The final week of February was marked by the second anniversary of Russia’s invasion of Ukraine, key US, European and Japanese equity indexes hitting fresh record highs and the latest inflation data for several major markets. The response from investors? Keep celebrating the positives and discounting the risks.

With expectations that the US economy is bound for a ‘soft landing’ seeming cast in stone and AI chip bellwether Nvidia’s 4Q23 earnings casting a warm glow over the technology sector, February ended with EPFR-tracked Cryptocurrency Funds posting their second-largest inflow on record, High Yield Bond Funds take in fresh money for the 17th time over the past 18 weeks and flows into Technology Sector and Frontier Markets Equity Funds climbed to 27 and 53-week highs, respectively.

Not every asset class benefited from this glass-half-full sentiment. Flows to China-mandated funds evaporated as the country’s workforce returned from the Lunar New Year holiday, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest outflow streak since 2012 and Balanced Funds saw another $3.5 billion redeemed.

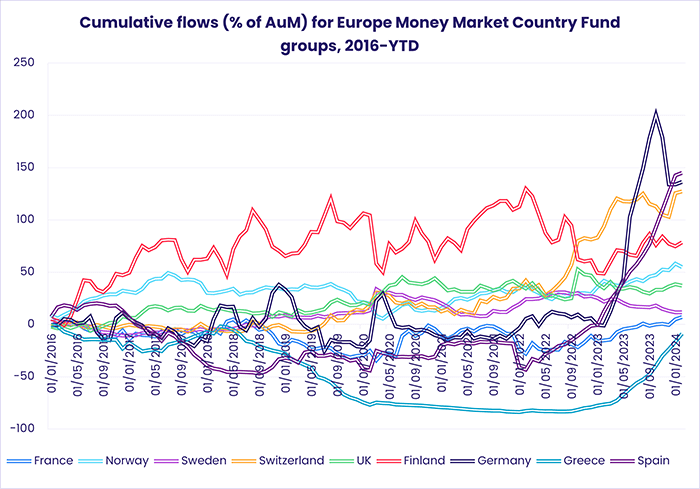

Cash also retained its allure for many US investors. US Money Market Funds pulled in over $50 billion – an eight-week high – as year-to-date inflows climbed past the $150 billion mark. It was a different story for China and Europe Money Market Funds, with the former posting their biggest outflow since late 2Q22 and the latter seeing over $15 billion flow out as UK Money Market Funds were hit with their heaviest redemptions in eight months.

At the asset class and single country fund levels, Physical Gold Funds chalked up their 12th outflow since the beginning of December, money flowed out of Dividend Equity Funds for the seventh time year-to-date and Inflation Protected Bond Funds posted their fourth inflow so far this year. Austria Equity Funds recorded their 51st outflow over the past 12 months, flows into Japan Bond Funds climbed to a 20-week high and Philippines Equity Funds posted their biggest inflow since 1Q22.

Emerging markets equity funds

EPFR-tracked Emerging Markets Equity Funds saw their longest run of inflows in over nine quarters come to an end in late February as the main driver, commitments to China Equity Funds, stumbled. The latest week also saw an inflow streak for EM Dividend Equity Funds that stretched back to early August come to an end and Latin America Equity Funds post their eighth outflow year-to-date.

The first redemptions from China Equity Funds since the third week of November came during a week when Chinese equity markets extended a rally that started during the first week of the month. The outflows were, for all Asia ex-Japan Equity Funds, partially offset by the more than $900 million that flowed into India Equity Funds as that group extended its record-setting inflow streak.

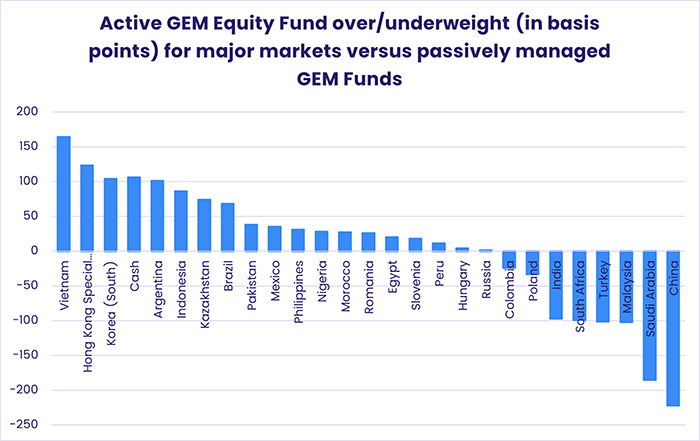

The latest country allocations data for the diversified Global Emerging Markets (GEM) Equity Funds shows exposure to China has fallen to its lowest level since 1Q17 while India’s average weighting hit a new record high coming into February. When filtered by management style, China’s underweight among actively managed GEM Equity Funds is the biggest of any major market.

Vietnam, the market with the biggest actively managed GEM Fund overweight, also remains the biggest single country allocation among Frontier Markets Equity Funds. That group ended February with its biggest inflow in over a year despite Pakistan Equity Funds suffering their heaviest redemptions in more than 15 years as investors wait to see how the country’s new government addresses Pakistan’s many problems.

As Russia’s invasion of Ukraine enters its third year, flows to Russia Equity Funds remain frozen. But EMEA Equity Funds have now taken in fresh money for four weeks running. That is their longest inflow streak since 4M22 as is underpinned by solid flows to Turkey-mandated funds.

Developed markets equity funds

Another week of solid flows to US Equity Funds propelled EPFR-tracked Developed Markets Equity Funds to their fifth inflow over the past six weeks going into March. Japan Equity Funds also contributed to the headline number, helping to offset redemptions from Global, Pacific Regional, Canada, Australia and Europe Equity Funds.

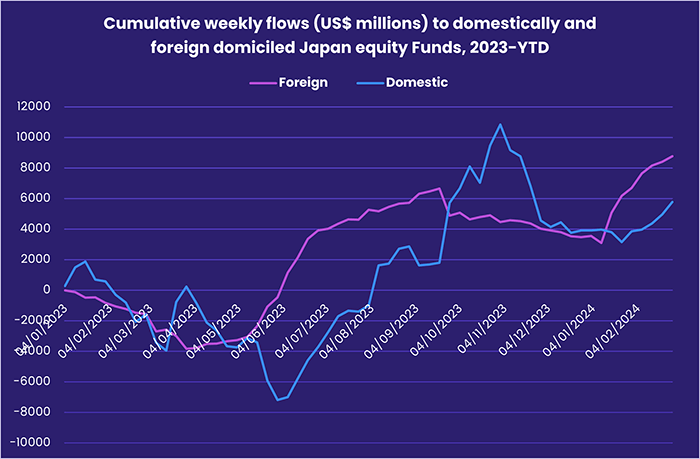

The latest flows into Japan Equity Funds saw those domiciled overseas post a collective inflow for the seventh straight week as the country’s benchmark Nikkei 225 index hit another record high before falling back. The latest inflation data, which is being assessed in light of Japan’s lengthy bout of deflation, showed consumer prices growth at a 22-month low but still in line with the Bank of Japan’s 2% target.

US core inflation, meanwhile, was up month-on-month in January and is still north of the US Federal Reserve’s goal – also 2% – as markets debate whether the first interest rate cut will come in the second or third quarters. But, with key indexes propelled into record territory by technology sector earnings and share buybacks, money flowed into US Equity Funds for the third week running.

When it comes to sector exposure, the average US Equity Fund allocation to technology stocks has breached the 30% level for the first time since EPFR started tracking this data. Financials have regained their position as the second largest sector allocation, having lost it to healthcare during the Covid-19 pandemic.

Europe Equity Funds came close to posting their first collective inflow of 2024, but fell just short as another $619 million flowed out of UK Equity Funds. Funds dedicated to Switzerland continue to attract solid flows and Italy Equity Funds posted their biggest inflow since mid-2Q21 that was attributable to a single European-domiciled ETF. Flows to funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates also bounced back, hitting a 19-week high.

Among the diversified fund groups, Pacific Regional Funds posted their seventh outflow so far this year, flows into Europe ex-UK Regional Funds climbed to a 10-week high, Global ex-US Equity Funds took in fresh money for the 10th week running and Europe Regional Funds racked up their ninth consecutive outflow.

Global sector, industry and precious metals funds

When it came to inflows, Technology Sector Funds cast a long shadow over the universe of EPFR-tracked Sector Fund groups last year. So far this year it has been more of the same, with Technology Sector Funds taking in over $4 billion during the final week of February. The group recording the next largest inflow attracted only $301 million, while six groups posted outflows ranging from $58 million to $797 million.

A single US domiciled ETF accounted for the lion’s share of the latest Technology Sector Funds, whose retail shares absorbed money for the sixth week running as they extended their longest run of inflows since 4M21. China Technology Sector Funds, which have pulled in $11 billion more than their US counterparts over the past five years, posted their biggest outflow in nearly four months.

Also pulling in fresh money were Healthcare/Biotechnology Sector Funds, which only posted six weekly inflows during the final seven months of 2023 and have chalked up six so far this year. This group was hit hard last year by the combined impacts of regulatory pressures, higher cost of capital, looming patent cliffs for some highly profitable medicines and the post-Covid adjustments to the healthcare market, but more attractive valuations and a clearer outlook are drawing investors back to healthcare stocks.

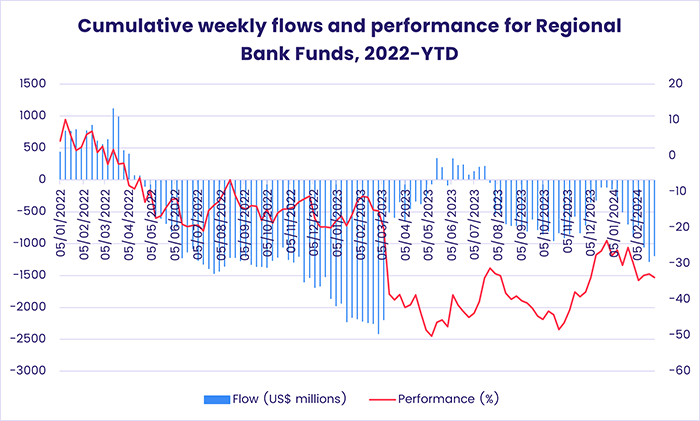

Among the groups posting outflows were Financial Sector Funds, whose cause was not helped by the growing list of issues dogging New York Community Bank. These include a souring portfolio of commercial real estate loans, which has rekindled fears about the stresses facing US regional banks, three of which failed in late 2Q23.

Precious metals funds are also struggling to find takers in an environment where liquidity funds are paying over 4% on deposits, cryptocurrencies offer an exciting alternative and hopes for artificial intelligence-driven breakthroughs are running hot. Physical Gold Funds have now posted outflows for nine straight weeks and Silver Funds 12 of the past 14 weeks.

Bond and other fixed income funds

The money kept coming for EPFR-tracked Bond Funds during the final week of February. For the fourth straight week, and seventh time year-to-date, the overall group absorbed over $10 billion with US Bond Funds again leading the way. Global and Europe Bond Funds extended their current inflow streaks to 16 and 17 weeks, respectively, while Asia Pacific Bond Funds posted their biggest weekly inflow since early October and flows into Canada Bond Funds hit a 12-week high.

At the asset class level, High Yield and Municipal Bond Funds both recorded their eighth consecutive inflows and investors committed fresh money to Catastrophe Bond Funds for the 14th straight week while Convertible Bond Funds posted their eighth straight outflow.

Once again Emerging Markets Bond Funds were on the outside looking in. Investors pulled money out of the overall group for the seventh time year-to-date, with hard currency funds again experiencing the heaviest redemptions. Retail share classes did post their first inflow of 2024 and their fourth since the beginning of 3Q23. Global Emerging Markets (GEM) Bond Funds, which posted their third outflow in a row, have cut their exposure to Indonesia to a 62-month low while allocations to Argentina, Turkey and India are at 20, 37 and 81-month highs, respectively.

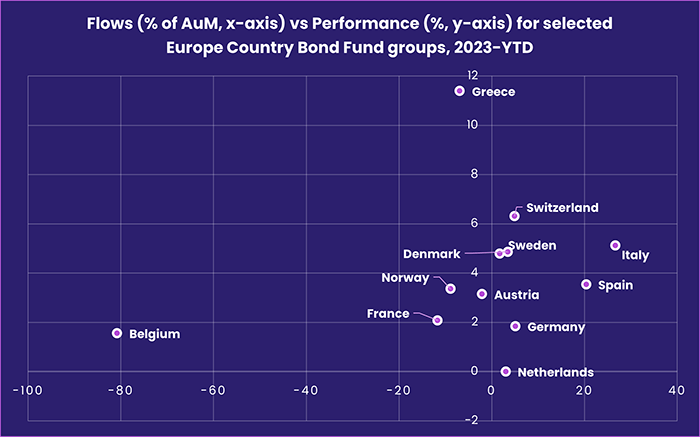

Flows to Europe Bond Funds shifted decisively to those with sovereign mandates in late February. Europe Corporate Bond Funds posted their biggest weekly outflow since early 4Q23 while flows into Europe Sovereign Bond Funds jumped to a 23-week high. At the country level, no group stood out. Over the past 14 months, in relative terms, Italy Bond Funds have offered the best combination of flows and performance.

Foreign domiciled US Bond Funds recorded their ninth straight inflow during the final week of February. Over the past two years, flows into foreign and domestically domiciled funds have been roughly equal. US Treasury Funds fared better, in flow terms, than their corporate counterparts for the fifth straight week.

Flows for the two major EPFR-tracked multi asset fund groups remain lopsidedly in favor of Total Return Funds. Over the past 12 months, Balanced Funds have posted only two weekly inflows.

Did you find this useful? Get our EPFR Insights delivered to your inbox.