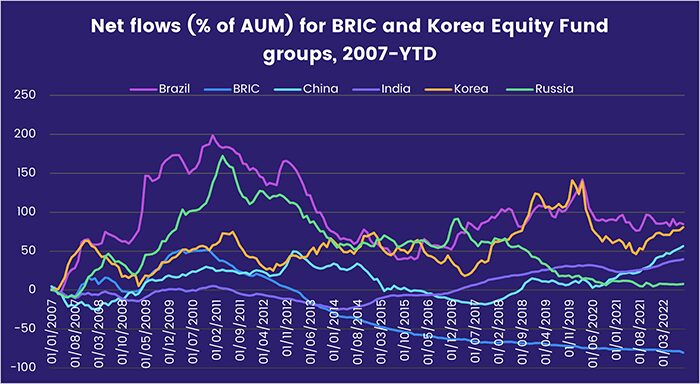

Although flows into China Equity Funds again proved the difference as EPFR-tracked Emerging Markets Equity Funds started the fourth quarter by recording their fifth inflow, funds dedicated to the biggest Asian markets were not the only ones to attract fresh money. EMEA Equity Funds posted their biggest inflow since late April as they snapped a five-week run of outflows and Latin America Equity Funds absorbed nearly $200 million.

Investors also showed more interest in the riskiest segment of the emerging markets universe. Frontier Markets Equity Funds recorded their largest inflow in four months. Flows into funds dedicated to Vietnam, which accounts for over a fifth of the average Frontier Markets Fund portfolio, also hit an 18-week high.

While China Equity Funds shrugged off an eighth consecutive week of retail redemptions to take in over $1 billion for the fourth week running, India Equity Funds saw their longest weekly inflow streak since 2Q17 come to an end ahead of the World Bank’s 1% cut in its forecast for Indian GDP growth. Among fund groups dedicated to smaller Asian markets, Thailand Equity Funds chalked up their 11th straight outflow while Malaysia Equity Funds snapped a three-week outflow streak.

The headline number for Latin America Equity Funds was underpinned by the over $100 million that flowed into Brazil Equity Funds. The bulk of that money arrived after Sunday’s presidential contest where incumbent Jair Bolsonaro defied expectations and took his challenger, former president Luiz Inácio Lula da Silva, to a runoff election on Oct. 30. Colombia Equity Funds also had a good week, recording their biggest inflow since the third week of 4Q20.

South Africa Equity Funds stood out among EMEA Equity Fund groups, chalking up their biggest inflow in six months despite the country’s high unemployment rate, unreliable energy supplies and the double-digit inflate rate for food. South Africa has supplanted Russia as the biggest single EMEA country allocation among the diversified Global Emerging Markets (GEM) Equity Funds, but its weighting has dropped three of the past four months.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds started October by posting their fifth collective outflow in the past seven weeks. Among the major groups, only Canada and Japan Equity Funds recorded inflows, while Global, Europe, Australia, Pacific Regional and US Equity Funds posted outflows ranging from $204 million to $3.4 billion.

Although the US Federal Reserve will not make another decision on interest rates until early November and key indexes started the fourth quarter with a short-lived rally, investors pulled money out of US Equity Funds for the third time since the beginning of September. US Equity ETFs did post a third consecutive inflow while actively managed funds extended a run of outflows stretching back to early August.

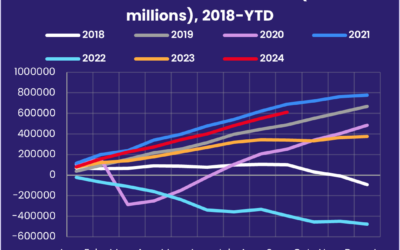

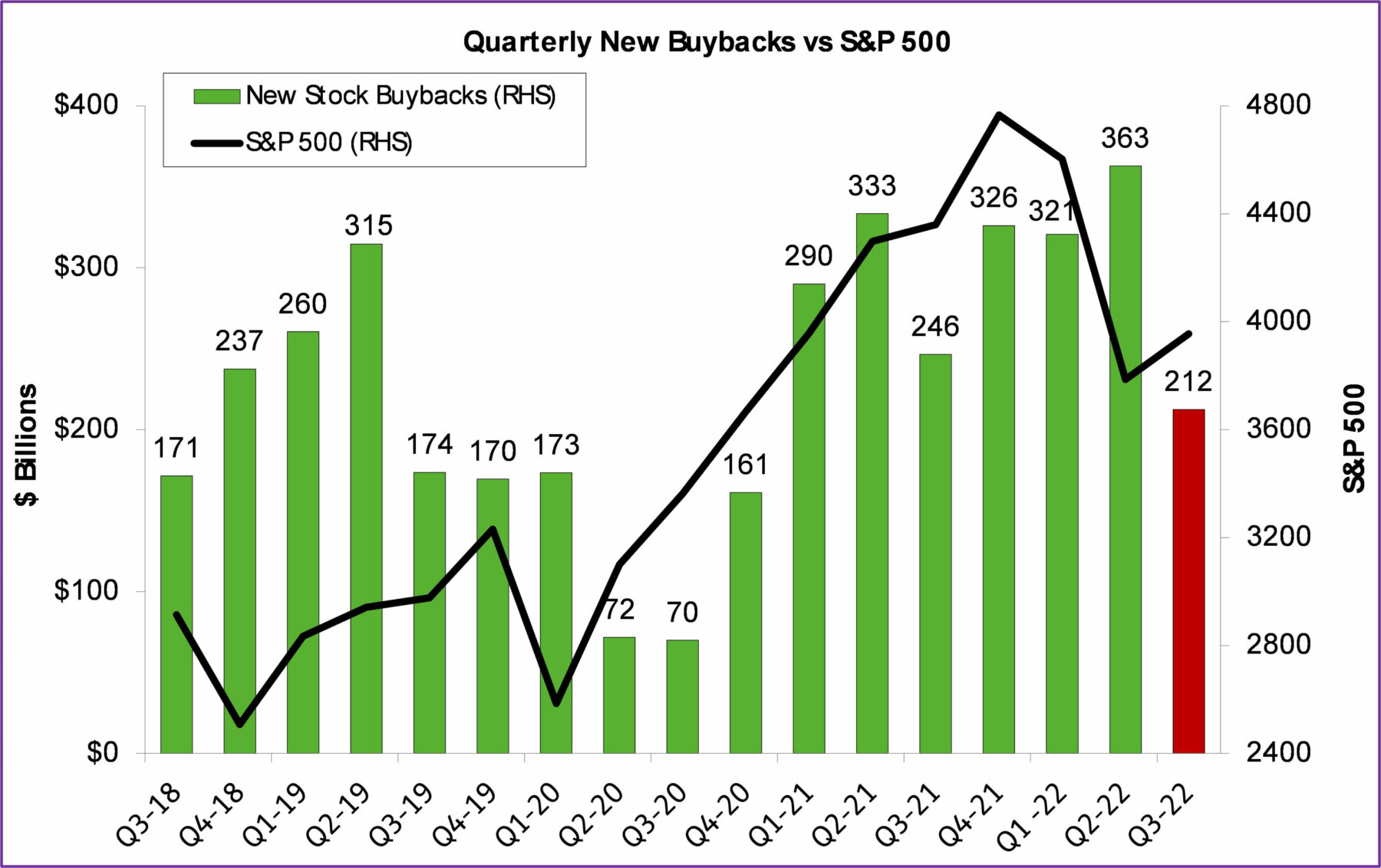

US stocks, especially those in the large cap space, continue to enjoy high levels of support from the companies that issued them. According to analysis by EPFR’s Winston Chua, “US companies have committed a record $1.3 trillion for announced buybacks and cash takeovers in the first nine months of 2022, smashing the previous record of $1.21 trillion in the first nine months of 2018.” Buybacks have accounted for 69% of total corporate buying, below the five-year historical average of 75% while cash mergers and acquisitions are running above the five-year average of 25%. New offerings, meanwhile, have slumped to $110 billion year-to-date, a level last seen in 1995.

For the second week running, heavy redemptions from dedicated UK Equity Funds prevented all Europe Equity Funds from snapping an outflow streak that now stands at 34 weeks and $94 billion. While the UK’s economic woes dominated the headlines along with Ukraine’s dramatic advances into previously occupied territory, the short-term outlook for continental Europe remains cloudy at best in the face of high energy prices, tighter monetary conditions and weaker Chinese demand for key exports.

At the country level, Spain Equity Funds posted consecutive weekly inflows for the first time since mid-July, flows into Sweden Equity Funds hit an 89-week high, Italy and UK Equity Funds saw money flow out for the 12th and 14th consecutive weeks, respectively and Greece Equity Funds added to an outflow streak stretching back to mid-April.

Japan Equity Funds posted their fourth inflow in the past five weeks as flows to foreign-domiciled funds rebounded to a six-week high. The latest industry allocations data shows that managers have lifted their exposure to technology hardware and capital goods plays to eight and 15-month highs, respectively.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, extended their longest outflow streak since 2Q20. Flows into Global ex-US Equity Funds hit a 14-week high but were more than offset by redemptions from funds with fully global mandates.

Global Sector and Precious Metals Funds

Coming into the fourth quarter, the number of major EPFR-tracked Sector Fund groups attracting fresh money fell from four the previous week and six the week before that to three. Of those, only Real Estate Sector Funds managed to attract more than $50 million, while the outflows ranged from $36 million for Consumer Goods Sector Funds to $736 million for Financial Sector Funds.

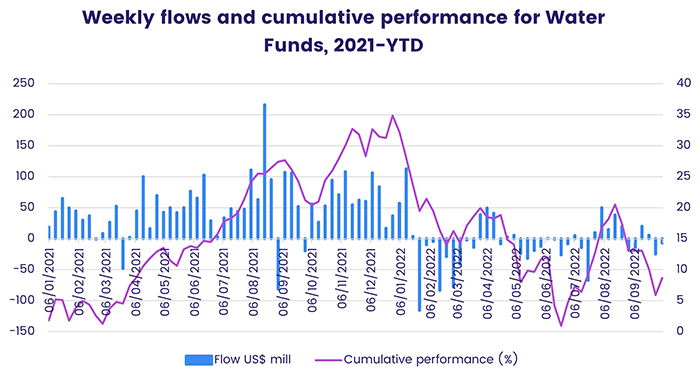

One classically defensive group, Utilities Sector Funds, recorded a solid outflow despite the sector’s reputation for dividend payments. Investors are concerned about the combination of rising energy and other costs and the unwillingness of governments to let them pass those costs on. Investors have also soured on a previously popular sub-group, Water Funds, even though 2022 has highlighted for many regions the constraints on supply of this vital commodity and the economic impacts when supplies run short.

Investors pulled money from Technology Sector Funds, for the fourth time in the past five weeks as higher capital costs, regulatory activity, the US dollar’s strength, supply chain issues and shrinking discretionary budgets weigh on the outlook for this sector. China Technology Sector Funds continued to buck this trend, recording their sixth straight inflow and seventh in the past eight weeks.

Year-to-date, Energy Sector Funds have delivered by far the best collective performance. Indeed, they are the only group carrying a positive number into 4Q22. Telecoms and Technology Sector Funds turned in the worst performance during the first nine months of 2022.

Bond and other Fixed Income Funds

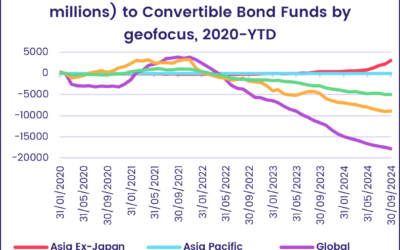

EPFR-tracked Bond and Balanced Funds remained in the firing line during the week ending Oct. 5 as investors factored stubborn inflation, rising interest rates and little in the way of fiscal restraint into their risk-reward calculations. Redemptions hit a 15-week high, with Emerging Markets, Global, Canada and US Bond Funds all posting outflows, as did most of the major asset class groups.

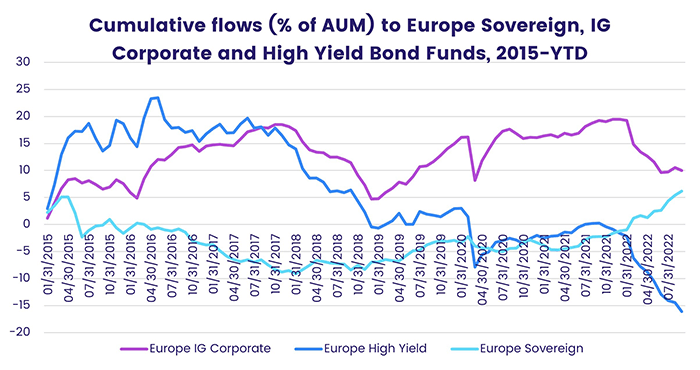

With short-term sovereign debt yielding more than it has – in many cases – for over a decade, investors did move into fund groups that offered exposure to this asset class. Europe Short Term Sovereign Bond Funds were one of the few Europe Bond Fund groups to post an inflow during a week when the headline number for all funds was an outflow of over $3 billion.

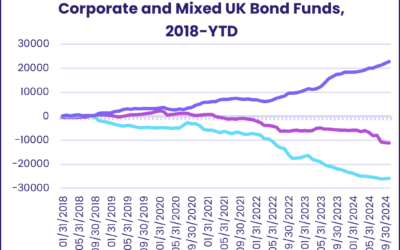

At the country level, another $746 million flowed out of UK Bond Funds and Italy Bond Funds posted their sixth straight outflow while Sweden Bond Funds pulled in over $100 million and France Bond Funds added to their longest inflow streak since 4Q14.

Elsewhere, at the asset class level investors pulled money out of High Yield Bond Funds for the seventh week running, Mortgage-Backed Bond Funds posted their biggest outflow since late 1Q20, redemptions from Total Return Bond Funds hit a 14-week high and Bank Loan Funds extended a redemption streak stretching back to mid-June.

Emerging Markets Bond Funds chalked up their seventh straight outflow and 23rd in the past 26 weeks as redemptions from funds with local currency mandates hit an 11-week high, as did those dedicated to EM junk bonds, and Frontier Markets Bond Funds posted their biggest outflow in over 30 months. Among EM Country Bond Fund groups, Russia Bond Funds posted their 15th straight outflow and redemptions from Turkey Bond Funds hit a 14-week high while flows into South Africa Bond Funds climbed to levels last seen in late March.

With US 2-year Treasury yields camped above 4% and running 40-50 basis points higher than the 10-year yield, investors with a US focus gravitated to funds offering exposure to short-term debt while giving most other groups short shrift. US Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded consecutive weekly outflows for the first time since the third week of June.

Did you find this useful? Get our EPFR Insights delivered to your inbox.