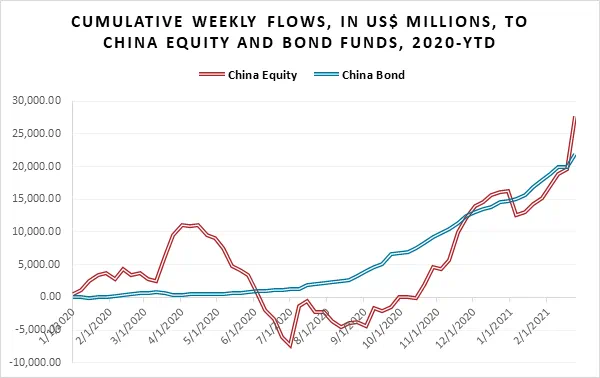

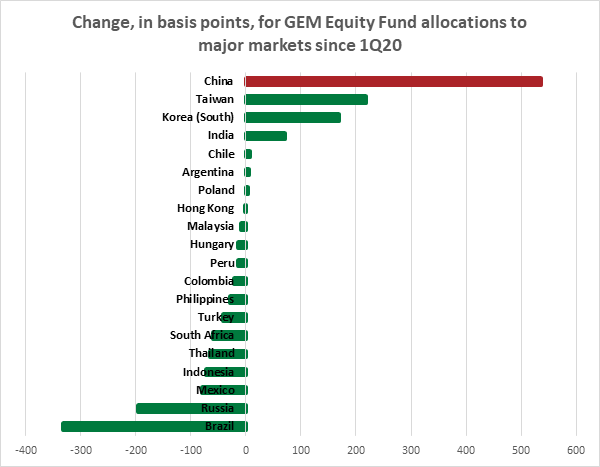

For Chinese citizens the Year of the Ox began on February 12. Horoscopes for this year say it is a good one for building up reserves and making long-term investments. During the week ending Feb. 24 investors appeared to be taking this to heart. China Bond Funds set a new weekly inflow record and China Equity Funds posted their second largest inflow since EPFR started tracking them while flows into Hong Kong Equity Funds hit a 24-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.