High energy prices have been a norm for 2022 with consistent pressure from the Russia-Ukraine conflict as it leans into the 300th day mark, while others are feeling the “need to rapidly move away from burning fossil fuels to stop average global temperature reaching dangerous levels.”

Along this path, the US made a major breakthrough in the fourth quarter by producing a “net energy gain” from a fusion reaction, meaning more energy was generated than used to start the fusion process. Likewise, this process results in “no long-lived radioactive waste” and emits no carbon, a drastic climate-friendly change to the typical nuclear power plants. 2023 and the years to come will continue to be a “global race for next-generation clean technology” and energy.

View from EPFR

With the potential for clean, limitless energy on the horizon, isolating elements and components within Energy Sector Funds gives us clues into investor sentiment – are they buying into these new ideas already? Uranium is one of the main ingredients in fueling power plants for nuclear fission – the splitting of atoms – while hydrogen is a key component of nuclear fusion – the process of joining atoms – but both generate significant amounts of energy.

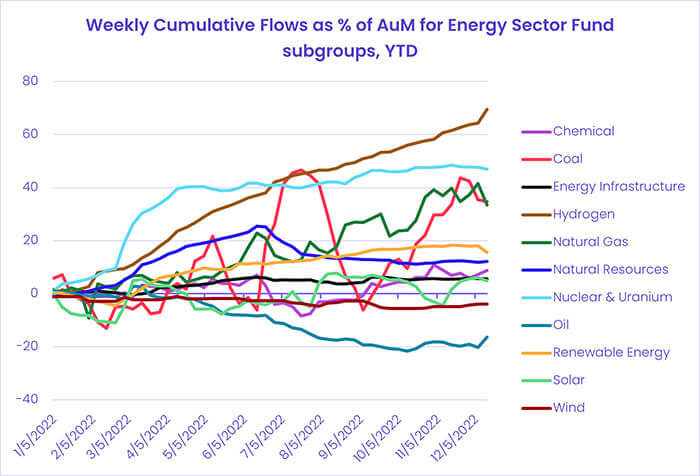

Throughout 4Q21 and at the start of the Russia-Ukraine conflict in February of this year, Nuclear and Uranium Funds saw a significant spike in the level of money committed, with flows as a percentage of AuM climbing 47% YTD. They started off 2022 with a 17-week inflow streak that attracted $1.6 billion total and captured multiple record-setting weekly inflows since EPFR started tracking them in 3Q07. Sentiment has died down since then with the latest four weeks in negative territory.

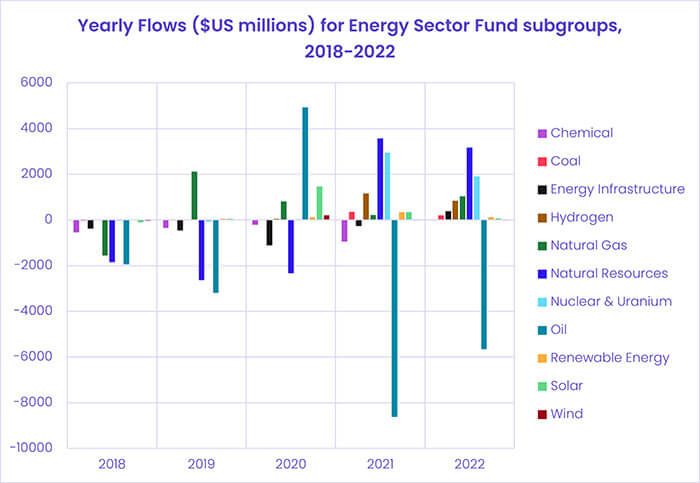

Flows into Hydrogen-related funds have seen comparatively the highest level of commitment out of all the subgroups rising 70% in AuM thus far this year and Natural Resources have attracted the most flows in dollar terms. Understandably, Oil dedicated funds were the only group to post net redemptions in 2022.

Big producers of uranium – Kazakhstan, Canada, Australia, Russia – could be hurt by the shift in the way we source energy and likewise, countries that rely solely on nuclear power plants for electricity – Lithuania, France and Slovakia – could benefit in the decades to come if they are supplied with alternative, cleaner energy. “A small cup of the hydrogen fuel [from nuclear fusion reactions] could theoretically power a house for hundreds of years.”

Did you find this useful? Get our EPFR Insights delivered to your inbox.